ECB President Christine Lagarde used her speech at Jackson Hole in August to draw attention to pressing structural investment needs. This column introduces the 2023 release of the European Investment Bank Investment Survey, which uses interviews with 12,000 firms across Europe to shed light on how they are responding to pressures from energy prices, trade disruptions, and the need to innovate and digitalise, all in the face of monetary tightening and a worsening outlook. The good news from the survey is that firms held steady on investment, but as firms’ financial buffers deplete, tighter financial conditions will start to have more impact.

ECB President Christine Lagarde used her speech at Jackson Hole in August to draw attention to pressing structural investment needs, and to suggest that, because of these, “we are likely to see a phase of frontloaded investment that is largely insensitive to the business cycle”. As she noted, this is likely to make the economic outlook harder to read (Lagarde 2023).

That such a phase of structurally high investment is needed, and even likely, is hard to argue against. On clean energy, for example, annual investment in the EU increased by 80% from 2019 to 2022 to reach €330 billion. But to be on track with the International Energy Agency’s net-zero scenario, it needs to reach €530 billion by 2030 (IEA 2023). European firms are also underperforming their peers when it comes to innovation (EIB 2023a). The need for new investment in emerging technologies means that resources have to be reallocated across sectors and firms, but this process of dynamic reallocation has slowed (Mertens et al. 2023). As di Mauro and Matani (2023) argue, significant catching-up efforts are needed among many of Europe’s firms in order to raise productivity and competitiveness.

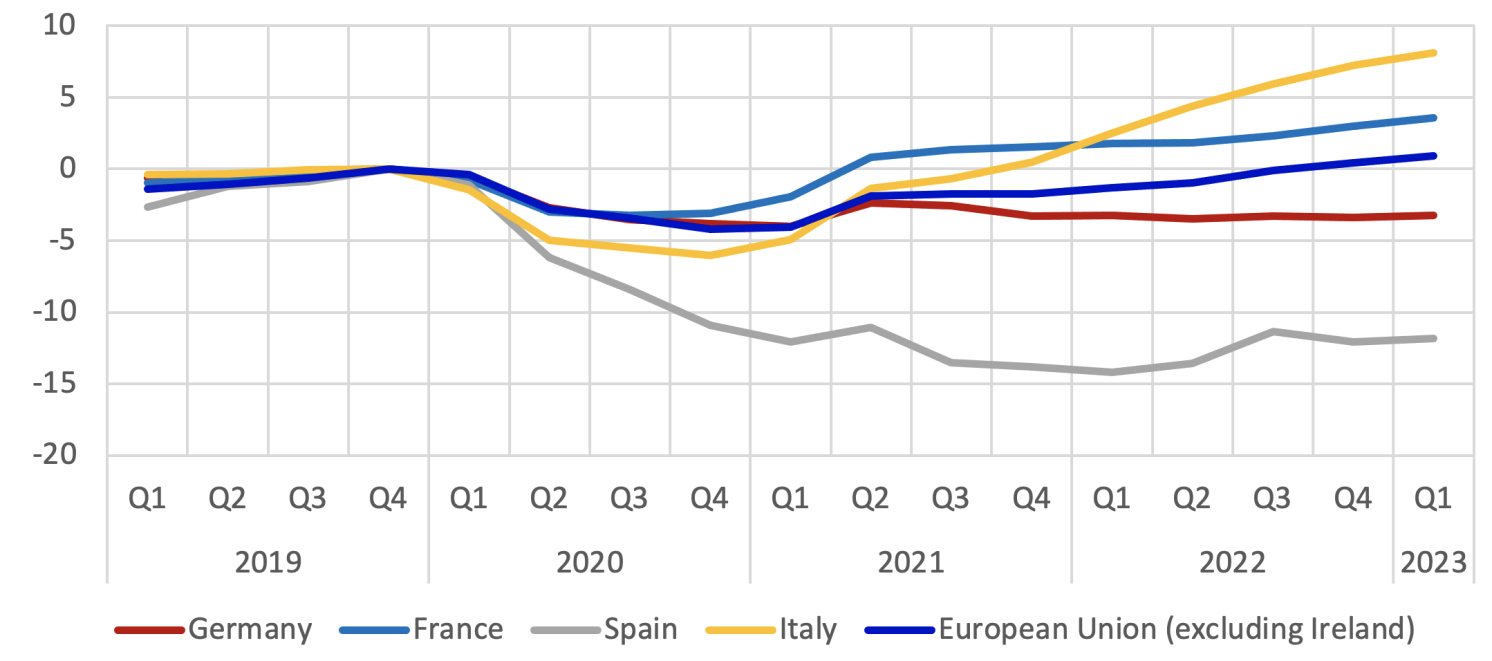

At the aggregate EU level, corporate investment has been gently growing, surpassing its pre-pandemic level at the start of this year. 1 But there are great differences across the Union: Italy has seen strong growth and Germany relative stagnation, while corporate investment in Spain remains mired at its end-2020 level (Figure 1).

Figure 1 Real investment of non-financial corporations (% change relative to 2019 Q4)

Source: Eurostat.

The European Investment Bank Investment Survey (EIBIS) is a unique tool to further understanding on the drivers and barriers of investment by businesses in the EU, including the influence of both structural and cyclical factors. Based on interviews with 12,000 firms across Europe, the new 2023 data release (EIB 2023b) sheds light on how they are responding to pressures from energy prices, trade disruptions and the need to innovate and digitalise, all in the face of monetary tightening and a worsening outlook.

European firms are pressing forward with transformation

The good news from EIBIS 2023 is that firms held steady on investment – at least up to the point of the interviews, which took place in mid-2023 – with the share of firms investing reaching pre-pandemic levels (85%) and investment still expected to grow, on balance.

Furthermore, we saw progress on important areas of structural transformation:

