In 2022, overall European Union industrial employment and output increased above 2021 levels, despite rocketing energy prices. However, output declined from energy-intensive industries including basic metals, chemicals, non-metallic minerals and paper, for which energy costs represent a much bigger share of production costs than for less energy-intensive manufacturing. Energy prices are likely to remain above historic levels for the foreseeable future.

In its industrial strategy response to this context, the EU must ask first whether the energy-intensive parts of the value chain should be outsourced permanently. Conditional on the answer being no, the second question is how to reduce energy prices to ensure the competitiveness of the energy-intensive productions stages that remain in the EU.

First, the EU could bridge the high energy price period with unconditional subsidies, which seems to be the preferred strategy currently. This will avoid irreversible large-scale relocation abroad but is expensive, does not help to drive down energy prices and poses risks of fragmentation within the EU. It will only succeed if internationally competitive energy supplies are made available quickly.

Second, the EU could support decarbonised production processes built on large-scale deployment of domestic renewables, grid interconnectors and storage. This would accelerate the green transition and reduce clean-tech prices worldwide. However, EU taxpayers would bear the cost of new technologies, without any guarantee of solving the current cost-competitiveness issue.

Third, the EU could facilitate imports of energy-intensive products, while helping EU industry move to higher value-added parts of the value chain. Subsidies could be given directly to industrial sectors that have not become structurally uncompetitive, while bringing down energy demand and thus energy prices. However, this strategy would result in temporarily higher unemployment and factory closures in energy-intensive industries, would need to accommodate concerns over excessive reliance on imports and would need to be engineered to address carbon leakage.

Policymakers should implement a mix of these policies. The EU should subsidise existing energy-intensive industries only in clearly justified cases, while deciding which energy-intensive products can be left to international market forces. By choosing which decarbonisation investments should be supported in Europe, the EU can combine industrial competitiveness and environmental sustainability.

1 Introduction

Russia’s invasion of Ukraine in February 2022 made clear that Europe’s dependency on energy imports from Russia was a grave strategic liability. The energy crisis that followed Russia’s weaponisation of natural gas supplies showed how decoupling from Russian gas has become essential. In the decoupling effort, European industry, accounts for more than a third of total European Union final demand for electricity and natural gas, has a major role to play.

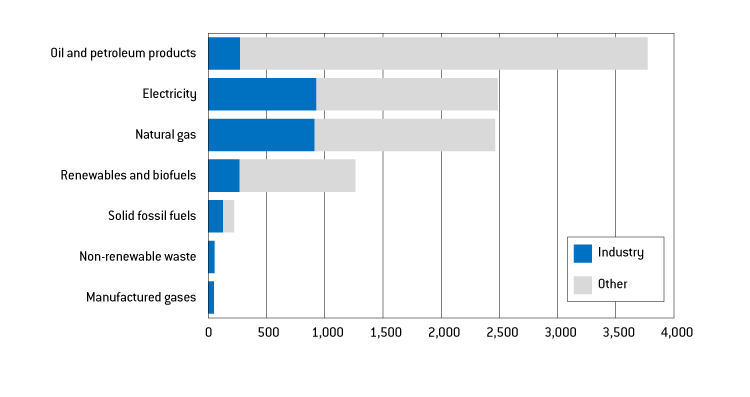

Industry uses energy – primarily natural gas and electricity (Figure 1) – for four main purposes: production of heat in industrial processes and for space heating in buildings; as feedstock to make products including plastics and chemicals; generation of steam for process heating and generation of electricity to run industrial processes; and to power machinery and industrial motors, lights, computers and equipment for heating, cooling and ventilation.

Figure 1: EU final energy use by type of energy, 2021 (TWh)

Source: Bruegel based on Eurostat. Note: In Eurostat’s energy balance datasets ‘industry’ is the aggregate of manufacturing, construction and mining and quarrying.

