The threats that misinformation poses to politics and public health are well documented, but the macroeconomic effects of fake news remain largely unexplored. This column surveys the impact of fake news on economic stability. Leveraging a novel dataset, the authors unveil the detrimental effects of technology-related fake news on key economic indicators. Fake news profoundly influences economic dynamics, from heightened uncertainty to amplified business cycle fluctuations. Policymakers grappling with the ramifications of fake news will need to monitor its heterogeneous effects on economic stability.

In the contemporary digital era, the proliferation of fake news has emerged as a significant concern, fundamentally altering the landscape of public discourse and raising questions about its economic ramifications. As Thomas Jefferson recognised over two centuries ago, truth itself becomes suspect when filtered through the lens of fabricated news. 1 Today, the urgency of Christine Lagarde’s words are emblematic of the emergence of fake news as a primary concern for policymakers and citizens alike. 2 Indeed, the 2024 World Economic Forum’s ranking of fake news as the most severe global short-term risk underscores the gravity of this problem. To date, fake news related research has focused primarily on the political economy of social media (for a review, see Campante et al. 2023); on understanding the factors driving – and tools to stop – the consumption and sharing of political news (Zhuravskaya et al. 2017, Ozdaglar and Acemoglu 2021, Guriev et al. 2023, Mattozzi et al. 2023); and on the impact of fake news on election outcomes (Fraccaroli et al. 2019).

Despite its evident societal and political implications, the macroeconomic impact of fake news remains largely unexplored. Our research (Assenza et al. 2024) attempts to fill this gap in the literature by investigating a fundamental question: Does fake news shape aggregate economic fluctuations?

At the heart of this investigation lies the methodological challenge of identifying fake news shocks. We rely on the hypothesis that fake news issuance introduces some degree of confusion or noise, thereby augmenting the uncertainty faced by economic agents. Leveraging data from the Assenza-Huber Fake News Atlas database, our study constructs a proxy that captures exogenous variations in fake news issuance. The database includes news items fact-checked by PolitiFact, a reputable and Pulitzer-Prize winning fact-checking organisation. By harnessing this dataset, the study sheds light on the dynamic causal relationship between technology-related fake news shocks and business cycle dynamics, employing a proxy-VAR approach (Stock and Watson 2018, Kilian and Lütkepohl 2018) to unravel the complex interplay between fake news and economic outcomes. To be precise, we instrument the Jurado et al. (2015) measure of macroeconomic uncertainty with our proxy for fake news.

