Dollar choppy as risk-off mood, dovish Fed unsettle markets

The risk selloff petered out somewhat in Europe, however, to leave the euro at $1.1704, steady on the day at a near two-month high, after

Bank specialization and the transmission of euro area monetary policy

Bank lending is a key channel through which monetary policy affects the real economy. This column explores how the effects of monetary policy on credit

Yen and euro struggle as Japan and France’s political dramas heat up

French political quagmire leaves euro at two-month lows. The yen stabilised on Friday but was still headed for its steepest weekly drop in a year

Interest rate and deposit run risk: New evidence from euro area banks in the 2022-2023 tightening cycle

Rising interest rates expose the interaction between hidden losses on long-duration assets and flighty uninsured deposits. This column uses confidential data for 139 euro area

Dollar steady before US inflation report, US-China tariff deadline

The euro was up less than 0.1% at $1.1652, while sterling was flat at $1.3462. The U.S. dollar was little changed on Monday before Tuesday’s

Sudden stops in the euro area

Internal balance-of-payment crises should be taken as a strong signal of weakness and a wake-up call to reform euro area structures The single currency was

The supply side of monetary policy: How floating-rate loans blunt the ECB’s fight against inflation

Central banks raise interest rates to reduce aggregate demand and bring inflation down. This column uses credit register data and product-level price data from the

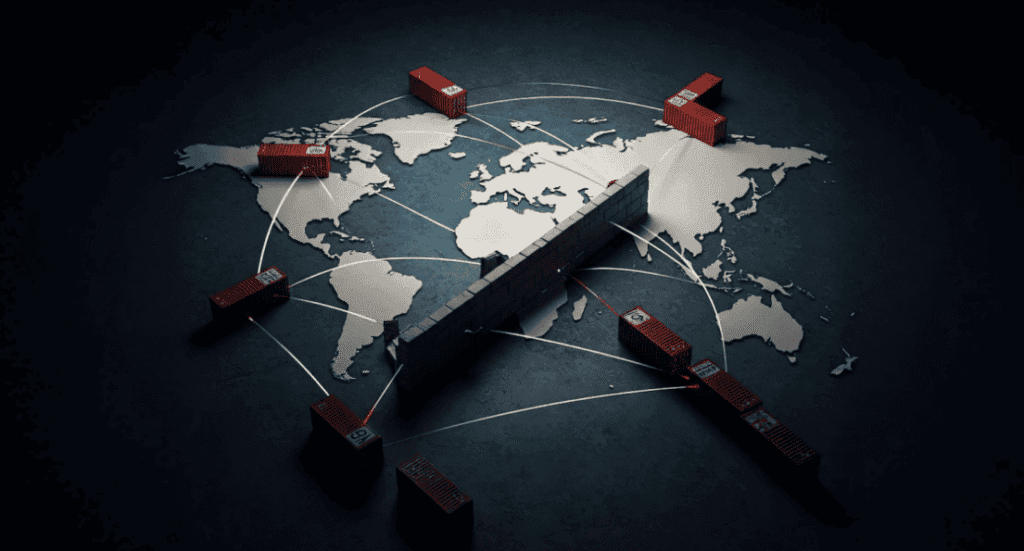

Tariffs across the supply chain

Tariffs disrupt trade flows and influence prices, but their broader impact depends on how they are structured and the type of goods targeted. This column