Turkey sees inflation at 28.5% in 2025 with single digits by 2027, programme says

GDP growth seen at 3.3% in 2025. Turkey’s medium-term economic programme forecasts inflation to hit 28.5% in 2025 and

GDP growth seen at 3.3% in 2025. Turkey’s medium-term economic programme forecasts inflation to hit 28.5% in 2025 and

For the week, Brent is down 2.2% and WTI down 1.3%. Oil extended its decline into a third session

The data did not offer much insight into job creation since March, leaving U.S. rate expectations unchanged for now.

ANZ Group raised its year-end gold price forecast on Wednesday to $3,800 per ounce and expects prices to peak

Since the Global Crisis, prudential instruments to address financial stability concerns have been enhanced and broadly adopted across countries.

History suggests that using lax monetary policy and a weaker currency to address debt sustainability is a dangerous game.

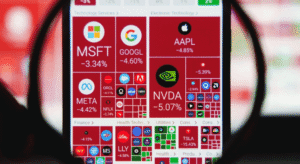

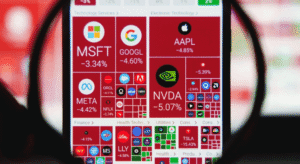

The recent performance of the largest US tech companies has raised concerns about the risk of a stock market

Governments and development institutions spend billions to help small businesses access financing, hoping this will create jobs and support

To many, the US dollar depreciation following the ‘Liberation Day’ tariff announcement on 2 April 2025 defied conventional wisdom.

Europe’s banks have long been slow to integrate across borders, but this is changing fast. ‘Pan-European banks’, with activities

GDP growth seen at 3.3% in 2025. Turkey’s medium-term economic programme forecasts inflation to hit 28.5% in 2025 and

For the week, Brent is down 2.2% and WTI down 1.3%. Oil extended its decline into a third session

The data did not offer much insight into job creation since March, leaving U.S. rate expectations unchanged for now.

ANZ Group raised its year-end gold price forecast on Wednesday to $3,800 per ounce and expects prices to peak

Since the Global Crisis, prudential instruments to address financial stability concerns have been enhanced and broadly adopted across countries.

History suggests that using lax monetary policy and a weaker currency to address debt sustainability is a dangerous game.

The recent performance of the largest US tech companies has raised concerns about the risk of a stock market

Governments and development institutions spend billions to help small businesses access financing, hoping this will create jobs and support

To many, the US dollar depreciation following the ‘Liberation Day’ tariff announcement on 2 April 2025 defied conventional wisdom.

Europe’s banks have long been slow to integrate across borders, but this is changing fast. ‘Pan-European banks’, with activities

Copyright © 2025 Global Business & Finance Magazine. All Rights Reserved.