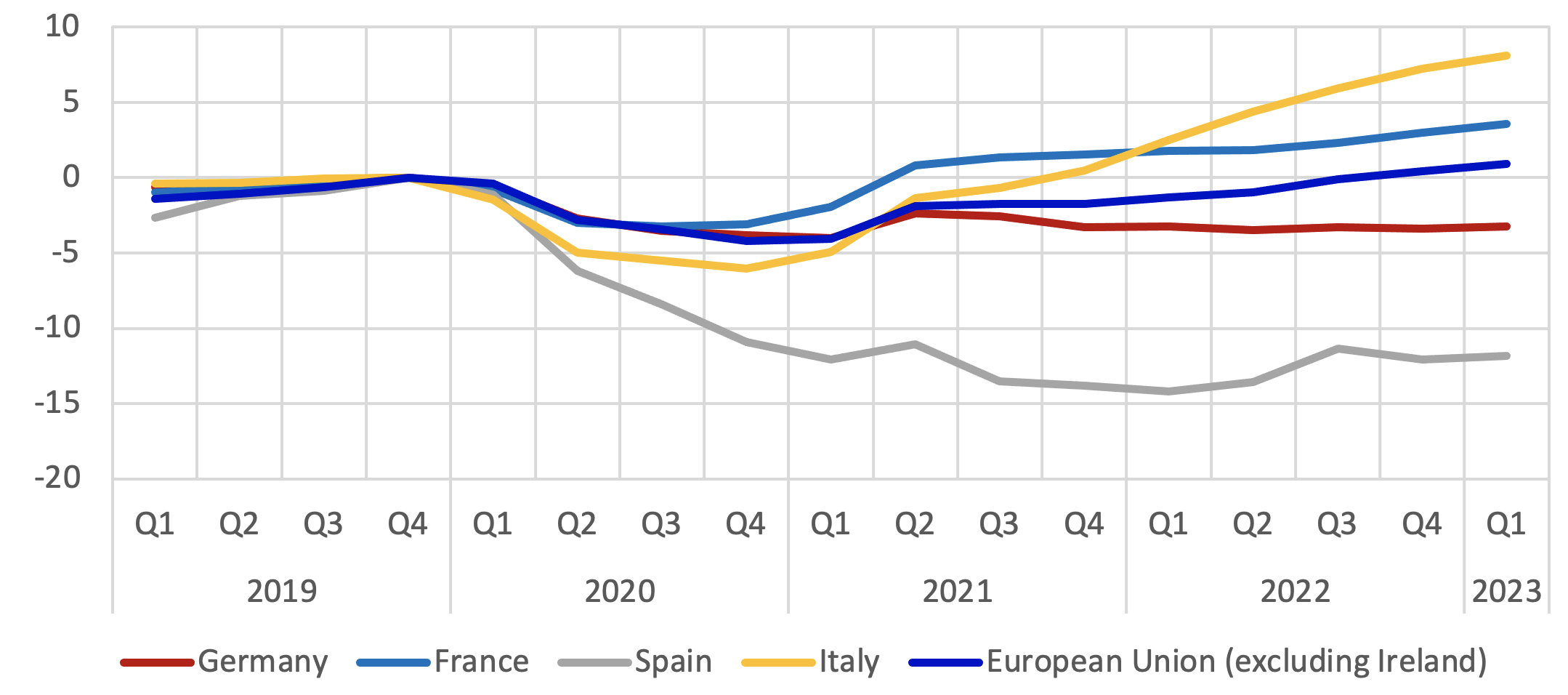

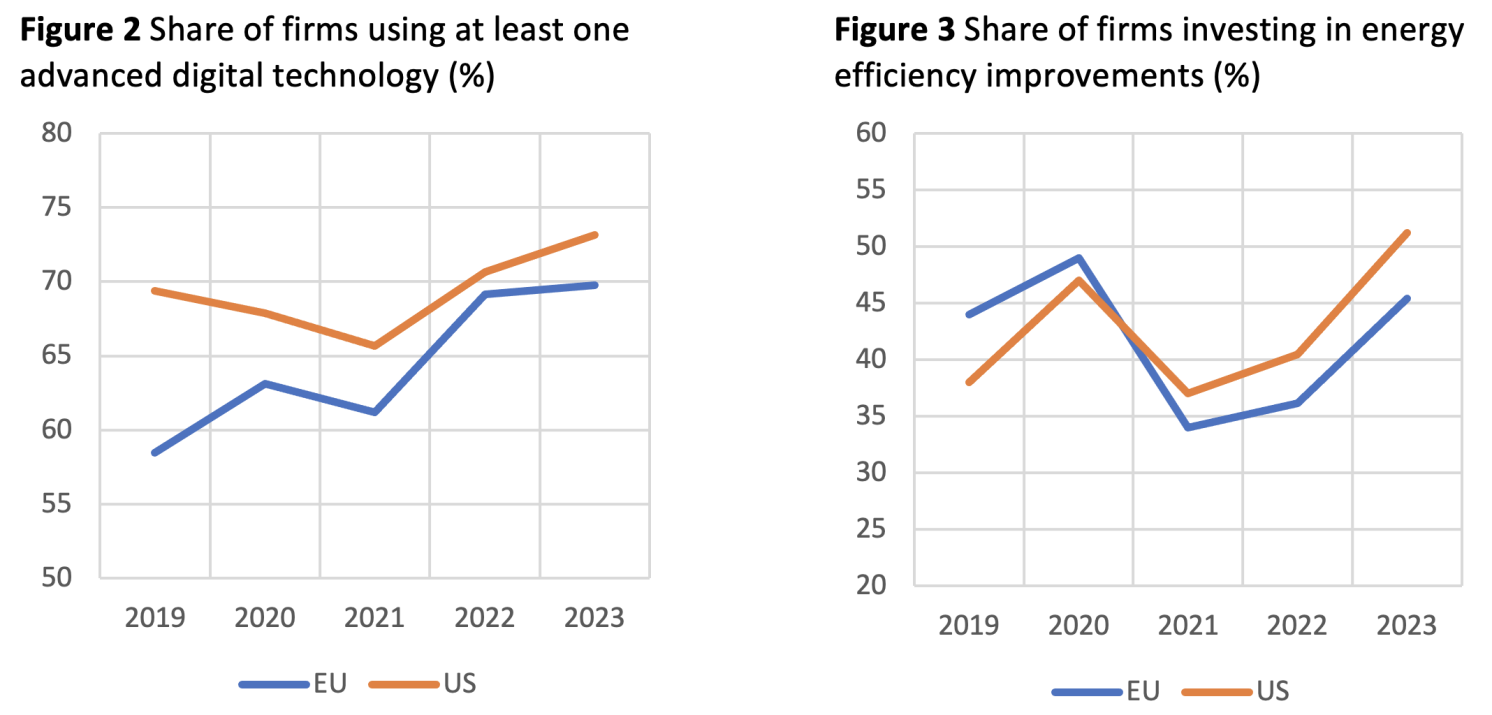

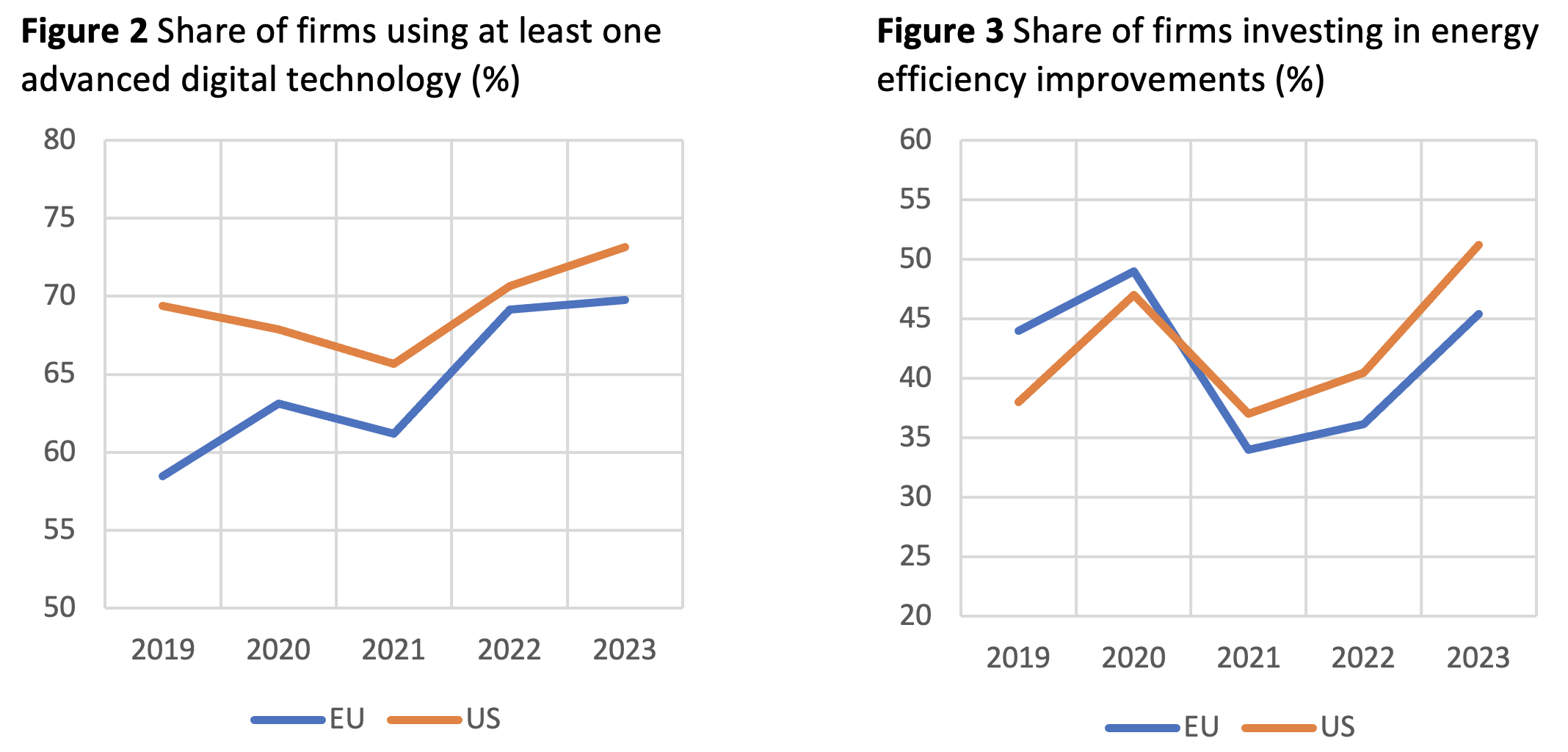

- Firms have been investing in digitalisation and closing the gap with the US digitalisation. Seventy percent of EU firms now use at least one advanced digital technology, confirming the post-pandemic trend of catch-up with the US (Figure 2).

- Firms accelerated investment in energy efficiency. The share of EU firms investing in energy efficiency jumped 11 percentage points to 51% (Figure 3). Altogether, 78% of EU firms have sought to save energy in response to the energy price shock.

- Firms have also acted to become more resilient, in the face of trade shocks. Most European firms focused on increasing stocks and inventory (31% EU firms) and instead of deglobalising, European importers were more likely to diversify supply sources (24% of importing firms), thus enhancing resilience.

Investment has been supported by internal finance buffers and policy support

