Price setting has become more flexible following a string of large adverse shocks. This column argues that a shift to a high-uncertainty regime incentivises firms to invest in their ability to adjust prices. Faced with higher productivity uncertainty, firms set prices more flexibly, and this gives rise to comparatively large price hikes when adverse supply shocks hit. Thus, inflation surges result not merely from large shocks alone, but as a by-product of higher uncertainty. At the same time, the greater ability of firms to raise prices in response to bad productivity shocks improves their resilience, reducing exit and output losses when uncertainty is high.

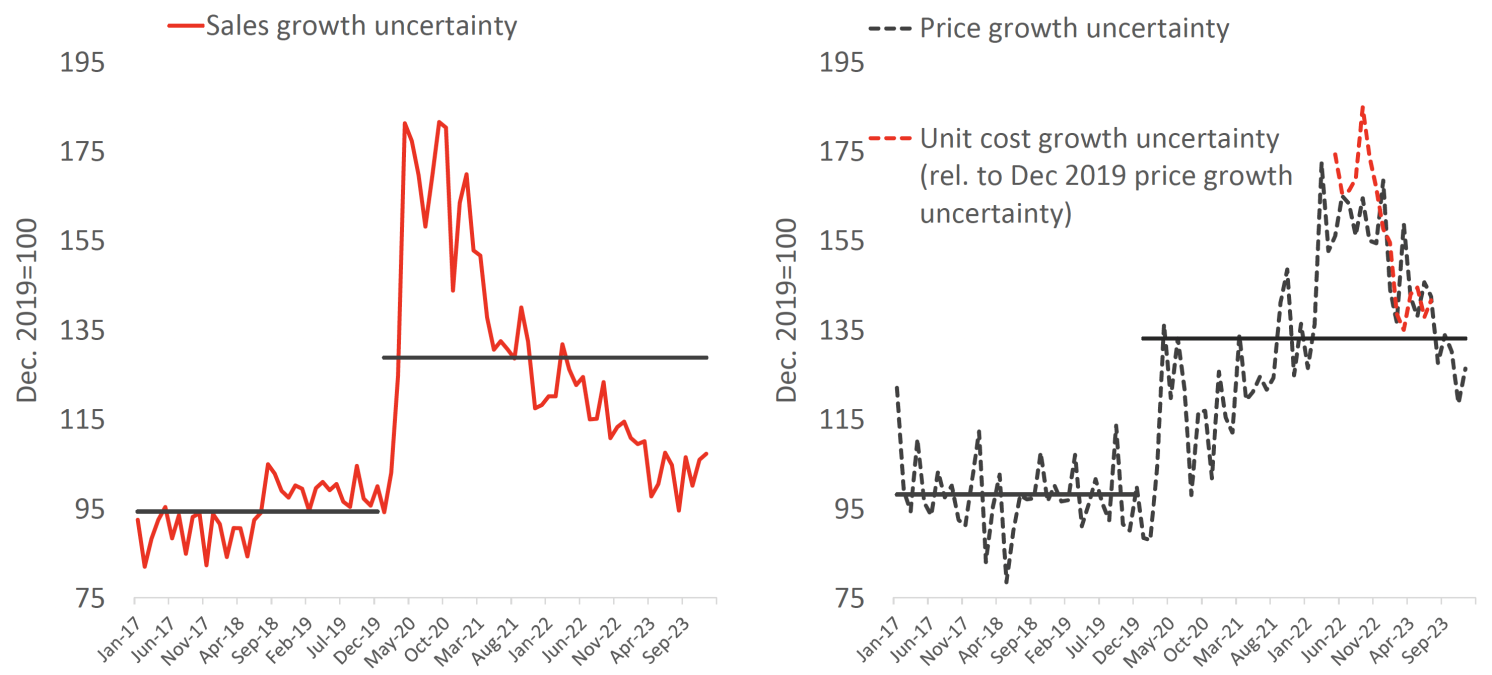

