Rising inflation rates and an overheating economy as the US economy recovered from the COVID-19 pandemic in 2021 and early 2022 shattered the popular belief that central banks had vanquished inflationary pressures for good and raised concerns about the economy re-entering an environment much like that of the 1970s. Indeed, there are some eerie parallels. Policymakers, for the first time since the 1970s, have been considering price controls in energy markets; in many countries, inflation targets have been subordinated to employment goals for the time being; and the spectre of a wage-price spiral is once again being debated.

The conventional wisdom in macroeconomics for many years had been that the inflation of the 1970s was caused by two major oil price shocks. While this account was subsequently rejected in the academic literature, it has remained a vivid memory in policy circles (Barsky and Kilian 2002, Nelson 2022). The recovery from the pandemic in 2021 and 2022 coincided with a surge in the demand for oil beyond what suppliers were able to produce after many years of underinvestment and downsizing. This fact has caused some policymakers to conclude that once again inflation is being driven first and foremost by oil prices. If only oil production could be lifted, this narrative goes, inflation would recede. In addition, rising prices of diesel fuel, jet fuel, natural gas and electricity have reinforced these inflationary pressures, independently of oil markets, drawing further attention to the role of energy prices.

Drawing on recent research by Kilian and Zhou (2022a, 2022b), in this column we show that the popular belief that energy prices have been driving US inflation is not supported by the data. There is strong evidence that rising energy prices were not the main determinant of the surge in US consumer price inflation in 2021 and 2022.

How energy prices enter the CPI

The direct effect of energy price shocks on inflation is limited by the share of energy spending in the consumer basket, which tends to be small. For example, the share of motor-fuel spending in the US is near 4%, far below the expenditure shares for food or shelter. Moreover, given the cost share of crude oil in the retail price of gasoline – about 60% in recent data – a 1% increase in the price of oil translates to only a 0.6% increase in gasoline prices. Much of that increase will occur within the first month. As a result, even sizeable unexpected increases in the price of oil will only have a modest direct effect on monthly inflation, and that effect will be short-lived. The share of spending on natural gas and electricity is even smaller than for motor gasoline and consumer spending on diesel fuel and jet fuel is negligible.

The reason why many macroeconomists are nevertheless concerned with energy price shocks is the notion that they may be passed through to prices of other goods and services. For example, an increase in the price of diesel fuel will raise the transportation cost for many other goods; an increase in the price of jet fuel will raise the cost of air travel and air freight. To the extent that firms have the market power to pass on these costs to the retail consumer, broader inflationary pressures will arise, possibly with a delay.

Moreover, to the extent that consumers are able to negotiate higher wages in response to these price increases, a wage-price spiral may set in, causing further broad-based price increases that may recur periodically, as wages catch up with consumer prices, or may occur gradually, if wage renegotiations are spread out over time (Blanchard 1986). These indirect effects are much harder to gauge without formally modelling this relationship.

How large is the inflationary effect of energy price shocks?

Despite the importance of quantifying the inflationary effects of energy price shocks, the academic literature has largely neglected this question until recently. Studies examining this question often use empirical methods that have been shown to be invalid (Kilian and Zhou 2022c).