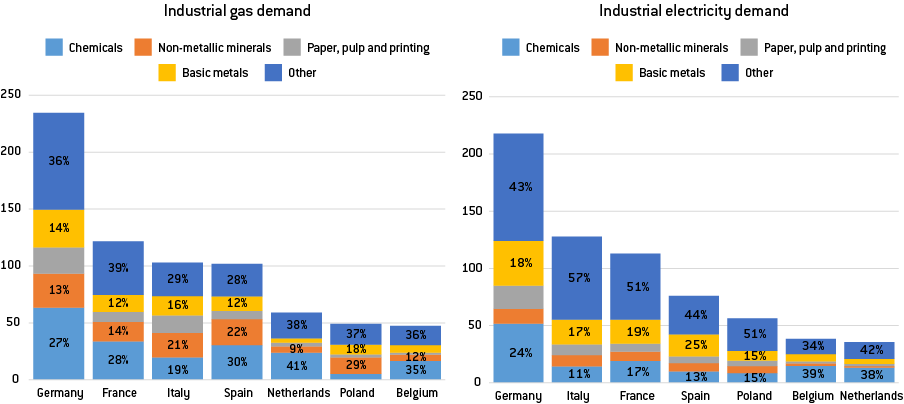

The four most energy-intensive industries in terms of gas and electricity demand in the EU are basic metals, non-metallic minerals, paper, pulp and printing, and chemicals. The EU countries with the largest industrial natural gas and electricity use are Germany, France, Italy, Spain, the Netherlands, Poland and Belgium. In these seven countries, the four most energy-intensive industries account for 62 percent to 71 percent of total industrial gas demand, and 43 percent to 66 percent of industrial electricity consumption (Figure 2).

Figure 2: Gas and electricity consumption by country and industrial sector, TWh and %, 2021

Source: Bruegel based on Eurostat.

At the EU level, the chemicals, paper, basic metals and non-metallic minerals industries represent 65 percent of industrial gas and 54 percent of industrial power consumption. Their weight in terms of jobs and gross value added (GVA) is more limited, accounting for 15 percent of people working in manufacturing and 2 percent of total EU employment and GVA (Table 1). The chemicals sector, for example, accounts for a quarter of total industrial natural gas demand and almost 18 percent of industrial electricity consumption, but represents only 0.5 percent of EU jobs and 3.7 percent of EU manufacturing jobs (Table 1). While this snapshot does not take into account the indirect value-added these industries provide to other economic sectors, it suggests that the importance of these industries might have been overstated in the public debate since the beginning of the energy crisis.

Table 1: EU energy-intensive industries

Source: Bruegel. Note: *No data was available for the chemical sector GVA in Ireland and Sweden, so the EU numbers are biased slightly downwards. Pulp, paper & printing = manufacture of paper and paper products (C17) and printing and reproduction of recorded media (C18); chemicals = manufacture of chemicals and chemical products (C20); non-metallic minerals = manufacture of other non-metallic mineral products (C23); basic metals = manufacture of basic metals (C24).