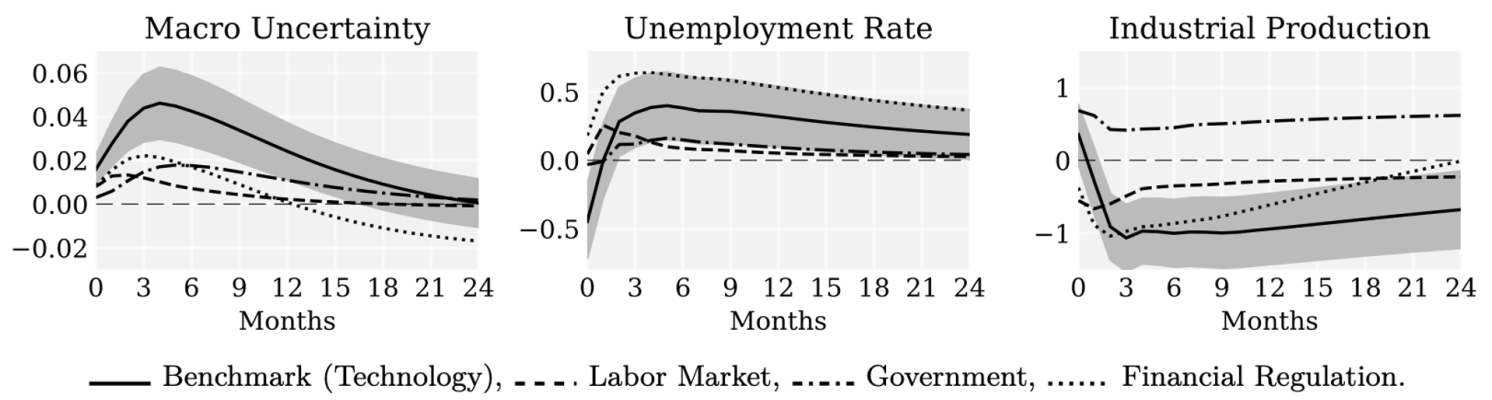

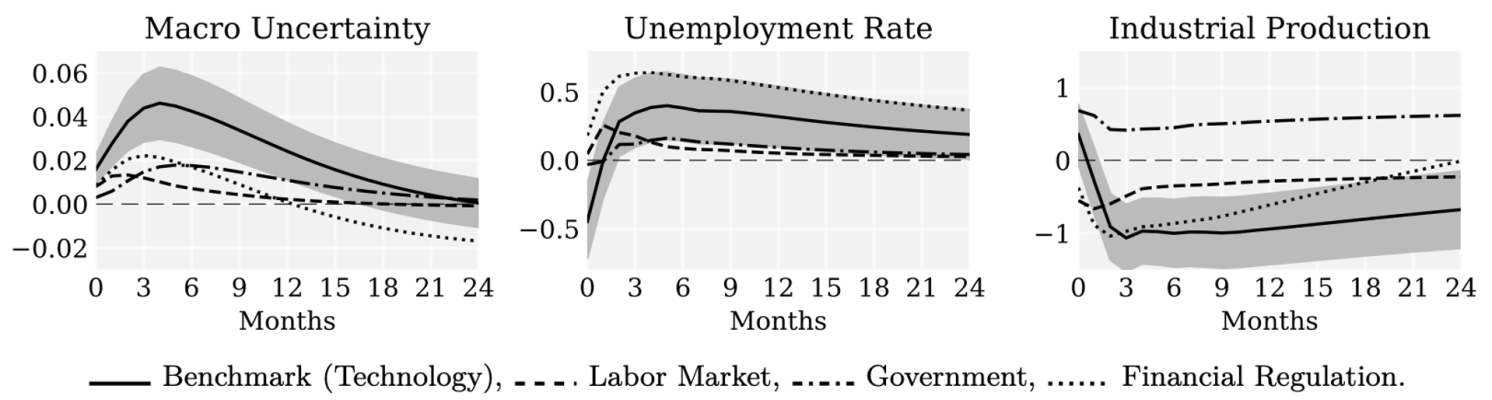

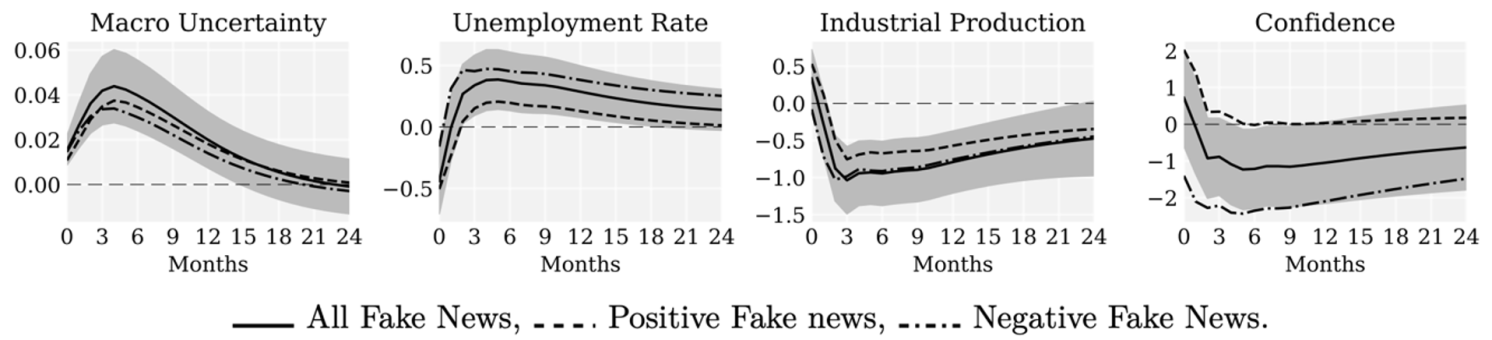

Our key findings, illustrated in Figure 1, reveal compelling insights. The figure displays the impulse response functions (IRFs) of the model variables to a one-standard deviation shock in fake news. Technology-related fake news shocks sow seeds of uncertainty that reverberate through the economy, manifesting in increased unemployment rates and lower industrial production. Moreover, these fake news shocks contribute significantly to the overall volatility of the business cycle, underscoring their systemic importance.