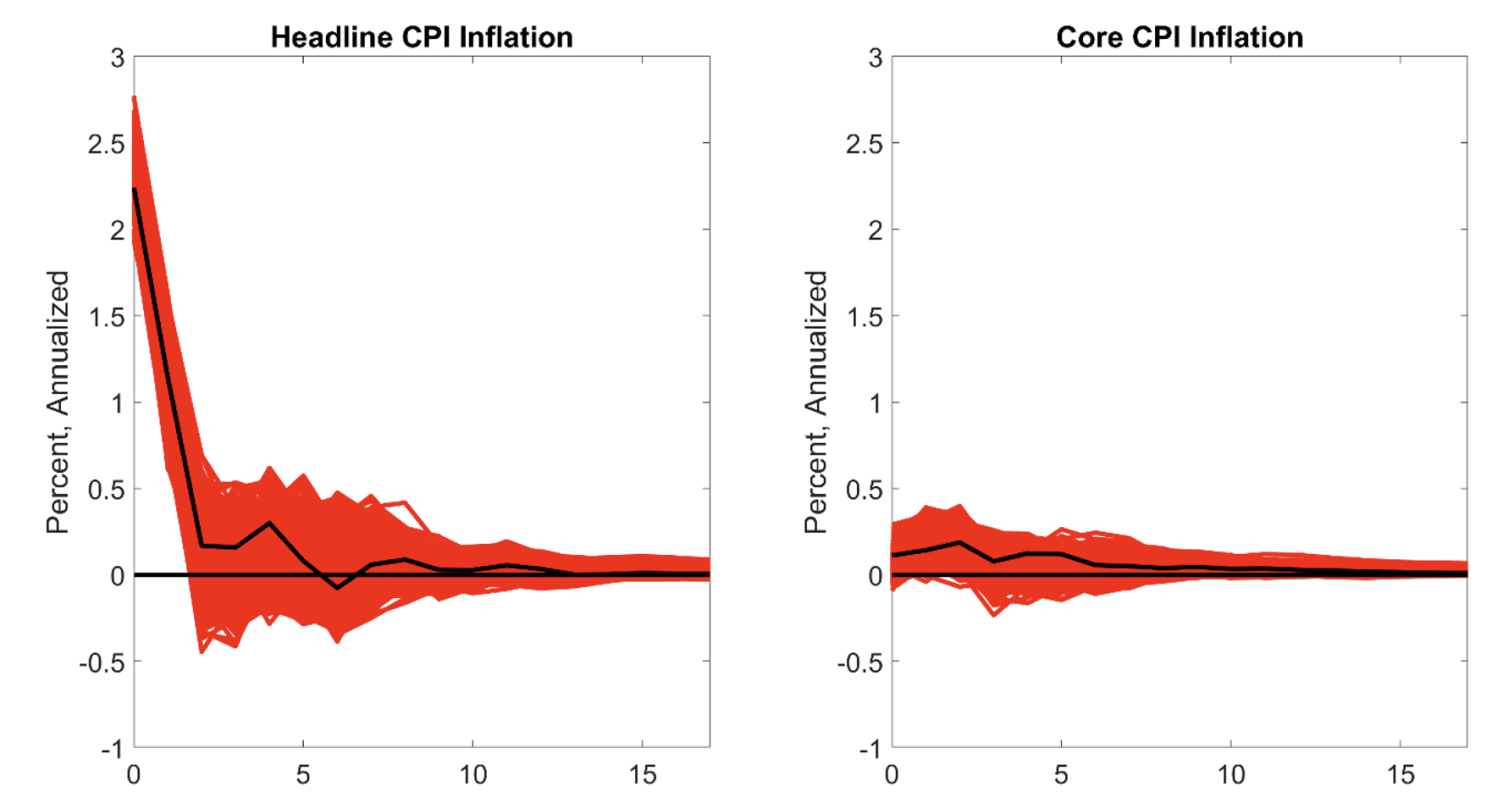

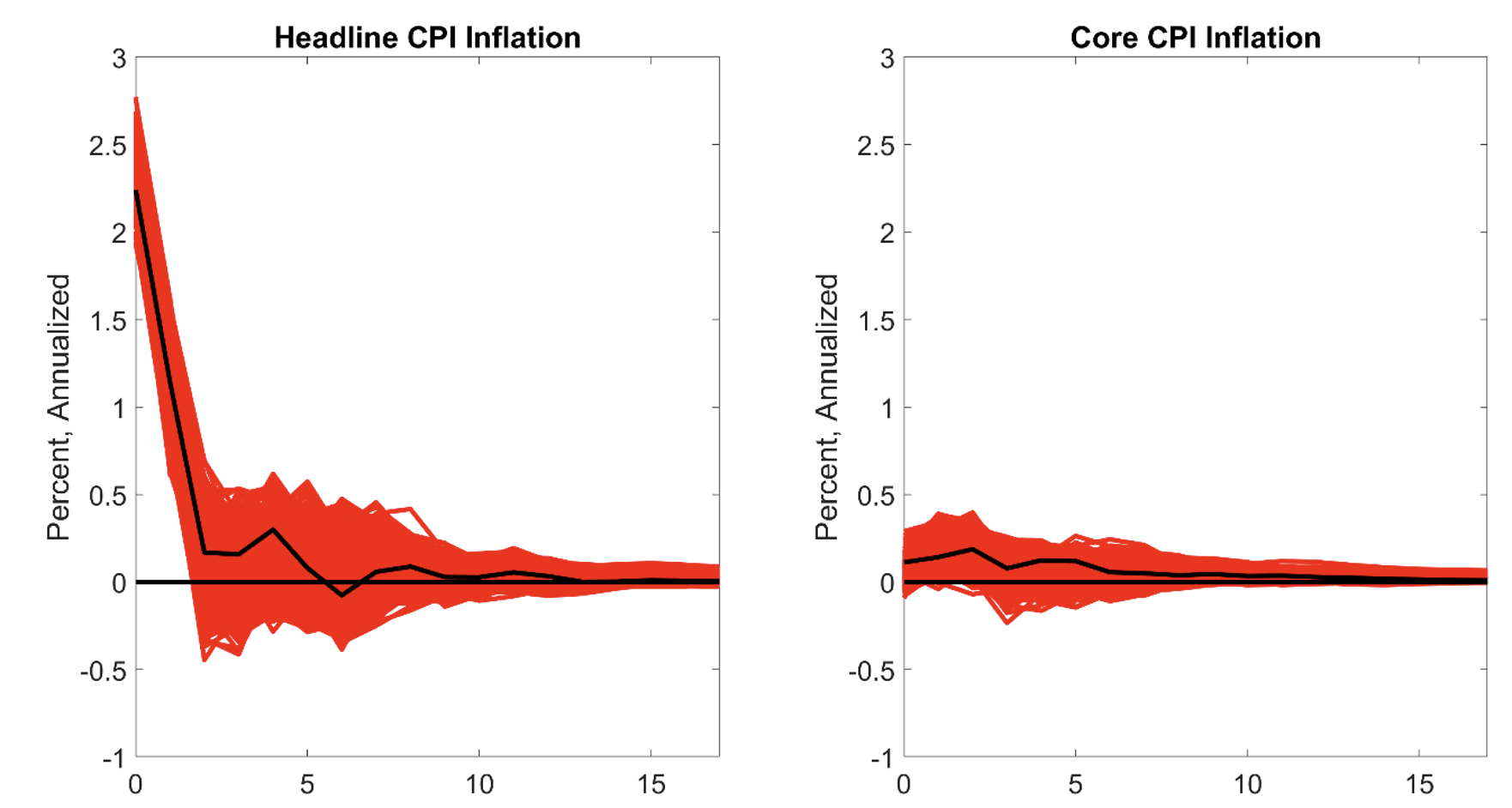

Using state-of-the-art vector autoregressive models, we show that a one-time unexpected increase in gasoline prices causes a sharp increase in US headline consumer price inflation, but that response only persists for two months before becoming indistinguishable from zero (Kilian and Zhou 2022a, 2022b; see Figure 1). There is no evidence of persistent increases in inflation in response to a positive gasoline price shock or of delayed periodic inflation spikes, as wages are renegotiated.

Figure 1 Responses of inflation to a one-time gasoline price shock

Source: Kilian and Zhou (2022b). The dark line is the response estimate. The shaded area captures the uncertainty about this estimate based on a 68% joint credible region.

Similarly, there are no large increases in core inflation (defined as inflation excluding energy and food prices). Nor is there evidence that long-term household inflation expectations show more than a negligible response to gasoline price shocks. Similar results hold for financial-market long-run expectations of inflation. This point is important because one of the tell-tale signs of a wage-price spiral would be the unanchoring of long-run inflation expectations.

