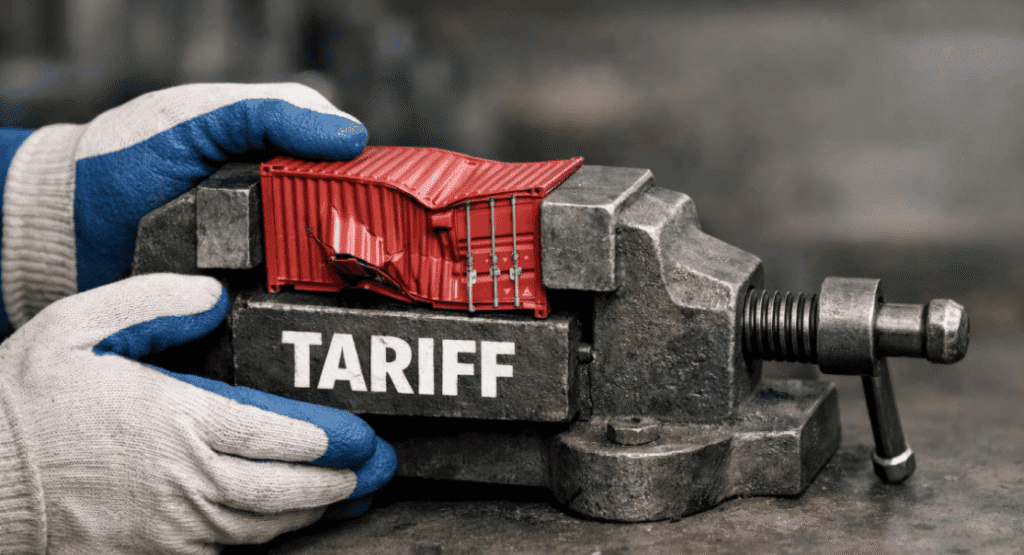

Tariff reciprocity and the True Cost of Protection Index

Effective tariff index comparisons are spotlighted in media reports on trade wars and trade talks. This column argues that the effective tariff index is inadequate

Introducing the World Bank Land Data Map

From urbanization to agriculture, land systems touch nearly every aspect of development. That’s why the World Bank Group has launched the Land Data Map, a new

Global economy set for 2.7% growth; trade tensions cloud outlook

Policymakers face an increasingly complex inflation landscape, where supply risks call for a more coordinated and forward-looking approach. Global economic output is forecast to grow

Northern insights: Measuring geopolitical risk through Finnish news media

Much of what we know about geopolitical risk is filtered through a narrow informational lens of global English-language media. This column constructs a geopolitical risk

The risk of tariffs as a tool to attract manufacturing investment

Recent tariff increases have sparked a debate over whether trade protectionism can effectively attract foreign investment. This column analyses how firms adjust their investment strategies

Big cities and globalisation

Globalisation has deepened economic inequalities between large cities and the rest. This column examines foreign trade integration in larger cities versus other regions across Brazil,

US dollar close to multi-week lows versus euro and yen before US data

Euro supported by ECB’s stance and strong economic data. Euro supported by ECB’s The U.S. dollar hovered around multi-week lows against the euro and yen

Gold eases after divided Fed rate cut vote; silver hits new high

Spot gold fell 0.3% to $4,217.09 per ounce, as of 1111 GMT. U.S. gold futures for February delivery gained 0.5% to $4,244.70 per ounce. Gold

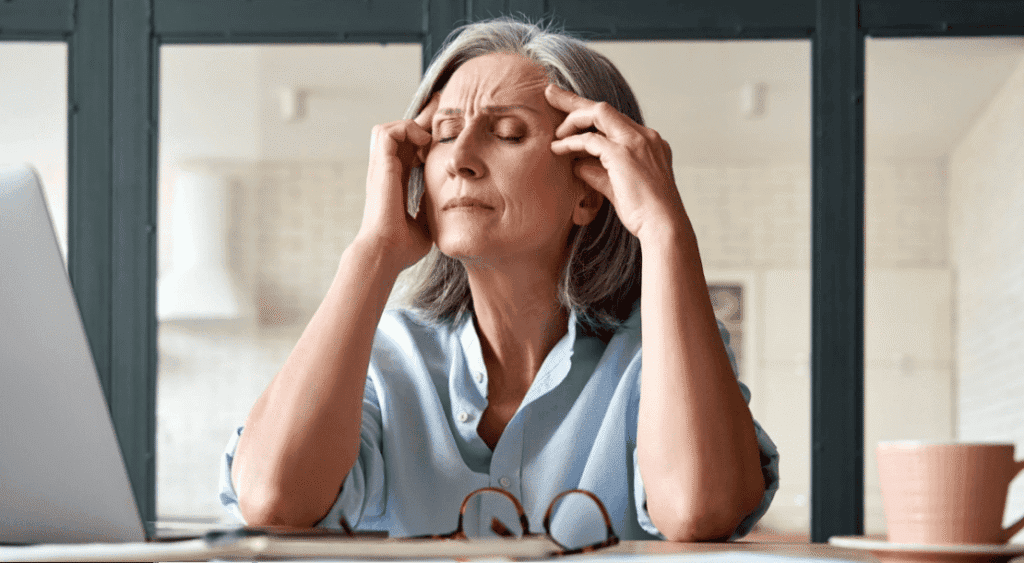

After ‘the change’: How menopause affects women’s labour and health outcomes

The labour costs associated with the menopause transition have been largely understudied. Exploiting the individual timing of menopause, this column estimates the causal effects of

Demographic change: Headwinds for economic growth

With fertility rates falling and populations ageing worldwide, the impact of demographic change on economic prosperity has become a central policy concern. This column uses