Figure 1 Benchmark responses: The economic impact of fake news

Note: The solid black line shows the IRF of the model variables to a fake technology news shock. Shaded areas represent +/- 1 standard deviation around average response obtained from 1,000 Bootstrap replications.

Technology-related fake news shocks trigger a sustained surge in macroeconomic uncertainty, peaking after four months before gradually subsiding. This hump-shaped pattern of the impulse response functions suggests a powerful and robust transmission mechanism, reflecting the spread of fake news, its gradual absorption by the public, and, ultimately, heightened confusion and uncertainty. As Figure 1 shows, the initial uncertainty gradually builds up, leading to a further depression of macroeconomic outcomes. In terms of magnitude, the fake technology news shock explains up to 84% of the one-month-ahead macroeconomic uncertainty after one year. It contributes 50% of the short-run volatility of the unemployment rate and still accounts for one third of its overall volatility after one year. While the shock explains only 14% of the short-run volatility of the industrial production index, it accounts for about 50% of its volatility at the one-year horizon. This highlights the potential of fake news to act as a key driver of the business cycle. These results survive a battery of robustness checks.

Disagreement rather than uncertainty

Our baseline identification rests on the idea that the issuance of fake news creates confusion and, in turn, greater uncertainty in the economy, complicating the forecast of economic agents. Accordingly, we have relied on the macroeconomic uncertainty index developed by Jurado et al. (2015) to identify our fake technology news shock. In addition, we dive into another potential channel for transmitting shock: disagreement. By its very nature, fake news is controversial and can lead to increased disagreement among agents regarding, among other things, future economic outcomes.

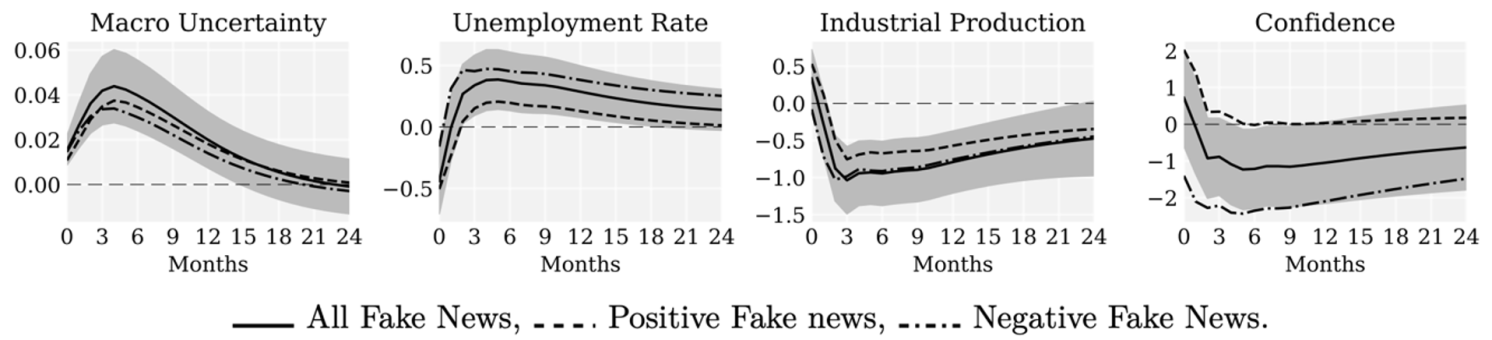

Figure 2 shows the IRFs that closely resemble those of our benchmark model. Amplified disagreement manifests as a decline in industrial production and a surge in unemployment. In line with our benchmark findings, the fake technology news shock accounts for a substantial share of business cycle volatility: about 65% for unemployment and 62% for industrial production at the one-quarter horizon. We take this as further evidence that fake technology news shocks sow confusion and disagreement among agents.

