Non-bank financial intermediation has grown rapidly since the global financial crisis, and its size now equals that of banks in many countries. This column reviews research and policy work on this form of financial intermediation from a financial stability perspective. Research has documented the benefits relating to its specific comparative advantages in maturity and liquidity transformation; its specialisation and ability to finance riskier but more productive segments; its greater allocational efficiency relative to banks, at least for some types of investments; and its risk-pooling and diversification gains for final investors. But non-bank financial intermediation comes with its own risks relating to interconnections and interactions between liquidity and leverage.

Non-bank financial intermediation (NBFI) has been in the news. This form of financial intermediation has grown fast since the global financial crisis (GFC), and its size now equals that of banks in many countries (Acharya et al. 2024 ). Presumably, this growth reflects the demand for, and economic benefits of, the specific services offered by non-bank financial intermediaries (NBFIs). Yet, NBFI has also been in the news as a factor behind some recent financial stresses (e.g. FSB 2020). These events, including severe dysfunctioning in core bond markets, have necessitated large central bank interventions. Related, some have questioned the spare wheel role of NBFI, the notion that it will help with financing the real sector in times of stress. Rather, some recent analysis (e.g. Forbes et al. 2023, Aldasoro et al. 2024) suggests that NBFI is less willing than banks to tie borrowers over during crises and may actually be more procyclical.

Reflecting this, in a recent paper (Claessens 2024) I review research and policy work on NBFI from a financial stability perspective. Reflecting its growth, stability, and procyclicality issues, NBFI has been researched more recently (for another review, see Aramonte et al. 2023) and received much more policy attention (e.g. FSB 2024). In some sense, this reflects a catching up with the attention long given to banking. But there are many differences. For one, NBFI is more diverse than banking, including as it does money market and other asset management vehicles, pension funds and insurance corporations, making for many aspects to cover and issues to consider. I therefore focus on market-based forms, and within that subset, on debt-related intermediation, as that is most closely associated with financial instability. And, as NBFI emerged more recently, it has led to crises only lately. Since NBFI-related financial instability is very episodic, there are few such events – less so than related to banking. Together, this has made it harder to study its financial stability properties than for banking.