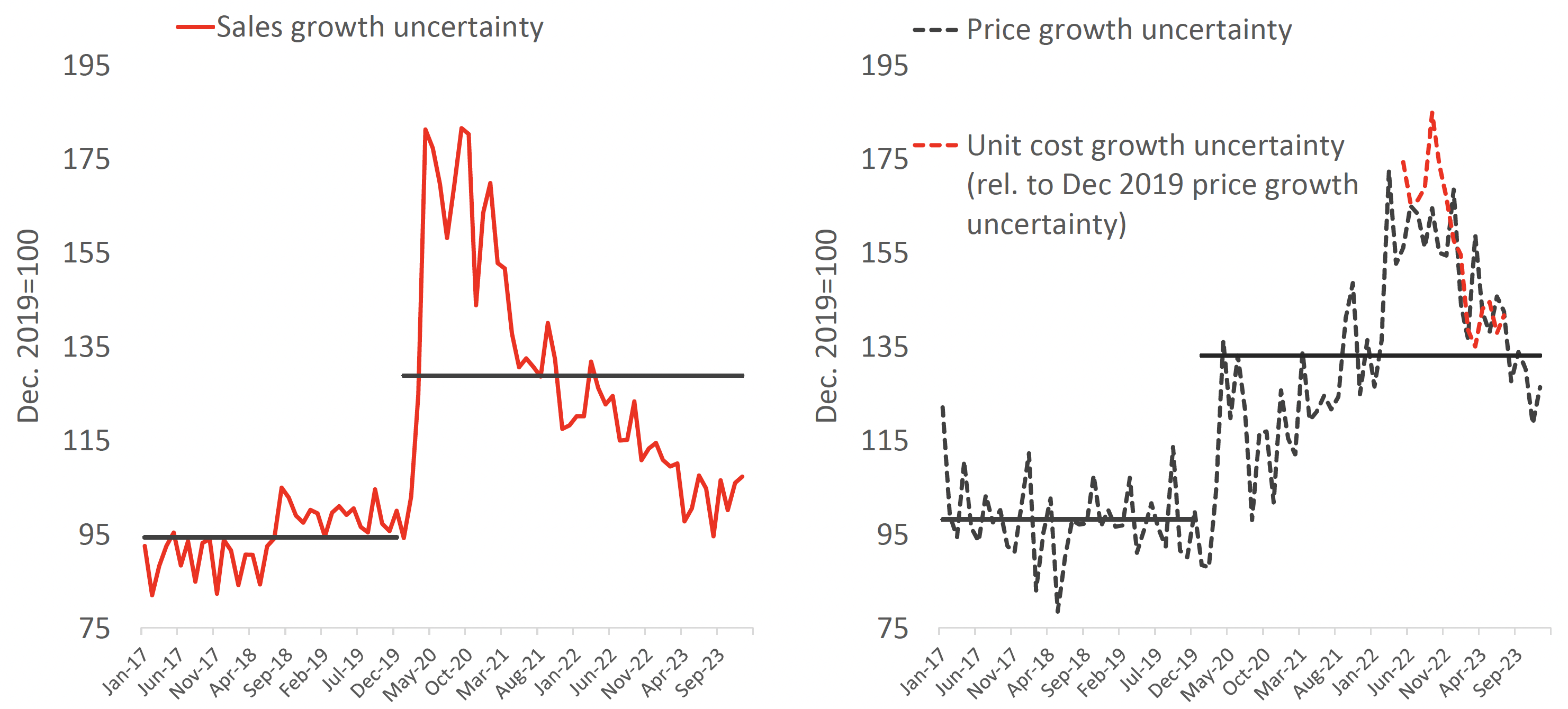

Recent empirical evidence points to two important developments in several advanced economies since the start of the coronavirus pandemic. First, there has been an upward shift in uncertainty after December 2019, as shown in Figure 1 for the UK. As the pandemic unfolded, price uncertainty and sales uncertainty moved in opposite directions. This suggests that, at first, firms were more certain about what prices they wanted to set but were less certain about what would happen to sales. Then, they became more certain about how much they would sell, but less certain about the prices. We conjecture that over time, firms were more willing and able to change prices to maintain output.