A number of factors can help to explain this performance. First of all, it appears that the relative profitability of firms, and the consequent availability of internal finance, helped to shield firms from tightening external finance conditions. About 80% of EU firms recorded profits last year, bringing the share of profitable firms back to pre-Covid shares, while the share of EU firms happy to rely on internal funds to finance investment remaining relatively high, at 25%.

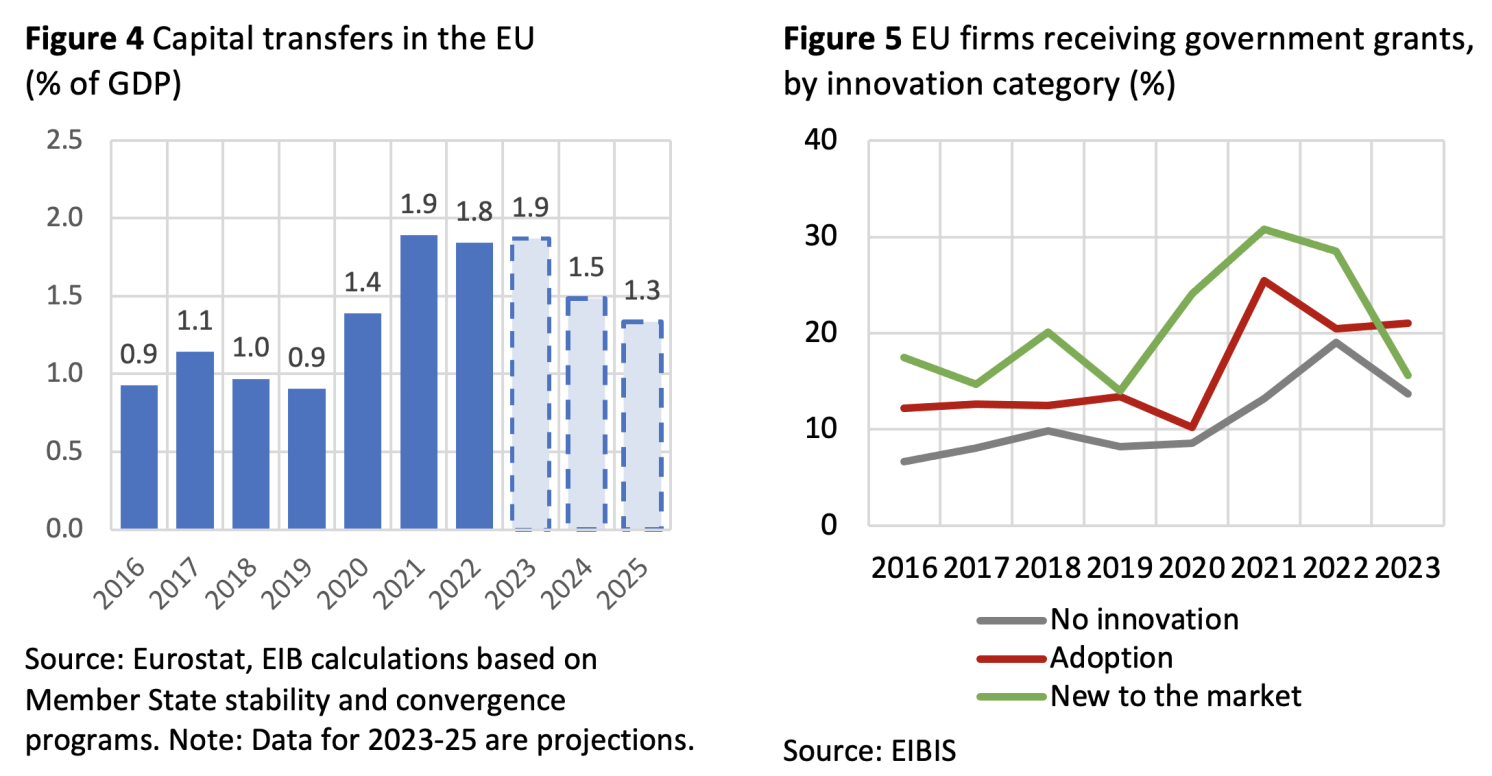

Public policy support remained another positive factor. Based on budget projections and national accounts data, across the EU, capital transfers to the private sector (such as transfers or grants) will likely be close to 2% of GDP for the third year in a row in 2023, after having averaged 1.1% in the period 2011-2019 (Figure 4). In fact, EIBIS shows that 16% of European firms used government grants to finance investment in the preceding year. Though significant, this support is falling rapidly (from 21% of firms receiving grants in the year before), along with COVID-19 support being wound down. Worryingly, firms engaged in frontier innovation appear to have been particularly reliant on grants, and particularly exposed to the decline in grant availability (Figure 5).

