Governments around the world provide fiscal incentives to firms to adopt profit-sharing arrangements between firms and workers. This column discusses lessons that can be drawn from the French experience of implementing mandatory profit-sharing rules. The authors find that mandatory profit-sharing does not increase firm productivity; while it represents a significant tax for shareholders, it does not appear to distort investment decisions; and at least in the short and medium run, it significantly increases workers’ total compensation, except for high-skill workers. Finally, mandatory profit-sharing primarily acts as a redistributive tool within the firm, which does not appear to generate significant distortions.

Profit-sharing incentives are routinely adopted by countries worldwide. For example, in Canada, employers can establish deferred profit-sharing plans where the firm makes tax-free contributions contingent on its profits and employees are exempt from federal taxes until they withdraw funds from the plan. Other countries have adopted mandatory profit-sharing schemes. For instance, in Mexico, the Employee Participation in Company Profits scheme requires companies with employees and more than about $15,000 in sales to share 10% of their profits with their employees. These profit-sharing schemes are part of a broader set of policies that aim to increase workers’ rents in the labour market (e.g. Jäger et al. 2020, Jäger et al. 2021). For policymakers, these policies attract more attention as concerns rise over declining worker power (Summers and Stansbury 2020).

For policymakers, these profit-sharing schemes raise two important questions: Do they really benefit workers? And do they help firm productivity? Academics have struggled to answer these questions. Finding reliable, firm-level data on profit-sharing is difficult. Furthermore, establishing the causal effect of these policies on wages or productivity requires comparing firms with a profit-sharing plan to similar firms without one. But this is in practice difficult. When profit-sharing policies are voluntary, adopting firms are likely to be fundamentally different from non-adopting firms. When they are mandatory, all firms are subject to the policy so there is no obvious comparison group.

Theoretically, the effects of profit-sharing policies are ambiguous. First, firms might be able to offset them by reducing wage growth to maintain total worker compensation constant. Whether or not firms can substitute wages with profit-sharing is key to understanding the effect of these policies on workers’ overall compensation.

Second, the effect of profit-sharing on productivity is not obvious. On the one hand, for workers, profit-sharing only represents a small share of total compensation, and a worker’s individual effort might have only a limited effect on firm profits, which would mute incentive effects. On the other hand, profit-sharing can appease labour relations by giving workers a slice of profits and better align employees’ objectives with corporate health. For instance, workers might be more inclined to support organisational changes if they directly receive a share of the generated surplus.

In a recent paper (Nimier-David et al. 2023), we study the economic effect of a large mandatory profit-sharing scheme in France. Our analysis combines a regulatory reform with rich administrative data to provide an economic evaluation of the French policy.

Mandatory profit-sharing in France

In 1967, Charles De Gaulle introduced mandatory profit-sharing in France, requiring firms with over 100 employees to redistribute a portion of their ‘excess profits’ (profits above 5% of firm equity) to their employees. The legal formula implies a substantial tax for shareholders, that, on average, amounts to 13% of annual profits. The profits shared through this scheme are paid to all employees of the firms, mostly proportionally to their wages.

The introduction of profit-sharing followed a series of social reforms implemented in the aftermath of WWII, including social security, universal healthcare, and employment protection laws. It was sold as a third way between capitalism and communism: a tool to increase workers’ compensation while, at the same time, reducing conflicts within firms while aligning worker’s objectives with corporate performance. The reform’s adoption was facilitated by tax advantages for both workers (no income tax if held at least five years on a dedicated savings account) and firms (no payroll taxes, deducted from the corporate income tax base).

In 1990, the left-leaning French parliament voted to extend the coverage of mandatory profit-sharing by lowering the eligibility threshold to 50 employees, from 100. We use this reform as a laboratory to study the effects of profit-sharing. First, we study firms’ behaviour around the 100-employee threshold. Second, the reform creates a natural comparison group and thus solves the identification problem discussed above: we can see the effect of profit-sharing by comparing firms with 50–100 employees (the ‘newly treated’) relative to either firms with fewer than 50 employees (the ‘never treated’) or firms with more than 100 employees (the ‘always’ treated).

The law, with a few modifications, still stands today. In 2019, approximately 40% of the workforce received some profit-sharing, averaging €1,500 or 3.8% of their wages (Briand 2021). This makes France the European country with the second-highest share of workers covered by such a scheme (Batut and Rachiq 2021).

