EU leniency on Germany’s fiscal plan highlights rule rigidity and the need for reform to support investment.

Germany’s July 2025 medium-term fiscal-structural plan exposes the tension between raising public investment in a low-risk country and the requirement in European Union fiscal rules for member state debt to comply with the 60 percent of GDP public debt ratio benchmark. Germany’s plan seeks to reconcile this tension by adopting overly optimistic GDP growth and inflation assumptions, and by proposing a large, backloaded fiscal adjustment. The European Commission endorsed the plan without rigorously assessing these assumptions.

Under more realistic economic assumptions, both the budget deficit and the public debt would be significantly higher than the plan’s projections. Rather than beginning to fall by the end of the allowed seven-year adjustment period, German debt will likely continue to rise, even if Germany keeps its promise to sharply reduce expenditure growth after 2026. This outcome would be inconsistent with the EU fiscal framework, but not threaten the sustainability of German public debt, as the fiscal adjustment required to stabilise the debt would remain feasible. Germany will likely ultimately deliver the necessary consolidation, but over a longer period than foreseen by the EU rules.

However, the Commission’s approval of the German plan establishes a precedent that could undermine the credibility of the EU’s fiscal framework. Other EU countries may cite the Commission’s leniency to justify higher expenditure growth not grounded in sound economic assumptions during the next round of national fiscal plan submissions in 2028, or even earlier through mid-term revisions.

To prevent such an outcome, EU fiscal rules should be adjusted. The best option would be to permit low-risk countries with credible investment plans longer adjustment periods than the current seven-year maximum. Such a reform would result in a coherent system that ensures both debt sustainability and allows more public investment. The second-best option would be to raise the Treaty’s debt reference value from 60 percent to 90 percent of GDP. If neither proves politically feasible, technical adjustments to the debt sustainability analysis could still be made, but these would yield only marginal improvements.

1 Introduction

In July 2025, Germany became the last European Union country to submit to the European Commission its medium-term fiscal-structural plan (MTFSP), a requirement under the revised fiscal framework adopted by the EU in 2024. Germany’s MTFSP envisages an initial increase in expenditure growth, followed by a sharp deceleration (Federal Ministry of Finance, 2025). Based on the plan’s assumptions, Germany’s structural primary balance would initially widen, from -0.9 percent in 2024 to -1.8 percent in 2026, before rising to 1.1 percent in 2031.

On 16 September 2025, the Commission endorsed the plan. It also endorsed Germany’s ‘national escape clause’ application. This allows Germany to spend up to 1.5 percent of GDP above its baseline expenditure path (European Commission, 2025b).

This Policy Brief analyses Germany’s fiscal plan and its endorsement by the Commission to answer the following questions:

What fiscal policy can now be expected from Germany? In March 2025, Germany changed its constitution to allow unlimited debt financing for defence spending above 1 percent of GDP, and to create a €500 billion (11 percent of annual GDP, spread over twelve years) extrabudgetary fund for additional infrastructure spending. This was expected to be a “game changer” that would allow Germany to run a much more expansionary fiscal policy over the medium term. Does the MTFSP bear out this expectation?

How does the MTFSP resolve the apparent contradiction between Germany’s March 2025 constitutional amendment and the EU fiscal rules? The former gave Germany much more borrowing space, while the latter require it to lower its deficit.

Notwithstanding the projected deceleration in expenditure after 2026, Germany’s proposed net expenditure path is substantially higher than the ‘reference path’ it received from the Commission in June 2025 (section 2). In light of this, how does the Commission justify its endorsement of the German plan? There is only one other EU country – Finland – for which the Commission has accepted a large deviation from the reference path, and in that case, there were very specific reasons for doing so.

What does Germany’s MTFSP and its endorsement by the Commission imply about the functioning and credibility of the new EU fiscal rules? Do they require yet another reform?

Our main findings are as follows.

On the face of it, Germany’s fiscal plan looks much more conservative than expected in March. Under the plan’s assumptions, the debt ratio would rise for a few years but start falling well before the end of the 2025-2031 adjustment period. This is true even if a temporary rise in spending, allowed under the national escape clause (NEC), is taken into account (so long as this is phased out by 2031).

However, the conservative flavour of Germany’s fiscal plan is to some extent an illusion, because it is based on optimistic assumptions about nominal growth that will likely not come to pass. Under more realistic assumptions, the structural primary balance will undershoot the MTFSP projections by a wide margin. Debt will continue to rise, though more slowly.

Regardless of how growth turns out, Germany’s plan requires it to sharply reduce expenditure growth after 2026. The flexibility that Germany receives through the NEC will allow it to delay, but not avoid, the moment when it hits the brakes. When this happens, the contractionary impact on the German and European economies will be substantial. Although Germany needs to adjust – in particular, through structural welfare state and tax system reform – this form of adjustment is not desirable. It is also not credible, since the required adjustment in the non-defence portion of the budget would be very large (in the order of 2 percent of GDP between 2028 and 2031), and because the adjustment would imply that by 2031, Germany would have ‘overperformed’ against the requirements of its constitutional debt brake. In other words, the adjustment that Germany will need to undertake in 2028-2031 responds mainly to the requirements of the EU rules, not to those of the national rule.

The implication is that the EU rules require reform to give low-risk countries such as Germany more room to use their fiscal space, even if it means that their debts will for a long period rise above the 60 percent of GDP limit specified in the EU fiscal rules.

We first present the main features of Germany’s MTFSP and explore the sensitivity of projected deficits and debt to nominal growth assumptions. We next quantify the gap between the requirements of the EU-level fiscal rules and Germany’s debt brake after the March constitutional amendment. Third, we answer the question of how the German MTFSP resolves the tension between raising spending under the amended national debt rule and complying with EU fiscal rules. Finally, we examine the implications of the MTFSP for Germany and Europe – economically and for the credibility of the fiscal framework, and set out recommendations for the best way forward.

