China is on track to meet global green-tech demand but needs to pivot from manufacturing to infrastructure.

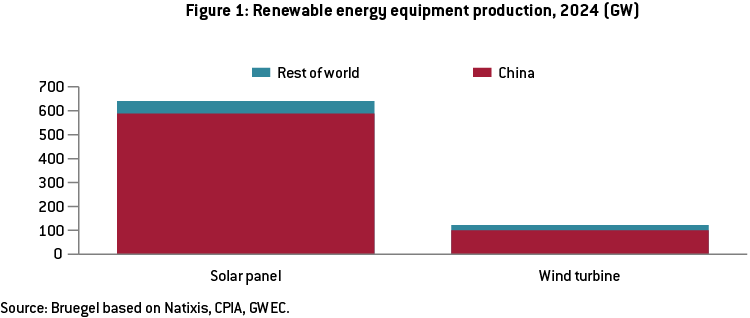

China is crucial role to the world’s green transition for two contrasting reasons: it is the world’s largest greenhouse gas emitter – over 30 percent of the global total – and it is the world’s largest producer of green technology. China is vital especially for renewable energy products, manufacturing 92 percent of the world’s solar modules and 82 percent of wind turbines as of 2024 (Figure 1). The fact that 90 percent of global emissions come from energy consumption underscores the importance of China’s dominant market share.

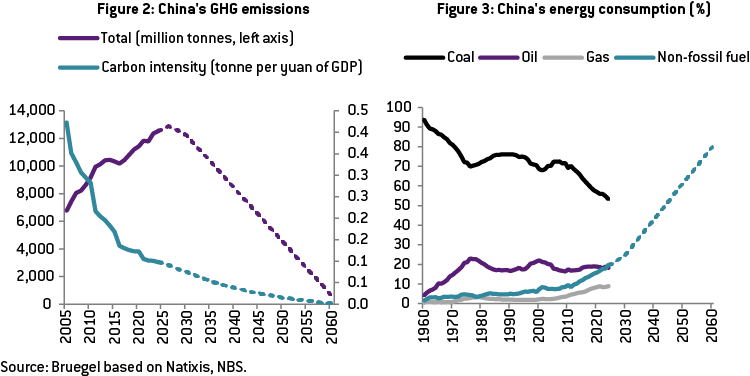

China’s leadership said in 2020 that it would achieve an emissions peak by 2030 and carbon neutrality by 2060 (Figure 2) . Although these goals have not been formally adopted in law, China has published a series of regulations to pave the way, including the Action Plan for Carbon Emission Peaking Before 2030 (NDRC, 2021) and the Energy Law of China . As a crucial part of its decarbonisation campaign, China aims to raise the share of energy consumption generated from non-fossil fuel sources to 20 percent by 2025, 25 percent by 2030 and 80 percent by 2060. Solar and wind power will meet the bulk of this increased demand. This share stood at 19.8 percent in 2024, only a nudge away from the 2025 target.

To meet its goals, China faces a steep curve for growth of non-fossil fuel energy consumption after 2030 (Figure 3). With the world’s heavy reliance on China’s green technology exports, the question arises as to whether China can produce enough renewable technology to facilitate not only its own demands, but also the rest of world’s requirements for net-zero emissions. In the following sections, we provide estimates to answer this question.

Calculating the required installed capacity

We calculated the amount of renewable power generation needed to meet the global renewable energy demand forecast in the International Energy Agency’s NZE 2050 scenario (IEA, 2023), which makes projections based on the premise of reaching global net-zero emissions by 2050 (Figures 4 and 5) . We then estimated the installed capacity of solar and wind power that would be required by 2050, assuming the same utilisation hours per year as the average for 2020-2024 (Figure 6). See the appendix for a full explanation.

Our projections show that despite being behind schedule, the stage reached in global installation of renewable power is not too far from the trajectory for achieving carbon neutrality by 2050 (Figure 7). This means the growth upside for global renewable energy demand may be limited. Meanwhile, the regional breakdown shows a great imbalance: China is surpassing the required rate of installation, while the rest of world is moving too slowly (Figure 8). It thus seems straightforward for China to fulfil its own renewable energy requirements in order to achieve net-zero emissions.