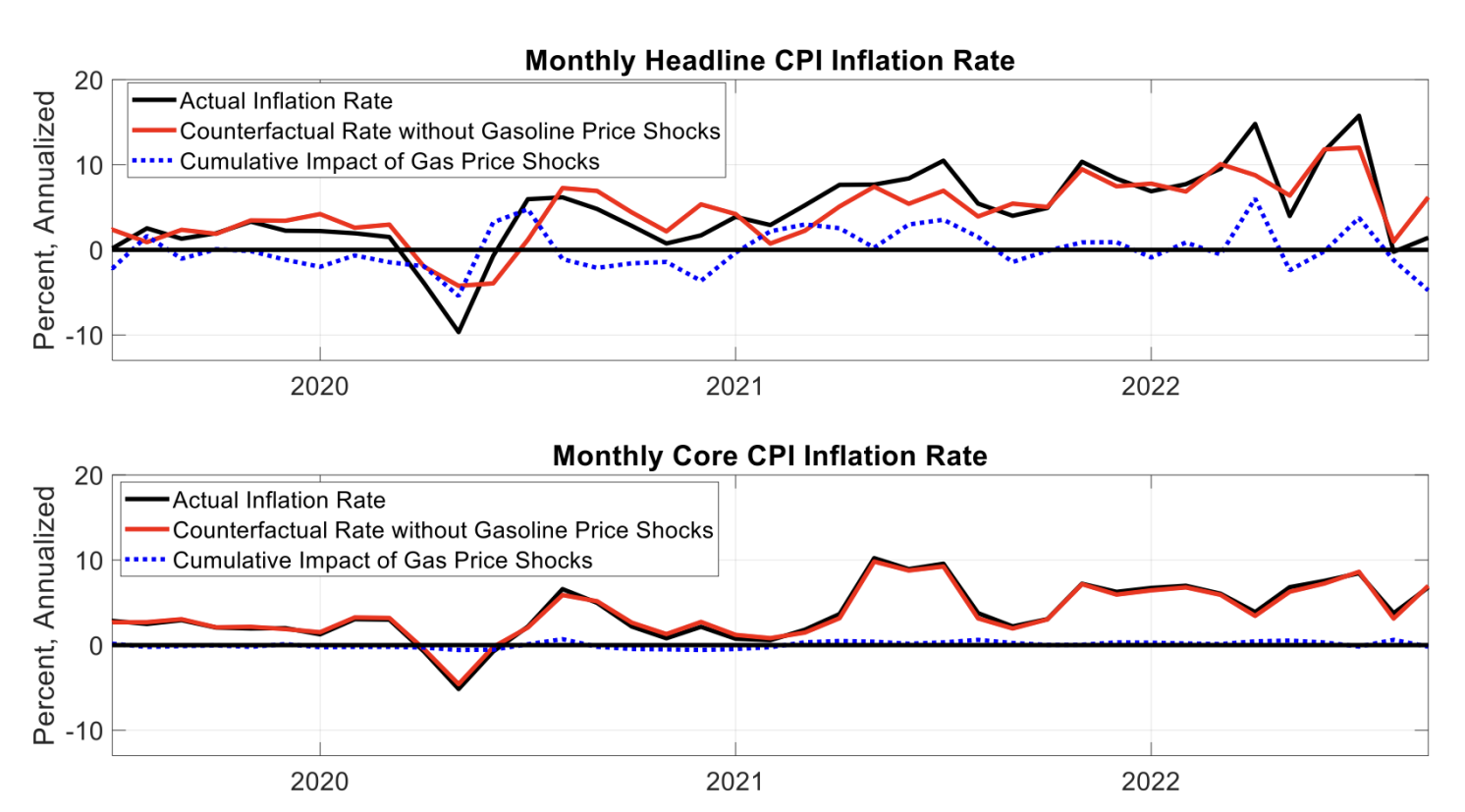

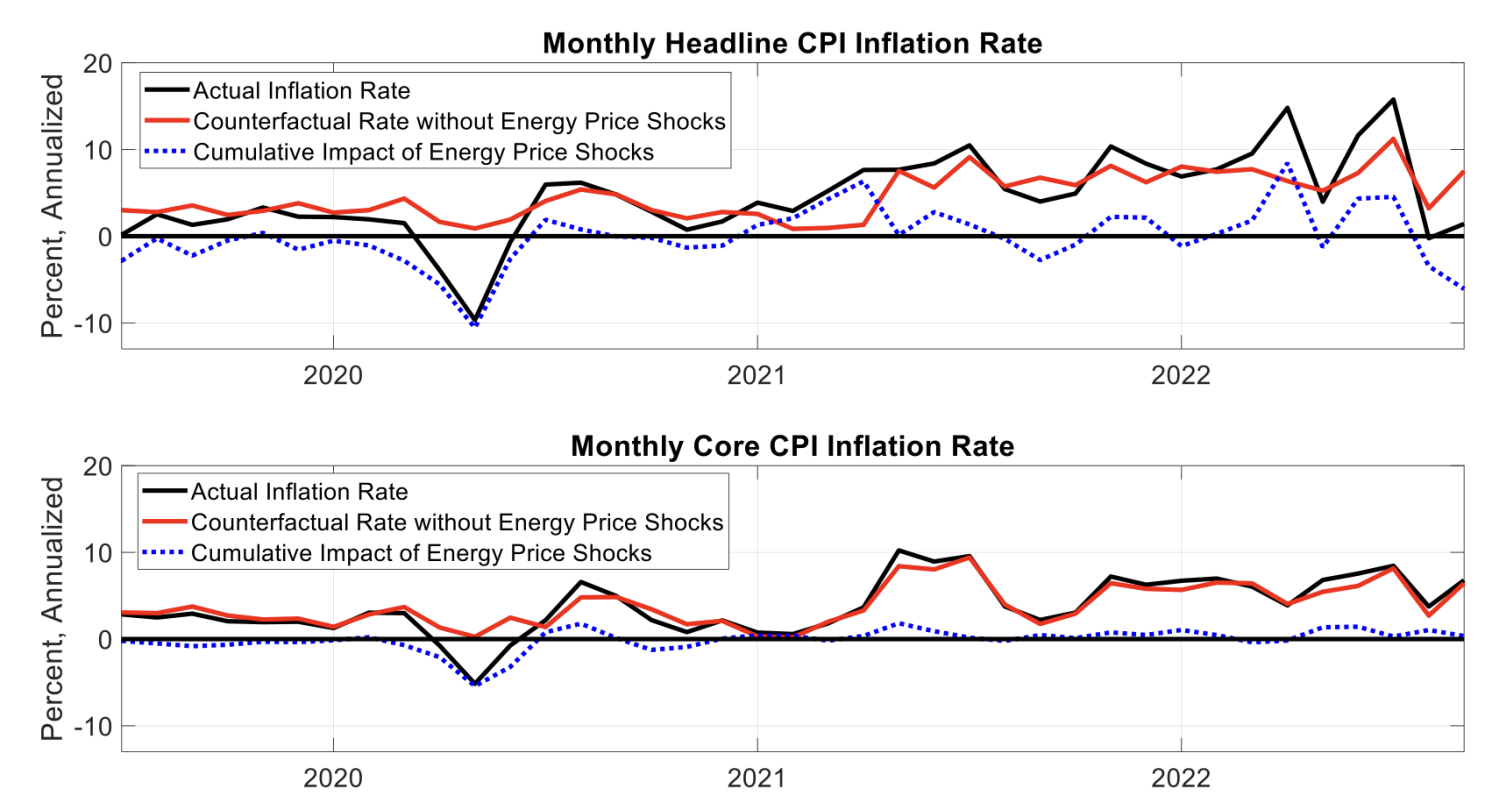

Policymakers tend to be less interested in the effects of a one-time gasoline price shock than in the cumulative effect of all gasoline price shocks up to a given point in time. The latter is addressed in Figure 2, which shows how US headline inflation would have evolved after June 2019 in the absence of gasoline price shocks. The difference between this path and actual inflation represents the cumulative impact of gasoline price shocks.

Figure 2 Cumulative effect of gasoline price shocks on inflation

Source: Kilian and Zhou (2022b).

Figure 2 confirms that this impact has been modest at best and at times negligible. For example, in May 2022, gasoline price shocks cumulatively added 1.2 percentage points to the 12-month headline consumer price index inflation rate compared with an actual rate of 8.5%. The corresponding impact on core inflation can be safely ignored.

What about other energy price shocks?

