Human-induced climate change is making disasters more frequent and more intense. Policy could help reduce the economic costs of climate change by helping firms withstand extreme weather events. This column explores how management practices shape the impact of environmental shocks on firms. Well-managed firms are doing more to adapt to climate change and are more likely to implement adaptive measures in response to perceived climate change risk. Such management practices can offset the negative impacts of climate shocks on capital, jobs, value added, and survival.

Human-induced climate change is making natural disasters more frequent and more intense. Helping firms withstand extreme weather events is therefore an important way policy can reduce the economic costs of climate change; yet, we know little about what types of firms are most vulnerable to disasters and whether they are already taking actions to reduce their exposure to climate change risks.

In this column, we discuss work that shows management practices are a key dimension of difference in both the impact of environmental shocks and in adaptation to climate change. It suggests that poorly managed firms – who already perform worse than their better-managed peers – are likely to fall further behind as global warming continues to intensify and that improving management practices could be an effective way to increase economic resilience to natural disasters.

Natural disasters: Expect more, expect worse, expect costs

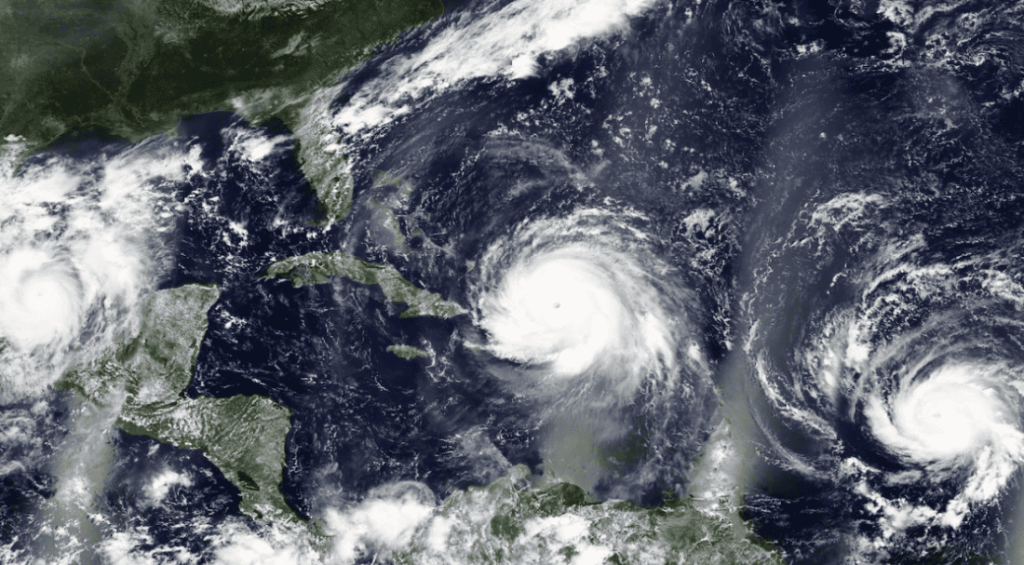

The year 2024 has already witnessed severe flooding in Brazil, East Africa, and Switzerland as well as the continuation of crippling droughts in Zambia and across the Mediterranean. China has experienced both extremes at once, with fatal floods in the southern province of Guangdong and droughts decimating crops in the country’s north. This comes after 2023, with unprecedented cyclones in Libya and Mexico, drought in the Philippines, and floods in the Democratic Republic of the Congo, Guatemala, and Italy, as well as in numerous other countries.

This apparent increase in extreme weather events is more than a coincidence. The scientific consensus is that anthropogenic climate change has increased the frequency and power of natural disasters and that these trends will continue in tandem with rising global temperatures (IPCC 2023).

A growing literature shows this is a major economic concern. Kocornik-Mina et al. (2020), for example, leverage international night-light data to document the negative impact of floods on economic activity, while Eickmeier et al. (2024) show natural disasters have had sustained, significant negative impacts on a range of aggregate economic outcomes in the US. Other papers such as Barrot and Sauvagnat (2016) examine impacts at the firm level, showing that negative impacts reverberate along supply chains and cause adverse indirect effects on firms that avoid being hit directly by disasters.

Such large economic costs have attracted the attention of policymakers. While international efforts have largely focused on reducing the severity of climate change by limiting greenhouse gas emissions, current trajectories show the planet is on track to exceed warming of 1.5 degrees Celsius by 2030. It is therefore imperative that policy also helps ensure that firms and individuals can adapt to new environmental conditions – including more frequent and severe natural disasters.

