Multinational corporations routinely shift their profits to tax havens globally in order to benefit from low-tax environments. This column uses German municipal data on trade and property tax rates to study the consequences of such corporate tax avoidance on government tax revenues and tax revenue structures. It shows that increases in trade tax rates lead to lower levels of trade tax revenue in places exposed to multinationals with at least one tax haven. Furthermore, municipalities exposed to profit shifting do not compensate for lost revenue with higher property tax revenues or rates, which leaves them with lower tax revenue overall.

The revelations from the Panama and Paradise papers in 2016 and 2017 exposed a sizeable amount of international tax avoidance by firms, and in particular, multinational corporations (MNCs). This spurred renewed interest in the literature to calculate the extent to which MNCs shift profits to tax havens and the scale of potential tax revenue losses to governments (e.g. Bilicka 2019, Davies et al. 2015, Garcia-Bernardo et al. 2022). As the evidence on the size, scope, and consequences of profit shifting by multinationals has been increasing, the global importance of the phenomenon has also been highlighted, with estimates showing that 36% of multinational profits are shifted to tax havens globally (Tørsløv et al. 2023). Although the magnitudes differ across studies, the existing literature agrees that the scale of profit shifting is large and has consequences for corporate tax revenues (Wier et al. 2018, Guvenen et al. 2022).

Profit shifting and the structure of government tax revenues

In a recent paper (Bilicka et al. 2023), we ask: what are the consequences of this corporate tax avoidance for where governments derive their tax revenues and, consequently, for the government tax revenue structure? To answer this question, we analyse the relationship between corporate tax avoidance and the structure of tax revenues, both at the country and at the local government level.

In principle, as multinationals shift profits to tax havens, this reduces the amount of corporate tax that they pay in their home countries. Does this mean that their home countries have lower overall tax revenues, or do these countries compensate for the lost corporate tax revenues using different tax instruments? These instruments can include the taxation of individuals or sales through changes in individual or value-added tax (VAT) rates or bases. If the use of different tax instruments is prevalent, this may affect the revenue structure and have potential distributional consequences, depending on the progressivity of the alternative tax instruments used.

To motivate our analysis, we show that countries with high revenue losses due to profit shifting have lower corporate tax revenues and rates and higher indirect tax revenues and rates. To do this, we take advantage of the country-level estimates of profit shifting from Tørsløv et al. (2023). These country-level results provide suggestive evidence that profit shifting may affect the revenue structure at the country level. Given the cross-sectional nature of the sample, however, we cannot draw any causal conclusions from these country-level results.

Aggressive multinationals in German municipalities

To establish causality, we use German municipal data and analyse how changes in municipal trade tax rates levied on corporate profits affect the local tax revenue structure. These trade tax rates vary between 7% and 21%, imposing a large tax burden on firms. Municipalities can decide on their own trade tax rates and property tax rates, which allows us to causally identify the relationship between tax revenue structure and profit shifting at the local level. We take advantage of a large variation in municipal trade tax rates across 11,000 municipalities during the period 2008 – 2019. We combine these data with information on the geographical presence of firms to compare the effects of trade tax rate increases on the share of tax revenues from the trade tax and the property tax for municipalities that are more, or less, exposed to aggressive multinationals.

We define ‘aggressive’ multinationals as those that have at least one tax haven in their ownership structure. The local exposure to more aggressive multinationals is a count and a share of subsidiaries that belong to those multinationals relative to the number of all firms in each municipality. Our estimates are also robust to using the share of assets, employment, and turnover that subsidiaries which belong to more aggressive multinational corporations own in each municipality instead of subsidiary counts.