2 Germany’s fiscal path, 2025-2031

Table 1 compares the fiscal paths and economic assumptions in the German MTFSP with those the European Commission transmitted to Germany in June 2025. The Commission envisaged linear adjustment from -1 percent of GDP to +0.8 percent by 2031 when the numerical safeguards specified in EU fiscal rules are disregarded, which is allowed when the NEC is applied. In contrast, Germany’s MTFSP envisages an initial widening of the structural primary deficit from -0.9 percent in 2024 to -1.8 percent of GDP by 2026, followed by a tightening that is so sharp that the Commission’s 0.8 percent target is reached a year early, and overshot by 0.3 percent of GDP in 2031. Average annual fiscal adjustment, taken over the seven years, is 0.29 percent of GDP in the German plan, very slightly higher than the Commission’s 0.26 percent, and although debt initially rises faster than in the Commission’s reference path, it starts falling in the same year (2029) as envisaged by the Commission.

The MTFSP’s narrative can hence be described as follows: Germany would like to proceed with investment and defence spending immediately. It also wishes to comply with the total fiscal adjustment required under the EU fiscal rules. Hence, its proposed adjustment path is backloaded. Eventually, Germany plans to reach – and even surpass – the 2031 structural primary balance (SPB) prescribed by the European Commission.

Germany’s backloaded trajectory for its SPB is mirrored by its proposed net-expenditure growth path – the operational target of its fiscal plan. Spending growth is projected to accelerate initially, from 4 percent in 2024 to 4.5 percent in 2026, above the 2.0 percent growth envisaged by the Commission’s reference path over the same period (if the extra room under the NEC is utilised, the spending increases would be even higher, as outlined below). Subsequently, the German plan foresees a sharp decline in nominal expenditure growth to 1.6 percent by 2029, below the reference path’s 2.3 percent, followed by a modest increase.

At the same time, average expenditure growth over the 2025-2029 period is much higher – by 0.6 percent per year – than in the Commission’s reference path. How is this possible, given that fiscal adjustment as measured by the change in the SPB is at least as high in the German plan as in the European Commission reference path? The answer is that the MTFSP makes much more favourable economic assumptions. While the Commission assumes average GDP deflator growth of around 2.2 percent, Germany assumes 2.6 percent, and while the Commission assumes average growth of potential output of 0.5 percent per year, Germany assumes 0.9 percent, which is the average potential output growth for 2025-2041 implied by the Commission’s assumed potential growth path.

Higher nominal GDP allows higher nominal expenditure growth for a particular level of planned fiscal adjustment, measured in terms of the change in the SPB. But if nominal GDP growth turns out lower than assumed, the implication is lower fiscal adjustment in terms of the SPB. Below, we investigate the consequences of lower-than-assumed nominal growth for the SPB path (and the associated debt path).

These trajectories do not yet factor in the extra spending room Germany obtained through the NEC. The implication of the latter is to allow Germany to target a somewhat higher SPB between 2025 and 2028 than would otherwise be approved – up to an amount that is capped by either the difference between actual defence spending and Germany’s defence spending in 2021, or 1.5 percent of GDP, whichever is smaller. Furthermore, the flexibility under the NEC might extend beyond 2028, either to accommodate payments for military equipment ordered in 2025-2028 that arrives later, or because the NEC itself is extended (European Commission, 2025a). We assume the NEC will be applied as follows:

Between 2025 and 2028, Germany will raise its net expenditure path by the maximum amount allowed under the NEC: that is, to target a lower SPB of about 0.5 percent of GDP in 2025, 0.8 percent in 2026, 1 percent in 2027 and 1.5 percent in 2028 (see penultimate line in Table 1).

During 2029-2030, the NEC will be used to allow Germany to smoothly reach its 2031 primary balance target of 1.1 percent of GDP, without having to lower expenditure in nominal terms (as it would have to if expenditure growth in 2029 were determined by Germany’s 2029 original SPB target before application of the NEC, that is, 0.3 percent of GDP); see note to Table 1.

The last two lines of Table 1 show the result. Expenditure growth would exceed the German MTFSP’s expenditure growth path by about 1 percentage point during 2025-2026, and by about half a percentage point in 2027-20286. During 2029, expenditure growth would drop to 1.4 percent, a few decimals below the originally planned growth rate, and would remain at about that rate until 2031. This slowing of expenditure growth in the last three years of the adjustment period is necessary to make up for the faster growth during 2025-2028, while still attaining the original SPB target of 1.1 percent in 2031. Hence, the application of the NEC exacerbates the backloading of the expenditure path proposed in the MTFSP, in the sense that it leads to an even larger expansion upfront, followed by a larger contraction (so long as the NEC is phased out by 2031).

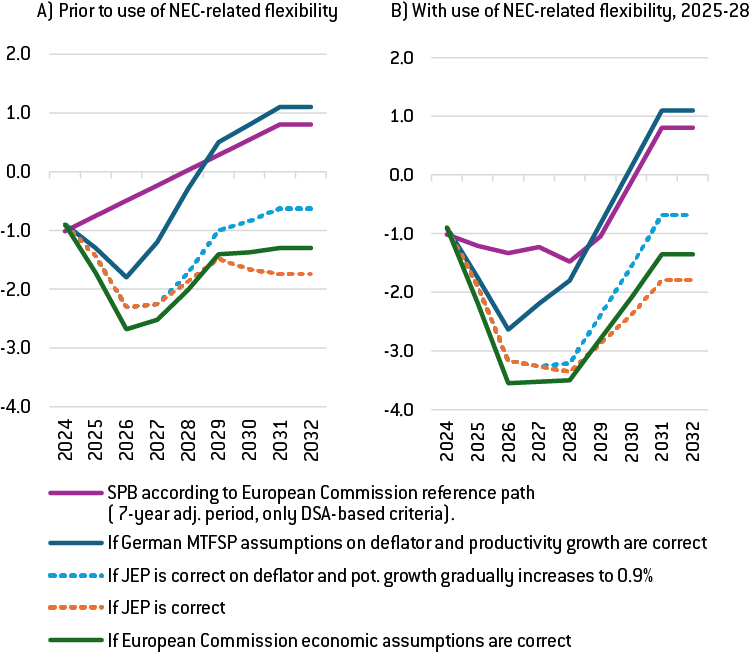

Figure 1 shows how Germany’s SPB would evolve if Germany executes its proposed net expenditure plan (not easy, since this requires reducing expenditure in real terms during 2027-2029), while inflation and potential output growth evolve in line with different scenarios. Figure 1 Panel A assumes the expenditure path shown in the fourth row of Table 1, while Panel B assumes the expenditure path after the application of the NEC, shown in the penultimate row of the table. The solid blue lines show the paths of the German SPB according to Germany’s MTFSP – that is, based on the MTFSP’s potential output and GDP deflator growth assumptions, as shown in Table 1. The solid purple lines at the top of the figures represent the Commission’s reference path, before and after application of the NEC. The solid green lines show how the German primary balance would evolve, conditional on Germany’s proposed expenditure growth and the Commission’s economic assumptions. The impact would be massive. Not only would Germany fail to reach the SPB of 0.8 percent of GDP by 2031, as prescribed by the Commission, but its 2031 primary balance would end up at 1.3 percent of GDP, lower than its starting value in 2024.