Figure 1 UK firms’ perceived uncertainty regarding sales and price growth

Sources: Bank of England (Decision Maker Panel). Monthly data, January 2017 to December 2023. Black solid line depicts pre- and post-December 2019 averages.

Second, micro price data and survey data suggest that the frequency of price adjustment has increased, see, among others, Balleer et al. (2024) and Montag and Villar (2023). In this column, we relate the increased flexibility in price setting to the rise in economic uncertainty facing firms.

In an environment of high volatility, it pays to be flexible

We argue that, when productivity is expected to be highly volatile – i.e. future states of the world become uncertain – more firms are likely to invest in their capacity to adjust prices flexibly. Determining and setting the right price for a product can be seen as a strategic capability, which requires investment in human resources, computer systems, and organisational structures (Dutta et al. 2002, Zbaracki et al. 2005). Building pricing capability could take many different forms, for instance moving into online sales, using IT to gauge demand and to monitor competitors’ prices, introducing electronic price displays, or adopting price escalation clauses.

Importantly, we consider a firm’s decision to invest in price flexibility in response to a regime change, rather than its price setting decision following a one-time shock. As an implication, in a high volatility regime, a relatively small shock also induces many firms to change prices. This prediction finds support in De Santis and Tornese (2023), who report that the price pass-through of energy price shocks is stronger in high-inflation regimes. Also, Arndt and Enders (2024) show that consumer prices respond more strongly to producer price shocks in high (inflation) volatility regimes, while no such state-dependence is observed with respect to the shock size.

More specifically, in Khalil and Lewis (2024) we develop a model in which firms face aggregate productivity uncertainty. As in Devereux (2006), firms must decide ex-ante whether to invest in price flexibility, subject to an idiosyncratic labour cost of doing so. Once productivity is realised, firms decide whether to produce. Production is subject to a fixed cost, which pins down profits and the number of producers. The two decisions, investment in price flexibility and the production choice, jointly determine the aggregate degree of price flexibility.