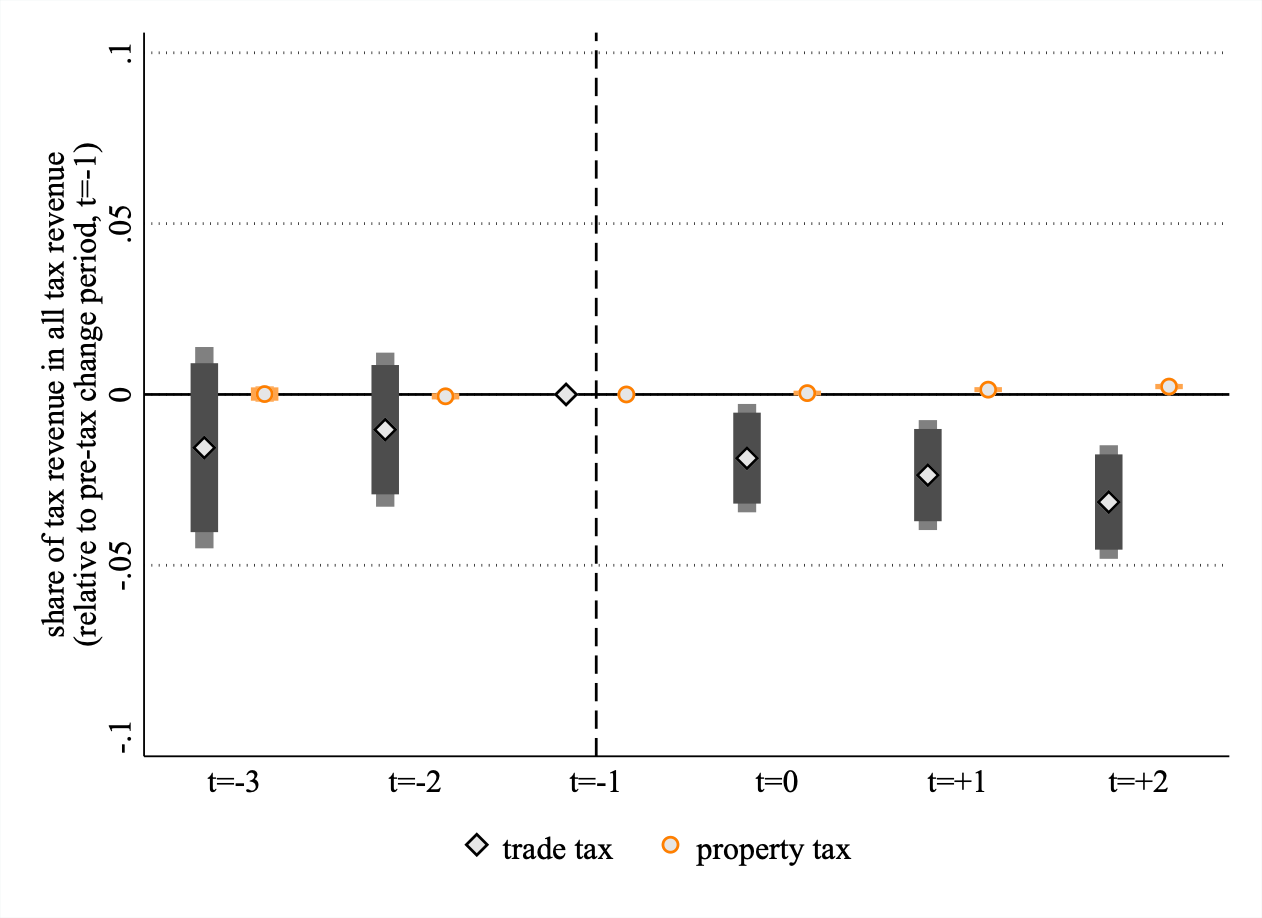

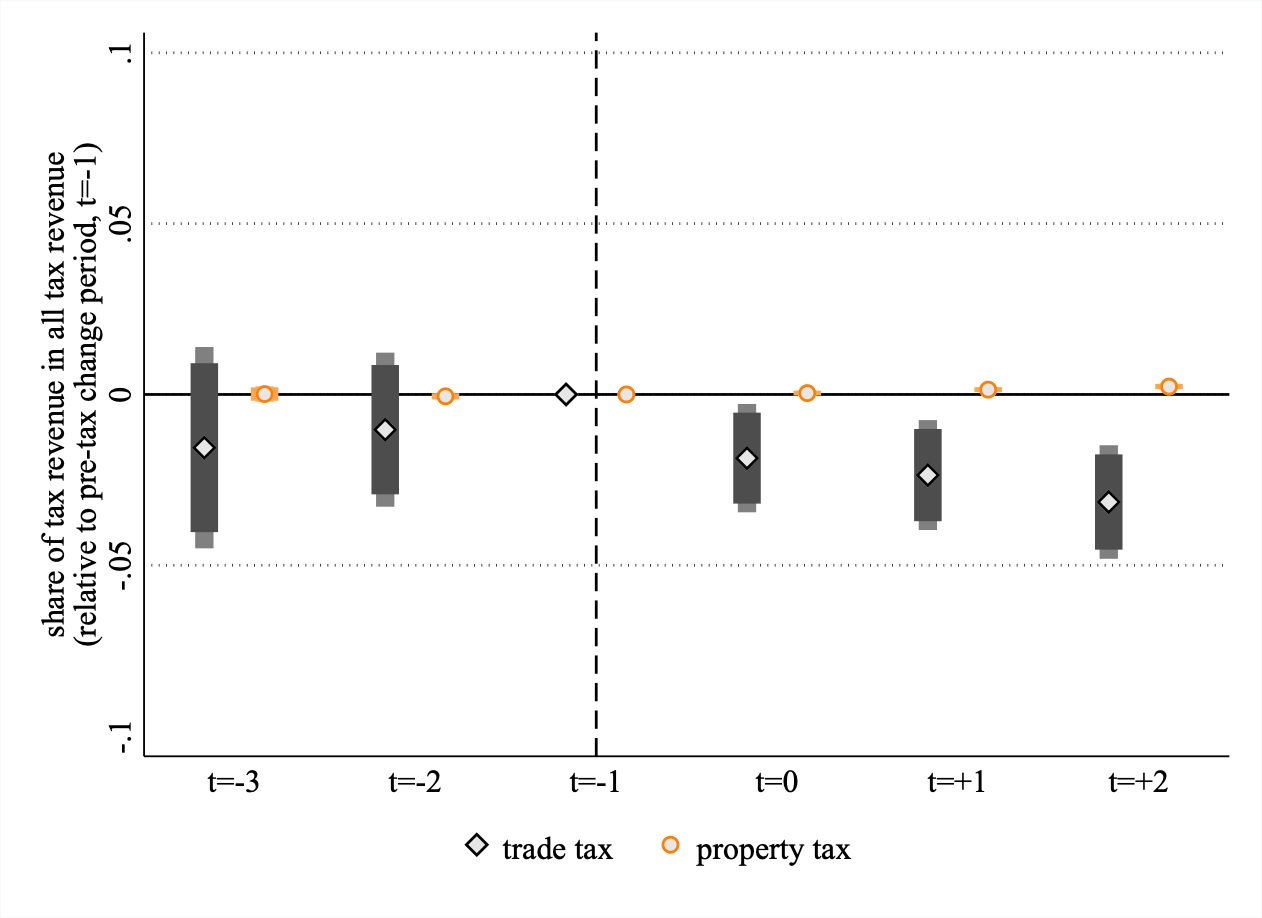

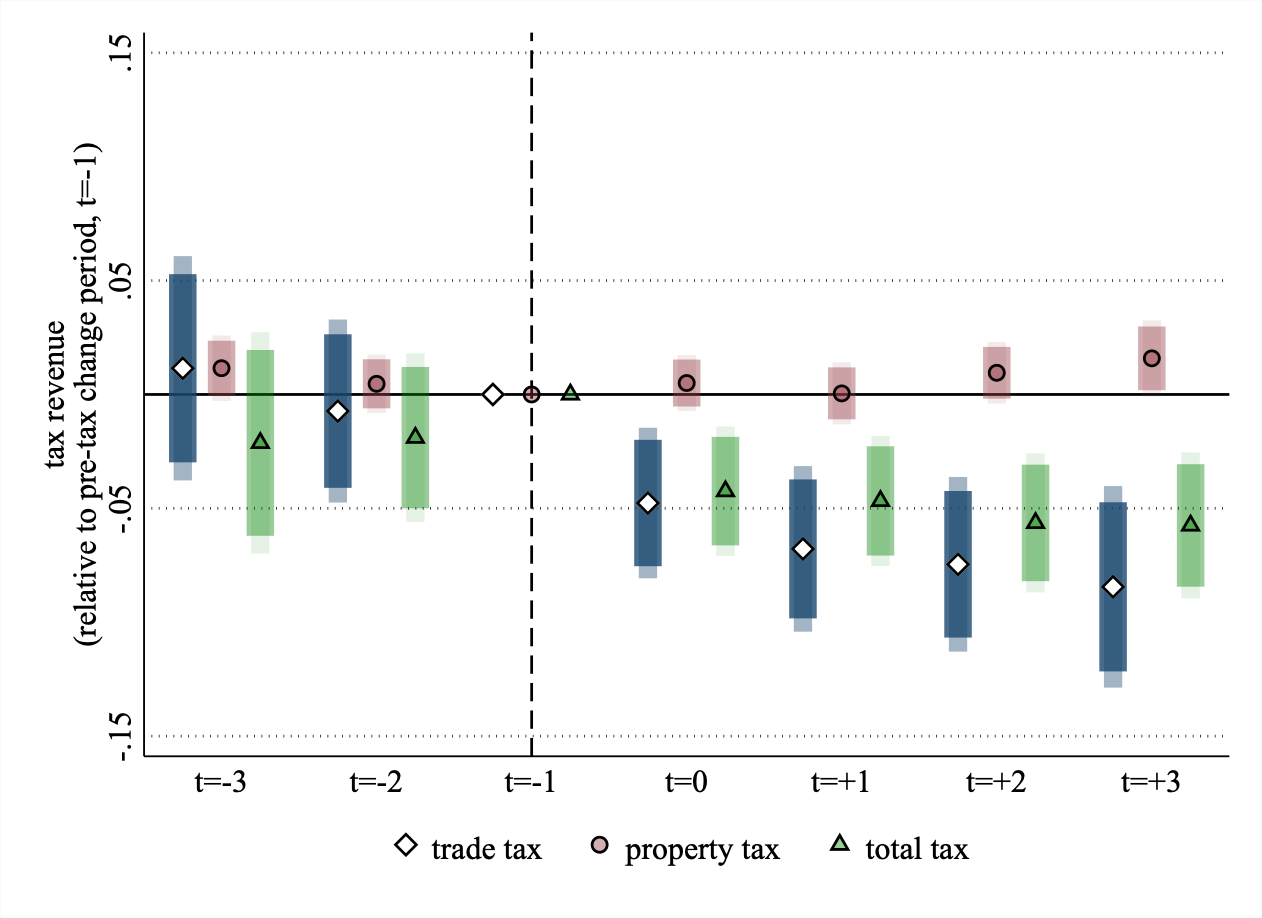

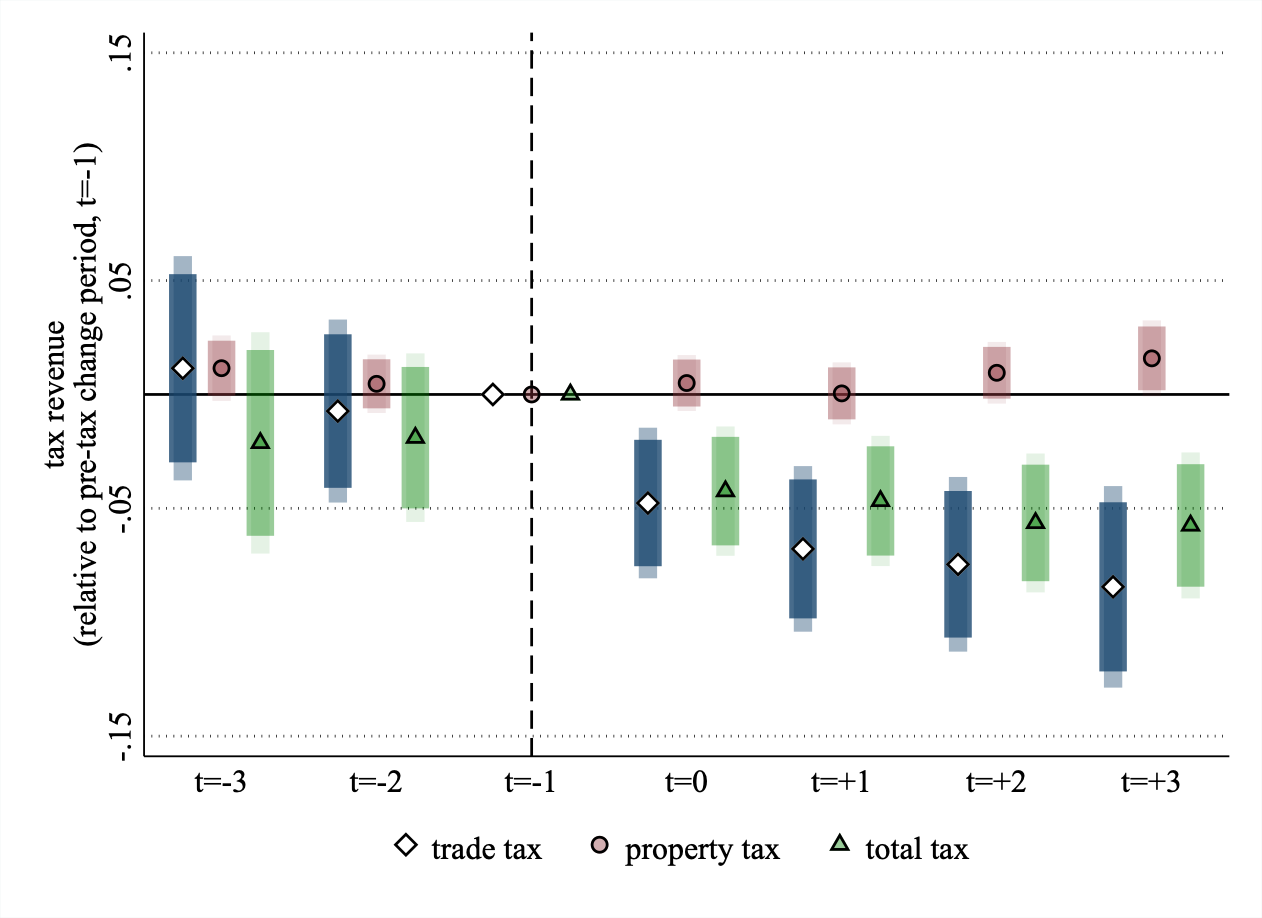

We find that when a trade tax rate increases at the municipal level, the level of trade tax revenues in municipalities that are more exposed to aggressive multinationals falls (Figure 1, right-hand side panel). The novelty of our paper is in understanding the implications of profit shifting for the revenue structure. To this end, we find that municipalities do not compensate for a reduction in trade tax revenue with higher property tax revenues or rates. Consequently, they also have a lower share of trade tax revenues in all revenues (Figure 1, left-hand side panel) and a lower level of total tax revenues.

Figure 1 Dynamic effects of the tax rate increase on municipal revenue structure in Germany, 2008 – 2019

A) Share of tax revenues in all tax revenues

B) Change in level of tax revenues

Source: Bilicka et al. (2023)

