The use of green hydrogen could be a critical factor in addressing climate change but policymakers, industry leaders and investors need to fund essential infrastructure and encourage research and development.

Many developing countries view industrialization as the benchmark for economic growth and success. This includes large infrastructure investments in heavy industries including steel and cement, fertilizer and other chemical production, shipping and aviation fuels.

Policies and regulations, such as the “Green Deal” in Europe or the Inflation Reduction Act in the United States, can create policy and financial incentives to decarbonize these large and pollutive industries. For advanced economies, it’s about retrofitting existing industries to low carbon energy sources while developing new green industrial sectors. The focus lies in funding a “safe switch” that does not jeopardize the already achieved industrialization standard.

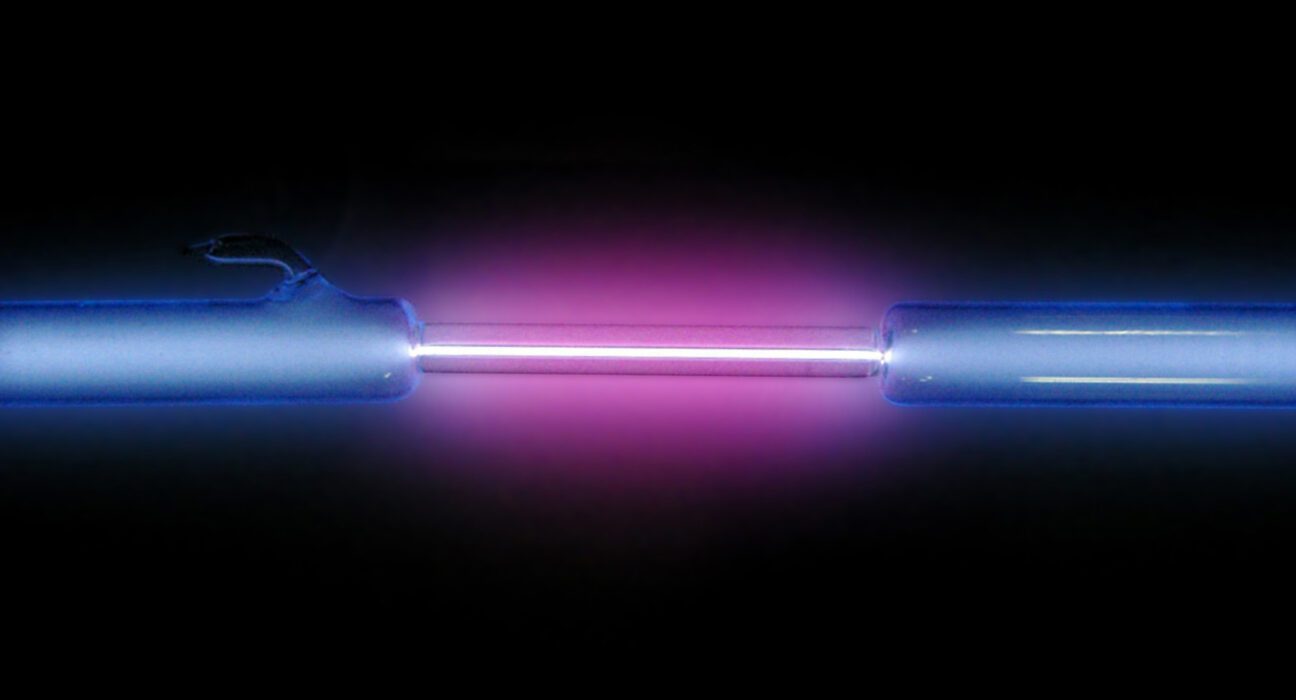

Scaling up the share of renewables quickly can be achieved through solar and wind capacity to produce green hydrogen and its derivatives for use in these industrial sectors. Green hydrogen can be produced through the electrolysis of water with close to zero greenhouse gas emissions. This is an interesting solution for decarbonizing “hard to abate” industries and setting up green energy at scale. However, green hydrogen is expensive at $5 per kilogram, which is five times more expensive than fossil hydrogen (grey or black hydrogen).