As buffers deplete, tighter financial conditions will start to have more impact

Thus, while investment has proved resilient so far, it is easy to foresee that the pass-through of tighter financial conditions may increase. Accumulated internal finance buffers are likely to deplete as the business cycle progresses. Fiscal consolidation, meanwhile, will generally limit public support. Capital transfers are projected to decline significantly over the next two years, based on data from stability and convergence programs (Figure 4). The share of firms receiving grants, from EIBIS data, has already fallen rapidly (from 21% of firms receiving grants in the year before), in line with the wind-down of COVID-19-related interventions.

At the time of the interviews, the share of finance-constrained firms in the EU remains elevated at more than 6%, with considerable variation across Member States: between 3% and 18%. Meanwhile, the share of firms dissatisfied with the cost of finance they are offered increased dramatically (from 5% to 14%), suggesting that external finance constraints had already started to bite, and with SMEs more affected than larger firms. Looking forward, 9% more firms expect their external financing conditions to deteriorate, than expect them to improve.

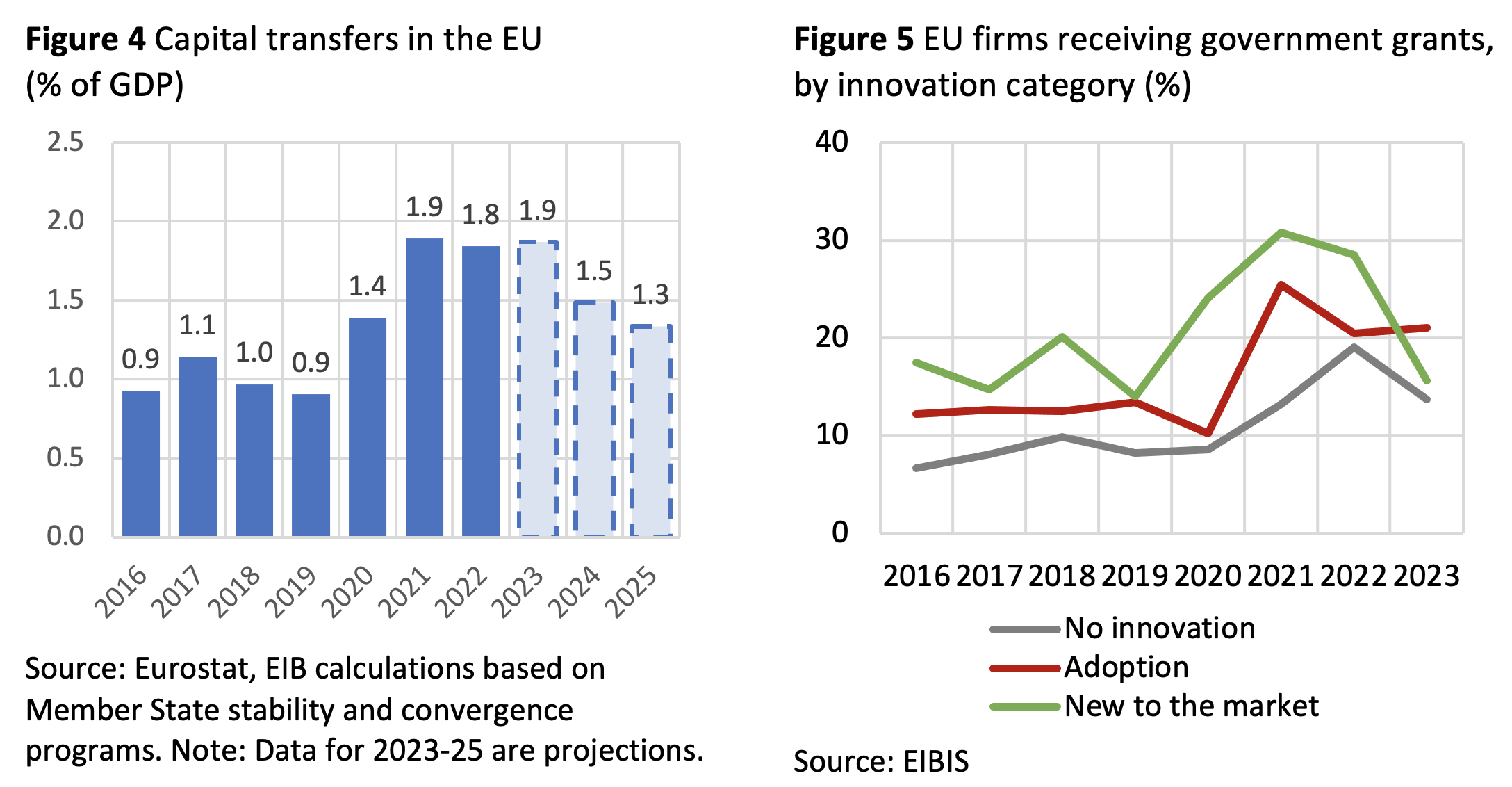

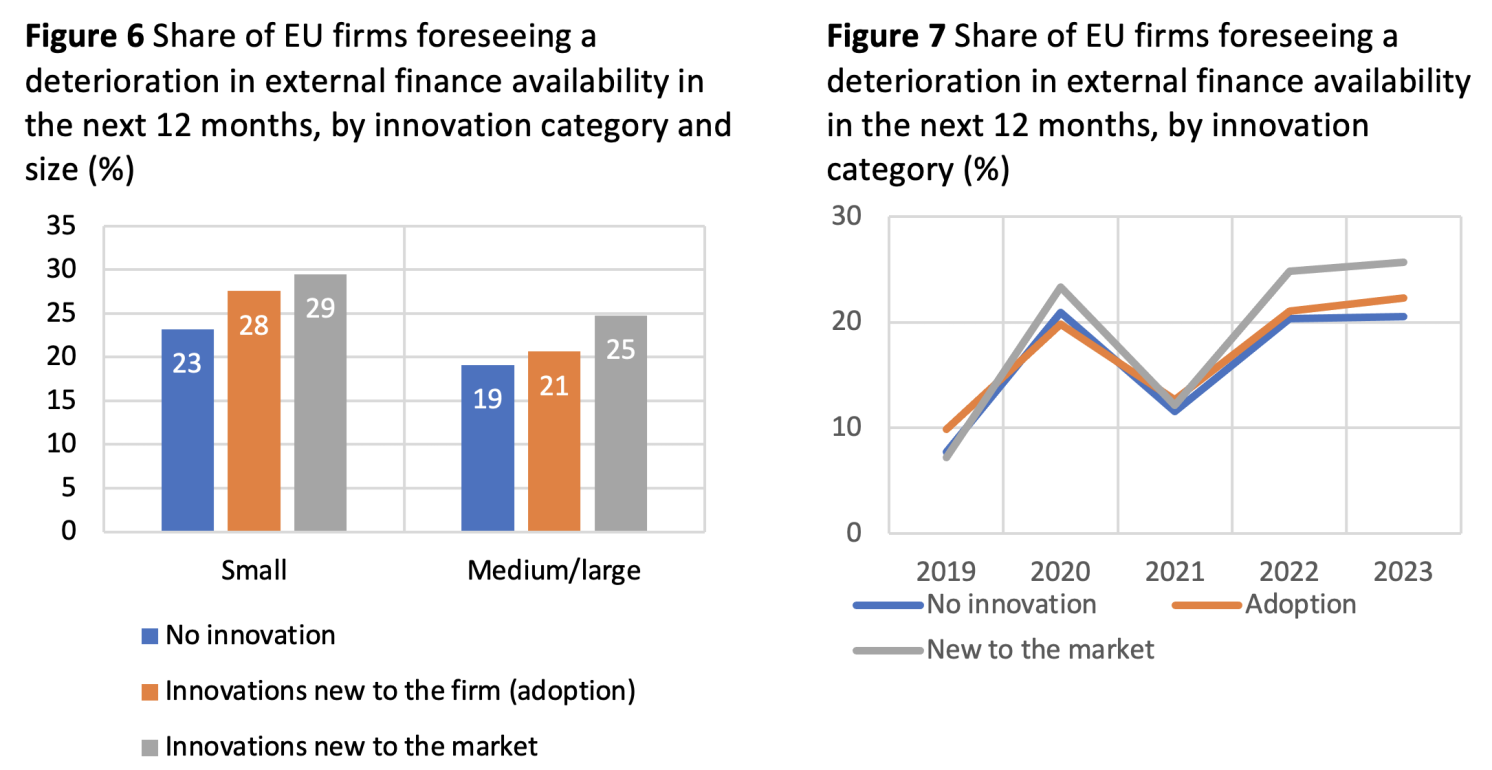

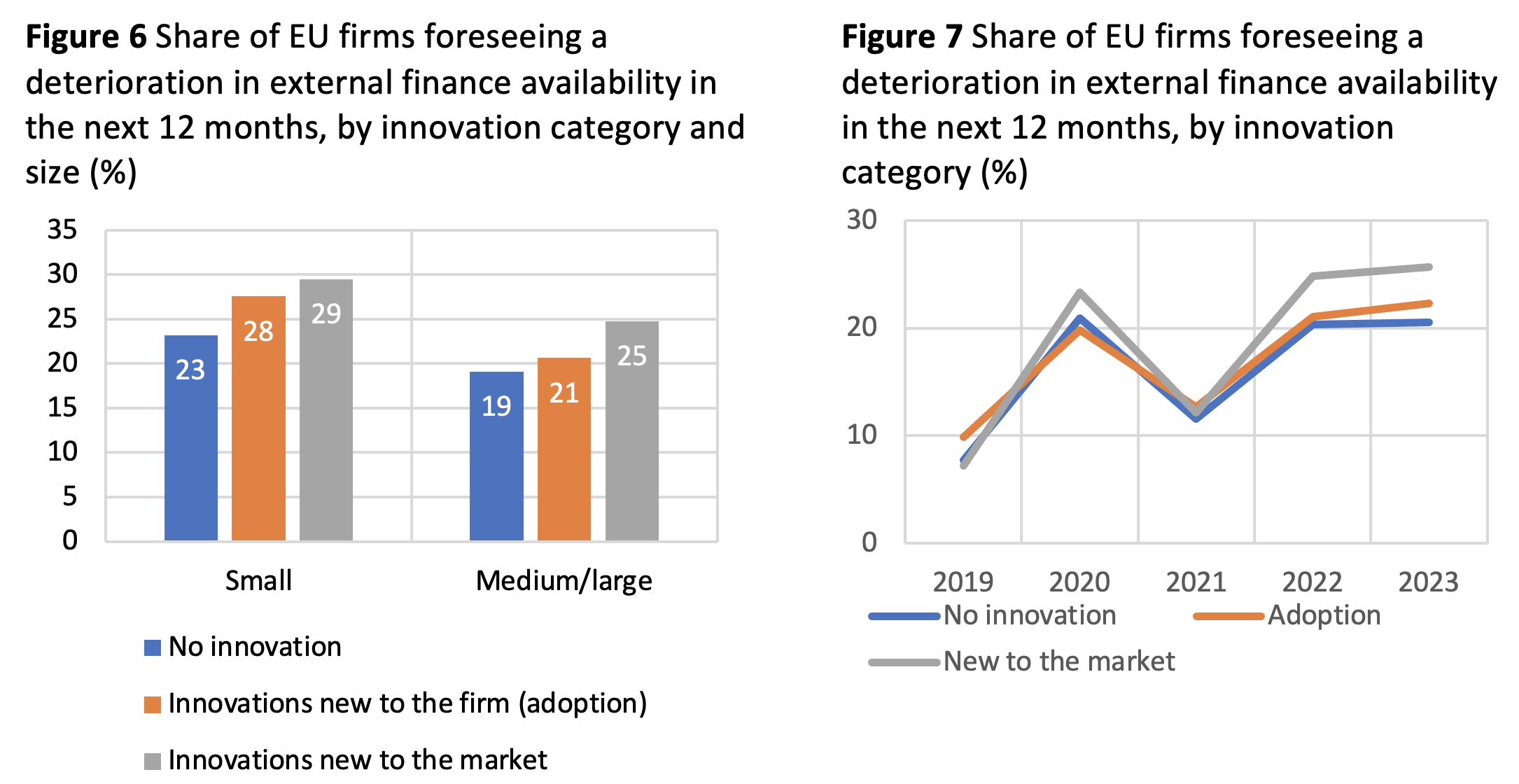

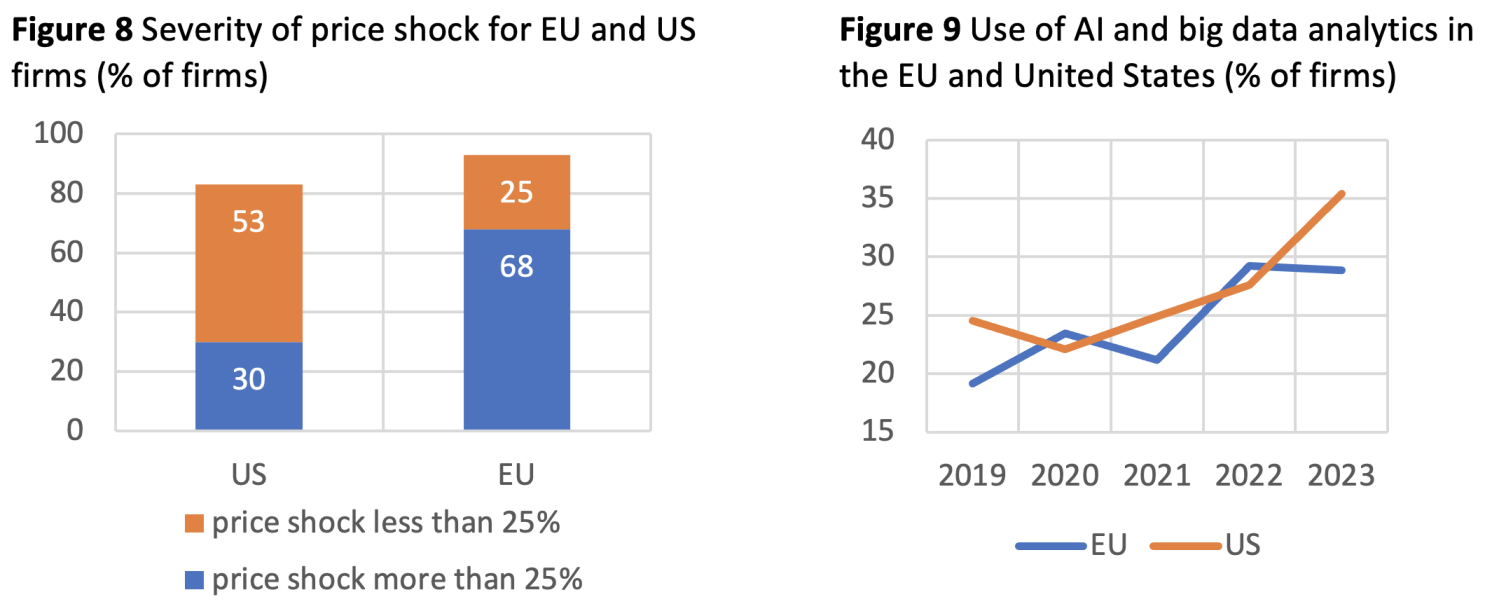

Smaller firms and innovative firms are more likely to foresee worsening finance conditions in the next year (Figure 6). Firms that introduce innovations that are new to the market appear the most pessimistic and vulnerable to a cyclical deterioration in financing conditions (Figure 7). Indeed, young innovative firms seeking to scale-up face not only tighter credit markets but a strong contraction in venture capital markets.

In general, it should also be noted that high levels of uncertainty about the economic and policy climate continue also to weigh on investment, reducing investment demand. 78% of firms saw this as a constraint impacting their investment planning.

