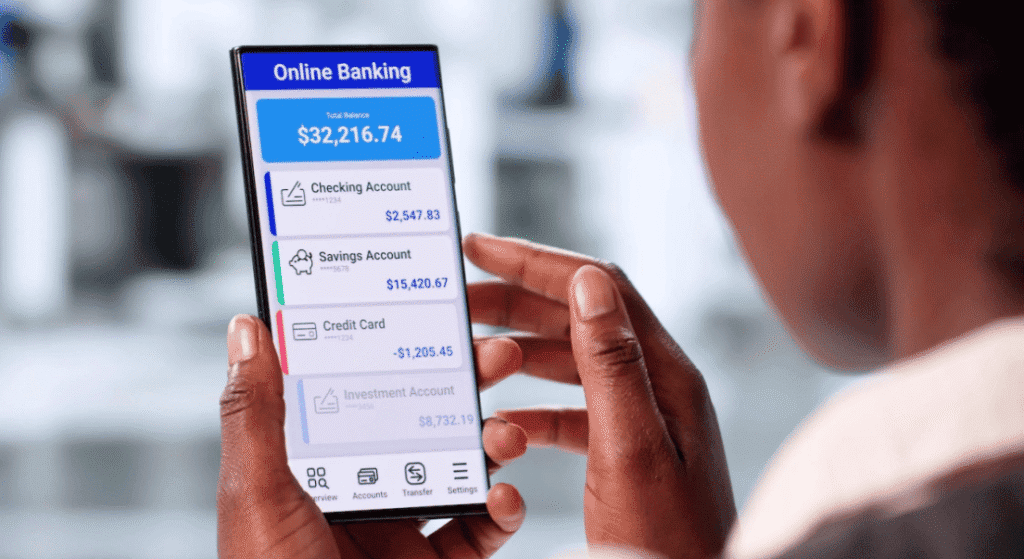

Stablecoins and the exorbitant privilege of money creation

Payment stablecoins are set to become an important financial instrument. Their impact on the financial system will depend on whether the issuers can purchase assets

Geopolitics as a monetary shock: The ‘silent tightening’ in the European banking system

Geopolitical tensions have once again seized the centre stage of macroeconomic policy debates. From Russia’s ongoing war in Ukraine to instability in the Middle East,

The digital euro: Awareness, adoption, and household portfolios

Several central banks are pursuing plans to potentially introduce a central bank digital currency. This column uses survey data covering the 11 largest euro area

Sterling drops as inflation cements BoE cut expectations, dollar up before US inflation

British consumer price inflation fell to 3.2% in November, its lowest since March, from 3.6% in October, official figures showed. Sterling fell on Wednesday after

World’s central banks are wary of AI and struggling to quit the dollar, survey shows

The primary concern is that AI-driven behaviour could “accelerate future crises,” the survey showed. Artificial Intelligence is not a core part of operations at most

Supply shocks and inflation: Timely insights from financial markets

Determining the drivers of inflation in real time is a central challenge for central banks. This column introduces a new financial markets-based model to identify

Households’ inaction in the deposit market

The sharp rise in interest rates since 2021 has not been matched by equal increases in household savings rates in advanced economies. This column uses

Reforming the education of economists in Europe: Breaking the tyranny of the top five

Many European countries have adopted the American model of doctoral training and academic evaluation. While this model suits America’s vast, mobile labour market, in Europe

Arab Energy Fund announces $600mln issuance with competitive pricing

The transaction represents the fourth successful public benchmark issuance completed by TAEF in 2025. MENA-focused The Arab Energy Fund (TAEF), formerly known as APICORP, recently

How central bankers speak about climate and what this means for financial markets

Central banks have increasingly engaged with climate-related topics in their public communication, but little is known about the drivers and effects of this shift. This