Even in the case of increased global demand under NZE 2050, China will still be able to supply the world’s installation needs to the same degree as it is doing now. In 2024, China supplied 91 percent of the solar modules and 39 percent of wind turbines installed outside China. Assuming China maintains production at that level, and that China exports all products beyond what is needed to meet domestic demand, it will be able to provide approximately four-fifths of solar equipment and more than half of the wind turbines needed for the rest of world.

For wind, there seems to be clear scope for China to contribute more than it has so far (Figure 9). For solar, it seems China’s current production is not enough to cover the world’s future demand. However, considering China’s meteoric production capacity rise, there is no doubt that China will be able to meet global demand easily, without further expansion (Figure 10). Therefore, China can already produce enough renewable products for the world’s energy transition, even in the most aggressive scenario. In fact, China faces overcapacity because global demand remains far below the NZE 2050 level.

Removing green-tech manufacturing subsidies deals a blow to China’s economy

Chinese overcapacity in solar products has grown since 2023 as export prices have fallen while export volumes have continued to rise (Figure 11; García-Herrero and Xu, 2025). As external demand has subsided due to delayed installation and protectionism against Chinese green technology, Chinese manufacturers have turned to the domestic market, with irrational business practices, such as offering below-cost prices for orders. Installation has consequently surged, greatly exceeding actual energy needs (Figure 12).

Consequently, the profitability of Chinese solar manufacturers has plummeted, with a 200 percent fall in their operating income from 2022 to 2024 (Figure 13). Given this, many have trimmed capital expenditure by 40 percent, on average (Figure 14).

In addition, China in February 2025 repealed the fixed feed-in tariff for renewable power, meaning newly built on-grid renewable projects since 1 June 2025 have to face market-determined prices. This triggered massive frontloading in the first half of 2025 . After the cut-off date, installation declined rapidly and is expected to continue to decline.

With worsening financial performance, the ending of price support and frontloaded installation, China’s enthusiasm for renewables should cool in the remainder of 2025 and beyond. Structural overcapacity will decline gradually as the market consolidates through mergers and acquisitions.

Silver lining: spurring growth through grid investment

Although installation of renewable energy generation capacity in China has increased, it hasn’t been utilised effectively, because of the unstable nature of renewable power and, more importantly, the lack of infrastructure for renewable projects.

From 2020 to 2024, China installed an unprecedented 900 GW of renewable capacity, yet failed to reduce energy and carbon intensity by 13.5 percent and 18 percent (Figure 15), as called for in the government’s 14th Five Year Plan . In addition to the structural slowdown in the Chinese economy, China’s continued reliance on electricity from fossil fuels could be a major reason. Despite the higher share of renewable power in installed capacity, the share of electricity generated from renewable energy sources remains low, leaving the bulk of the power load to fossil fuels (Figure 16).

The root cause of this is the widespread underutilisation of installed renewable power capacity and increased curtailment (Figure 17), due to China’s underinvestment in the power grid. Since the dual carbon targets were announced in 2020, investment in power generation has surged while investment in the power grid has remained largely the same (Figure 18). The lagging investment in the power grid has put a cap on renewable power consumption as projects sit on a waiting list to connect to the grid (IEA, 2024).