Any investment slowdown would be concerning, given the challenges to the competitiveness of EU firms

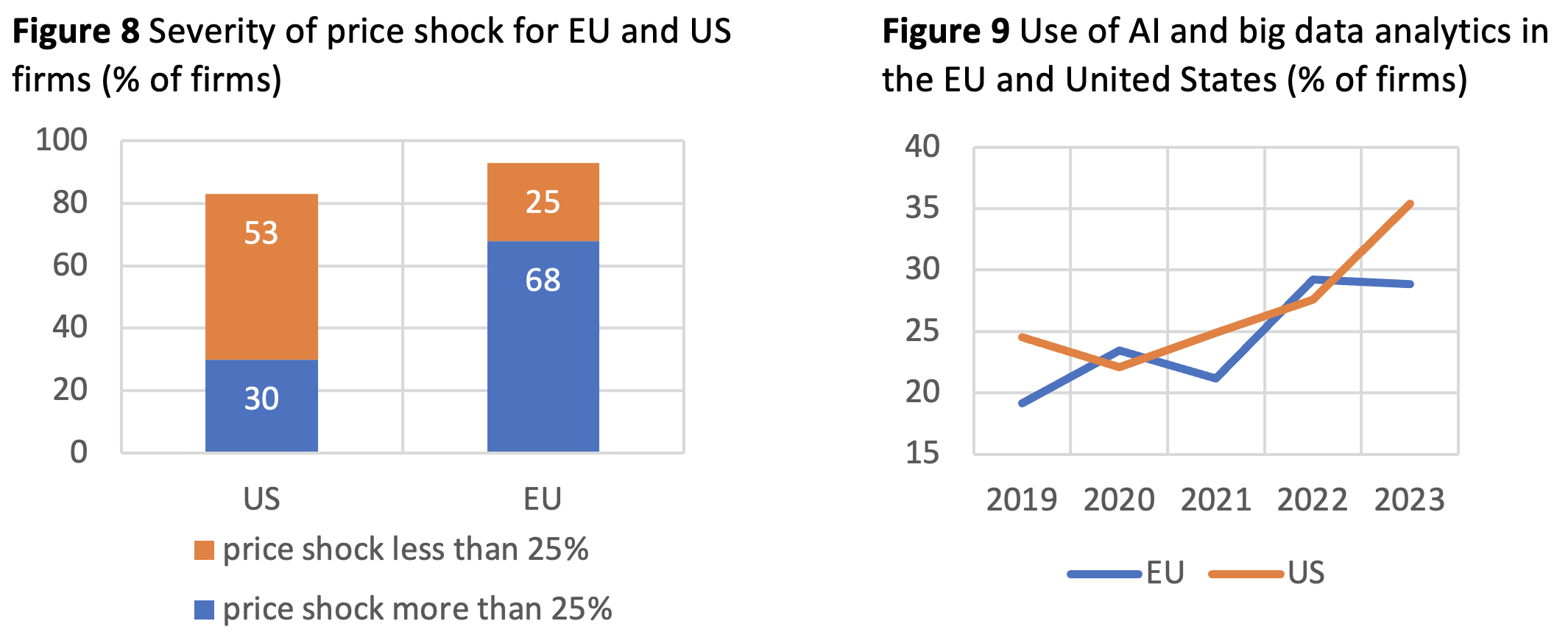

The energy transition is an area where there is clearly a structurally elevated need for investment. EIBIS reveals that energy costs are a concern for 83% of EU firms, while 68% of them experienced a significant increase in energy costs (of more than 25%), compared to only 30% of firms in the US. Indeed, electricity prices in the EU are some three times higher than those in the US (Figure 8). While many firms have shown a capacity to adapt to the energy shock in the short term (Kramer et al. 2023), lasting changes in the pattern of energy supply mean that EU firms face structurally higher energy costs than global competitors, with investments in the energy transition potentially taking as long as 15 years to trickle down to marginal price setting.