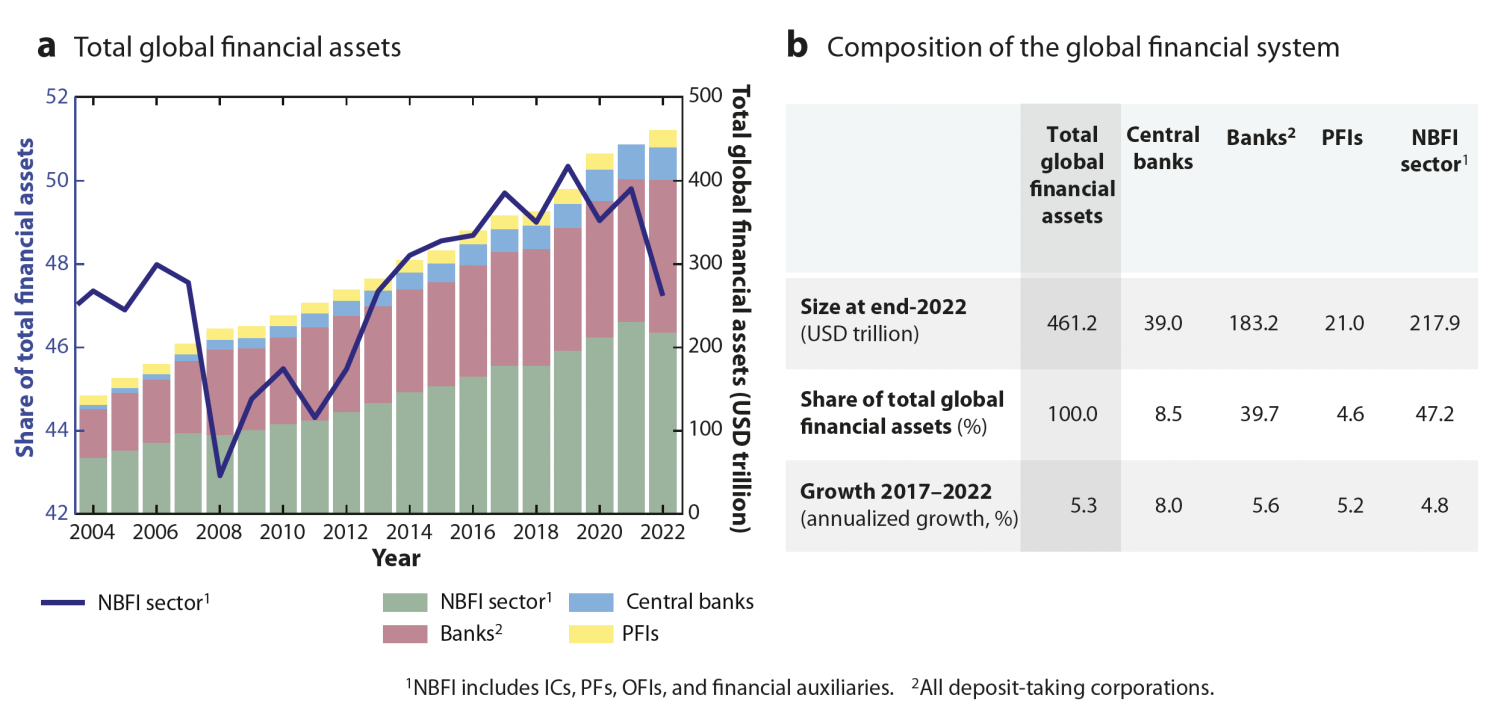

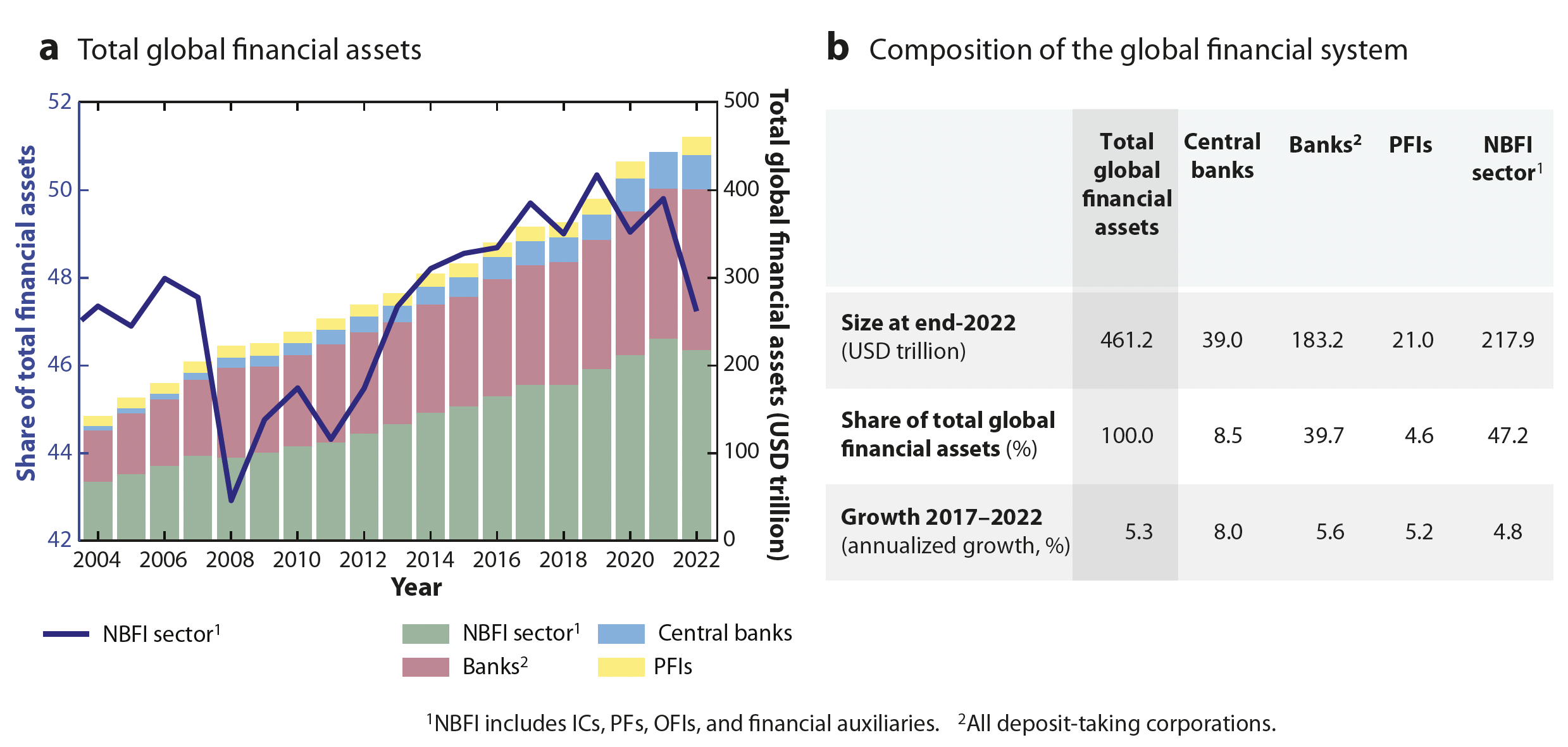

With these caveats in mind, I first document the rapid growth of NBFI. While it has slowed down recently, since the GFC its growth has exceeded that of other financial assets (Figure 1a; for more details, see FSB 2023b). NBFI assets now account for nearly one-half of total global financial assets (Figure 1b). In 2022, approximately 65% was held by so-called other financial intermediaries (OFIs) – institutions other than central banks, banks, public financial institutions, insurance corporations, pension funds, or financial auxiliaries. Among OFIs, about three-quarters are collective investment vehicles (CIVs), such as money market funds (MMFs), fixed-income funds, balanced funds, hedge funds, and real estate investment trusts. Relative to GDP, between 2012 and 2022 they grew by 7 percentage points in the UK, 3 percentage points in Italy, 2 percentage points in Japan, 1 percentage point in the US, roughly doubled in Brazil and South Africa, and increased by one-third in India. While attribution is difficult, the low interest rate environment, generally low asset price volatility, as well as technological advances and financial reforms likely drove this growth.

Figure 1 Total global financial assets and the NBFI share

Notes: The NBFI sector includes all financial institutions that are not central banks, banks, or public financial institutions. Included are all Argentina, Australia, Brazil, Canada, the Cayman Islands, Chile, China, the euro area, Hong Kong SAR, India, Indonesia, Japan, South Korea, Mexico, Russia, Saudi Arabia, Singapore, South Africa, Switzerland, Türkiye, the UK, and the US. Panel a includes data for Russia up until 2020; panel b does not include data for Russia.

Source: FSB (2023b).

Stress periods related to NBFI are rare and can be triggered by many shocks, but they appear to have increased in frequency. The onset of the GFC, the global COVID-19 outbreak in March 2020, and, most recently, the start of the war in Ukraine have been associated with NBFI-induced financial stress. Most were due to CIVs, which have features that make them susceptible to runs and have driven the NBFI growth since the GFC. But it can be other NBFIs too, as in the UK in September 2022 when gilt interest rates rose following a mini budget announcement, triggering a crisis among pension funds as collateral calls related to so-called liability-driven investments could not be met.

Research has documented the benefits of NBFI in terms of greater access to finance and economic impact, relating these to its specific comparative advantages in maturity and liquidity transformation; its specialisation (for example, some CIVs invest (mostly) in one specific asset class) and ability to finance riskier but more productive segments; its greater allocational efficiency relative to banks (due to its more decentralised nature), at least for some types of investments; and its risk-pooling and diversification benefits for final investors. NBFI’s complementary relationships with banks and capital markets, which can be from the supply and demand side, are also argued to provide benefits.

