You only live twice: A growth strategy for Ukraine

Between regaining independence in 1991 and the Russian invasion in 2022, Ukraine went from being on par with the more prosperous economies of the former

Income, democracy, and growth: Broadening the perspective

Does prosperity bring democracy? Does democracy boost prosperity? This column argues that the answer to both questions depends critically on whether a country has made

Geopolitics as a monetary shock: The ‘silent tightening’ in the European banking system

Geopolitical tensions have once again seized the centre stage of macroeconomic policy debates. From Russia’s ongoing war in Ukraine to instability in the Middle East,

Trump’s mortgage-backed bond purchases not moving needle on housing costs

Experts say $200bln bond-buying effort unlikely to significantly lower housing costs. There’s scant evidence so far that U.S. President Donald Trump’s bid to make housing

Trump tariff shift calms European bond market

That has helped at least to put a floor under euro zone bond prices. Euro zone bonds steadied on Thursday with longer-dated bond yields dropping

Vision 2030 projects may drive corporate loans by Saudi banks to $75bln in 2026

Bank profitability will remain strong this year despite lower interest rates, says S&P. Saudi banks are expected to extend $65-$75 billion in new corporate loans

Europe’s emissions trading system is an ally, not an enemy, of industrial competitiveness

The 2026 review of the EU ETS must be anchored in facts and focus on the potential benefits of the system to EU competitiveness. The

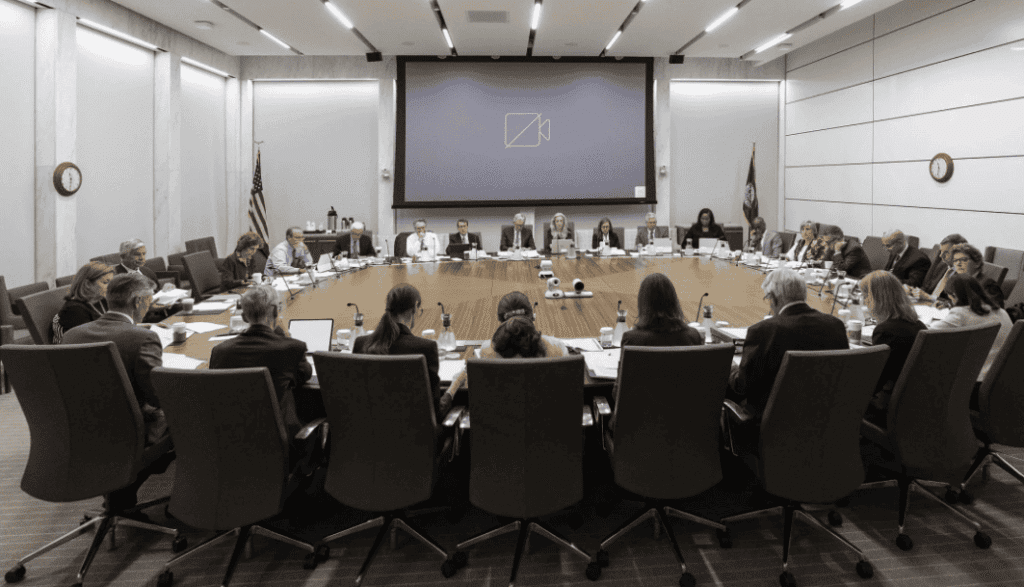

How the Fed makes decisions: Disagreement, beliefs, and the power of the Chair

Federal Open Market Committee statements typically sound unanimous, but the Committee’s internal debates rarely are. This column analyses historical meeting transcripts to show that policymakers

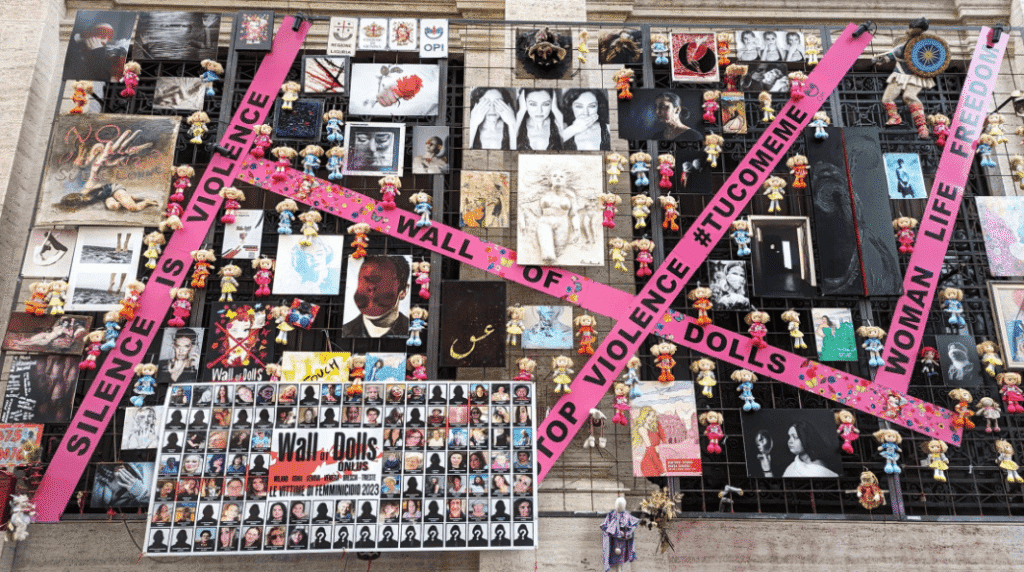

Femicides, anti-violence centres, and policy targeting

Local responses to gender-based violence, with femicide as its most extreme form, remain uneven across Europe. This column combines machine-learning forecasting with policy evaluation to

Central bank digital currency and monetary sovereignty

Calls for a digital euro increasingly invoke monetary sovereignty, often on the grounds that Europe must retain control over its payment systems. This column argues