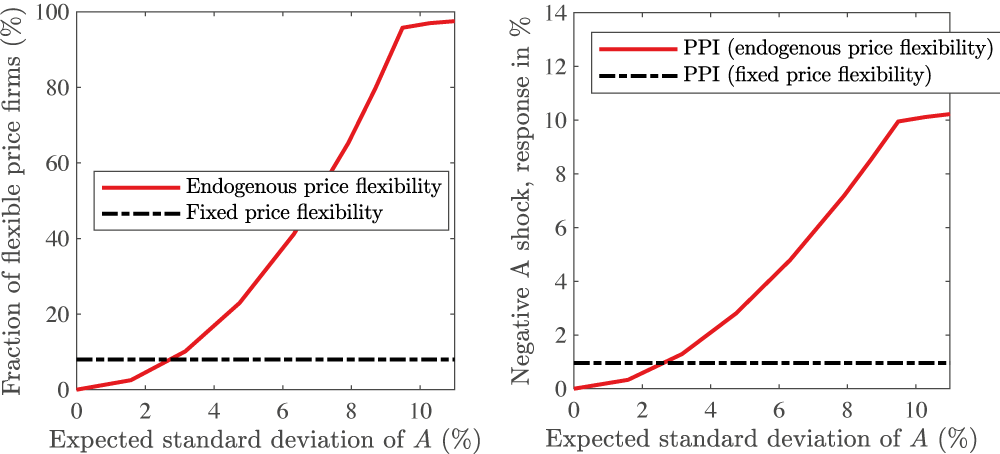

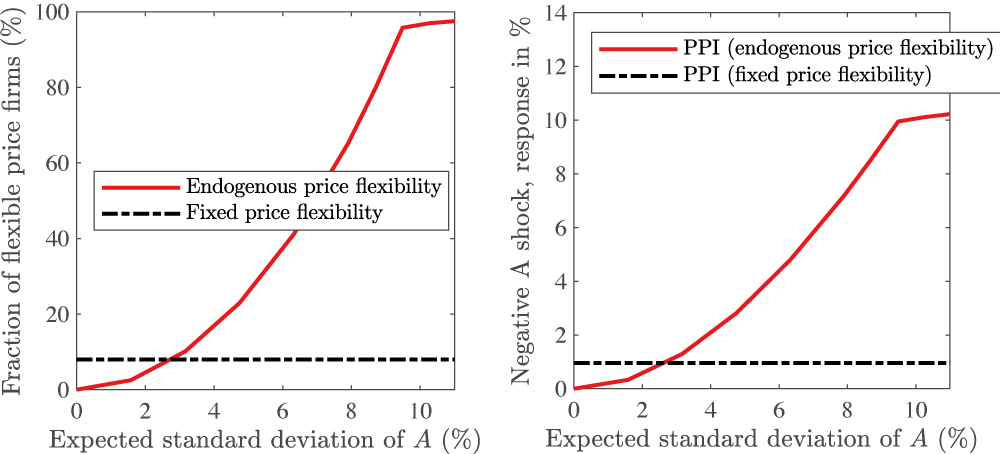

Figure 2 The role of uncertainty for price setting and the producer price index (PPI) response to an adverse supply shock

Notes: Left panel: Model-implied fraction of flexible price firms under endogenous price flexibility (in red). Right panel: Model-predicted impact responses of the producer price index (PPI) to a 10% reduction in productivity (A), for different ex ante volatilities of productivity (in red). In the black-dotted line we switch off endogenous price flexibility by fixing the number of firms that can adjust prices. Consequently, uncertainty has no implication. The fraction of flexible-price firms in this alternative model is 8%, roughly equal to the pre-pandemic estimate of Montag and Villar (2023) based on monthly data.

We find that the degree of price adjustment depends positively on productivity uncertainty. Faced with higher productivity uncertainty, firms take measures that allow them to set prices more flexibly. Therefore, a regime of higher uncertainty sees larger producer price increases when adverse supply shocks hit. This is illustrated in Figure 2, where we compare our model with endogenous price flexibility to a framework without a price flexibility choice. Thus, in our model, a bout of high inflation results not only from large adverse productivity shocks alone, but partly reflects more flexible price adjustment, which in turn is driven by higher uncertainty.

