Big manufacturing economies struggle as US tariffs hit order books

Euro zone factory activity stagnated as new orders flatlined and headcount fell. The world’s big manufacturing economies struggled to fire up in October, business surveys

From policy to results: How legal solutions drive development impact

Strong legal systems are essential to the goals of the world’s development agenda. They enable governments and institutions to design and implement the policies, laws, and

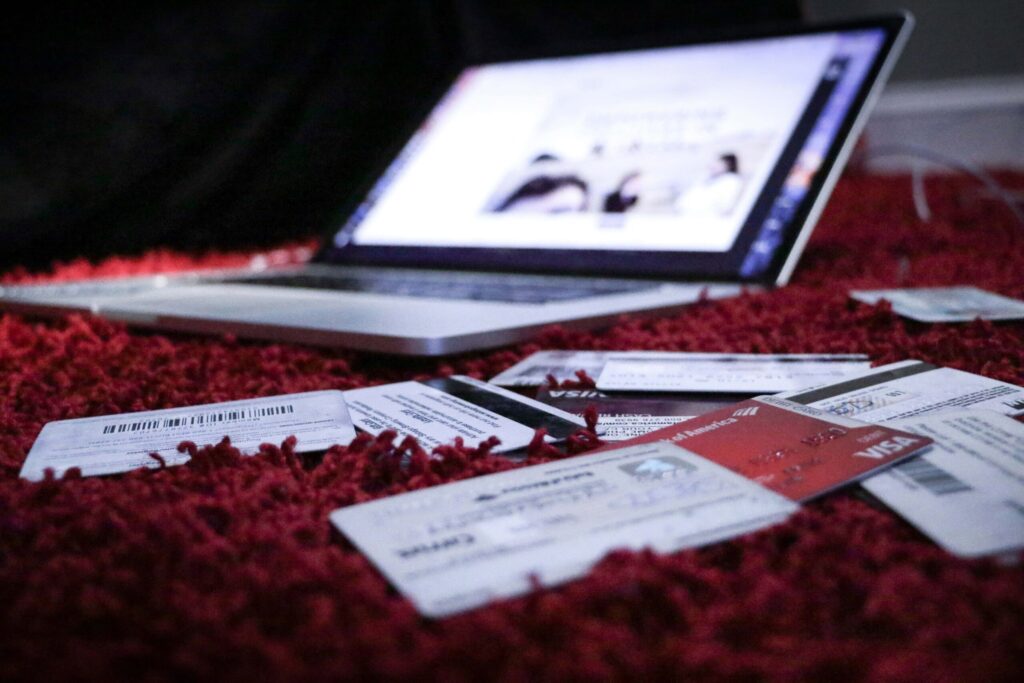

How tariffs hurt the ones you love

US stock markets fell in response to the announcement of President Trump’s “Liberation Day” tariffs until the tariffs were paused a few days later. This

Decoupling without deglobalisation: The new geography of trade blocs

As geopolitical tensions rise, fears of deglobalisation have taken centre stage. However, world trade has remained surprisingly resilient, at least through 2023. This column uses

Global economy showing signs of moderate slowdown says IMF

Global growth is projected to slow from 3.3 percent in 2024 to 3.2 percent in 2025 and 3.1 percent in 2026. The global economy is

IMF sounds alarm about high global public debt, urges countries to build buffers

The IMF this week edged up its 2025 global growth forecast given a more benign impact from tariffs. Global public debt is projected to rise

Gold leaps above $4,100 on Fed rate cut hopes, US-China trade tension

Fed Chair Powell to address NABE annual meeting on Tuesday. Gold prices jumped to a record high above $4,100 on Tuesday, supported by rising expectations

Oil recoups some losses after US-China trade tensions

Oil prices rose on Monday after hitting five-month lows in the previous session, as investors focused on potential talks between the presidents of the United

Re-imagining South Africa’s state structure for inclusive growth

When economies lose momentum and stagnation becomes entrenched, a shift in thinking and action is imperative. So urged Kofi Annan at a Davos panel decades

Soviet communism was not more successful at reducing inequality than other regimes

Inequality is a major concern for many economies, prompting the question of whether some regimes are more effective at reducing inequality than others. This column