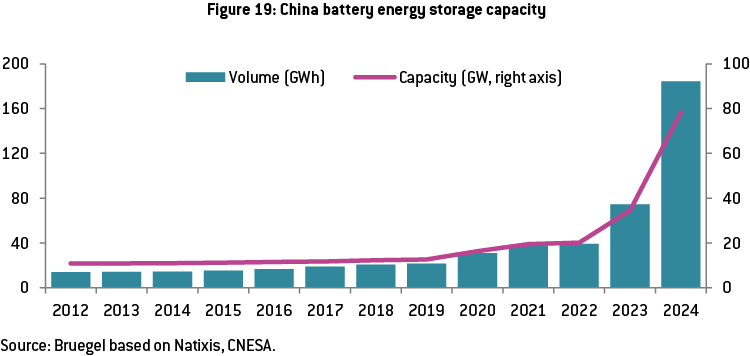

The lack of grid capacity is especially apparent in inter-regional transmission, power dispatching and power load management, which creates further blocks to renewable power consumption. In some of China’s western provinces, where the largest renewable projects are located, the curtailment rate can reach over 30 percent because of insufficient grid capacity. Moreover, although China’s energy storage projects have picked up in the past two years, the total storage capacity remains minimal compared to the stock of renewables (Figure 19), meaning less flexibility in responding to demand fluctuations.

Conclusions: overcoming overcapacity and spurring the economy

China needs to increase its investment in power infrastructure to reduce renewable curtailment and curb its reliance on carbon-intensive power sources. This would create new growth momentum to counter the retreat of capital expenditure in renewable equipment manufacturing and renewable project construction.

First, China needs to ramp up investment in its national power grid to increase power transmission capacity. This has started already, with power grid investment increasing to 608 billion renminbi in 2024 from 528 billion renminbi in 2023 and continuing to grow by 12 percent year-on-year in the first seven months of 2025. With power demand projected to grow by 50 percent by 2050 and the need for improved west-to-east power transmission, China may need to double investment in its power grid by 2030 to fill the gap.

Second, China needs to set more ambitious targets for energy storage capacity to support the functioning of the power grid. With integrated or standalone storage solutions, renewable projects can better navigate the volatility of power demand. Energy storage allows the freedom to time power sales for maximum profit and can also serve as a stabiliser when the power grid faces overload or underload.

Finally, global demand for power infrastructure is rising (Figure 20). Given the rising share of renewable power, global power grid systems need to be upgraded as disturbances from weather events require greater grid stability. This will continue to boost China’s exports of electrical equipment, supporting the economy (Figure 21).

Beyond the fact that investing in power infrastructure will keep China’s green-growth engine running, there is the additional geopolitical advantage of shifting international attention away from China’s overcapacity in renewables and subsequent dumping of subsidised green technology on the global market. Power infrastructure may even replace renewable equipment as a new source of trade revenue, as it is less sensitive and thus less likely to be a target of sanctions.

China’s push to meet both domestic and global demand for renewable energy technology to achieve carbon neutrality has led to massive overcapacity. By pivoting investment from renewable energy capacity to power-grid upgrades and equipment, China can shore up an otherwise underwhelming domestic economy, keep on track for its net-zero emissions targets and relieve geopolitical pressures.

Appendix

To determine how much renewable energy capacity is required in a net-zero scenario, we started with the forecast of renewable energy demand in a net-zero scenario, converted it back to actual renewable energy amounts and calculated the generation capacity needed to fulfil it.

We used the International Energy Agency’s NZE 2050 scenario (IEA, 2023). The figures are input equivalent, meaning they are converted to the equivalent amount of fossil fuel required by a thermal power plant with average efficiency. Using the Energy Institute’s efficiency factor for fossil fuel (Energy Institute, 2025), we reversed the calculation to obtain the amount of renewable energy required to feed the projected ‘input-equivalent’ energy demand. The original series is available for 2000-2023. For 2024-2050, we use estimates from linear regression (Energy Institute, 2025).

We calculated the required installed capacity to meet such renewable energy demand by dividing the projected amount of renewable energy by the same utilisation hours per year as the average for 2020-2024, meaning renewable power generation is assumed to work for a similar amount of time as now.

Denoting the input-equivalent energy demand as Ed, the actual renewable energy amount as Es, and the required installed renewable power generation capacity as P, we have:

Es = Ed x ƞ

P = Es / T

where ƞ denotes the average efficiency factor of thermal power plants and T denotes the average utilisation hours of renewable power projects.

This is an output of China Horizons, Bruegel’s contribution in the project Dealing with a resurgent China (DWARC). This project has received funding from the European Union’s HORIZON Research and Innovation Actions under grant agreement No. 101061700.

Source : Bruegel