The EU depends significantly on third markets for specific products and technologies in the semiconductor industry. This column describes a comprehensive approach to monitor the EU semiconductor ecosystem. Given the intricate nature of the global semiconductor supply chain, disruptions could propagate rapidly and affect multiple players across different countries. A comprehensive understanding of the entire supply chain and the early identification of potential vulnerabilities are important to mitigate shocks and inform policymaking.

The semiconductor value chain is a key target of geopolitical strategies and economic policies, due to its crucial role in modern economies. As the core of all electronic devices, chips are crucial to competitiveness, national security, and global stability. This criticality explains why the industry has long been intertwined with government strategies and reliant on public funding, a dynamic that dates to the early years of electronics (García-Herrero 2022, Bown and Wang 2024).

The consequences of disruptions in this value chain are evident from recent events. The global chip shortage had severe worldwide repercussions across industries such as automotive and defence: the EU automotive sectors, for example, experienced a reduction in output of 23% in 2021 compared to 2019 (see Huitema 2021 and The Economist 2021 for more details). Catastrophic natural events, like the Taiwanese earthquake and flooding in the US, have also raised concerns in the industry (see Kerr 2024 for the Taiwan earthquake and Bradshaw 2024 for the flooding of the quartz-mining site in North Carolina). These events drew attention to the vulnerabilities in this production network, highlighting the need for a resilient supply chain.

Understanding the EU semiconductor supply chain is essential to enhance the resilience of this industry

Researchers and policymakers are collaborating to develop a better understanding of the complex dynamics shaping this industry and develop coordinated strategies to mitigate crises. In 2023, the European Commission adopted the European Chips Act, which introduces a set of measures to strengthen the EU’s semiconductor ecosystem, including actions to bolster large-scale technological capacity building and innovation, improve the EU security of supply, and set up a monitoring and crisis-response mechanism to ease the negative effects of potential shortages on European society (for a thorough description, see the European Commission website).

Research provides insights into the dependencies and vulnerabilities of global supply chains. Studies have developed indicators to track pressure points and anticipate potential risks in value chains (Benigno et al. 2022, Komaroni et al. 2022). Schwellnus et al. (2023) highlight the strategic importance and high concentration in the semiconductor value chain. Furthermore, a recent OECD study (Haramboure 2023) warns that disruptions in a few key economies could destabilise the whole supply of semiconductors, with ripple effects on downstream sectors such as ICT, automotive, and electrical equipment. From a broader perspective, Martin et al. (2022) mapped out strategies to mitigate the impact of future disruptions in supply chains.

Against this background and in support of the provisions foreseen in the Chips Act, we put forward a comprehensive monitoring framework for the semiconductor supply chain, structured around three pillars. First, we identify key actors in each segment of the chain. We then monitor critical products, tracking trade dependencies along the production chain. Finally, we introduce a real-time alert system to identify disruptive events that could negatively affect this strategic industry.

Mapping the intricate network of international key players

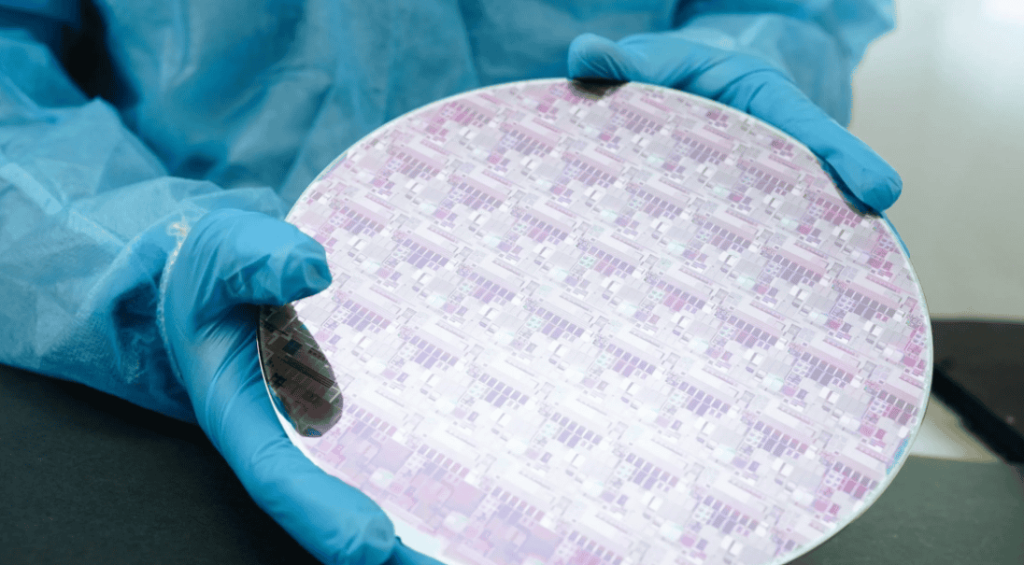

We first identify key actors in the different segments of the supply chain. We identified firms operating in the semiconductor ecosystem worldwide (Ciani and Nardo 2022) and refined the list of European companies through a stakeholder consultation in 2022, obtaining information on over one thousand companies, as reported in Figure 1 (Rosati et al. 2023). 1

Figure 1 EU companies in the semiconductor ecosystem

An in-depth analysis of European semiconductor companies reveals that while the companies have strengths in chip-manufacturing equipment, they are weaker in the intermediate inputs and chip-production segments, relying heavily on imports. Supplier-customer data from FactSet show that nearly 80% of the companies’ suppliers are headquartered outside the EU, with 35% located in the US, 12.4% in Taiwan, 11.7% in China or Hong Kong, 10% in South Korea, and nearly 9% in Japan. Additionally, European companies have a significant share of their customers in semiconductors (63%) headquartered outside the EU (Ciani and Nardo 2022).