Figure 1: Structural primary balance paths conditional on Germany’s proposed net expenditure targets, for varying nominal growth outcomes (% of GDP)

Source: Bruegel. Note: ‘SPB according to the EC reference path’ is taken from the European Commission’s prior guidance calculations sheet7, which disregards the safeguards, but does not include the increased fiscal space resulting from the NEC. ‘SPB based on Germany’s planned expenditure growth and assumed deflator and productivity growth’ is from the German plan. For the remaining scenarios, SPB at time t is calculated as spb(t) = spb(t-1) – (E/Y)*{e(t)-g(t)-pi(t)}, where e(t) is net expenditure growth according to table B4 of the German MTFSP, g(t) and pi(t) are the real potential growth and deflator growth assumptions associated with each scenario, (E/Y) is set at 0.485, and spb(2024) = -0.9.

As the MTFSP argues (see section 4.2), the Commission’s assumptions about nominal growth might too pessimistic because they do not yet reflect the impact of the German spending package. To check this, we refer to the 2025-2027 Joint Economic Projection of the German economic research institutes, published on 25 September 2025 (henceforth JEP; Projektgruppe Gemeinschaftsdiagnose, 2025). This sees GDP deflator growth in 2025 at 3.0 percent, slightly higher than the MTFSP, falling to 2.4 percent in 2026 and 2.1 percent in 2027. We extrapolate this forecast by assuming 2.2 percent GDP deflator growth after 2027, in line with market-implied forward inflation rates and European Commission’s reference trajectory projections. Potential output growth is forecast at 0.3 percent per year for 2025-2027 and about 0.2 thereafter, much below the assumptions in the MTFSP (Table 1). For 2027 and beyond, they are also lower than the European Commission’s reference trajectory projections.

We use the JEP forecasts to construct two additional scenarios, represented by the dotted lines in Figure 1. One follows the JEP in both their GDP deflator and potential growth assumptions. The other uses their GDP deflator assumptions and potential output growth assumptions up to 2027, but assumes that by 2029 potential growth subsequently converges to 0.9 percent of GDP (the average value of the 2025-2041 European Commission forecast). This ‘combined scenario’ (Table 1) could be justified through the productivity effects of the German investment package. However, the assumed sudden rise in potential growth from 0.3 percent in 2027 to 0.9 percent in 2029 continue to make this an optimistic scenario.

Figure 1 shows that in both of these scenarios, the SPB paths would remain much below the MTFSP target. If the assumptions of the JEP are correct, the SPB in 2031 would end up at around -1.8 percent, even lower than in the scenario in which the European Commission’s assumptions are correct. In the combined scenario, the SPB would reach about -0.7 percent in 2031 – a modest improvement over the 2024 outturn of -0.9 percent of GDP, and still much below the 0.8 percent target of the European Commission’s reference path.

Figure 2 shows the implications for the debt path of the SPB paths in Figure 1, based on the same economic scenarios. The solid blue line in Figure 1 Panel A shows the debt path projected in Germany’s MTFSP: debt would rise to about 67 percent of GDP in 2028 and then decline to about 63 percent (slightly above the 2024 starting value) in 2031. However, this is before accounting for higher spending under the national escape clause. If the latter is taken into account, while continuing to assume the MTFSP’s nominal growth path, debt would rise to about 71 percent and then start a gradual decline to about 70 percent in 2031.

In all other scenarios, however, there is no debt inflection. If the JEP assumptions materialise and the NEC is used to support higher expenditure growth, as described in the penultimate row of Table 1, debt would rise to about 80 percent of GDP in 2031 and would continue to rise, albeit slowly, crossing 90 percent of GDP by 2037 (orange dotted line, Figure 2 Panel B). If the assumptions of the combined scenario are realised (blue dotted line, Figure 2 Panel B), debt would rise to about 77 percent in 2031 and continue rising, exceeding 80 percent by 2036. As a result, the main goal of the debt-sustainability assessment under the new EU fiscal framework – to put the public debt ratio onto a plausibly declining path after the four-to-seven-year adjustment period – would be violated in all economic scenarios shown in Figures 1 and 2, except for the MTFSP scenario.

These continued rises in debt ratio reflect the assumption that the SPB, excluding ageing costs, will remain frozen at its 2031 value (about -0.7 percent of GDP in the combined scenarios). However, this would not be the case, either because Germany’s national debt brake would become binding (see below) or because at the next application of the framework in four years, Germany would be asked to raise its SPB from 2030 onwards. In the meantime, German debt would hover at about 80 percent of GDP and Germany would likely continue to have low-cost access to debt markets.

Figure 2: Debt-to-GDP paths conditional on Germany’s proposed net expenditure targets, for varying nominal growth outcomes (% of GDP)

Source: Bruegel. Note: see notes to Figure 1.

This points to a paradox. Under plausible economic assumptions, the fiscal path proposed by Germany fails against the debt-sustainability criteria in the fiscal framework. But it is also clear that debt sustainability as conventionally defined (for example, in IMF, 2021) would not be seriously threatened in any of the four scenarios. Even in the most pessimistic scenario, the SPB would fall to -1.8 percent. From that position, debt stabilisation would require a medium-term fiscal effort about 1 percent larger than in 2025-2031 (when the starting position was -0.9 percent), but this would remain feasible. If investment gaps were reduced and defence spending reached 3.5 percent of GDP in the meantime, it might even be easier to achieve than today.

