Structural transformation in the past three decades has been driven by a fast-growing services sector, which has outpaced the manufacturing sector in many developing economies. This column summarises the key messages from a workshop organised by the World Bank that showcased recent evidence on how the services sector will be increasingly central to productive structural transformation in emerging markets and developing economies. Topics include prospects for services-led growth, the link between services-led growth and income distribution, and the need for a new policy approach for the services sector.

Structural transformation in the past three decades has been driven by a fast-growing services sector, which has outpaced the manufacturing sector in many developing economies. The likelihood of developing economies following a services-led growth model looks increasingly certain, although its benefits may not apply to all countries and individuals equally. The Services and Structural Transformation Workshop, organised by the World Bank, brought together leading experts to discuss the implications of services-led growth on labour productivity, deindustrialisation, industry polarisation, growth dynamics, and job creation.

The services sector is an increasingly important growth engine for developing countries

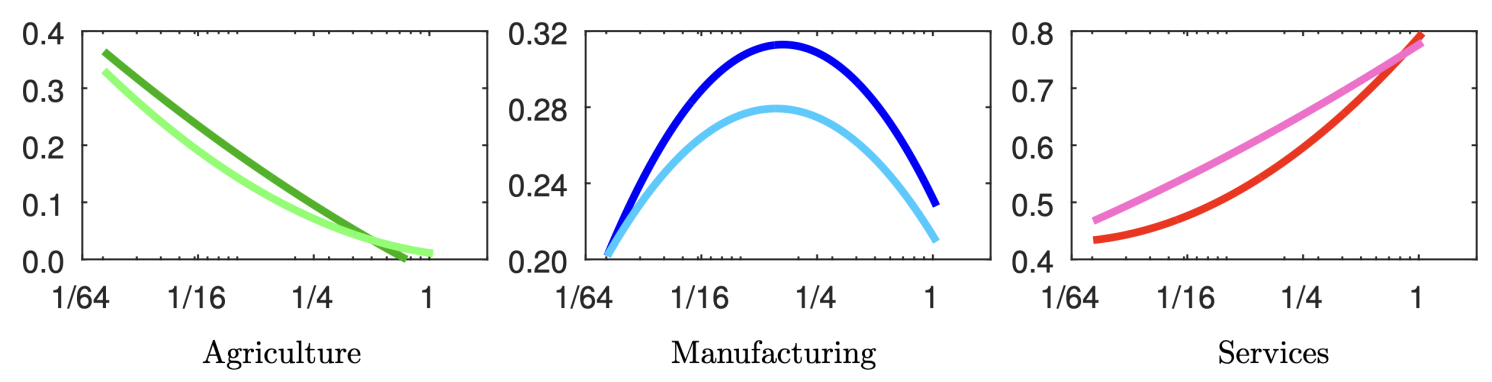

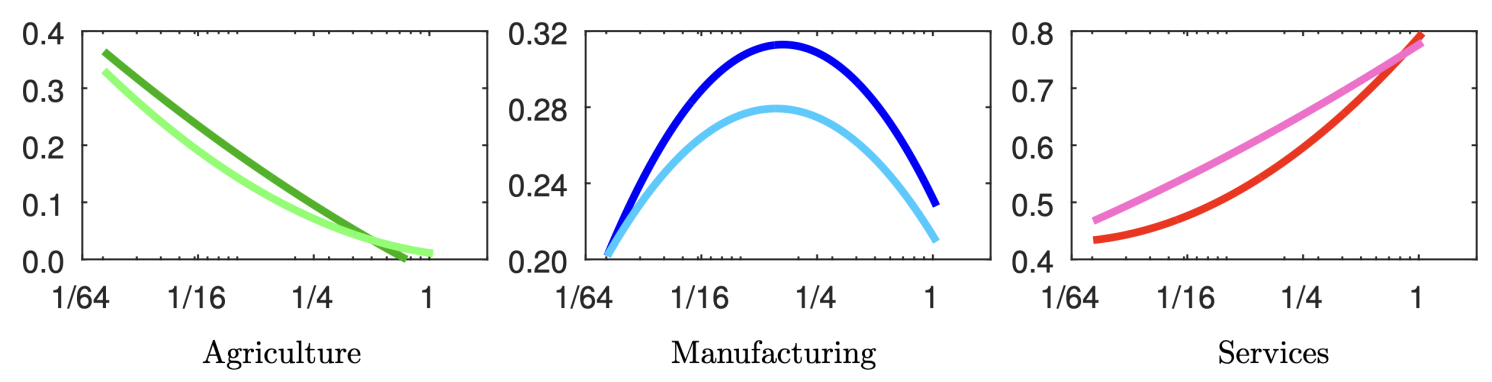

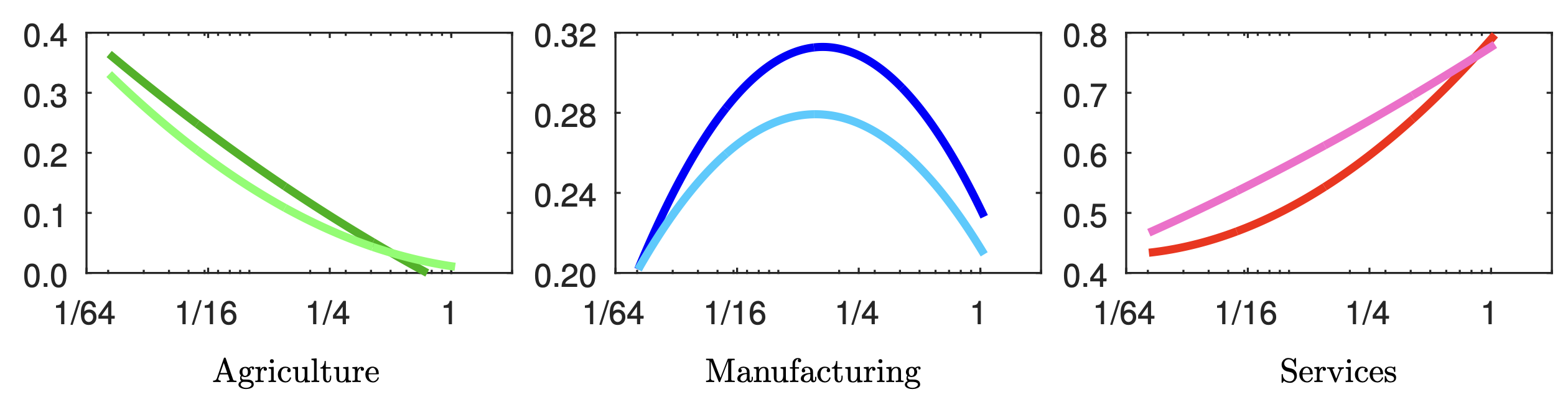

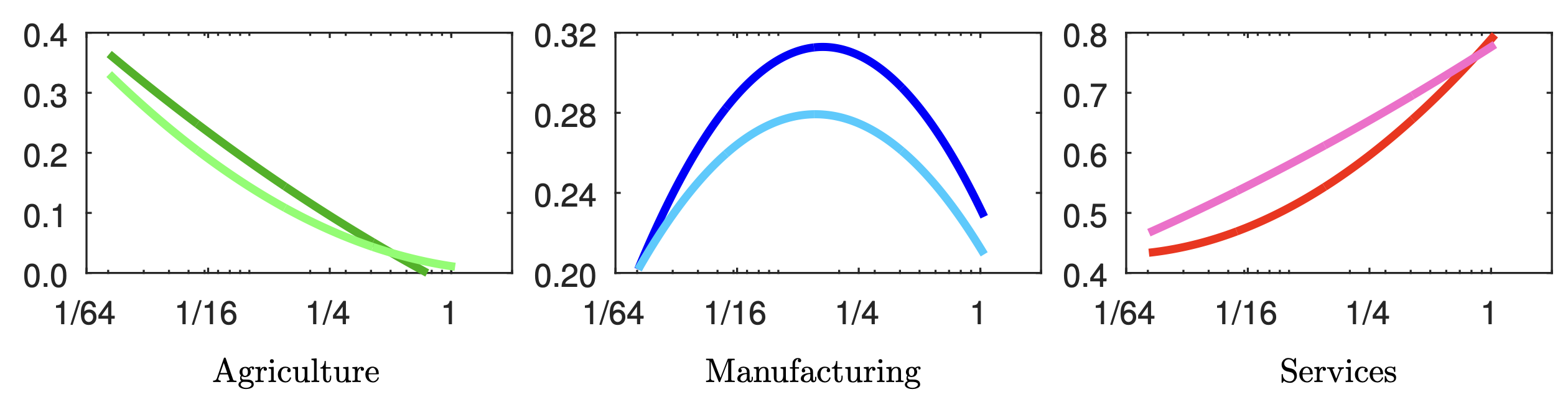

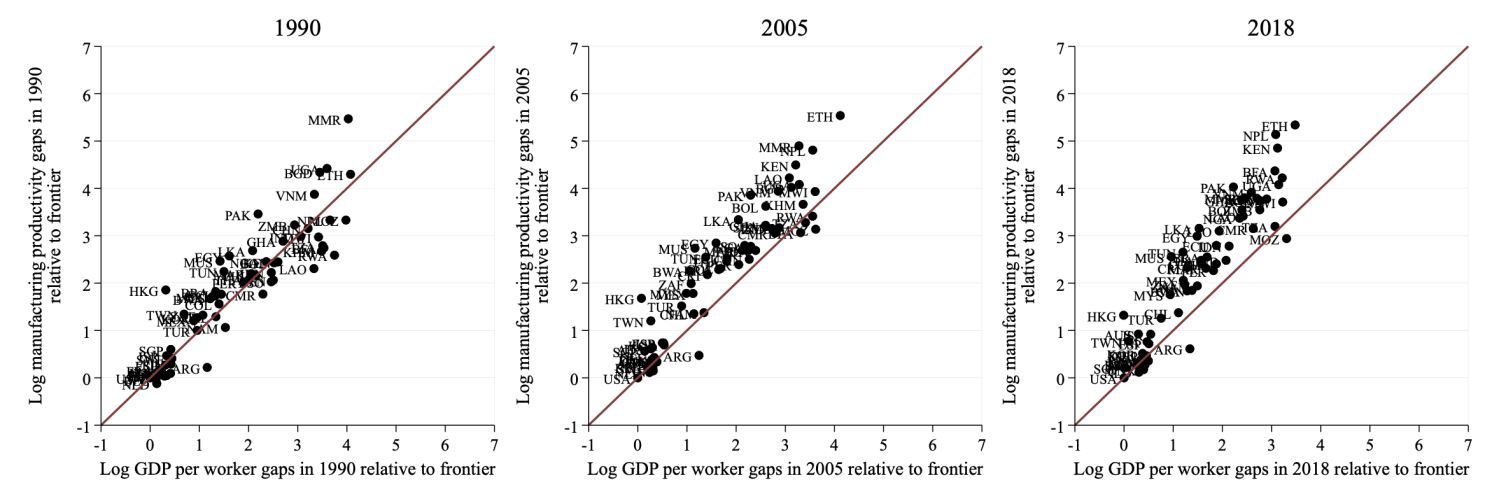

The share of manufacturing in value added and employment in developing economies has stagnated or declined at lower levels of income compared to the experience of developed economies decades ago (Rodrik 2016). This ‘deindustrialisation’ has been accompanied by rising cross-country dispersion in the manufacturing sector’s share of total value added (‘industry polarisation’), suggesting more limited opportunities for developing economies to industrialise (Figure 1).

Figure 1 Deindustrialisation: Predicted sectoral value-added shares, pre-1990 versus post-1990

Notes: Lines show the predicted value-added shares for a sector on the y-axis, estimated from a balanced panel of 28 countries over 1971–2011 and over the observed ranges of income per capita (i.e. real income per capita, at PPP prices, relative to the US in 2011) on the x-axis. Lines in the darker (lighter) colour are for the pre-1990 (post-1990) period.

Source: Sposi et al. (2021).