At the country level, governments have a wide variety of tax instruments, as well as borrowing capacity and flexibility, at their disposal to make changes that would compensate for the lost corporate tax revenues. This is why we show that country governments are more successful in maintaining the overall tax revenue constant than municipality governments. At the municipal level, it is possible that having only one instrument – property tax rate – may not be sufficient and that is why municipalities lose overall tax revenue when exposed to profit shifting. We show that this has further fiscal consequences, as it lowers the level of municipal expenditures and increases their borrowing.

Two possible mechanisms can explain why tax revenues decline after a tax rate increase. First, multinationals may choose to move profits away from municipalities that levy larger taxes on them toward their foreign locations. Given that profits are mobile across borders, this can potentially be immediately reflected in tax revenues. Second, multinationals may choose to move their affiliates and/or business operations away from the municipalities that levy higher taxes on them. We do not find evidence to support the real operations reallocation mechanism, suggesting that profit shifting is driving the decline in the levels and shares of trade tax revenues.

Finally, we empirically tackle the issue of tax competition across municipalities. Given the evidence that municipalities, especially smaller ones, can set their tax rates in response to changes in rates of neighbouring municipalities, we control for neighbouring tax rates, as well as weight our results by population. These additional controls do not significantly change the magnitude of our baseline estimates. Another concern is that German municipalities can use local tax rates to attract multinational corporations as a source of skilled labour, physical capital, and local business taxable income. In our context, competition amongst municipalities for those more aggressive firms is unlikely to yield much local business tax revenue, due to the potential profit-shifting activities of those firms. Empirically, we find that following a trade tax rate increase there is no change in the average trade tax rate of municipalities that neighbour the municipality that is exposed to more aggressive multinational corporations. Hence, we argue that tax competition is not a threat to our specific identification strategy.

Concluding remarks

Taken together, our country- and municipal-level estimates suggest that the ability of firms to shift profits is strongly related to the tax revenue structure and has potential distributional consequences. At the country level, our analysis allows us to understand which groups of firms or individuals may bear the burden of taxes that are not paid by multinational corporations. Our findings matter from a policy perspective, as they suggest that countries that are more exposed to profit-shifting multinationals, may choose to rely more on indirect taxes. To the extent that indirect taxes can be viewed as more regressive, this may amplify the inequality in countries that lose more tax revenue due to profit shifting. At the municipal level, we show that increasing tax rates in municipalities that have a large presence of aggressive firms has the opposite of the expected effect and reduces corporate tax revenues. This has implications for local governments that are trying to increase their revenues from multinational corporations.