For developing countries, the challenge involves de-risking investments in new energy technology and infrastructure mixes to expand affordable energy access, ensure energy security, and attract investors to establish new industries, ultimately creating jobs, generating revenue, and tax income.

This requires sound knowledge-based policy and regulation, coupled with market-making subsidy regimes. This is especially true for the large investments required to scale green hydrogen. Besides the financial risks there are also other risks for green hydrogen: limited supply chains, safety concerns due to hydrogen’s high explosiveness, rapidly increasing renewables capacity, a shortage of skilled personnel to operate green hydrogen plants and ramping up manufacture of electrolyzers.

Green hydrogen is not a large part of the energy mix globally, but its use has an oversized impact on emissions. For countries without fossil resources, green hydrogen is also path to higher energy security with lower carbon emission.

Countries are starting to define green hydrogen, specifying threshold carbon emissions and hydrogen production sources necessary to classify hydrogen as “green.” This approach helps establish standards and regulations and develop policies for green hydrogen and electrolyzer manufacturing. For instance, India is actively promoting green hydrogen investments in targeted hubs, offering tax incentives and financing access to accelerate hydrogen merchant markets and the necessary transport infrastructure.

Green hydrogen investments can be grouped into three pathways: as a commodity with large scale renewable energy production, to reduce carbon emissions in challenging areas, and at a distributed level for social and environmental impacts.

Green hydrogen investments can be grouped into three pathways:

Green hydrogen as a commodity with related large scale renewable energy production. This includes hydrogen valleys/hubs and ports infrastructure. The price differential between fossil and green hydrogen is a challenge for these investments.

Green hydrogen to reduce carbon emissions in challenging areas like steel, cement, fertilizer production, aviation fuel, and marine transport. Projects in this space often make financial sense for efficiency gains and potential carbon credit revenues.

Green Hydrogen at a distributed level. This includes green hydrogen from agricultural and municipal waste and the related transport and filling infrastructure. Distributed projects that support the supply chain for green hydrogen have a much higher development dividend for social and environmental impacts such as local jobs, less transport and opportunities for digitization to change existing supply chains.

While distributed green hydrogen production is less sensitive to cost variations, larger scale projects are profoundly impacted by cost. The hard-to-abate sectors require a thriving green hydrogen industry to fuel decarbonization.

Providing rational subsidies to kick start the green hydrogen economy requires an understanding of why fossil hydrogen is actually so much cheaper than green hydrogen at the moment. The answer is simple. Fossil fuels enjoy massive subsidies, and their price does not include the damage done by the carbon emissions created.

The real cost of carbon globally is explored in the paper “The price is not right”. This real cost is highly dependent on national fossil fuel subsidies and any existing emissions legislation.

Fossil hydrogen ranges from five to 20 times more pollutive than green hydrogen, depending on the technology chosen. Green hydrogen’s lowest emission rate is 1 kilogram of CO2 for every 1 kilogram hydrogen.

The real cost of carbon emissions range from $50 to $200 per ton of CO2. There is no global price on carbon emissions, only corporate shadow pricing or tariff adjustments in some countries.

The price difference between green and fossil hydrogen doesn’t include the real carbon impacts of between five cents to five dollars per kilogram of hydrogen of whatever type. This market distortion slows green hydrogen use.

On a brighter note, scaling up of green hydrogen production will enjoin significant cost reduction based on the massive price reductions seen in the solar industry deployment. A competitive unadjusted price of $1.25 per kilogram is a possibility in the long term with a lot of work. Targeted subsidies of green hydrogen will have to make do till then.

The transition to green hydrogen is not just an environmental imperative but a strategic investment in our collective future. It’s time for policymakers, industry leaders, and investors globally to support initiatives and policies that accelerate the adoption of green hydrogen, invest in the necessary infrastructure, and promote research and development in this field.

Source : Asian Development blogs