Drivers of international primary income balances

Financial globalisation since the 1990s has led to large holdings of cross-border assets and liabilities in many countries. This column analyses the yields on assets

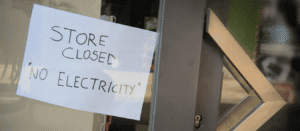

Bahrain unveils special reform package to bolster public finances

These measures include increases in fuel prices, higher electricity and water tariffs for certain categories, and greater dividend contributions from state-owned enterprises Bahrain’s government has

Sterling drops as inflation cements BoE cut expectations, dollar up before US inflation

British consumer price inflation fell to 3.2% in November, its lowest since March, from 3.6% in October, official figures showed. Sterling fell on Wednesday after

Dollar remains firm as markets await ECB, BoE rate announcements

The yen dipped 0.1% to 155.85, extending a 0.6% slide on Wednesday. The dollar inched higher against its major counterparts on Thursday as markets positioned

Sterling drops as inflation cements BoE cut expectations, dollar up before US inflation

British consumer price inflation fell to 3.2% in November, its lowest since March, from 3.6% in October, official figures showed. Sterling fell on Wednesday after

Gold edges down as investors turn cautious ahead of year-end US data

US Nov non-farm payrolls, unemployment rate data. Gold prices slipped on Tuesday, as investors turned cautious ahead of key U.S. jobs and inflation data, which

Yen gains ahead of BOJ decision in packed week for investors

A separate closely watched survey showed that big Japanese manufacturers’ business sentiment hit a four-year high in the three months to December. The yen strengthened

Emerging market resilience to risk-off shocks: Good luck, but mostly good policies

Emerging markets used to be hit hard whenever global investors turned nervous. This column analyses how emerging markets have managed output and inflation during global

Global trade to hit record $35trln despite slowing momentum

Between July and September, global trade grew 2.5% compared with the previous three months. Global trade is expected to grow about 7% in 2025, adding

Gold eases after divided Fed rate cut vote; silver hits new high

Spot gold fell 0.3% to $4,217.09 per ounce, as of 1111 GMT. U.S. gold futures for February delivery gained 0.5% to $4,244.70 per ounce. Gold