Business investment in OECD countries has remained weak over the past decades, while the cost of capital has significantly and steadily decreased. This raises the question of whether business investment still responds to the cost of capital and thus whether corporate tax policy can support investment. Based on new empirical findings at the firm and industry levels, this column shows that business investment is still sensitive to taxation but that this sensitivity has fallen significantly since the global financial crisis. This sensitivity also differs significantly across firms and corporate tax parameters, calling for a more nuanced and granular approach to corporate tax policy.

Business investment has been weak in OECD countries since the Global Financial Crisis (GFC). What can be done to boost it?

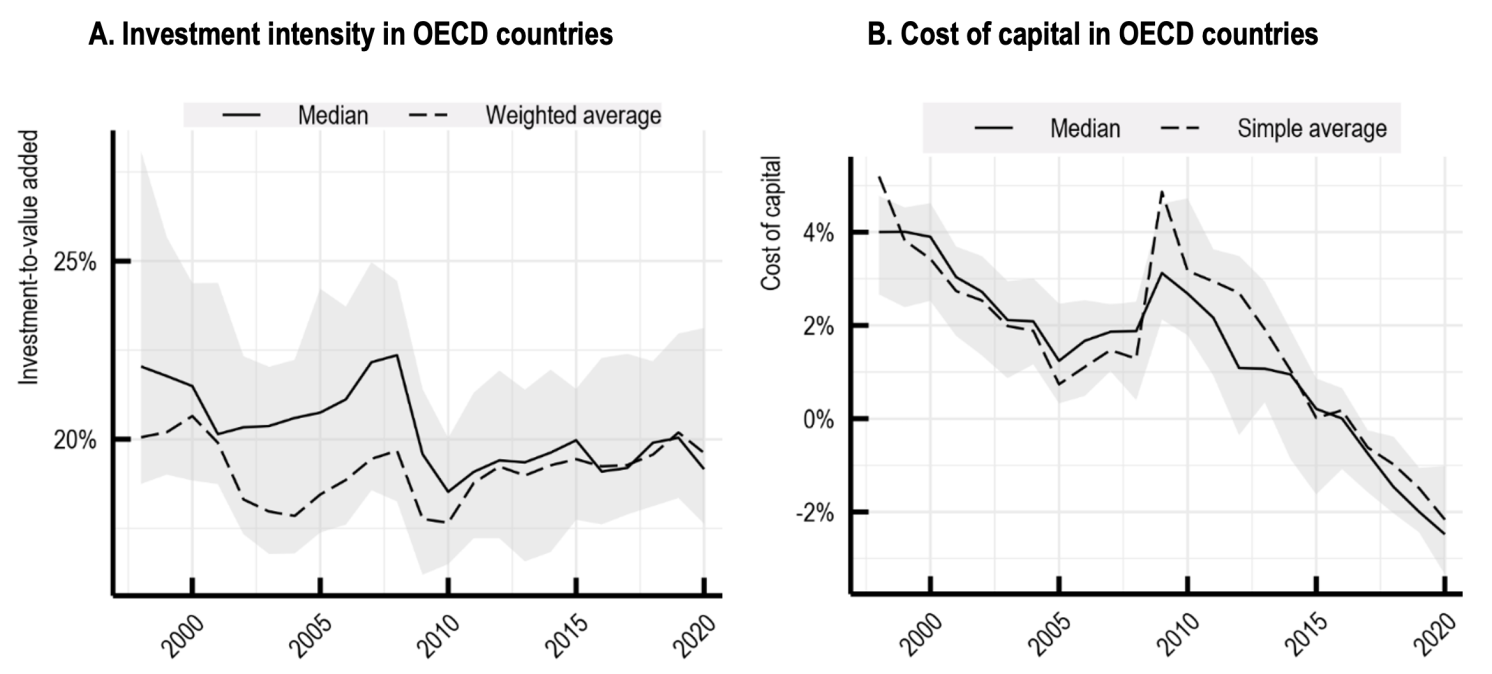

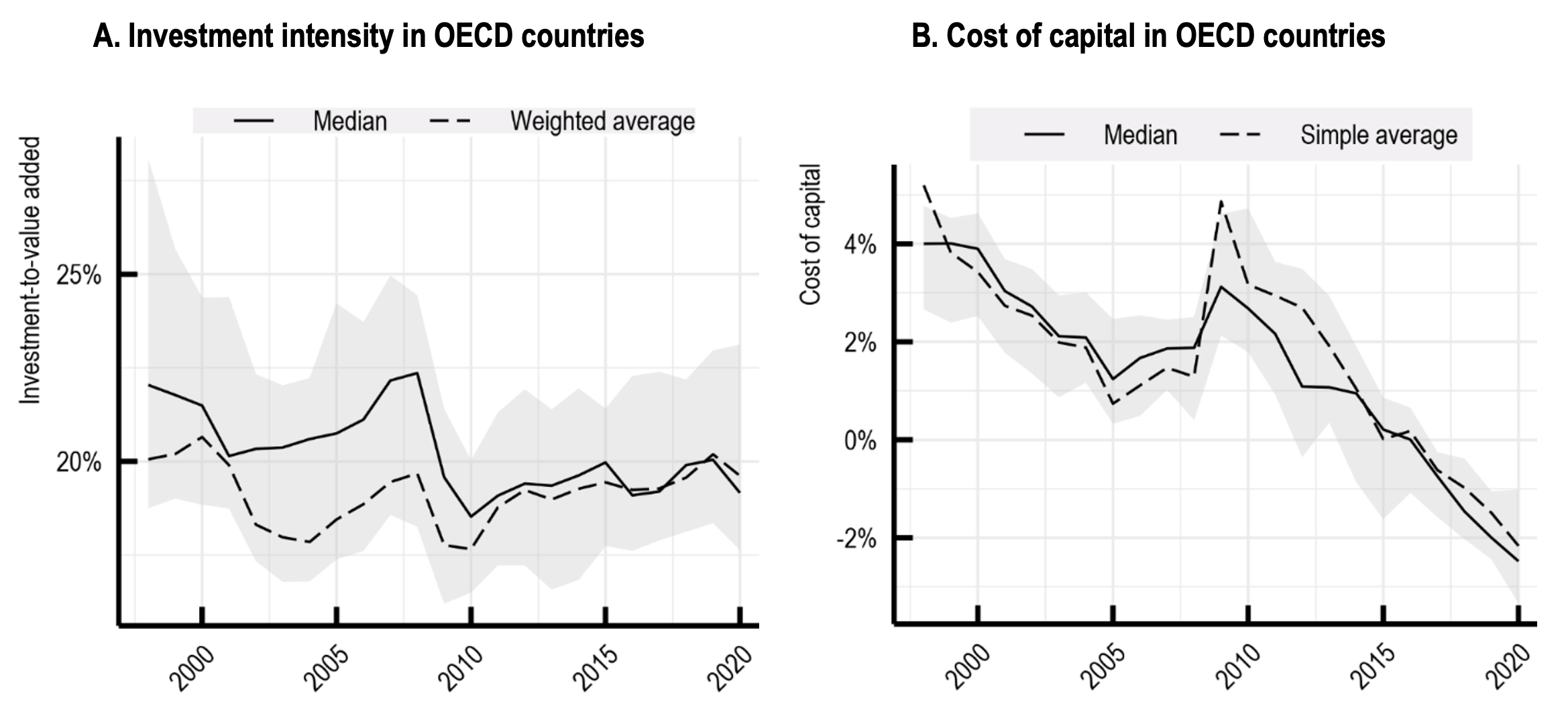

One potential lever is modifying corporate taxation to reduce the cost of capital, which is usually considered as key determinant of investment (Feld and Heckemeyer 2011, Vartia 2008, Schwellnus and Arnold 2008). However, as can be seen in Figure 1, while the cost of capital has steadily fallen, reflecting the secular decline in global interest rates (Summers and Eggertsson 2016) and cuts in statutory corporate tax rates (STRs), business investment rates have not increased and real investment has barely caught up with its pre-GFC trend. This is sometimes referred to as the ‘missing investment puzzle’ (Gormsen and Huber, 2023). These observations suggest that either the sensitivity of firms’ investment to the cost of capital has declined, or the desired level of investment for a given cost of capital has fallen because of other factors. In turn, they raise questions about whether and which changes to corporate tax systems can stimulate business investment.