2 What has happened to European industrial jobs and output during the energy crisis?

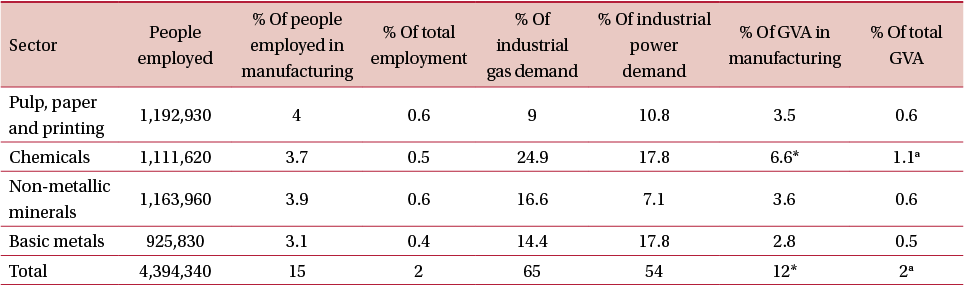

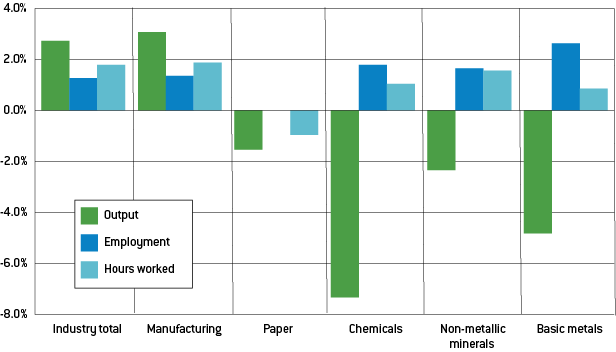

On aggregate, industrial output and employment have been unaffected, but the crisis impact is visible for individual sectors. Europe’s energy supply and price crisis started in September 2021, when Russia started to phase down gas flows to European buyers, resulting in 86 billion cubic metres of forgone supplies, or a 60 percent reduction in 2022 compared to 2021. In the first year of this, however, the EU did not experience the massive job losses that many warned would happen in case of a drastic reduction in natural gas supplies from Russia. By summer 2022, when energy prices peaked, industrial employment in the EU had actually increased, both in terms of people employed and hours worked, compared to the same period in 2021. Total manufacturing output was also higher (3 percent year-on-year in the third quarter of 2022, and continuing at the same level in the fourth quarter). However, output decreased in particularly energy-intensive subsectors, with chemicals experiencing the biggest fall (Figure 3).

Figure 3: Change in EU industrial output, employment and hours worked, Q3 2022, compared to same period 2021

Source: Bruegel.

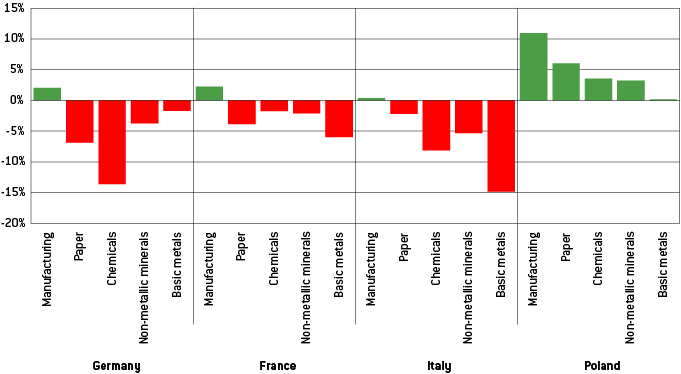

The energy mix of countries is likely to affect industrial output. The EU-wide figures hide significant differences between EU countries. Output from the chemical sector in Germany and basic metals in Italy, for example, changed much more significantly (-14 percent and -15 percent year-on-year, respectively) than the same sectors in Poland (+3.5 percent and +0.2 percent; Figure 4). The extent of use of natural gas in countries’ energy mixes is likely to be a major factor underpinning such differences. Industries in countries where the natural gas is a larger part of the energy mix – as in Germany and Italy – found themselves competing for gas with households and the power sector.

Figure 4: Percentage changes in production, in Germany, France, Italy and Poland, Q3 2022 compared to same period 2021

Source: Bruegel based on Eurostat.

3 Three policy strategies

When thinking about how to maintain the competitiveness of energy-intensive industry in Europe, and whether it is worth doing so, two linked questions need to be answered. First, would it be better to outsource permanently some parts of energy-intensive value chains? Second, if the answer to the first question is no, how can industrial energy prices be reduced to ensure the competitiveness of energy-intensive productions stages in the EU? To navigate the loss of Europe’s main external energy supplier and the subsequent impact on prices, EU policymakers have three options.