The risk-reduction benefits of NBFI arise in large part from the diverse forms of financial services it provides. NBFI generally uses instruments that involve greater risk-sharing among a wider pool, which can benefit borrowers. Also, since NBFIs do not have very highly levered balance sheets and are not core to the payment system as banks are, individual NBFI failures tend to have less systemic consequences. Evidence also supports that better-developed capital markets, typically associated with more NBFI, mitigate the negative real effects of crises. But NBFI comes with its own risks, related specifically to interconnections and interactions between liquidity and leverage, and can be procyclical too.

The connections between NBFIs and banks, often referred to as shadow banking, have been extensively analysed post-GFC, as they contributed to that crisis. These links are much smaller today due to various reforms. Still, they and related risks remain (e.g. Acharya et al. 2024), as the large impact of the bankruptcies of Archegos Capital Management and Greensill Capital on some banks showed.

The main systemic risk analysed in relation to NBFI recently has been its fragile liquidity. The underlying mechanisms are well-known (Aramonte et al. 2023) and were present in several recent stress events. At its core are the interactions between liquidity mismatches and leverage with risk-management practices, with the latter influenced in part by regulation. Fragile liquidity can arise from those NBFIs that issue liabilities with near-money characteristics yet are backed by illiquid assets and channelled through vehicles with no (or limited) ability to generate their own liquidity. These forms include MMFs and other types of CIVs. When faced with large-scale redemptions and other withdrawals, such CIVs can quickly run down their buffers. Additionally, in times of stress, fund managers typically hoard cash. Both behaviours can make CIVs want to sell assets at times of few buyers. The demand for liquidity services from dealers may rise, but their supply is not elastic either. Market imbalances may follow. Depending on the size and concentration of investments CIVs hold, this can lead to fire sales and potential market dysfunctions, with spillovers to other parts of the financial system and the real economy.

Such collectively destabilising behaviour and dynamics were analysed well before recent events. New theoretical and empirical work has clarified old and identified new channels, highlighting the large role of leverage in general, and more recently the role of NBFI. Several papers show how stresses in the US Treasury market in March 2020, at the start of the COVID-19 pandemic, in the form of the dash for cash related to NBFI actions (e.g. Schrimpf et al. 2020, FSB 2020). Open-ended funds investing in corporate bonds amplified the bond market stresses in March 2020 as they liquidated assets on an elevated scale (e.g. Claessens and Lewrick 2021). And large margin calls led to price spillovers and stresses in commodity markets in March 2022 when energy and other prices spiked following the invasion of Ukraine (e.g. Avalos and Huang 2022). Finally, the procyclicality of NBFI shows up in the reduced access to external financing domestically, but also in cross-border financing, during stress periods (e.g. Fleckenstein et al. 2020, Chari 2023).

Especially following bouts of stress leading to large-scale central bank interventions, policy work has increasingly focused on NBFI. Areas addressed or covered in policy proposals include MMF resilience; liquidity management in OEF; margining practices; the liquidity, structure, and resilience of core bond markets; and US dollar funding and related external vulnerabilities for emerging market economies. Additionally, the role of central banks in responding to market dysfunction has been analysed. Progress with these reforms and policy proposals is summarised in FSB (2023a). While policymakers have been active, the paper points out the many outstanding issues and suggests further analytical work.

One last challenge is data. While many parts of the NBFI sector, at least as covered here, are very transparent, in many ways more so than banks, there are large data gaps which hurt market discipline and supervisory effectiveness. At the same time, analysis of the UK September 2022 event (Pinter 2023) showed that by matching various price and quantity data, it could have been anticipated. Nevertheless, steps can be taken to enhance the disclosure and availability of data and address remaining data gaps.

Source : Voxeu