This suggests that something is not quite right in how the EU fiscal framework defines debt sustainability for a country such as Germany. We return to this point in section 5.

3 How the German plan reconciles EU and national fiscal requirements

This section answers how the MTFSP resolves the contradiction between the requirements of the EU fiscal rules and using the greater fiscal space afforded by the amended national debt brake. Part of the answer is that the MTFSP makes optimistic macroeconomic assumptions. However, this is not the full story.

We first show why there is a gap and quantify it. Second, we decompose the gap into two components – underperformance of Germany’s SPB against the requirements of the EU rules, and overperformance of Germany’s SPB against the requirements of the German rule – and show how the two components vary depending on macroeconomic assumptions, and what this means for German fiscal adjustment.

3.1 Quantifying the gap between the German and EU fiscal rule requirements

EU fiscal rules operate by setting an adjustment period of four years, unless the country is granted an extension, and a target path for nominal expenditure growth, which is calibrated on the basis for the required change in the general government SPB from the starting year until the end of that adjustment period. For Germany, the adjustment period is seven years. Over this period, Germany is required to raise its SPB from a deficit of about 1 percent of GDP in 2024 to a surplus of 0.8 percent by 2031. Under the assumptions made in the previous section, the NEC will allow it to delay this adjustment, but not to avoid it entirely.

By contrast, Germany’s national fiscal rule does not prescribe any general government fiscal target. Instead, it requires federal and state governments to limit their structural deficits to 0.35 percent of GDP, excluding spending through extrabudgetary funds and the excess of security spending over 1 percent of GDP9.

To see what these national rules and Germany’s spending plans imply for Germany’s medium-term general government SPB, it helps to write down a few inequalities. Denoting the structural balances of the federal and state governments as bFed and bstates, respectively, annual spending from the extrabudgetary funds as f and security spending as s , Germany’s national fiscal rules can be expressed as:

| bFed ≥ – 0.35 – (s – 1) – f = 0.65 – (s + f) | (1) |

| bstates ≥ – 0.35 | (2) |

which implies

| bFed + bstates ≥ 0.3 –s – f | (3) |

Germany’s structural primary balance at the general government level is defined as

| spbGer ≡ bFed + bstates + bMun + bSsec + i | (4) |

where and refer to the structural balances of municipalities and the social security fund, and is interest expenditure.

Using (3), this leads to the constraint:

| spbGer ≥ 0.3 –s – f + bMun + bSsec + i | (5) |

To compare this to the EU’s general government SPB target, we need three more pieces of information:

First, a projection for s and f. The government has not published such projections for 2031, but has published spending projections from extrabudgetary funds and defence spending projections up to 2029. The intention is to raise NATO defence spending to 3.4 percent in 2029 and keep it at 3.5 percent from 203010. We use this as a lower bound for security spending s. f will be around 1.2 percent of GDP in 2029 and will then likely decline, as a €500 billion fund appropriated in 2025 is gradually used up. Assuming linear depletion of the fund after 2029 leads to an estimate of about 0.4 percent of GDP for f in 2031.

Second, an estimate for general government interest spending. In its MTFSP, the government reckons that this will be 1.4 percent in 2029 and 1.6 percent in 2031.

Third, an assumption about the balances of the social security fund and municipalities, since these are also part of the general government SPB. Historically, the sum of the two has averaged zero since German unification in 1991, but recently they have been in deficit (Steinbach and Zettelmeyer, 2025). According to Bundesbank data, in 2024 this deficit was 0.43 percent of GDP for municipalities, and 0.25 percent for the social security fund. We assume, conservatively, that bMun + bSsec ≤ 0 until at least 2031 (ie that municipalities and the social security fund will not generate a joint surplus autonomously).

Taken together, these assumptions imply that the minimum SPB implied by the German constitutional fiscal constraints is:

| spbGermin = [0.3 – s – f + i] | (6) |

while the gap between the requirement of the EU fiscal rules and the minimum requirement of the German constitution is:

| gap ≡ spbEC – spbGermin = spbEC –[0.3 – s – f + i] | (7) |

Hence, using the above assumptions and estimates for 2031, we have

gap2031 = 0.8 −[0.3 − 3.5 − 0.4 + 1.6] = 2.8

Hence, on the assumption that the NEC no longer applies in 2031, EU fiscal rules require Germany to run an SPB in 2031 that is 2.8 percent higher (tighter) than the minimum requirement under German national rules.

For 2029, the last year of the government’s planning horizon, the EU rules do not provide a firm target, but a reference value for the structural primary balance, of 0.3 percent of GDP. The approval of the NEC for Germany does not necessarily affect this value, as the NEC currently extends only until 2028. However, if the assumptions made in the previous section on how the NEC might be used beyond 2028 are realised11, the relevant reference value would be -0.8 percent rather than 0.3 percent (last line of Table 1). Hence:

gap2029 = 0.3 − [0.3−3.4−1.2+1.4]=3.2 if NEC is not used beyond 2028, or

gap2029 = −0.8 − [0.3 − 3.4 − 1.2 + 1.4] = 2.1 if the NEC is used beyond 2028.

3.2 Closing the gap: optimistic macro assumptions vs. overperformance

The question is how Germany’s MTFSP closes these gaps. To answer this, we expand equation (7) as follows:

| gap ≡ spbEC – spbGermin = (spbEC – spb) – (spb – spbGermin) | (8) |

The bracket on the right-hand side denotes the difference between spbEC, the SPB reference value set by the European Commission (after taking into account the impact of the national escape clause, if any), and the actual (ex-post) SPB. The second bracket denotes the difference between the actual SPB and spbGermin, the minimum required SPB under the new German constitutional debt rule.

Hence, there are two ways in which the MTFSP can close the gap between the European and national fiscal requirements:

It could set its target SPB at or close to the reference value required by the European Commission, while also making optimistic economic assumptions – in particular, by assuming high nominal growth over the relevant (2025-2031) period. If nominal growth turns out lower than assumed, the realised SPB will be below the SPB path targeted in the MTFSP and hence the SPB required by the European Commission (spbEC – spb > 0). This is because, once the MTFSP is accepted by the European Commission, the fiscal rules require Germany to stick to the promised expenditure growth rates, not the promised SPB path.