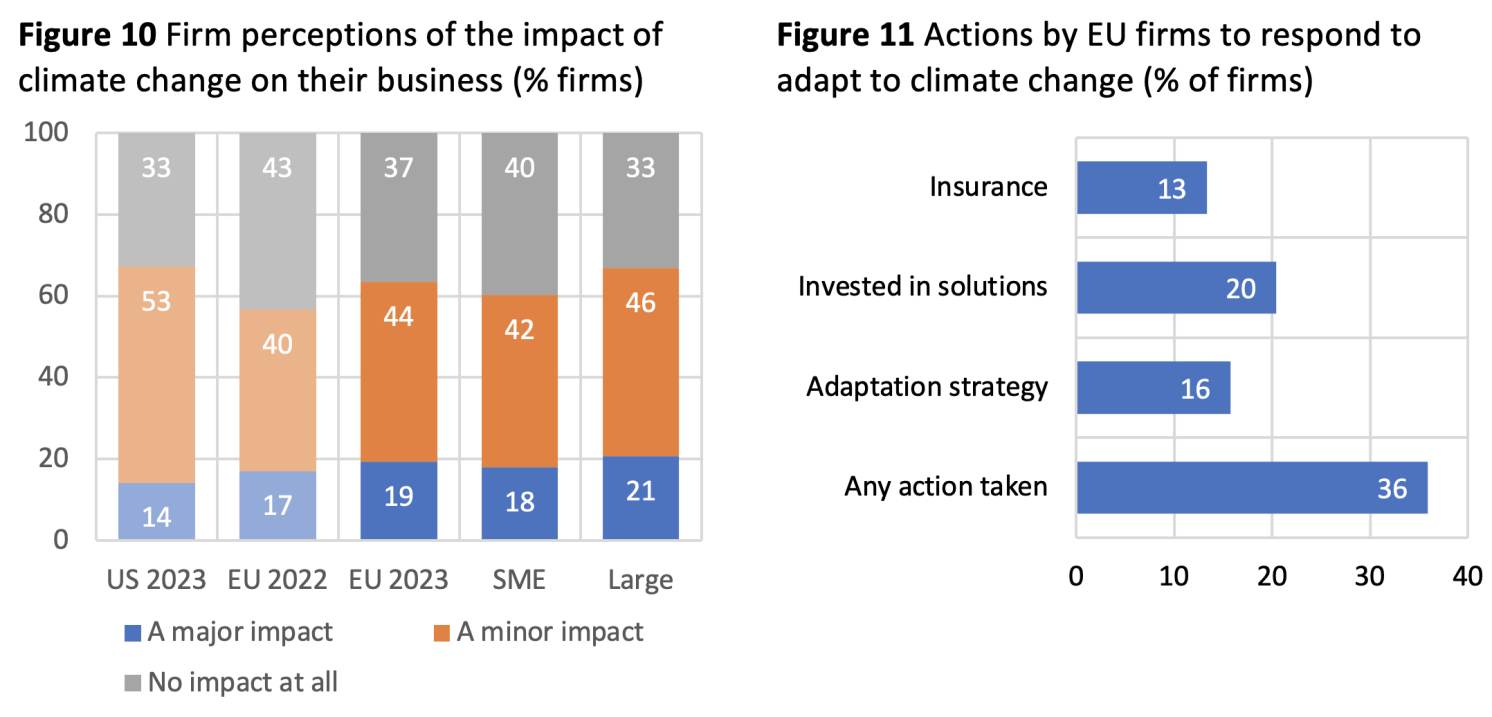

On digitalisation, we have seen an acceleration in Europe since the pandemic, but EU firms still have to maximise return from this investment. Moreover, when one looks at the frontier technology of artificial intelligence, we still see EU firms lagging, with 29% of firms adopting, versus 35% in the US (Figure 9). Our initial analysis shows that AI adoption is already having a positive effect on firm performance.

As firms innovate and transform themselves, we see that the availability of staff with the right skills remains a key impediment in Europe. Eighty-one percent of EU firms continue to signal difficulties in this area. Investment in training is gradually picking up. Analysis of EIBIS data has already suggested how investment in skills and digital tech are both very effective in raising firm productivity (EIB 2023a, Brunello et al. 2022).

The climate emergency is becoming another push factor for investment, and also calls for a more pronounced reallocation of resources

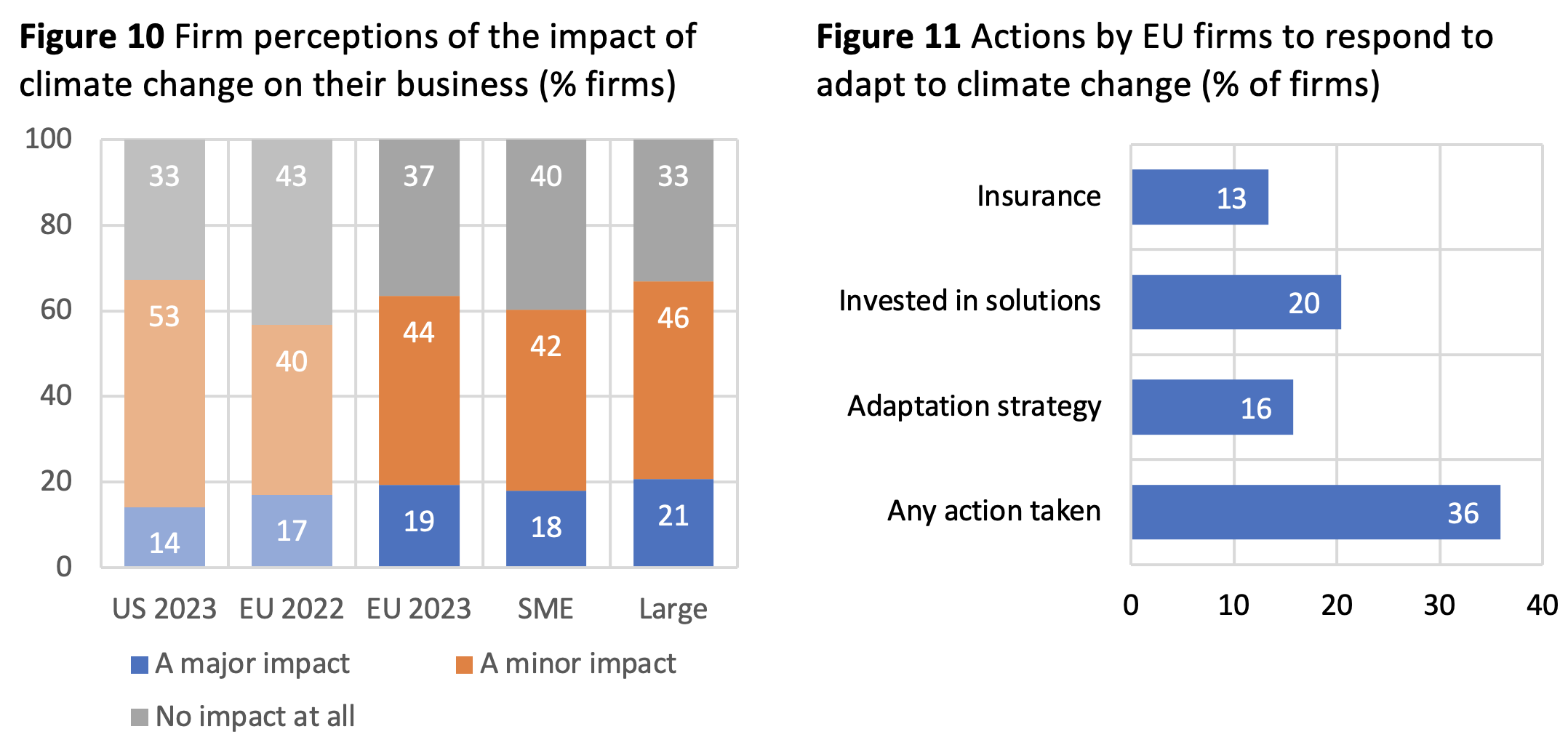

Climate change is becoming a real issue for firms. The share of European firms that say climate change, in the form of adverse weather events, is already affecting their business, has jumped 7 percentage points in a year, to 64% of firms (Figure 10). However, the share of EU firms taking action to adapt to such risks is lower, at 36%, with only 13% of firms buying insurance for this purpose (Figure 11). Among those firms that say climate change has had a major impact, still only 21% report using insurance as a response.