Figure 2 Disagreement VAR

Note: The black solid line shows the IRFs of the model variables to a fake technology news shock. Instead of the 1-month ahead Jurado et al. (2015) macroeconomic uncertainty index, we include a measure of disagreement in the VAR (using micro-data from the Survey of Consumer Expectations published by the New York Fed). Shaded areas represent +/- 1 standard deviation around average response obtained from 1,000 Bootstrap replications.

Fake news impacts the broader economy

Expanding beyond the core economic indicators presented in Figure 1, our research dives deeper into critical sectors – such as consumption, labour, and finance – uncovering the extensive impact of fake news on economic behaviour. We find that fake news influences various facets of economic activity. Specifically, we show that fake technology news shocks explain a sizeable share of durable and non-durable goods consumption expenditures as well as services. Following a fake technology news shock, consumers tend to cut their spending. This downturn extends to the labour market – both hours worked and a fall in job openings after the shock. It also impacts financial markets, with stock prices decreasing amidst increased volatility. Inflation and inflation expectations initially dip, as does the monetary policy interest rate, but quickly revert to their long-run value. Finally, credit spreads and risk premiums increase, suggesting the occurrence of market confusion and a higher level of investor risk aversion. Overall, fake technology news shocks play a significant role in shaping fluctuations, highlighting the pervasive impact of fake news on economic stability and behaviour.