Kei-Mu Yi presented evidence that early industrialising countries – facing high prices of manufactured goods – redistributed resources from agriculture to manufacturing. In contrast, countries that began to industrialise later – when prices of manufactured goods were lower – faced more limited opportunities to specialise in the manufacturing sector and instead began to redistribute resources predominantly from agriculture directly to services (Sposi et al. 2021). Despite its increasing prominence, the services sector has been under-studied by researchers and underappreciated by policymakers as a means to create jobs, achieve productivity gains, and reduce poverty (Nayyar et al. 2021).

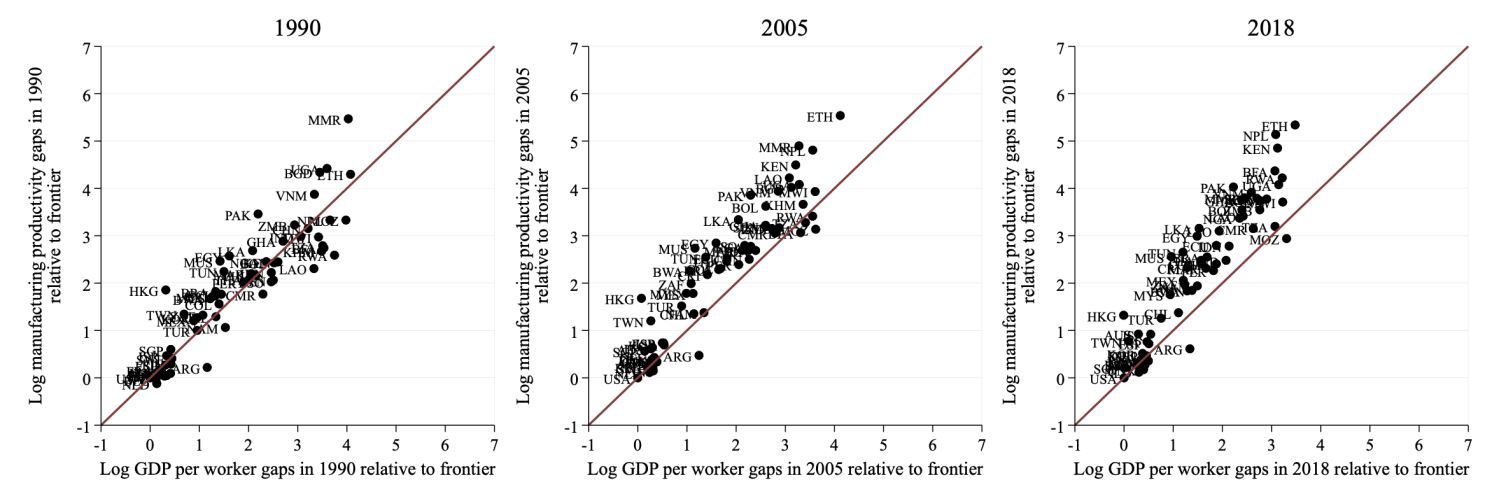

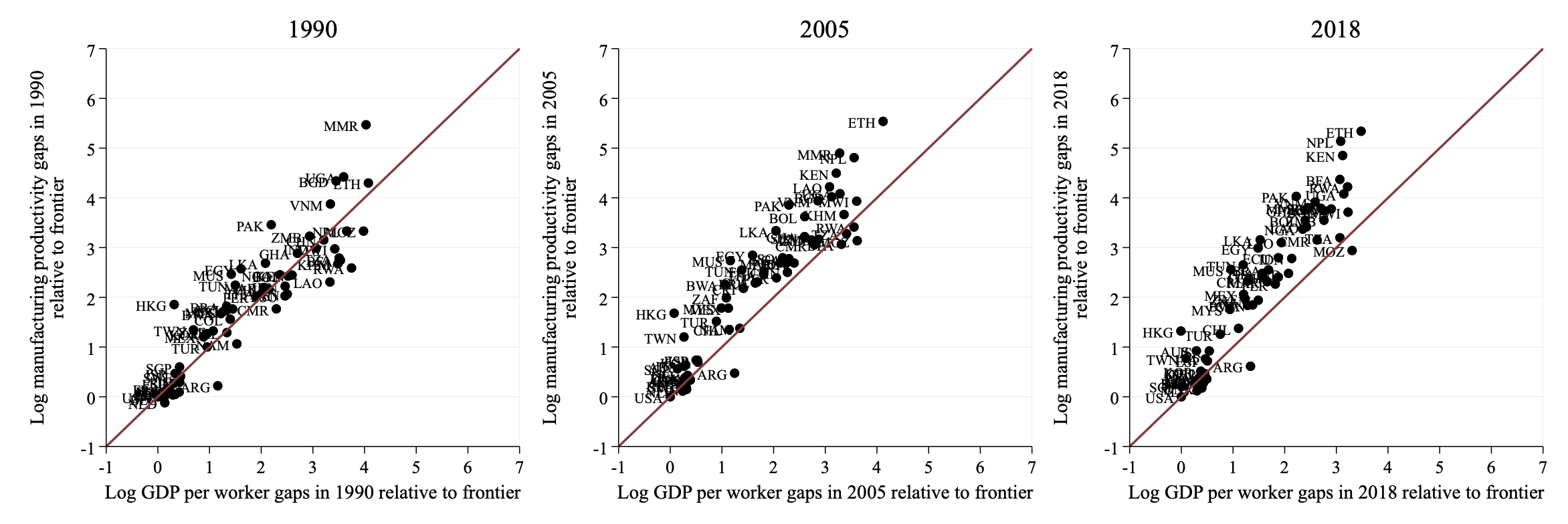

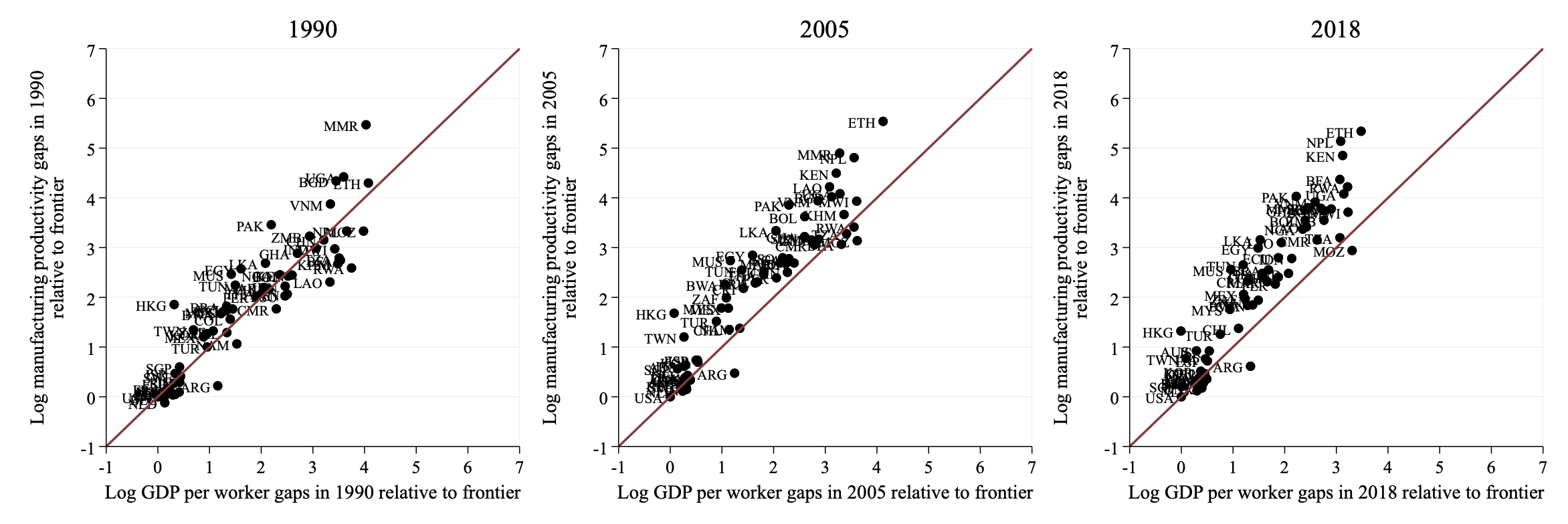

Richard Rogerson highlighted that cross-country productivity gaps in the manufacturing sector did not shrink in the past three decades (Herrendorf et al. 2022; Figure 2). This challenges the view that expanding manufacturing employment is a prerequisite for developing economies to catch up, given earlier evidence of unconditional convergence in labour productivity levels in the sector across countries (Rodrik 2013). In fact, new evidence shared by Michael Peters suggests that productivity growth has underpinned the expansion of the services sector in developing economies, such as India, where most jobs have been created since the 1990s (Fan et al. 2021). Firm-level evidence from 20 low- and middle-income countries also shows that service establishments can achieve high productivity despite being smaller than manufacturing establishments (Hallward-Driemeier et al. 2022).

Figure 2 Manufacturing versus aggregate productivity relative to respective frontier

Source: Herrendorf et al. (2022).