It could ‘overperform’ the national debt brake, ie undertake fiscal adjustment beyond what it is required under national fiscal rules (spb- spbGermin > 0)

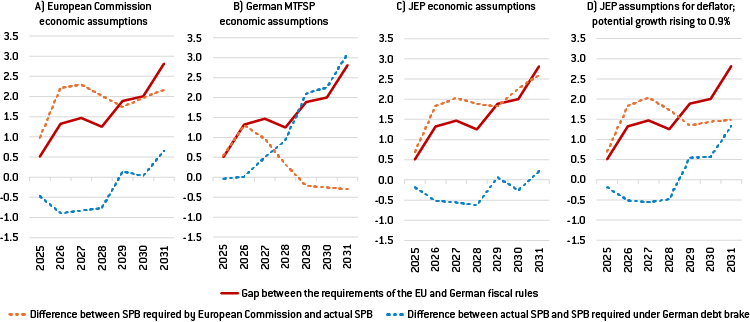

Figure 3 plots the contributions of economic assumptions and debt-brake overperformance to closing the 2031 gap of 2.8 percent of GDP for the four economic assumptions illustrated in Figures 1 and 2. If the assumptions in Germany’s MTFSP turn out to be correct, its SPB would exceed that required by the European Commission (0.8 percent of GDP in 2031) by 0.3 percent of GDP (Table 1 and Figure 2). This means that the adjustment proposed in the German plan would overperform relative to the required 2031 structural primary balance under German fiscal rules (conditional on projected defence and extrabudgetary spending in 2031) by 2.8 + 0.3 = 3.1 percent GDP (first bar on the left in Figure 3).

Figure 3: The role of economic assumptions and debt brake overperformance in closing the gap between the EU and German fiscal rule requirements in 2031

Source: Bruegel; see Table 1. Note. ‘Contribution of economic assumptions’ is calculated as the difference between the 2031 value of the relevant European Commission’s reference path for the SPB, 0.8 percent of GDP and the 2031 value of the SPB associated with each set of economic assumptions. ‘Contribution of overperformance’ is calculated as 2.81 minus ‘Contribution of economic assumptions’. ‘Contribution of overperformance’ can also be calculated directly, as [spb(31) + f(31)+ s(31)] – [i(31)+0.3], where f(31), s(31) and i(31) refer to the extrabudgetary spending, security spending and interest spending projected by the German government for 2031, and spb(31) refers to the SPB for 2031 associated with each scenario, after application of the NEC (see Figure 1 Panel B).

However, in all remaining three scenarios, optimistic assumptions play the main role in closing the gap, while some degree of overperformance relative to the national debt rule would still be required. This is true even for the JEP assumptions (section 2; Projektgruppe Gemeinschaftsdiagnose, 2025), which lead to the lowest 2031 structural primary balance, pushing the actual spb very close – but not all the way – to the low spbGermin required by the German rules. In the combined scenario (last bar in Figure 3), the MTFSP’s optimistic economic assumptions do slightly more to explaining the gap than overperformance against the national debt rule.

Figure 4 shows the evolution of the gap between the EU and German rule requirements and the contributions of debt-brake overperformance and economic assumptions in closing it, assuming that the NEC is used in line with the assumptions explained above and in the note to Table 1. Each panel represents one of the four scenarios shown in the previous figures. The solid red line is identical in all four panels: it shows the evolution of the gap between the SPB requirements of the EU rules (taking into account the NEC), and those of the German fiscal rules, assuming that the sum of the fiscal balances of municipal governments and social security funds is zero (see equation 6). The two broken lines show the decomposition of the gap into the two terms on the right-hand side of equation (8):

The orange broken line plots spbEC – spb, the first term on the right-hand side of equation 8. Under the assumptions of the MTFSP (Figure 4 Panel B), this term is initially positive because of backloading of adjustment, but quickly converges to zero after 2027, and becomes slightly negative (reflecting the fact that the MTFSP’s SPB target of 1.1 percent is above the European Commission requirement of 0.8 percent). In all other economic scenarios, however, the term stays large and positive.

The blue broken line represents spb – spbGermin, the overperformance of the actual SPB over what German national fiscal rules require. Under MTFSP assumptions, this is approximately zero in 2025-2026 but then rises sharply. In all other scenarios, it is negative during 2025-2028 but eventually becomes positive, most notably in the combined scenario.

In short, the decomposition suggests that unless the assumptions of the MTFSP come to pass, the assumed expenditure path – resulting from the German commitments under its MTFSP, overlayed by the additional flexibility provided by the NEC – would violate the national fiscal rule until 2028, but would eventually lead to an overperformance. The degree of this initial violation and eventual overperformance will depend on how nominal growth turns out. Except in the ‘combined scenario’ – in which the assumptions on potential growth are close to those assumed in the MTFSP, and hence optimistic – the initial violation outweighs the eventual overperformance.

Figure 4: Evolution of the gap between the requirements of EU and German rules and decomposition of the latter, for alternative economic assumptions (with NEC)

Source: Bruegel; see Figure 1.

An important remaining question is what this overperformance would imply for the non-defence, on-budget fiscal balance that Germany will need to achieve in the next few years. To see this, we start with the term spb – spbGermin, substitute spbGermin = [i + 0.3 -s – f ] (equation (6)), and rearrange to obtain:

| spb – spbGermin = [spb + s + f] – [i + 0.3] | (9) |

The first term on the right-hand side of equation (9) equals the combined SPB of the federal and state governments, net of outlays for defence and the infrastructure fund. The second term is the constitutional lower bound that applies to this balance (see equation 3). Figure 6 in the appendix plots this decomposition, and shows that under MTFSP assumptions, the security and infrastructure-adjusted structural primary balance would need to rise from 1.4 percent of GDP in 2026 to over 5 percent of GDP in 2031 – an implausibly large adjustment. In the combined scenario, the 2031 target value would be 2.6 percent of GDP.