It’s the economic supply-side fake news that matters

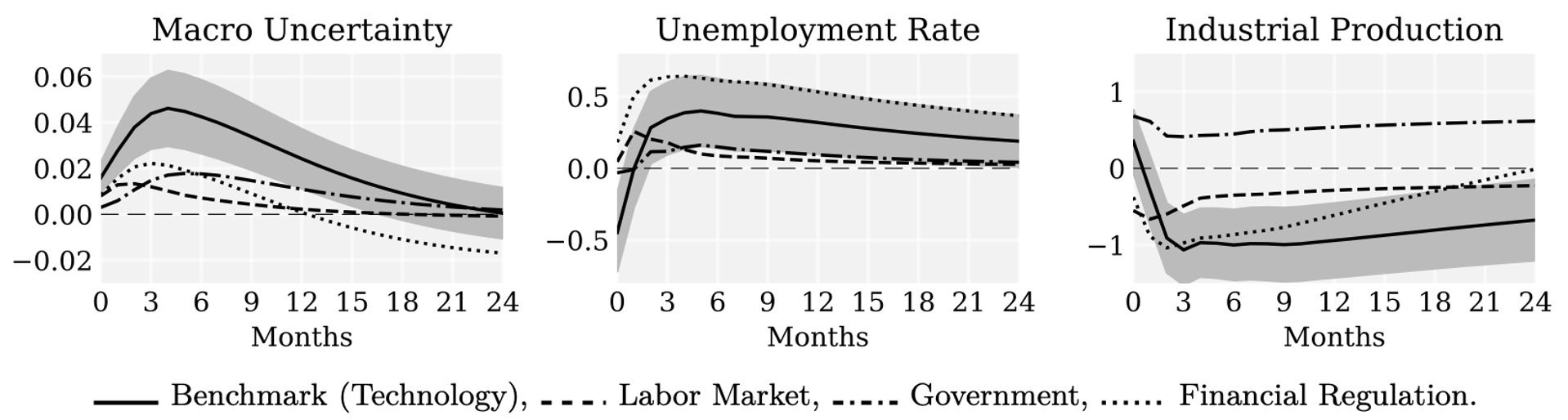

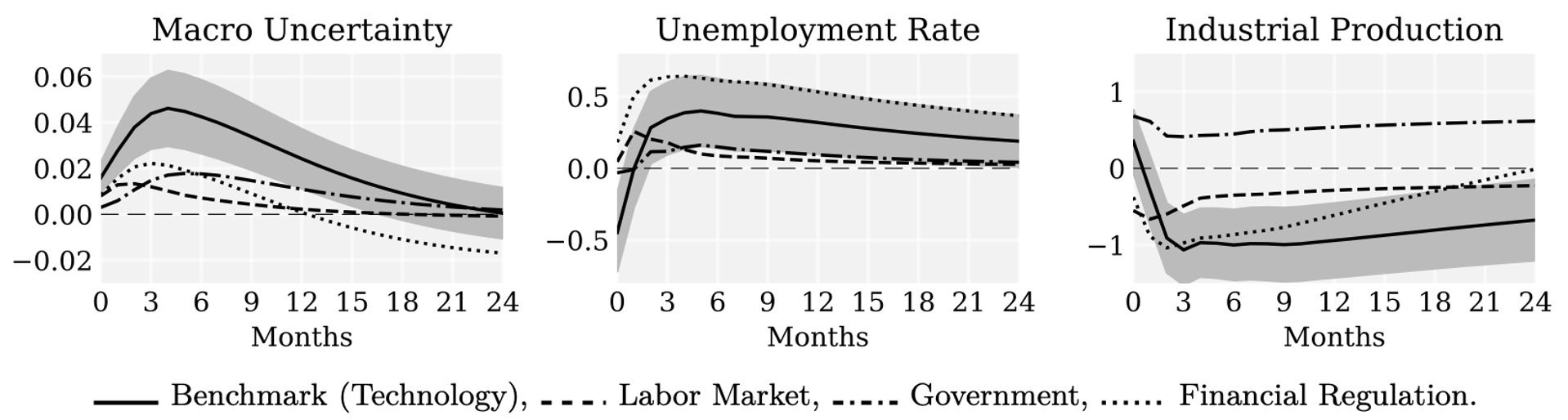

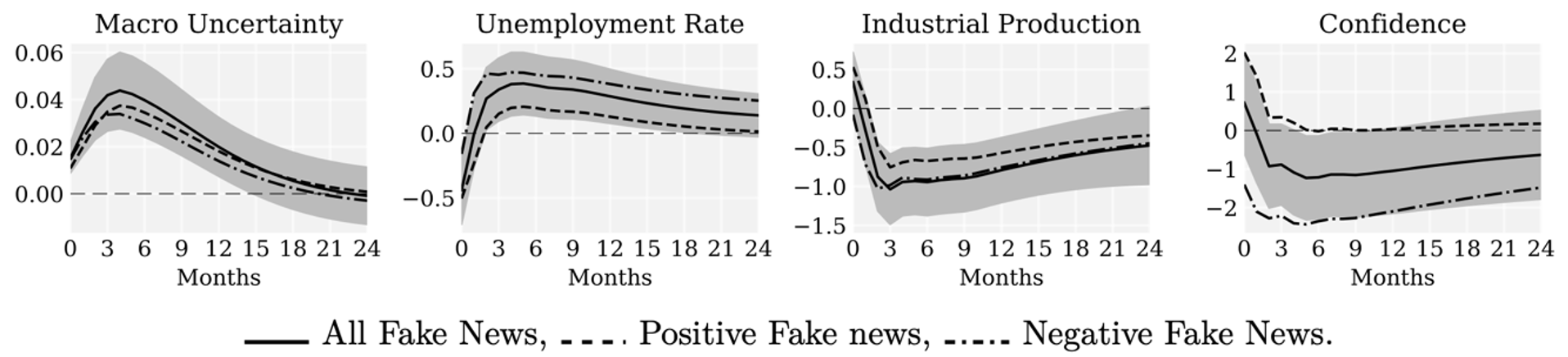

Notably, the study uncovers nuanced differences in the economic response to different types of fake news. Specifically, we find that supply-side fake news on topics such as technology, taxes, and gas prices exerts significant influence on economic outcomes. However, fake news focusing on other aspects of the economy – such as labour markets, government spending, or financial regulation – fails to yield a statistically significant impact (see Figure 3).

Figure 3 Comparing the economic impact of supply-side versus other types of fake news

Note: The black solid line shows the IRFs of the model variables to a fake technology news shock, the dashed line the IRFs to a fake labour market news shock, the dash-dotted line the IRFs to a fake government news shock, and the dotted line the IRFs to a fake financial regulation news shock. Shaded areas represent +/- 1 standard deviation around average response obtained from 1,000 Bootstrap replications

This result does not necessarily indicate that these types of fake news do not impact the economy. Rather, it suggests that these types of fake news do not influence the economy through our mechanism – that of macroeconomic uncertainty. For example, we show that government fake news issuance is fundamentally related to the (fixed) electoral cycle, which is predictable in the US and therefore does not affect macroeconomic uncertainty. This underscores the importance of understanding the diverse channels through which different types of fake news shape economic dynamics.