In the past, the benefits of industrialisation were often associated with trade integration. Richard Baldwin made the case that future benefits of international trade for developing economies will likely derive from services trade – in particular, intermediate services – rather than goods trade (Baldwin 2023). A range of factors, such as geopolitical tensions and the diffusion of industrial automation, can reduce trade in manufactured goods and weaken their link with generating quality jobs. At the same time, the acceleration of digitalisation is lowering barriers to services trade (Baldwin and Forslid 2020). Further, manufacturing inputs are being displaced by services inputs in export value added (Baldwin and Ito 2022). Banu Demir found that the structural shift toward services can also be linked to an observed increase in demand for local business services, owing to improved market access for local manufacturing (e.g. in Turkey; Avdiu et al. 2023).

Even for non-tradable services, such as wholesale and retail, ICT-based technologies, together with the adoption of new management practices, have enabled firms to standardise and scale up delivery across locations. Chang-Tai Hsieh argued that this is reflected in the rising market share and labour productivity of top firms in these sectors. In the US, the entry of top service firms into new local markets has led to substantial unmeasured productivity growth, particularly in small markets (Hsieh and Rossi-Hansberg 2021).

Income gains from services-led growth may not be equally distributed

Income gains from service-led structural transformation are not necessarily equally distributed across countries or within countries. As the value added in exports shifts from the manufacturing sector to the services sector, own-country sourcing of services has declined in developing economies, while developed economies have been able to maintain their relatively high levels of own-country services sourcing (Baldwin and Ito 2022).