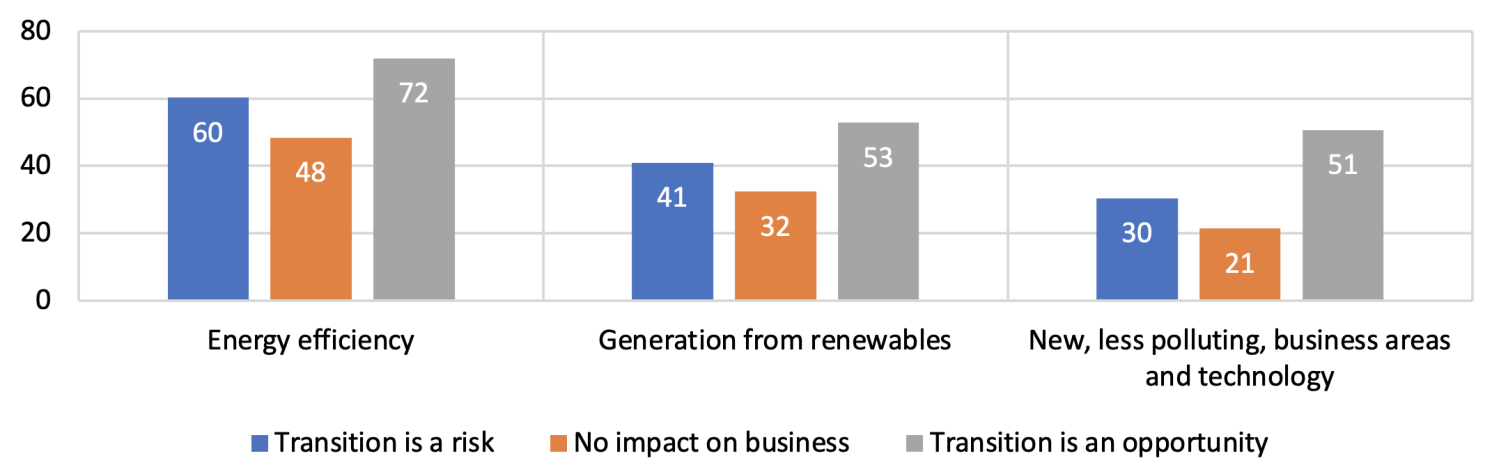

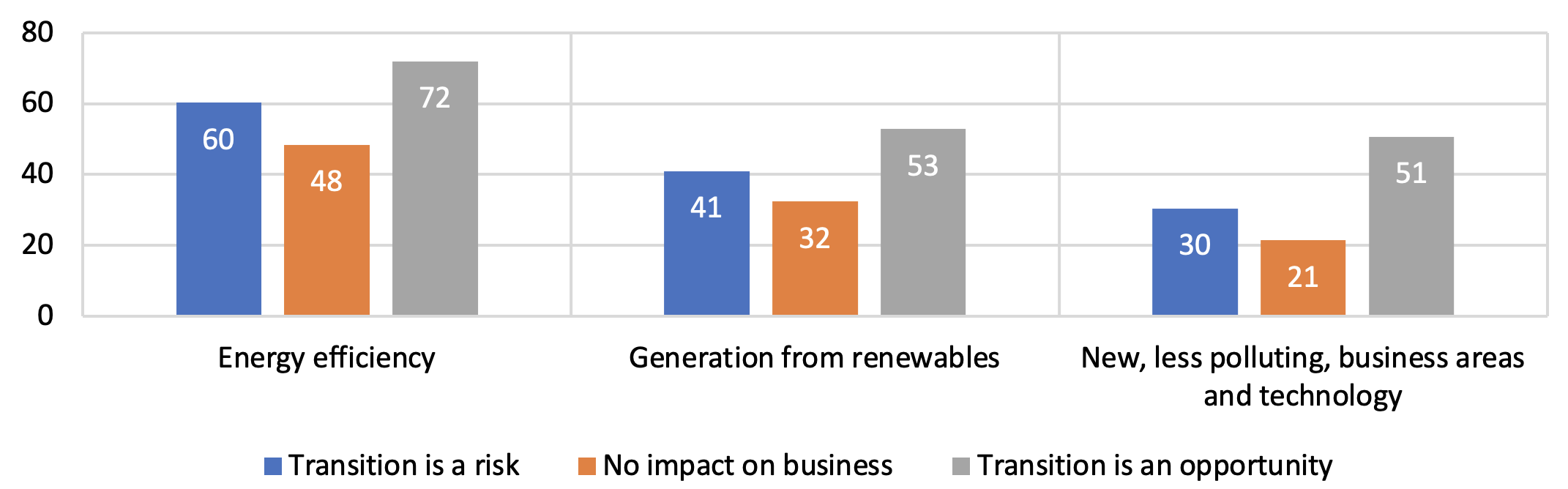

The attitude of European firms with regards to the climate transition remains quite stable, with 29% seeing it as an opportunity and 33% seeing it as a risk for their business (Figure 12). Notably, the share seeing the transition as a business risk rises to 51% among the most energy-intensive sectors. Investment in the net zero transition seems to be driven by the positive story of new business opportunities, rather than by the transformation of those more at risk. Firms that see the climate transition as an opportunity are more likely to invest overall, to exploit the benefits of this transition. By contrast, firms that see it as a risk follow more of a wait-and-see strategy, being slightly less likely to invest in areas such as energy efficiency and renewables, and much less likely to radically transform by investing in new, less polluting business areas. Firms that do not yet foresee an impact of the net zero transition on their business are the least likely to invest in all of those areas.

Figure 12 Climate change mitigation investment undertaken by EU firms, according to their perceptio of the climate transition (%)

Altogether, the share of EU firms that have invested to tackle the causes and effects of climate change (56%) and that plan such investment in the next three years (54%) continue to increase steadily and remain above levels in the US (where 42% have invested and 40% plan to).

Complacency about corporate investment would be misplaced

Europe is facing a backlog of rather overdue investment in the climate transition, energy independence and digitalisation. It is critical that European firms keep up the pace of that investment.

In this context, it is a concern that conditions are becoming harder for investment. Internal finance buffers are shrinking, tighter monetary conditions are starting to bite, and fiscal space constraints in the wake of the pandemic are reducing to the scope for broad-based support of the corporate sector.

It is becoming especially important to look at how to support transformative investment, in a non-inflationary way. One immediate way is to improve the investment environment, by tackling barriers such as uncertainty, regulatory obstacles, and skill gaps. Likewise, policy support should become much more targeted and effective in times of reduced fiscal space. Targeting should privilege competitiveness-enhancing investment in innovation, and in the digital and green transitions, with a strong focus on measures to catalyse private investment and to facilitate the reallocation of resources in the economy.

Source : VOXeu