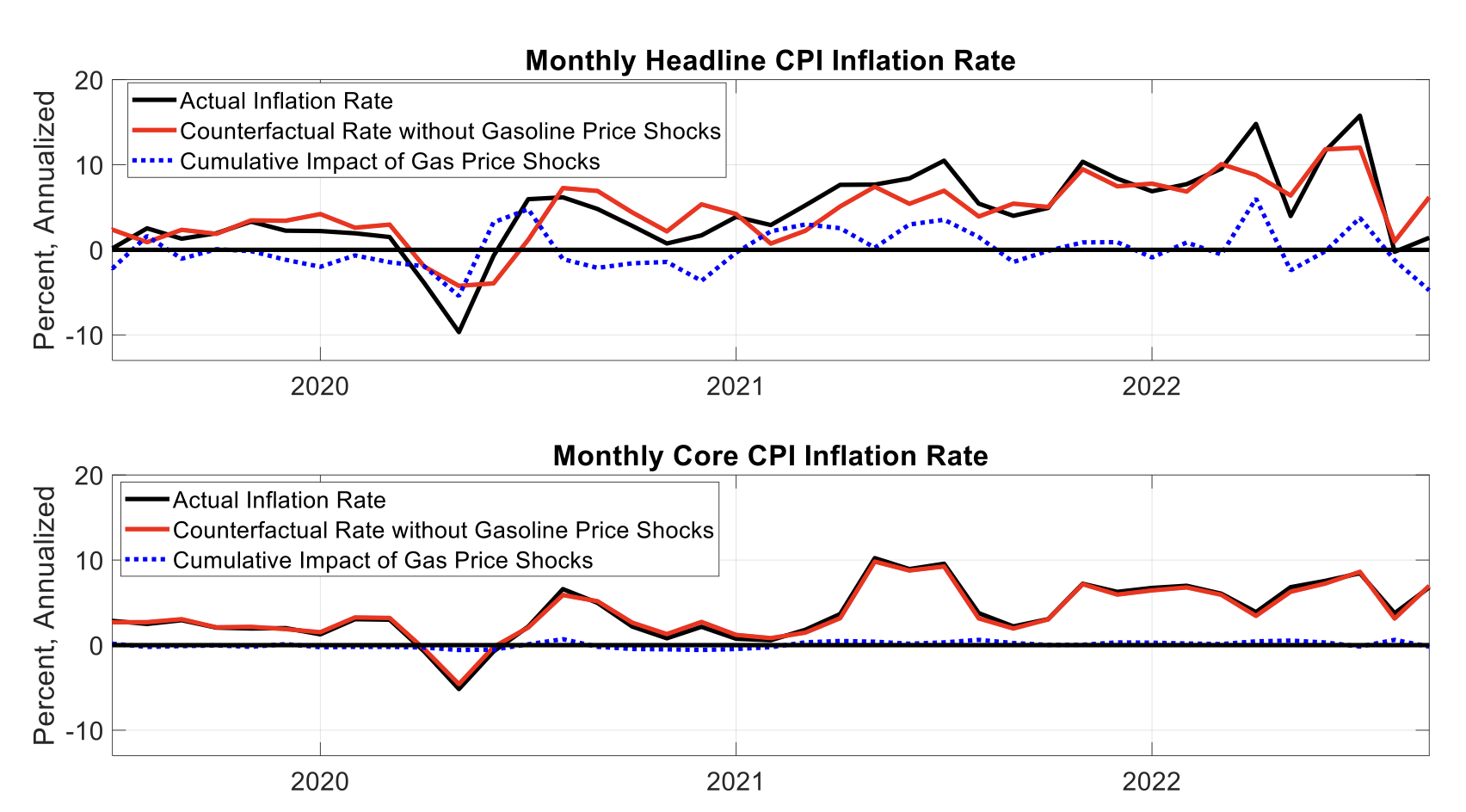

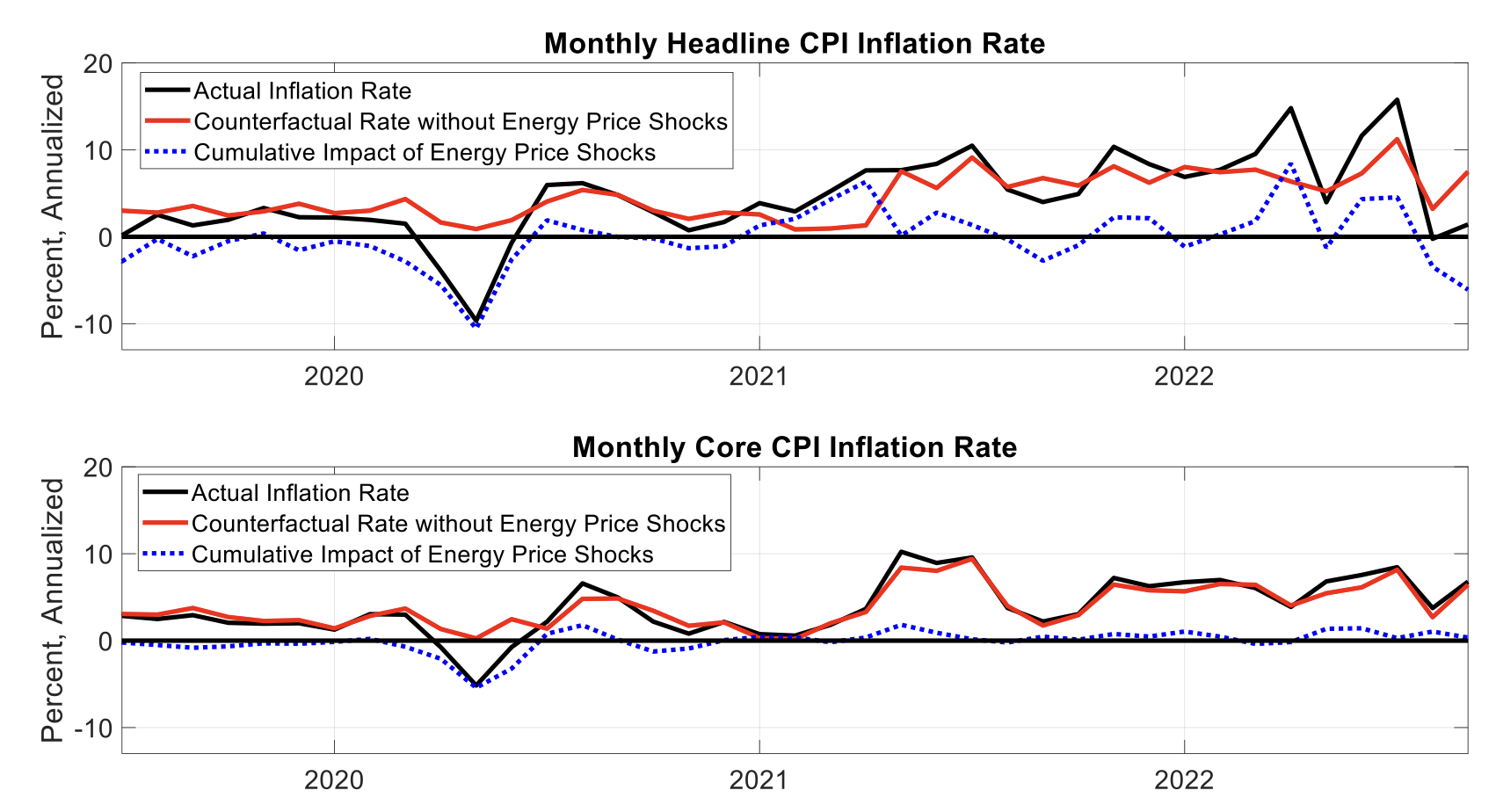

One may object that gasoline price shocks have been the most visible manifestation of rising energy prices but by no means the only one. In this regard, we document that accounting for natural gas, electricity, diesel fuel, and jet fuel price shocks and their indirect effects on consumer prices – in addition to the effect of gasoline price shocks – does not fundamentally change this conclusion (Kilian and Zhou 2022b). Not only are gasoline price shocks the only energy price shock with a large direct impact on headline inflation, but, as Figure 3 shows, accounting for all these energy price shocks simultaneously only slightly increases the cumulative impact on headline inflation in 2022. As before, there is only a negligible impact on core inflation.

Figure 3 Cumulative effect of energy price shocks combined on inflation

Source: Kilian and Zhou (2022b).

Concluding remarks

Our evidence suggests that an unexpected increase in the level of energy prices by itself does not create persistent inflation. It only creates a blip in the inflation rate. In other words, inflationary pressures in monthly data wane as soon as positive gasoline price shocks cease. For example, when gasoline prices stop rising, headline Consumer Price Index inflation stops growing and starts to decline slowly. When periods of rising gasoline prices are followed by unexpectedly falling gasoline prices, as in the second half of 2022, this will accelerate the disinflationary effects.

In contrast, the year-over-year rates many policymakers focus on will look more persistent due to temporal aggregation. These 12-month rates may seem to indicate that gasoline price shocks are raising inflation when actually these inflationary pressures no longer exist, simply because they are constructed as averages of monthly annualised inflation rates over the preceding 12 months. Thus, care is called for when looking for signs of slowing effects of energy price shocks on inflation rates.

Source : Voxue