Figure 1 Investment intensity and cost of capital in OECD countries

Notes: Panel A: Investment intensity is computed as the ratio of gross fixed capital formation over gross value added in business sectors (Sectors B through N according to the ISIC Rev.4 classification, excluding Real Estate). Panel B: The cost of capital corresponds to the rate of return on a marginal investment required for an investor to break even after tax. It is computed based on the formula from Hanappi (2018), the fiscal parameters from Spengel et al. (2020), long-term sovereign interest rates and changes in the GDP deflator as a proxy for inflation. Trends and changes in the cost of capital, but not levels, are robust to replacing sovereign bond yields with a stable premium for corporations. In both panels, the shaded area corresponds to the interquartile range across OECD countries.

Source: Hanappi et al. (2023).

Aggregate trends hide heterogeneity in investment responses to taxation. Indeed, recent analysis has shown that the sensitivity of firm investment to corporate taxation tends to be heterogeneous across different types of firms (Federici and Parisi 2015, Zwick and Mahon 2017, Fuest et al. 2018, Kopp et al. 2019, Keuschnigg and Egger 2019, Millot et al. 2020). As such, a more nuanced assessment of the implications of corporate taxation on investment and growth is needed.

Our new paper (Hanappi et al. 2023) aims to fill this need. We bring together country-industry and firm-level data on investment, as well as detailed data on the cost of capital and its tax component, to analyse how the tax sensitivity of investment has evolved over time and how it differs across firm and investment characteristics. Finally, we also disentangle key parameters of the corporate tax system to analyse the potential impacts of different tax designs.

The tax sensitivity of investment has weakened since the GFC and varies across firms and tax parameters

Our estimations at the industry and the firm level confirm previous findings that business investment tends to respond negatively to increases in corporate taxation as measured by forward-looking effective tax rates (ETRs) (see Hanappi 2018 for details on the methodology to construct those ETRs). However, the analysis shows that the tax sensitivity of investment fell after the GFC, suggesting that lower ETRs increase investment less now than they did in the past.

We also find that firms that are large, are part of multinational groups, have a large proportion of intangibles in their total fixed assets, or are highly profitable have all become less sensitive to taxation compared to other firms after the GFC. The fact that these firms have become less sensitive could largely explain the aggregate trends, as investment tends to be highly concentrated among a small number of big firms, usually belonging to multinational groups.

Finally, our paper highlights significant heterogeneity in investment responses to different corporate taxation parameters. Increases in effective taxation delivered through non-profit taxes (i.e. business taxes levied on bases other than corporate income, such as real estate or corporate wealth) have a stronger negative impact on business investment than corporate income taxes (CITs). As for the CIT, ‘equivalent’ changes (i.e., those resulting in the same effective marginal tax rate) in the STR and in capital allowances are associated with different investment responses, depending on the initial level of STR and allowances.

What are the implications for corporate tax policy?

Corporate taxation can support business investment, but the ‘bang for the buck’ may have fallen, and the details of the tax system matter. The results from the empirical analysis call for a more nuanced and granular approach to corporate tax policy. Beyond headline statutory tax rates, a variety of measures can be considered to support investment effectively, accounting for heterogeneity in tax sensitivity.

Potential policy options include:

- Eliminating or reducing non-profit taxes on domestic and international businesses, which are likely to generate larger adverse effects on investment than taxes on profits.

- Limiting cuts in the headline corporate income STR, which can be relatively costly compared with other corporate tax policies as they lower the effective tax rates for all firms regardless of their tax sensitivity.

- Considering the use of targeted CIT instruments to support specific investments, provided that a coherent policy rationale and a strong institutional framework exist. Differences in effective tax rates across assets and firms can be justified when there are positive externalities. However, decisions to implement targeted measures should also account for the costs of the induced distortions, potentially increased compliance costs and administrative burdens for taxpayers and tax authorities.

- Making use of more generous capital allowances to reduce ETRs where they are expected to induce strong investment responses. Higher STRs, combined with more generous capital allowances, are likely to be less distortive as the CIT would be largely levied on economic rents. Moreover, such policies would likely be less affected by the Global Minimum Tax under the Global Anti-Base Erosion (GloBE) Rules due to the exclusion of a fraction of the value of assets and payroll from the base of the minimum tax and the fact that the GloBE Rules are designed to avoid imposing additional Top-up Tax as a result of timing differences (e.g. due to accelerated depreciation). In this way, tax incentives to support investment can be provided without being impacted by the Global Minimum Tax, which some have suggested may negatively impact investment (Vaitilingam 2021).

Source : VOXeu