These findings reveal a distinctive characteristic of the semiconductor supply chain: no single country controls all the steps of the production process. Instead, a complex network of relationships exists, which makes the supply chain vulnerable to shocks: the existence of chokepoints in several segments of the chain means a single shock can cause disruptions throughout the network.

The EU is exposed to supply chain disruptions due to significant reliance on third markets

The second pillar of our monitoring framework entails an in-depth analysis of relevant products and their dependencies, building on the European Commission’s bottom-up methodology (2021; see also Arjona et al. 2023). We tailor the Supply Chain Alert Notification (SCAN) tool, originally proposed by Amaral et al. (2022), to the semiconductor supply chain as refined by Bonnet and Ciani (2023). The tool leverages granular trade and production data (e.g. Comext and PRODCOM) 2 to identify potential vulnerabilities in the EU supply chain due to over-reliance on a limited number of foreign countries, as well as limited domestic capacity to diversify these dependencies. Our analysis focuses on more than 120 products that we selected as critical to the chain, following a thorough review of the literature (OECD 2019) and consultations with experts in the field. These products have been allocated to five broad segments of the chain: raw materials, inputs, wafers, equipment, and chips.

Figure 2 provides a snapshot of the EU’s overall position in terms of aggregated trade flows. Notably, the 2023 trade data reveals a significant trade surplus of €26.4 billion in semiconductor equipment, due to the leadership of European manufacturers in this segment. In contrast, the EU faces a substantial deficit of €19.6 billion in final products, with Taiwan accounting for 22% of the total extra-EU imports, followed by Malaysia (16%), China (14%), and South Korea (7%).

Figure 2 Segments monitored along the semiconductor supply chain, 2023

Source: European Commission Joint Research Centre elaboration based on Comext data for year 2023.

The SCAN monitoring tool allows us to dive deeper into individual products’ foreign dependencies. By calculating concentration and substitution indicators, it can pinpoint products that are most vulnerable to import disruptions. Figure 3 displays the distribution of monitored products across two key indicators: import concentration, calculated using the Herfindahl-Hirschman index (horizontal axis), and substitution potential (vertical axis), proxied by the exposure indicator that captures the extent to which imports from outside the EU can be replaced with domestic production.

Figure 3 Concentration of imports and potential substitution with EU production, by product, 2023

Notes: Import concentration (horizontal axis) is calculated using the Herfindahl-Hirschman index. Substitution potential (vertical axis) is proxied by the exposure indicator that captures the extent to which imports from outside the EU can be replaced with domestic production. The exposure indicator is defined as the share of extra-EU imports in total EU supply, where the total supply in the EU is the sum of extra-EU imports and domestic production from the dataset PRODCOM. TW: Taiwan; CN: China.

Source: European Commission Joint Research Centre elaboration based on Comext and Prodcom data for year 2023.

Our analysis reveals potential vulnerabilities in certain upstream products, particularly among raw materials and inputs. For example, products related to unwrought gallium or articles of germanium exhibit very low levels of EU domestic production and are highly reliant on imports from China, although the value of the imports is relatively small. Interestingly, gallium and germanium have been recently subject to Chinese export bans towards the US. Several chip categories, including DRAM memories and certain subcategories of processors and controllers, show a low potential for domestic substitution, with significant volumes being imported from Asian countries, like Taiwan. When selecting products with high import concentration and low substitutability potential with EU domestic production, we identify 23 products that can be considered at risk of import disruption.

Detecting ongoing disruptions in the supply chain with real-time monitoring tools

To further enhance our supply-chain monitoring framework, we propose the development of a real-time alert system for potential disruptions (Molnar et al. 2024) that employs a combination of industry-specific indicators, online news monitoring, and real-time disaster tracking.

Our analysis of online news coverage, using web scraping, reveals a significant surge in articles mentioning semiconductors during 2021 and 2022, coinciding with the global chip shortage (Figure 4a). We find pronounced spikes in media attention on specific dates, aligning with events such as production cuts by major automotive manufacturers, political announcements, and reports of disruptions in semiconductor production facilities.

We also explore the potential of a disaster-detection tool that provides near-real-time awareness of potential consequences for production sites located close to disaster zones. By integrating information on the location and timing of the event, this tool can identify plants at risk, enabling stakeholders to take swift actions to minimise supply chain disruptions. A case study of the 2024 Japanese earthquake, reported in Figure 4b, demonstrates the effectiveness of such a tool in identifying affected sites and facilitating prompt responses. All in all, such an alert system, once in place, could provide early signals of emerging threats before they escalate into major disruptions.

Figure 4a Media monitoring of semiconductor supply chain

Figure 4b Locations of semiconductor fabrication plants near the epicentre of the Japanese earthquake of 1 January 2024

Conclusion

This column underlines the importance of a thorough understanding of vulnerabilities in the semiconductor ecosystem, emphasising the need for a comprehensive assessment of the supply chain. Our holistic monitoring framework offers a multi-step approach to achieve this goal. First, it identifies key actors in each segment of the supply chain. Second, it tracks the dependencies of each product, highlighting vulnerabilities along the different segments of the chain. Finally, the framework proposes a real-time alert system of events that could negatively impact this industry, leveraging news and the geolocation of disasters.

While our analysis provides useful insights into the risks of the geographic concentration of sourcing, it could be further improved. Access to technical information on potential alternatives to traded inputs and materials, as well as more granular trade-data classifications, could enhance the accuracy of our framework. In line with Pichler et al. (2023), a comprehensive understanding of international supply linkages that also takes into consideration intra-company trade would require collaborative data gathering among the various key players.

Source : VOXeu