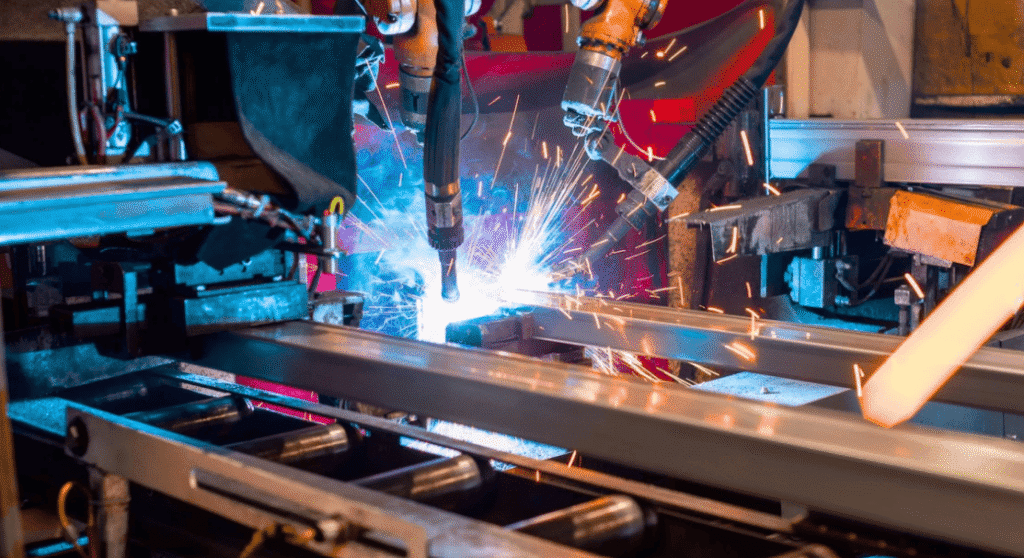

Saudi to offer steel projects worth $16bln

They aim to tackle supply gap. Saudi Arabia has completed a study about the optimal options to address the supply shortage in the domestic steel

Geopolitical shifts, uncertainty, and investment: Evidence from the EIB Investment Survey 2025

Geopolitical risks impact firms on both sides of the Atlantic. While the short-term outlook is better than expected, there remains huge uncertainty related to the

Assessment of disruptive innovation in science and technology policy: Insights from meta-science research trends

Technological innovation, including disruptive innovation, is a driving force for economic growth and social change, but early identification of such technologies and assessments of their

$488.6mln battery project to help Oman achieve green energy goals

The investment will be implemented in phases over four to six years. The first phase alone is valued over OMR73 million. With a project investment

Artificial intelligence in the office and the factory: Evidence from administrative software registry data

The rapid adoption of AI in the workplace has raised concerns about job loss. This column uses data covering all AI-related commercial software registered with

Future jobs: AI, robots, and jobs in developing countries

Studies of the impact of robots on labour markets often conceptualise jobs as bundles of distinct tasks. In such frameworks, technologies substitute or complement workers.

How is innovation competition exacerbating global overcapacity?

The world is moving into a period of entrenched manufacturing overcapacity, threatening deflation and stagnant growth. Over the past two decades, China has emerged as

Soybeans, corn fall on China demand worries, US crop tour awaited

Expectations a closely-watched crop tour in the United States this week will boost expectations of large U.S. corn harvest also weakened corn Chicago soybean and

Oil steadies ahead of US-Russia talks

Oil prices steadied on Monday, after falling more than 4% last week, as investors looked towards talks this week between the U.S. and Russia over

Filtering labour market data optimally to detect recessions early and accurately

The timely detection of recessions is critical for policymakers to make informed decisions. This column presents an algorithm for detecting recessions early using labour market