Investment in price flexibility alters the transmission of supply shocks

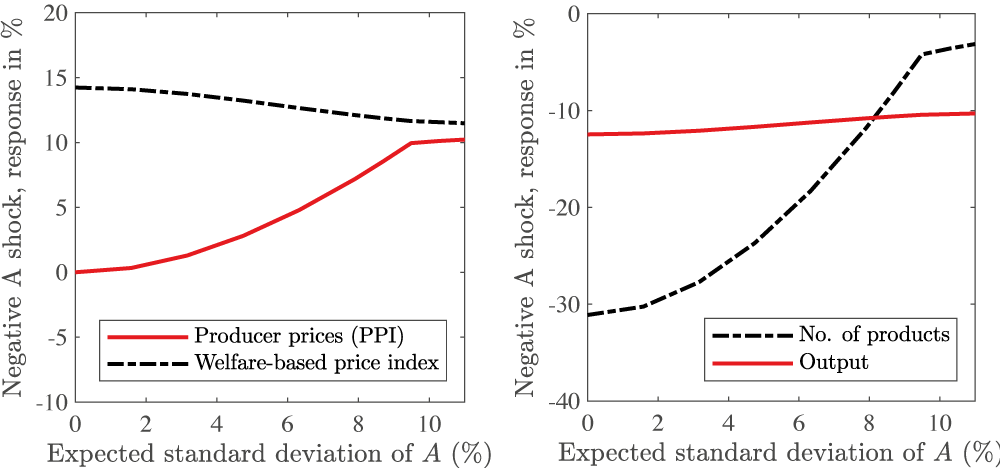

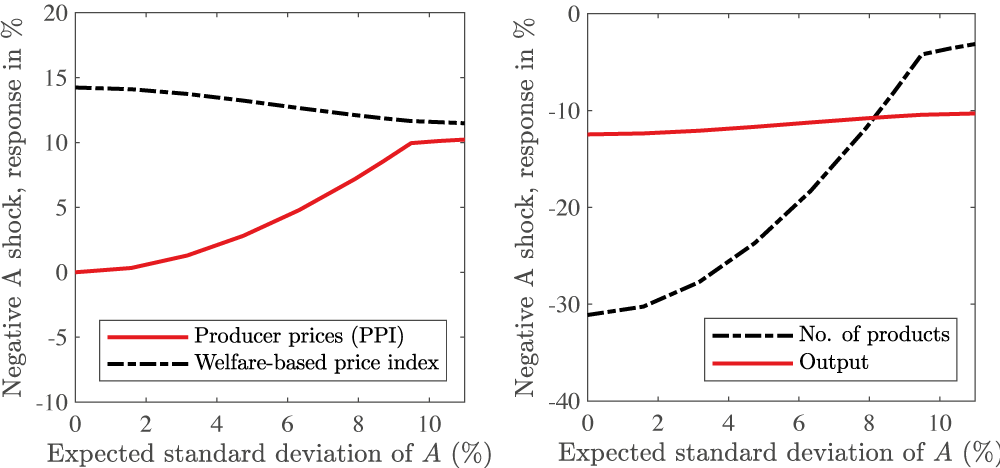

Our model shows that productivity uncertainty not only renders overall price setting more flexible, but also makes firms more resilient to adverse supply shocks. When such a shock hits, producer prices rise by more, fewer firms exit the market, and output falls by less in comparison to a regime of low productivity uncertainty. This is shown in Figure 3.

Figure 3 Impact responses to an adverse supply shock under different uncertainty regimes

Notes: Model-predicted responses of productivity (A), welfare-based price index and producer prices (PPI), as well as the number of goods and output to a 10% reduction in productivity (A), for different ex-ante volatilities of productivity.

Notably, the potential for firms to shield themselves from expected large shocks by investing in price flexibility under high uncertainty is beneficial for consumers, despite a larger pass-through of productivity declines to consumer prices at the product level. The reason is that there is less exit and more product diversity after bad shocks than in the case where firms have not invested in price flexibility before shocks happen. This implies that the welfare-based price index – that accounts for changes in product varieties – rises as the range of available products shrinks (see the dashed black line in the left panel of Figure 3); however, this ‘variety effect’ becomes less important for higher levels of productivity uncertainty.

Bilbiie and Melitz (2020) point out that firm exit worsens the downturn resulting from an adverse supply shock when many firms keep their prices unchanged. They dub this amplification effect the ‘entry-exit multiplier’. Importantly, their analysis treats the degree of price flexibility as given. Instead, when investment in price flexibility is allowed for, the entry-exit multiplier depends critically on productivity uncertainty.