4 Implications for Germany and Europe

What are the implications of Germany’s approach – seeking to reconcile domestic policy objectives with the EU rules by sharply backloading fiscal contraction and making optimistic assumptions – both economically and for the EU fiscal rules?

4.1 Economic implications

Under any assumptions about nominal growth, Germany is planning something of a fiscal yo-yo. For example, in the combined scenario – based on the JEP deflator assumptions (Projektgruppe Gemeinschaftsdiagnose, 2025) and a quick increase of potential output growth to 0.9 percent per year – Germany would inject stimulus of about 2.3 percent of GDP into the economy by 2027 (assuming its room under the NEC is utilised fully). It would then hit the brakes, imposing a fiscal contraction in the order of 2.6 percent of GDP by 2031. Does this make sense?

The German economy is in or close to recession. The September JEP expects an output gap of almost 2 percent of potential GDP in 2025 and 1 percent in 2026. Hence, given the low risk of debt unsustainability, a fiscal stimulus during 2025-2026 – particularly one based on investment spending – is a good idea. But to subsequently reverse this stimulus rapidly (rather than just to withdraw it) makes no sense. Germany needs to eventually adjust to stabilise its debt ratio. But given its moderate level of debt and low interest spending, it can afford to undertake this adjustment gradually.

An important question is whether the sharp spending slowdown after 2026 can be justified by political economy, to force a budgetary restructuring that might not happen otherwise. But if this restructuring is to be sustainable, it will need to be based on structural reforms, including deep reform of Germany’s pension system and its long-term care costs, which are both threatened by adverse demographics (Darvas et al, 2025a), and tax reform. Structural reforms of this magnitude require time. While they can and should be initiated by the current government, it is hard to imagine that the sharp fiscal adjustment envisaged for 2027-2029 could be consistent with high-quality reform.

4.2 Implications for the credibility of the fiscal framework

Germany is not the only country to use optimistic nominal GDP assumptions to soften the fiscal adjustment needs associated with reaching the debt-reduction requirements of the EU fiscal rules, as reflected in the reference trajectories calculated by the European Commission using the commonly agreed methodologies (see Figure 5 Panel A, which updates data from Boivin and Darvas, 2025) . What distinguishes the German plan, however, is its significantly higher net expenditure growth compared to the Commission’s reference trajectory (Figure 5 Panel B). With the exception of Finland, which is a special case, most other countries suggested only minor deviations from their reference trajectories.

The question is whether this seemingly special treatment of Germany can be justified based on the letter and spirit of the EU fiscal rules – specifically, Regulation (EU) 2024/1263, the law that updated the fiscal rules in April 2024. This allows EU countries to use different economic assumptions from those of the European Commission, but it does require them to provide detailed justifications. Article 13 (b) allows EU governments to propose a “higher net expenditure path than in the reference trajectory” – which is what the German MTFSP has done; see Table 1 – so long as the country “provides in its plan a sound and data-driven arguments explaining the difference.” Article 36(f) contains a transition provision for potential growth assumptions, under which “Member States may use more stable series than the ones resulting from the commonly agreed methodology, provided that such use is duly justified by economic arguments and that the cumulated growth over the projection horizon remains broadly in line with the results of that methodology.”

Figure 5: Deviation of the plan from the reference trajectory (average annual gap between growth rates during the adjustment period)

Source: Bruegel. Note: only countries that received a reference trajectory are included. A positive value indicates a higher growth assumption in the plan compared to the reference trajectory. Nominal potential growth is calculated from real potential growth and GDP deflator assumptions. Hungary submitted its initial plan on 4 November 2024, and subsequently revised it by 16 January 2025.

The second condition of Article 36(f), referring to cumulated growth, is in fact satisfied for the potential growth path assumed by Germany: for 2025 to 2041, cumulative growth in real potential output assumed in the MTFSP is the same as in the Commission’s reference projection. Furthermore, the MTFSP very much attempts to “duly justify” both the assumed jump in productivity growth to 0.9 percent in 2025 and the high deflator growth assumptions:

With respect to potential growth, the MTFSP argues that “current third-party projections and internal estimates by the federal government alike indicate that the measures associated with the fiscal package will lead directly to an expansion of the public capital stock and, especially in the current macroeconomic environment, are likely to stimulate additional private investment and hence boost productivity growth in the overall economy” (p. 26).

With respect to deflator growth, it argues that the planned fiscal expansion will push the GDP deflator up beyond the Commission’s forecast, which was still “unable to take into account the macroeconomic implications of this fundamental adjustment to the constitutional fiscal framework”; and that “forecasts now published by leading German economic research institutes take the measures concerned into account and expect significant positive effects both on economic growth and on the rate of change of the GDP deflator” (p. 25). In addition, a recent “sharp fall in net immigration, especially from the EU” is expected to exert upward pressure on prices, given “the hitherto large immigrant contribution to employment growth” (p. 26).

In our assessment, it is plausible to assume that Germany’s fiscal package will eventually increase potential output growth. The strength of this impact is unclear, as it depends not only on the (one-off) impact of higher public investment on the capital stock but also on the MTFSP’s impact on productivity growth. Whatever its strength, however, construction and implementation lags imply that any increase will take several years, even if the rise in public and private investment is immediate. Consistent with this view, the German economic research institutes, the European Commission and the International Monetary Fund all project potential GDP growth of between 0.1 percent and 0.5 percent up to 2027 – well below the 0.9 percent assumed by the German government. Hence, the MTFSP’s productivity growth assumptions seem hard to justify using economic arguments.

In addition, the government’s assumptions are not all consistent. The MTFSP assumes much faster potential growth (0.9 percent) than actual growth (0.4 percent) in 2025, which implies expanding the already existing slack in the economy (from -1.4 percent to -1.8 percent, Table B2, line 30 of the MTFSP). This would exert downward pressure on prices, not upward pressure. For 2026, actual and potential growth are assumed to be equal (0.9 percent), implying no aggregate price pressure from the fiscal expansion. Moreover, the argument that a fall in immigration will drive up wages and prices is at odds with the high potential-output assumption, as lower net immigration would dampen potential growth, as argued by the JEP (Projektgruppe Gemeinschaftsdiagnose, 2025) .

