Central bank business surveys: Version 2.0

Sample surveys have been a fundamental tool for capturing policy-relevant heterogeneities among agents, especially firms, and remain crucial for

Sample surveys have been a fundamental tool for capturing policy-relevant heterogeneities among agents, especially firms, and remain crucial for

The recent surge in the price of Bitcoin has reignited debates about a cryptocurrency bubble, many of them based

While conventional wisdom considers research investment and human capital the wellsprings of innovation, a more subtle catalyst has perhaps

Standard Chartered (StanChart) will target $200 billion in new assets and double-digit growth in income from its wealth business over

Donald Trump’s re-election as president of the United States on 5 November has stirred both optimism and apprehension in

The question of why productivity growth slowed from the early- to mid-2000s continues to interest policymakers, but researchers have

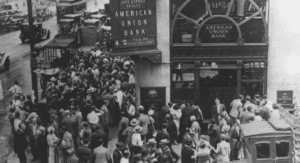

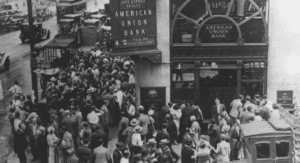

Bank runs are notoriously difficult to measure systematically. This column constructs two novel, cross-country databases on bank run events

The shift from fossil fuels to renewable technologies may render the global economy less oil-intensive and more metals-intensive. This

Negative economic shocks can cause waves of investor pessimism about the resilience of banks, which in turn generate additional

Immigration is one of today’s most controversial policy issues. A recurrent concern is that immigrants are taking the jobs

Sample surveys have been a fundamental tool for capturing policy-relevant heterogeneities among agents, especially firms, and remain crucial for

The recent surge in the price of Bitcoin has reignited debates about a cryptocurrency bubble, many of them based

While conventional wisdom considers research investment and human capital the wellsprings of innovation, a more subtle catalyst has perhaps

Standard Chartered (StanChart) will target $200 billion in new assets and double-digit growth in income from its wealth business over

Donald Trump’s re-election as president of the United States on 5 November has stirred both optimism and apprehension in

The question of why productivity growth slowed from the early- to mid-2000s continues to interest policymakers, but researchers have

Bank runs are notoriously difficult to measure systematically. This column constructs two novel, cross-country databases on bank run events

The shift from fossil fuels to renewable technologies may render the global economy less oil-intensive and more metals-intensive. This

Negative economic shocks can cause waves of investor pessimism about the resilience of banks, which in turn generate additional

Immigration is one of today’s most controversial policy issues. A recurrent concern is that immigrants are taking the jobs

© | Global Business & Finance Magazine. All rights reserved.