Effects on workers’ compensation

While one of the main goals of profit-sharing policies is to redistribute profits from shareholders to workers, firms might try to avoid the cost of these policies by substituting base wages for profit-sharing. Such substitution can be further encouraged by the preferential tax treatment of profit-sharing over salaries.

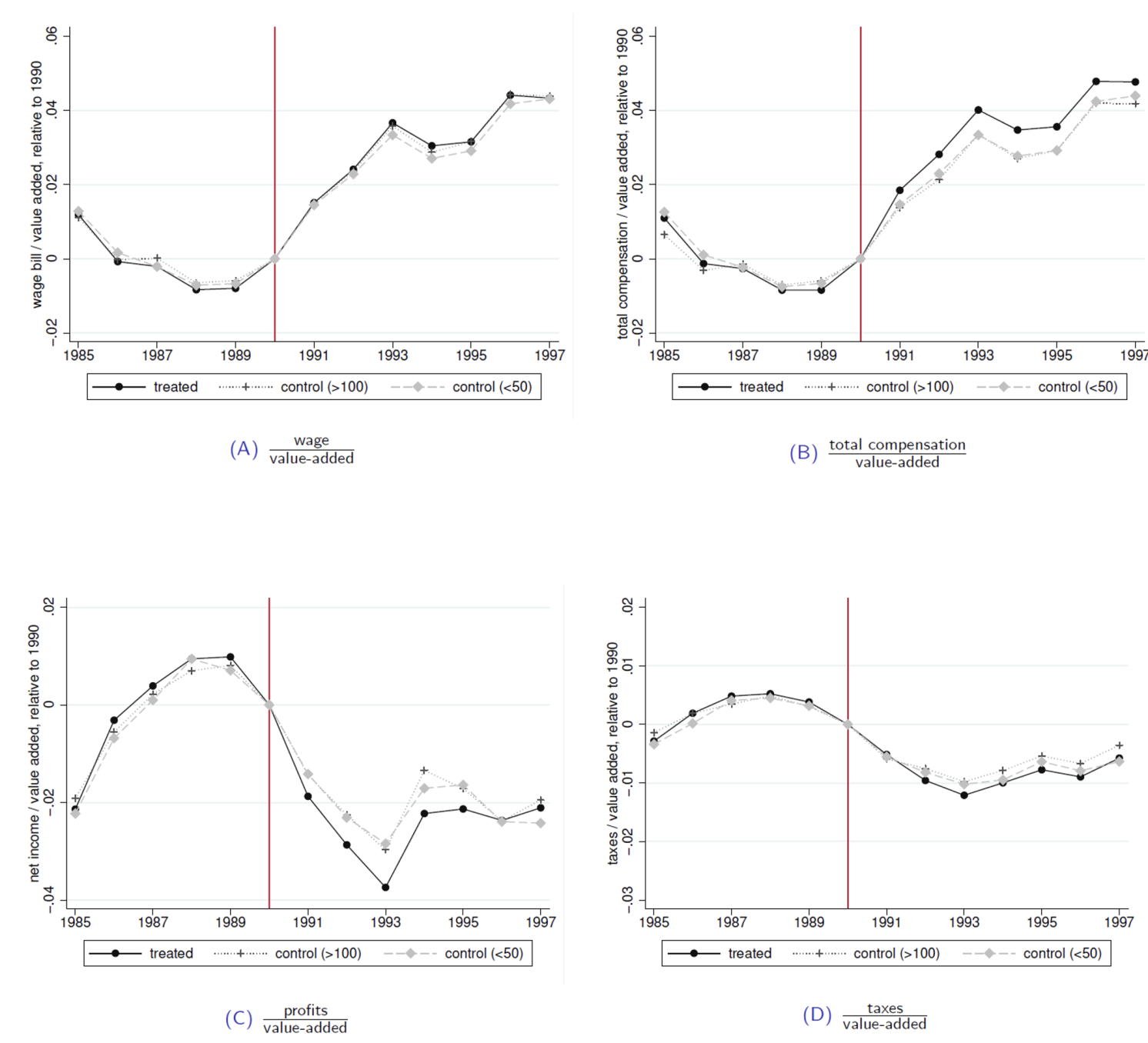

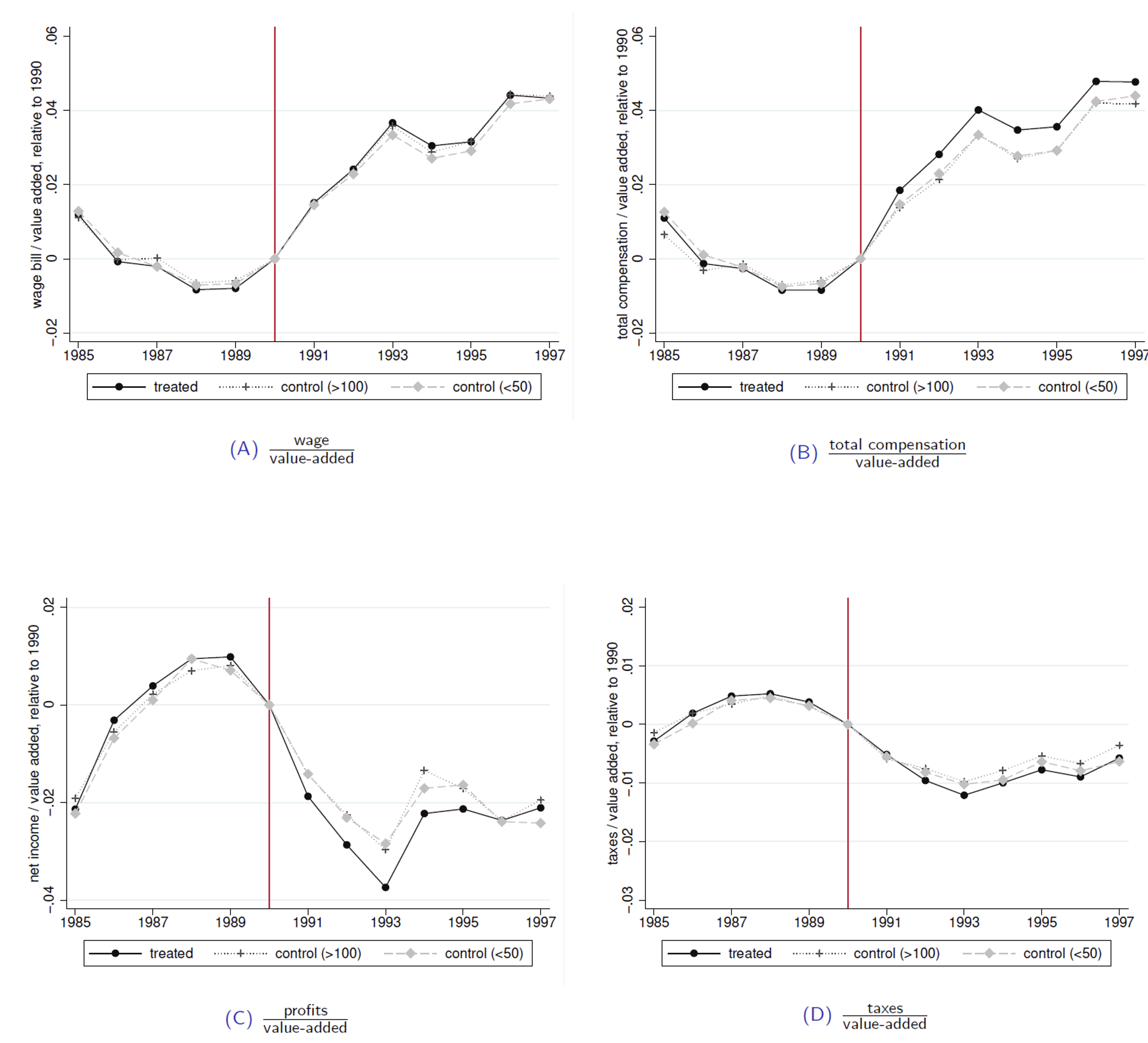

Figure 1 illustrates the changes in workers’ compensation, shareholders’ profits, and taxes remitted to the fiscal authority for treated and control firms. On average, mandatory profit-sharing leads to a large increase in the share of workers’ total compensation (including profit-sharing) in value added of about 1.8 percentage points. The wage share is, in contrast, unaffected. Overall, 77% of this increased compensation for workers is paid by shareholders, through a reduction in profits (panel C), while the fiscal authority pays for the remaining 23% (panel D).