Assuming higher GDP deflator growth than the European Commission makes sense in the short run but is not plausible in the medium term. The JEP, the European Commission, the IMF and market-implied inflation forecasts all see GDP deflator growth returning to around 2.2 percent by 2027 (Table 2). Importantly, the lower 2026 and 2027 deflator growth projections of the IMF and the research institutes cannot be attributed to a disregard of the planned fiscal stimulus: their forecasts assume a substantial widening of the structural primary balance in 2026 (by 1 percent of GDP in the case of the IMF and 1.2 percent of GDP in the case of the JEP). Furthermore, contrary to MTFSP assumptions, both the IMF and the research institutes project the expansion to continue in 2027.

The moderate inflationary effect that the JEP associateS with this expansion relates to the economy starting from a position of considerable slack. Like the MTFSP, the JEP explicitly acknowledges the possibility of demand-pull inflation in capacity-constrained sectors including civil engineering and defence. But JEP also refers to falling energy prices, easing service sector inflation and wage growth as moderating factors (Projektgruppe Gemeinschaftsdiagnose, 2025).

The MTFSP’s projection of continued elevated deflator growth beyond 2027 is even harder to defend. If a tight link exists between the government’s fiscal stance and the GDP deflator – as the MTFSP argues to justify its high forecasts for 2025 and 2026 – then sharp fiscal consolidation planned from 2027 onward should push deflator growth down. Yet, the MTFSP sees deflator growth remaining at 2.6 percent, well above the growth rates projected by the European Commission, the IMF and financial market expectations. The MTFSP arrives at these high medium-term levels by linearly interpolating from its elevated 2026 projection to 10-year financial market expectations of 2.2 percent. While the interpolation method aligns with the Commission’s debt-sustainability analysis methodology, the high starting point for 2026 mechanically results in average deflator growth that exceeds all other available medium-term forecasts.

Table 2: Comparison of deflator growth projections

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| GDP deflator growth (percent) | |||||||

| European Commission (June) | 3.11 | 2.44 | 2.17 | 2.18 | 2.19 | 2.20 | 2.21 |

| German MTFSP (July) | 3.10 | 2.70 | 2.60 | 2.60 | 2.60 | 2.50 | 2.50 |

| DIW (September) | 3.10 | 2.91 | 2.30 | 2.10 | … | … | … |

| IW Halle (September) | 3.10 | 2.56 | 2.00 | 2.10 | … | … | … |

| Ifo (September) | 3.10 | 2.89 | 2.22 | 2.50 | … | … | … |

| Kiel Institute (September) | 3.10 | 2.95 | 2.53 | 2.50 | … | … | … |

| Average | 3.10 | 2.83 | 2.26 | 2.30 | … | … | … |

| JEP (September) | 3.10 | 3.00 | 2.40 | 2.10 | … | … | … |

| IMF World Economic Outlook (October) | 3.11 | 2.34 | 1.89 | 1.96 | 2.15 | 2.17 | 2.22 |

| Memo item: structural primary balance (percent of GDP) | |||||||

| German MTFSP (July) | -0.9 | -1.3 | -1.8 | -1.2 | -0.3 | 0.5 | 0.8 |

| JEP (September) | -0.8 | -0.2 | -1.5 | -2.2 | … | … | … |

| IMF World Economic Outlook (October) | -1.1 | -0.9 | -1.9 | -2.9 | -3.0 | -3.0 | -2.7 |

Source: Bruegel based on European Commission, IMF and JEP (Projektgruppe Gemeinschaftsdiagnose, 2025). Note: the months shown in brackets are the months in 2025 when the projections were published.

We conclude that the deviation of average expenditure growth in the MTFSP from the reference path cannot be justified by “sound and data-driven arguments”, as required by the EU’s fiscal rules. How then, could the European Commission (2025b) endorse the MTFSP? The answer is that the Commission’s assessment does not contain a serious discussion of the plausibility of the MTFSP’s net growth assumptions.

With respect to the MTFSP’s potential-growth assumptions, the Commission notes, correctly, that the use of a “smoothed” series can be consistent with the rules “provided that that cumulative growth over the projection horizon (i.e. up to 2041) is broadly in line with the Commission’s assumptions and the application is duly justified by economic arguments, which is the case in the plan”. However, the Commission did not specify which economic arguments it finds convincing. The Commission also notes that “in the plan, the application of potential growth smoothing is justified by higher uncertainty in the estimation due to recent macroeconomic external shocks.” This is fair enough, but it justifies only the use of smoothing, not the way in which smoothing is applied – in particular, the assumed jump of potential GDP growth from 0.45 percent in 2024 to 0.9 percent in 2025, which is critical to justify the higher expenditure growth path. The Commission does not discuss this.

With respect to the higher GDP deflator path, the Commission correctly noted that “The difference between the GDP deflator in 2025 in the Commission’s assumptions and that in the plan is justified by more recent data”, but then went on to state that “the difference in GDP deflators for 2026 can be justified by price effects of global trade tensions and the significant expected increase in public spending. Taken together, these arguments duly justify this deviation in deflators vis-à-vis the Commission figures.”

This is an extraordinary line of argument. First, as argued above, the significant expected increase in public expenditure does not necessarily justify higher deflator growth because the economy is in a position of slack, which according to the MTFSP is expected to widen in 2025. Second, given the absence of EU retaliation against United States tariff increases and the importance of the US market for German exports, trade tensions are expected to have a contractionary impact on German demand. This would push prices down rather than up. Moreover, the reduction to zero of EU tariff rates on imported US industrial goods will also have some disinflationary impact. Third, and most importantly, the Commission does not engage at all with the MTFSP’s assumption that German deflator growth will stay at or above 2.6 percent of GDP over the entire five-year duration of the plan. As shown in section 2, this is essential for the argument that Germany will reach the Commission’s SPB target for 2031, notwithstanding higher average expenditure growth.

We conclude that the Commission has failed to conduct the careful assessment required by the rules of the assumptions underlying Germany’s proposed expenditure growth path.

