Households’ inaction in the deposit market

The sharp rise in interest rates since 2021 has not been matched by equal increases in household savings rates in advanced economies. This column uses

What Germany’s medium-term fiscal plan means for Europe

EU leniency on Germany’s fiscal plan highlights rule rigidity and the need for reform to support investment. Germany’s July 2025 medium-term fiscal-structural plan exposes the

Confusopoly unveiled: How firms use complexity to raise prices

Can entire markets strategically confuse consumers to raise prices? This column tracks the prices of nearly all mobile phone tariffs and handsets in the UK

Speaking of debt: Framing, guilt, and economic choices

In many Germanic languages, the word for ‘debt’ also means ‘guilt’. This column explores whether the linguistic overlap leads to greater debt aversion in Germany,

Details matter: How loan pricing affects monetary policy transmission in the euro area

Classifying loans as fixed-rate or floating-rate fails to fully capture their distinct sensitivity to changes in ECB policy rates. This column analyses the maturity of

Sustained growth through creative destruction: Nobel laureates Philippe Aghion and Peter Howitt

Philippe Aghion and Peter Howitt have been jointly awarded the 2025 Nobel Prize in Economic Sciences with Joel Mokyr ‘for having explained innovation-driven economic growth’.

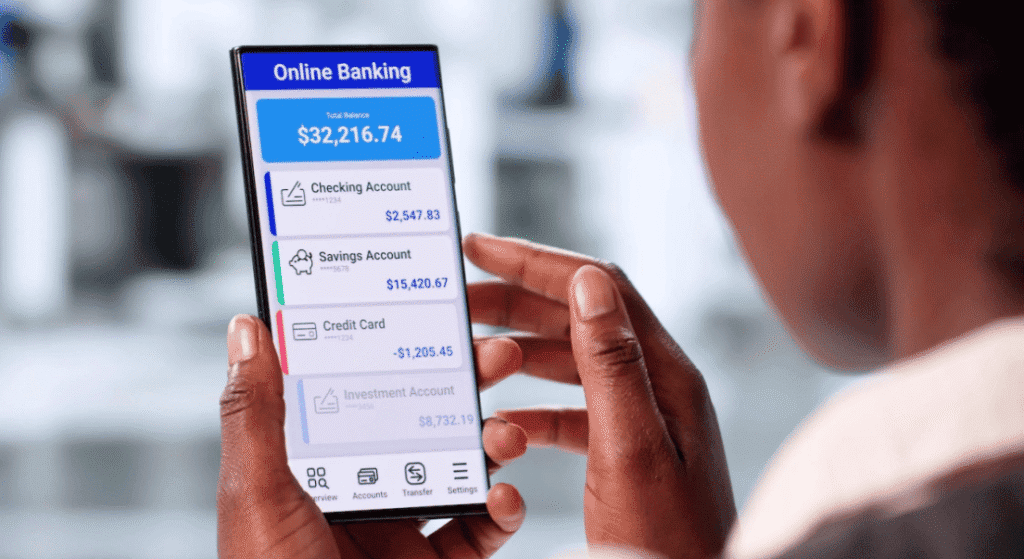

The impact of fintech on lending

Fintech has improved efficiency and inclusion in banking, especially lending, but has also raised concerns about financial stability, privacy, discrimination, and overall wellbeing. This column

Egypt to invest $5.7bln in 480 oil wells

101 wells will be drilled in 2026. Egypt is planning to drill 480 new oil and gas exploration wells over the next five years, with

Saudi to offer steel projects worth $16bln

They aim to tackle supply gap. Saudi Arabia has completed a study about the optimal options to address the supply shortage in the domestic steel

UAE insurance firm Salama to raise up to $48mln in Mandatory Convertible Sukuk following capital reduction

Shareholders approve capital reduction to offset accumulated losses and cancel treasury shares. The Islamic Arab Insurance Company (Salama), listed on the Dubai Financial Market (DFM),