Figure 1 Employees’ compensation, shareholders’ profits, and taxes

Our analysis further reveals that mandatory profit-sharing does not benefit all workers equally: for high-skill workers (e.g. managers and engineers), profit-sharing leads to a reduction in their base wages, so these workers benefit little, if at all, from mandatory profit-sharing policies. We explore two potential mechanisms driving these results. One explanation could be tied to risk: if workers are risk-averse and profit-sharing is a more volatile form of compensation than wages, workers might simply have a low value for profit-sharing. Our analysis suggests this is unlikely to be the case, as, in the data, profit-sharing only marginally increases earnings variability.

Another, more credible, explanation relies on wage rigidity for low-skill workers. Given the elevated minimum wage in France, a large share of wage variations for low- and middle-income workers is driven by yearly variations in the minimum wage. In contrast, profit-sharing can be used in negotiations with high-skill workers to bargain for lower wage growth (at least in real terms).

Effects on productivity and investment

We also investigate the effects of profit-sharing on real activity. Advocates of profit-sharing policies argue that they might boost productivity by aligning the interests of employees and shareholders. We assess whether this is the case by analysing various measures of productivity, including quantitative metrics such as total factor productivity and qualitative indicators such as sick days and overtime. Our analysis shows that mandatory profit-sharing does not boost productivity. We can reject with 95% confidence a positive effect on total factor productivity greater than 1%.

Critics of profit-sharing policies argue that by taxing net income, profit-sharing policies increase the cost of capital and discourage investment. This is not the case in the data. We find that profit-sharing has no substantial effect on investment.