Whether and to what extent this has damaged the credibility of the rules is harder to say. As argued above, Germany’s request for higher expenditure growth, and the Commission’s willingness to grant this request, is not typical of implementation of the rules so far. However, the Commission’s endorsement of Germany’s plan has hardly caused a ripple: it was entirely expected, perhaps because the Commission had signalled, even before Germany submitted its MTFSP, that it would accommodate Germany’s plans for higher defence and investment spending14. So far, no member state appears to have protested, at least publicly.

It is possible that other EU countries tacitly agree with the Commission that Germany is a special case, and that the German request for higher expenditure growth than provided by the Commission’s reference path should be accommodated, even if it is not based on “sound and data-driven arguments explaining the difference”. But it is also possible that other countries will attempt to use the Commission’s accommodation of Germany as a precedent, should they too decide to make request higher expenditure growth that is not fully backed by economic arguments. This would undermine the credibility and the goals of the EU fiscal framework.

5 Conclusion and policy recommendations

Germany has tried hard to reconcile its plans for increased spending on defence and investment with the EU fiscal rules, both by basing its plan on overly optimistic growth and inflation assumptions, and by proposing a large backloaded fiscal adjustment. Notwithstanding the European Commission’s endorsement, we do not consider this attempt to have been successful. But we do not blame Germany: as already argued by Steinbach and Zettelmeyer (2025), and with greater rigour in this paper, it is impossible to use the extra borrowing space Germany has given itself under its March 2025 constitutional amendment while also meeting the constraints imposed by the EU’s fiscal rules.

Two conclusions can be drawn from this.

The first, implied by Deutsche Bundesbank (2025) and the Scientific Council of the German Ministry of Finance (2025), is that Germany should not in fact use its borrowing space under domestic rules, in the sense that it should put debt on a declining path sooner rather than later, despite domestic rules allowing significantly higher debt on a sustained basis. We disagree with this: by excessively constraining investment and defence spending, this solution would likely be suboptimal for Germany and the EU15. Germany certainly should adjust, primarily by reforming its unsustainable entitlement system. But reforms of this type will not bend down the debt curve within the horizon required by the fiscal rules.

The second, favoured by us, is that use of the extra borrowing space may well be appropriate if it is used for its designated purpose – to raise investment and defence spending. As shown by Zettelmeyer (2025), utilising this space will not make Germany’s debt unsustainable. Rather, the problem is with the EU fiscal rules, which are inappropriate for countries with somewhat higher than 60 percent of GDP debt but low fiscal risks. The rules should allow such countries to borrow in order to invest, even if their debt exceeds 60 percent of GDP for a prolonged period.

The most generous interpretation of the German MTFSP and its endorsement by the European Commission is that Germany and the Commission are behaving as if a better version of the fiscal rules along the lines described were in place. However, if a better system were in place, Germany would not have had to come up with overly optimistic growth assumption, and it might have felt encouraged to present reform and adjustment plans that are more realistic, even if they take longer. Allowing Germany to achieve its spending targets by endorsing growth assumptions that are clearly not justifiable will likely have a cost for the system, as other countries may request the same treatment. Furthermore, as argued in section 4.1, Germany’s proposed sharp expenditure reduction in the final years of its five-year plan is not credible, and would not be desirable even if Germany manages to pull it off.

There are three main options to reform the EU’s fiscal rules to give more fiscal space to low-risk countries while safeguarding public debt sustainability, in decreasing order of political ambition:

A simple (if coarse) way would be to raise the treaty debt reference value from 60 percent to 90 percent of GDP, while keeping the fiscal requirements for countries not facing excessive deficits unchanged (Regulation (EU) 2024/1263; Steinbach and Zettelmeyer 2025). Raising the debt reference value requires unanimity among EU countries to change Protocol 12 to the Treaty on excessive deficits16, but this is simpler than changing a main article of the Treaty.

The rules could be revised to allow countries with low fiscal risks and convincing investment plans a longer adjustment period than the present seven-year maximum. Pench (2025) proposed that for countries with debt ratios between 60-90 percent of GDP, debt reduction with high probability could be achieved by the end of the sustainability assessment horizon (this adds ten more years). In addition, the definition of ‘unchanged policy’ that applies for the ten-year long post-adjustment period should be tweaked to allow for the expiry of investment programmes. A complementary proposal (Darvas et al, 2024, Annex 1) would exempt certain public investment plans from quantitative debt and deficit reduction requirements, provided that the additional investment is consistent with debt sustainability.

The debt sustainability analysis methodology could be refined, without any rule change. For example, the current 70 percent threshold used to define ‘high probability’ of debt reduction could be lowered for low-risk countries17. The deterministic stress tests – which assume identical shocks across all member states regardless of volatility – could either be eliminated for low-risk countries or recalibrated to reflect country-specific volatility and debt levels.

We recommend option 2: enabling countries with debt ratios between 60-90 percent to implement public investment programmes. This would provide a coherent system that would both ensure debt sustainability and allow more public investment. The main drawback is procedural: agreeing on the fiscal rules update (Regulation (EU) 2024/1263) took several years; a revision could also require time and political effort. Nevertheless, lessons learned during the first two years of the implementation of the new fiscal framework could facilitate quicker agreement on these rather limited modifications.

Second best would be to raise the Treaty’s debt benchmark from 60 percent to 90 percent of GDP. Changing a single figure in the Protocol could prove simpler than amending Regulation (EU) 2024/1263. However, given that several EU countries have long failed to meet the 60 percent benchmark, raising it might risk persistent non-compliance, which could endanger debt sustainability.

If neither of these options proves feasible, the third should be implemented by the Commission, in consultation with EU countries and the European Parliament. Reducing the 70 percent probability requirement to 55 percent in the debt sustainability analysis would reduce the German 2031 SPB goal by 0.4 percentage points of GDP – a noticeable reduction, though not a game changer.

There may be little appetite for another reform of the rules, even narrowly defined. But the Commission should prepare for such a reform before the next round of MTFSPs in 2028. It will become clear that the current system cannot cope with the plans of countries such as Germany when Germany’s fiscal balance and debt ratio start to diverge from the MTFSP’s projections beyond what is explained by the allowance of the NEC for defence spending – even if Germany sticks to its expenditure targets.

Source : Bruegel