Within countries, although productivity growth in non-tradable consumer services like retail trade has been an important driver of rising living standards, such as between 1987 and 2011 in India, the gains have gone disproportionately to high-income households in urban areas (Fan et al. 2021). Further, the type of services jobs matters for development. Bernard Hoekman shared evidence of a positive relationship between the share of workers in high-skilled services and development (measured by nighttime luminosity) but a negative relationship between low-skilled services and development (Baccini et al. 2022). One possible underlying mechanism is foreign direct investment, which is associated with workers shifting toward higher-skilled jobs (Hoekman et al. 2023). Paolo Bastos added that there is also evidence of dynamic benefits resulting from ‘learning-by-working’ in high-skilled services, which accrues to workers even if they are not currently employed in these sectors (Bastos and Artuc 2023).

The rapid growth of the services sector could call for new ‘industrial’ policies

Given the fundamental shift in the patterns of structural change, with workers moving predominantly into services and informal manufacturing rather than into formal manufacturing, Dani Rodrik called for new ‘industrial’ policies for the services sector. Guiding principles could include policies that promote collaboration and customisation, focus on small- and medium-sized firms, and where partnerships between firms and governments are used to revitalise communities (Rodrik 2023). As the prospects for service-led growth brighten, new development strategies could emphasise elements such as human capital development (via training), quality-job creation, and services value-chain engagement (Baldwin 2023, Rodrik 2023). The panel discussion during the workshop, chaired by Aaditya Mattoo, highlighted the significance of better data availability to advance our understanding of how policy can best leverage the services sector for economic growth.

Source : VOXEu