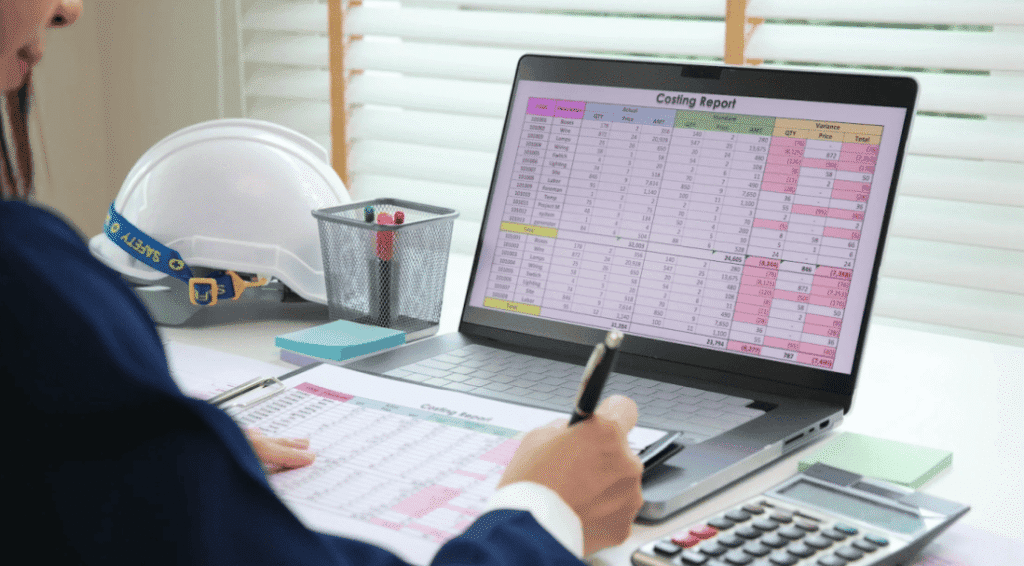

Micro and macro cost-price dynamics in normal times and during inflation surges

Recent evolutions in US attitudes and policies have raised questions about the future of the dollar’s role in the global economy. This column explores a

Finding the sweet spot between bank rivalry and safety

Imagine your favorite open-air market. Stalls hustle for customers, prices fall, and shoppers win—until one fragile roof gives way and everyone scrambles. Banking is similar.

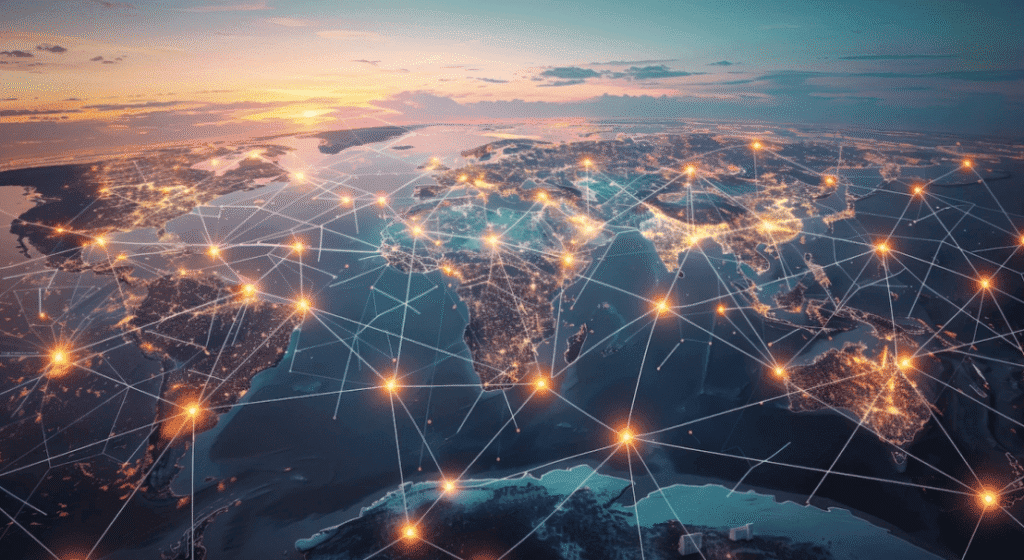

The trade imbalance network and currency fluctuations

In recent years, concerns over global financial fragmentation have grown amid rising geopolitical tensions. This column integrates a network structure in a multi-country model with

Family law reform: An overlooked catalyst of economic growth

On this year’s International Day of Families, we explore a critical issue: the sidelining of family-oriented policies in mainstream economic discussions. Despite their transformative potential,

What the financial sector needs to know about climate-related risks in the next five years: Navigating the new NGFS short-term scenarios for Europe

The immediate effects of climate-related risks are particularly relevant for the financial sector. Climate stress tests, which are often carried out over three to five-year

Agreed and disagreed uncertainty: Rethinking the macroeconomic impact of uncertainty

The conventional wisdom is that uncertainty leads to economic contractions, but recent evidence challenges this assumption. This column introduces two novel concepts of uncertainty –

Non-bank financial institutions’ reliance on banks for contingent credit under stress and its consequences

In recent years, banks’ credit line exposure to non-bank financial institutions has grown significantly. This column analyses the implications by focusing on a specific type

ADNOC listed companies to distribute over $6.7bln in total annual dividends

Shareholders voted overwhelmingly to approve the dividend proposals brought forth by each companies’ Boards of Directors ADNOC Group’s publicly traded portfolio companies collectively endorsed over

Lumpy forecasts: Rational inaction in professional forecasting

Forecasts from professionals (economists, analysts, brokers, academics) are a key input into economic decision-making. This column highlights that professional forecasts are ‘lumpy’, often remaining unchanged

Managing credit in dollarised economies: The effective but asymmetric effects of foreign currency reserve requirements

Emerging markets with partially dollarised financial systems are particularly vulnerable to global financial cycles. This column examines how reserve requirements on foreign currency deposits can