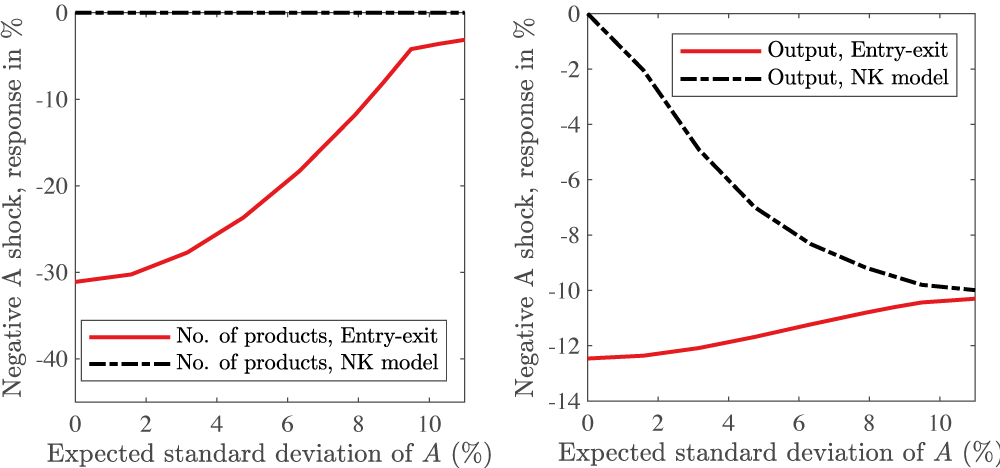

In our model, entry-exit dynamics strongly amplify the effects of supply shocks in an environment of low productivity uncertainty. This is due to the comparatively strong price rigidity that prevails in such an environment. Consider Figure 4, which compares impulse responses of two models, our entry-exit model and a ‘New Keynesian’ model featuring a constant number of firms, i.e. no entry and exit. In both models, firms choose price flexibility endogenously.

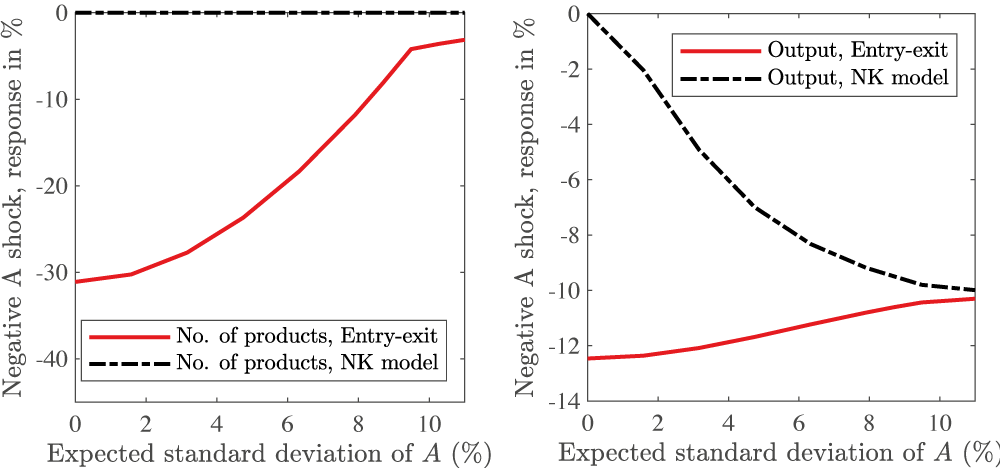

Figure 4 Impact responses to an adverse supply shock: the role of entry-exit

Notes: Model-predicted impact responses of the number of products and output to a 10% reduction in productivity (A), for different ex-ante volatilities of productivity: New Keynesian (NK) model with fixed product diversity versus entry-exit model. Both models feature endogenous price flexibility.

The left panel of Figure 4 shows the impact response of the number of products as a function of productivity uncertainty under endogenous price flexibility. By construction, the number of products does not change in the New Keynesian model. In the entry-exit model, the impact response of the number of products is decreasing in the degree of productivity uncertainty. The lower productivity uncertainty, the more rigid are prices, and the greater is the adjustment along the extensive margin.

This has implications for the output response in the two models, as can be seen in the right panel of Figure 4. The impact response of output increases in productivity uncertainty in the NK model: as in the entry-exit model, firms choose to invest in price flexibility when uncertainty is high and producer prices increase more after supply disruptions. In the NK model, this allows demand and output to adjust by more. In contrast, in the entry-exit model the output response instead decreases in productivity uncertainty.

Summary

We study the consequences of adverse supply shocks for output and product diversity in a model where price flexibility is a choice. In particular, we consider a firm’s investment decision in a technology that allows the firm to change its price in response to shocks. We show that the volatility of productivity shocks is critical for the equilibrium degree of price flexibility in an economy. When uncertainty rises and shocks are larger on average, more firms are willing to invest in price flexibility and this reduces product exit and output losses in the wake of negative productivity shocks. At the same time, producer prices respond more markedly, giving rise to higher inflation. The results of our analysis are highly policy relevant against the background of new risks arising from climate change and the green transition, as well as protectionism and de-globalisation, as we might be entering an episode of ‘Great Volatility’ (see Schnabel 2022).

Source : VOXeu