Firms’ behavioural response and avoidance

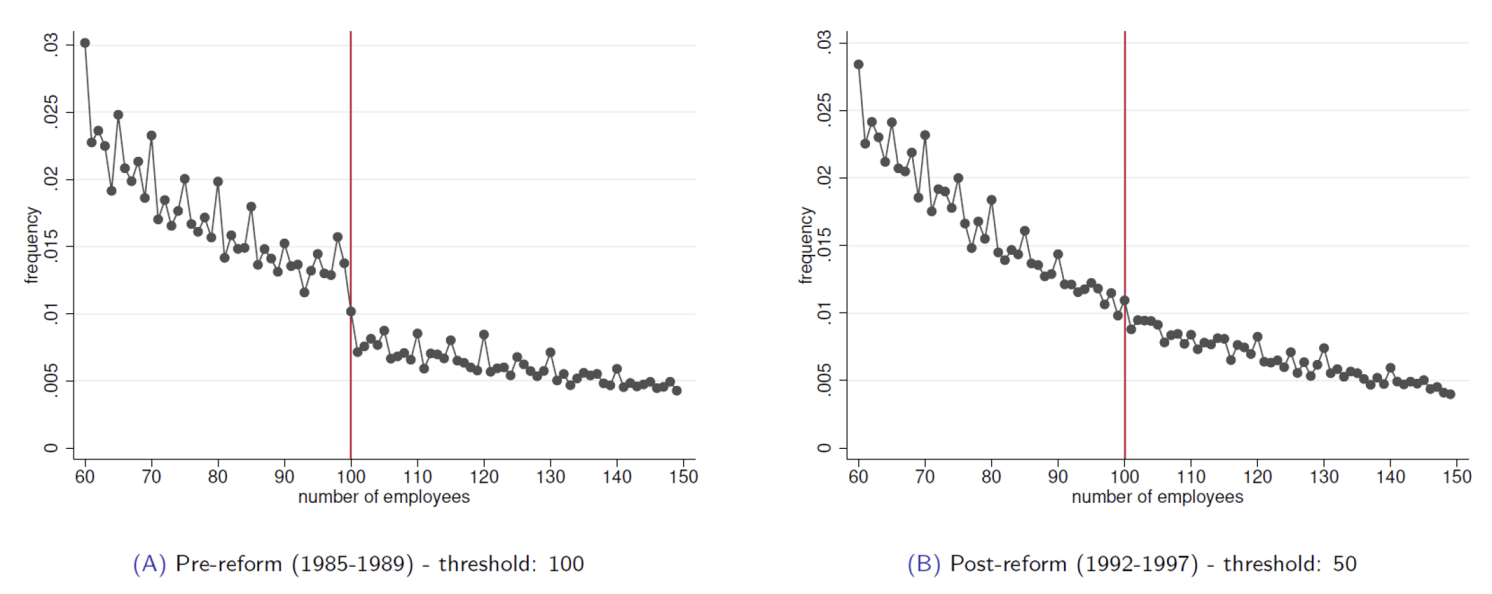

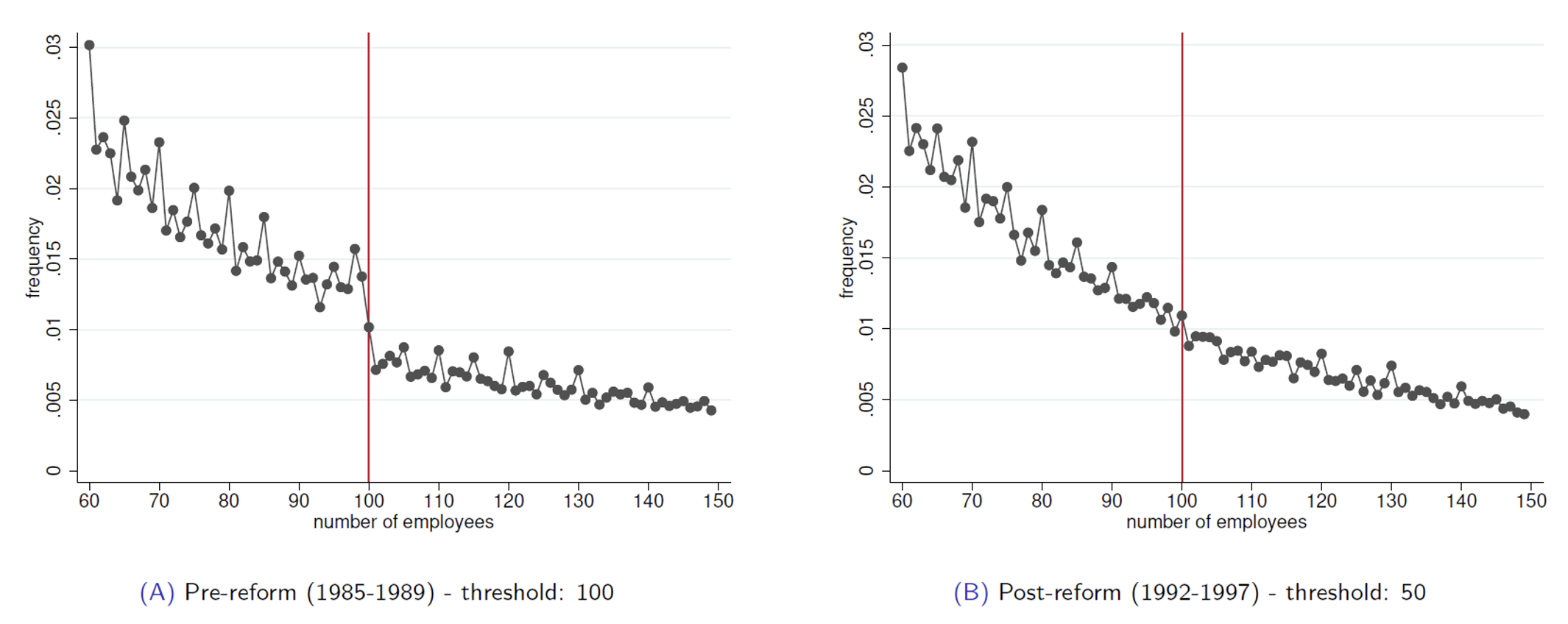

Our analysis so far shows that mandatory profit-sharing policies increase labour costs without significantly increasing productivity. As a result, firms might implement strategies to mitigate the effects of profit-sharing. We consider two types of avoidance. At the extensive margin, we show that firms that might be slightly above the mandatory size threshold (for example, have 101 or 102 employees) reduce their employment in order to avoid sharing their profits. 1 This is proven by a significant 22% excess mass of firms just below 100 employees until 1990 (Figure 2). This excess mass disappears once the threshold decreases from 100 to 50. 2

Figure 2 Firm size distribution around the 100-employee threshold

At the intensive margin, we do not find any evidence that firms shift their income to avoid profit-sharing. One interpretation for this finding is workers’ monitoring: employees know that a significant share of their compensation is tied to profits, so they monitor that firms are truthfully reporting earnings, becoming de facto tax enforcers. In fact, many firms hire consultants to help them check the profit-sharing formula. This absence of avoidance at the intensive margin is an interesting aspect of mandatory profit-sharing policies, especially when compared to standard corporate income tax, which is known to generate significant profit-shifting (Devereux et al. 2014).

Source : VOXeu