Management practices help firms withstand natural disasters

There are numerous reasons why climate change adaptation in the absence of policy is likely to be suboptimal. Information on new conditions may be hard to acquire and uncertain. Credit constraints may inhibit investment, while adopting new technologies such as flood defences or refrigerated storage capacity may generate externalities in the form of learning spillovers. But it’s also likely that these factors vary in importance across firms, meaning that untargeted policy interventions will be inefficient.

In Norris Keiller and Van Reenen (2024), we document that firms’ management practices are an important dimension of heterogeneity both in terms of the impact of natural disasters and what firms are already doing to adapt to climate change. We use the World Management Survey – a unique source of firm-level management data derived from long-form interviews with managers in manufacturing firms – to obtain a measure of firms’ management that encapsulates whether they have structured processes in place to monitor their performance and personnel (see Bloom et al. 2019 for further information). We use all waves of the Survey including a new wave completed in 2022 (see Bloom et al. 2024). We match with globally comprehensive data on natural disasters from NASA’s Geocoded Disaster dataset (Rosvold and Buhaug 2021) and firm financial data from Historical Orbis, giving us a panel dataset spanning 31 countries and over 30 years. We use this unique database to estimate the impact of disasters on firm performance and how management practices reduce negative effects.

Figure 1 illustrates our main results. Disasters cause significant reductions in capital and value added growth and in firm survival over a one-year horizon. Compared to sample averages, these effects amount to 17% and 22% reductions in capital and value added growth and an 11% increase in firm exit. Management practices, however, offset the negative impacts on capital, jobs, value added, and survival. For example, a firm with a management score one standard deviation below average suffers a fall in value-added growth four times larger than a firm which has a standard deviation of the management score above the average. Generally, an improvement in management practices completely eliminates the negative disaster effects.

Figure 1 Better management helps firms neutralise the negative effects of natural disaster exposure on performance

Notes: The figure plots the estimated impact of disaster exposure on the performance of firms with a given level of management, denoted by the bar colour (low management scores in orange on the left and high management scores in teal on the right). The outcome for bars grouped under ‘capital’, ‘employment’, and ‘value added’ is average annual growth rate of the variable denoted by the axis label. For example, a badly managed firm hit by a natural disaster shrinks by 1% a year on average, if it survives. The outcome for bars grouped under ‘survival’ is a dummy variable indicating that a firm stays alive after a disaster strikes. For further details, see Table 3 in Norris Keiller and Van Reenen (2024).

To examine the mechanisms behind the greater resilience of well-managed firms, we leverage new questions that were asked in the latest wave of the World Management Survey. Firms were asked whether rising temperatures, natural disasters, and changing seasonal weather patterns could put the operation of their firm at risk and whether they had undertaken specific measures in response to the potential effects of climate change.

Relating standardised scores on these questions to firm attributes, we find firms in areas that recently experienced a natural disaster are more likely to perceive climate change and disasters as a risk to their businesses, and this perception is even stronger for well-managed firms. Regardless of location, we find that well-managed firms are doing more to adapt to climate change and are more likely to implement adaptive measures in response to perceived climate change risk.

These findings complement those of Adhvaryu et al. (2022), which provide further evidence that management practices can reduce the negative impact of environmental shocks. Leveraging detailed production-line data from a garment manufacturer in Pakistan, the authors show that pollution shocks reduce worker productivity. However, consistent with our results, they find the negative impact of pollution shocks is less severe for more attentive managers who redeploy vulnerable workers to tasks where productivity is less sensitive to air pollution.

The work discussed here complements a body of work that documents a robust positive association between management practices and firms’ greenhouse gas emissions (Bloom et al. 2010). Viewed together with the findings of Norris Keiller and Van Reenen (2024), and Adhvaryu et al. (2022), this literature suggests that policies that aim to improve firms’ management may yield a double dividend in terms of their climate impact by both reducing firms’ greenhouse gas emissions – and thereby the intensity of climate change – and by improving firms’ ability to withstand the impacts of natural disasters.

Conclusions

Evidence from a wide range of countries and studies shows management practices are positively associated with firms’ performance (for example see Bloom et al. 2019). This column has summarised research highlighting a new dimension in which well-managed firms perform better: they are more resilient to natural disasters and negative environmental shocks. As the planet continues to warm making natural disasters more frequent and more severe, it is therefore firms with poor management practices who face the greatest risks. Indeed, while well-managed firms in disaster-prone areas are already implementing measures to adapt to climate change, poorly managed firms are not. This suggests policies to increase adaptation will have a greater impact (at least on the extensive margin) if they target firms that lack structured management practices. Given the greater resilience of well-managed firms, encouraging structured management practices may itself be an effective form of climate change adaptation.

Improving management practices should already be an aim of policymakers. In light of climate change and the research discussed in this column, it should become an imperative.

Source : VOXeu