Sparking the investment miracle developing economies need to create jobs

Developing economies today face an investment shortfall of historic proportions. Meeting even the most modest development goals will require a huge investment push—equal to about 5 percent

The return of inflation: Why ‘look through’ can backfire under incomplete information

Central banks facing post-pandemic inflation often considered ‘looking through’ supply shocks. Using a New Keynesian framework in which agents gradually learn whether a cost-push shock

Africa’s industrial champions – Why it takes a village to build a continent’s future

Africa is bracing for a consumer and manufacturing boom. It won’t come with the snap of a finger. The continent must first navigate a gauntlet

Belt, Road Summit concludes with nine deals, $1bln deals

Organizers highlighted that Hong Kongآ’s external trade with Belt and Road countries reached $276bln in 2024. The 10th Belt and Road Summit in Hong Kong

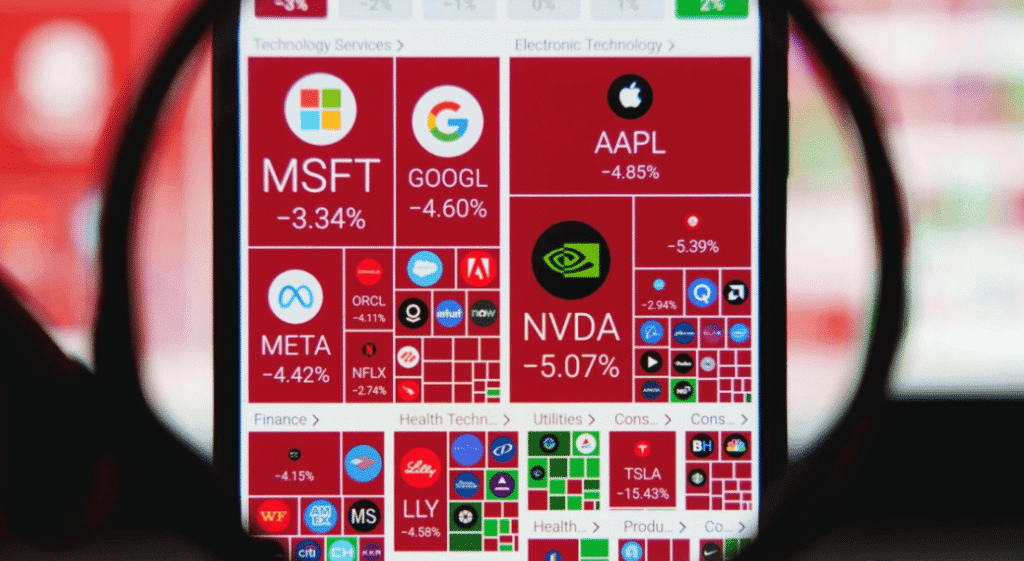

Unpacking US tech valuations: An agnostic assessment

The recent performance of the largest US tech companies has raised concerns about the risk of a stock market bubble. Using a three-stage pricing model

How institutions interact with exchange rates after the 2024 US presidential election

Within minutes of the result of the 2024 US presidential election becoming clear, it triggered a global tremor in currency markets. This column investigates how

Turning knowledge into action: Scaling solutions for disaster risk

Knowledge, especially practical, hands-on know-how, is essential for countries to tackle development challenges and to build resilience to disasters and shocks. One of the most

Navigating debt and trade: Data show persistent debt challenges for developing countries amid uncertain trade prospects

Low- and middle- income countries (LMICs) have rebounded strongly since the COVID-19 pandemic. Gross national income (GNI) among these countries was resilient in 2023, at

Laws, Data, and Empowerment: Insights from UNDP’s Women’s Empowerment Index and World Bank’s Women Business and Law Index

When it comes to improving economic outcomes for women and women’s empowerment, effective action requires reliable data. Yet, data capturing the full scope of women’s

Global shocks, institutional development, and trade restrictions: Learning from crises and recoveries between 1990 and 2022

During the past 20 years, the world economy has suffered two major crises in the form of the Global Financial Crisis and the COVID-19 pandemic.