The asymmetric impact of fake technology news shocks

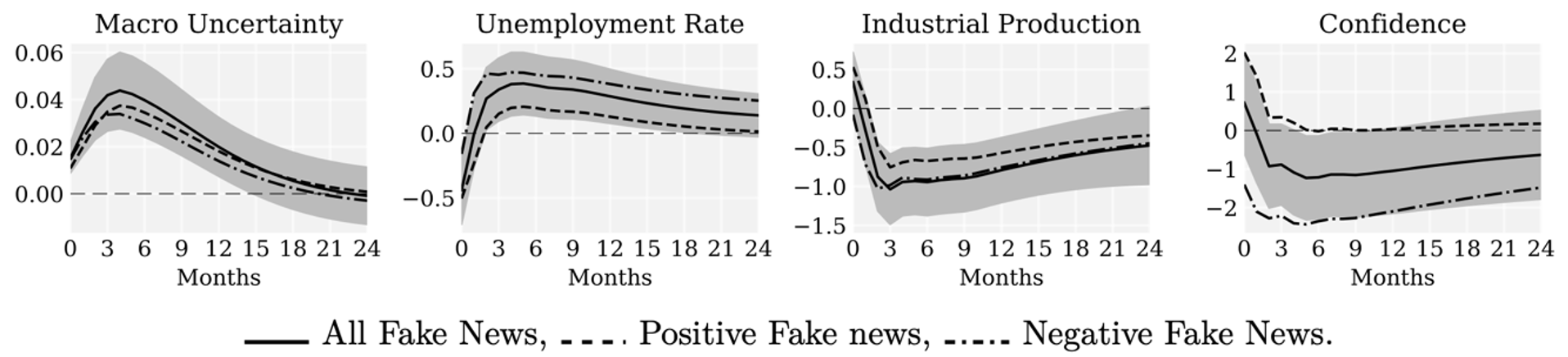

Moreover, our research highlights the role of ‘news sentiment’ in amplifying the economic impact of fake news. We find that fake technology news shocks with a negative tone account for a greater share of the volatility of macroeconomic uncertainty, the unemployment rate, and industrial production than those with a positive tone. Figure 4 illustrates that the influence of negative fake technology news shocks on key economic indicators outweighs the influence of positive shocks. In addition, we find that negative fake technology news shocks trigger a significant persistent consumer confidence loss, while the same shocks identified on positive news induce a very short-lived surge in confidence. Hence, fake (negative) technology news not only increases uncertainty but also instils a sense of pessimism that positive fake news fails to counteract.

Figure 4 Comparing the economic impact of positive versus negative fake news

Note: This VAR includes the Michigan Confidence Index in addition to the benchmark variables. The black solid line shows the IRFs of the model variables to a fake technology news shock, the dashed line the IRFs to a positive sentiment fake technology news shock, and the dash-dotted line the IRFs to a negative sentiment fake technology news shock. Shaded areas represent +/- 1 standard deviation around average response in the VAR featuring all fake technology news obtained from 1,000 Bootstrap replications.

Conclusion

Our research offers insights into the economic ramifications of fake news, shedding light on its systemic importance. While specific policy recommendations lie beyond the scope of our paper, our findings emphasise the need to recognise that fake news poses challenges not only to social and political stability, but also to economic stability. However, current policy-related analyses and discussions focus largely on the political and societal consequences of fake news, such as its detrimental effects on democratic processes; the Code of Practice on Disinformation requested by the Internal Market and Consumer Protection (IMCO) and the EU is one example (Frau-Meigs 2018). Our research contributes to this ongoing discourse by shedding light on the adverse economic implications of fake news. Moreover, it suggests that policymakers, particularly those in economic and financial realms, could benefit from monitoring the prevalence of fake economic news, especially when it pertains to the supply side of the economy.

Source : VOXeu