First would be to defend energy-intensive industry in its current form by using subsidies and production targets to bridge the high cost period until new cheap energy arrives. This implies substantial fiscal costs, and could undermine multilateral trade system that the EU has championed in the past. Furthermore, subsidising the current industrial players could mean missing the opportunity presented by the crisis to rethink the EU’s industrial model, and implicitly imposing higher energy prices and lower energy consumption on all non-supported sectors. However, this first strategy can be rationalised as maximising option value, given the potential irreversibility of allowing significant parts of energy-intensive industries to relocate abroad. The EU might maintain a comparative advantage in some of these industries, conditional on wholesale energy prices being lower in the very near future.

Second would be to transform energy-intensive industry in Europe, exploiting the crisis to boost the green transition by adopting clean technologies and focusing on domestic clean-energy production. In this scenario, policymakers should promote change with support conditional on companies implementing innovative clean technologies and boosting production of clean electricity. The main shortcoming of this strategy is its cost. Being a first mover in deploying at large scale new technologies to decarbonise energy-intensive sectors will likely require very substantial public support, and might affect negatively the production cost-competitiveness of industry. Similarly to what happened with subsidies rolled-out in the early 2000s for the solar industry, in the medium-term this strategy will likely bring down the cost of clean technologies, with other regions of the world benefitting from upfront subsidy-driven demand in the EU.

The third policy strategy would be to help EU companies to import more energy-intensive intermediate products. While this approach would conflict with the focus on shortening value chains and domestic production targets, it would have the advantage of allowing a market-based reallocation of economic activity away from energy-intensive commodities and towards upper parts of the industrial value chain. This strategy might free-up fiscal space for governments, and would make energy cheaper for other industrial sectors. The main drawbacks of this strategy are the risk of carbon leakage, import security risks and short-term economic pain as factories shut down.

The energy crisis is an external shock that governments should exploit to rethink a traditionally rigid European industrial structure by putting at its core products in which the EU has a comparative advantage, and by fostering the green transition. The best approach would be a mix of the three strategies, but the weight to be given to each strategy is important and policymakers will have a decisive role in establishing the right policy mix. Better knowledge of value chains and a better sense of the EU’s comparative advantages will be instrumental in taking the right decisions to navigate through the structural changes to European industry that surely lie ahead.

3.1 Strategy 1: bridge the crisis and maintain the status quo

Policymakers so far have mostly pursued the first strategy: trying to preserve industry in its existing form. This political choice might have been the best response at the outbreak of the energy crisis, when there was a justifiable expectation, confirmed by subsequent events, that peak prices would be temporary. But extending this approach over the medium term will be costly, and makes sense only if further price declines are anticipated.

Governments have already allocated €672 billion in state aid to companies

Under the EU Temporary Crisis and Transition Framework adopted on 23 March 2022 in response to the Russian invasion of Ukraine (European Commission, 2022a), the Commission had by early 2023 already approved state aid subsidies of €672 billion to EU companies. Moreover the EU emissions trading system (ETS) guidelines were revised to provide €60 billion between 2021 and 2030 in compensation for higher electricity costs in aluminium, steel and certain chemical sectors alone. Government subsidies have played an important role in supporting energy-intensive companies and related jobs in Europe, exerting the option value of keeping energy-intensive industry alive.

Without more coordination there is the risk of single market fragmentation, weakening EU cohesion

Within the current economic outlook of increasing interest rates and the relative increase in the cost of debt issuance, differences in the fiscal capacities of EU countries become even more marked than before. Governments find themselves in very different positions when it comes to supporting their national industries. There is a risk of an intra-European subsidy race to the detriment of the internal market and weaker countries/regions, and also European households and less energy-intensive sectors. Little to no harmonisation of the policies rolled out so far (Sgaravatti et al, 2023) risks undermining the fairness of the EU’s single market.

Measures such as price caps on natural gas and electricity for industrial consumers, for example, are decided nationally and vary from country to country. Energy-intensive sectors in countries with generous support schemes will be able to outcompete their peers in other countries. But if all countries provide generous support in a specific sector to maintain a level playing field, this sector will consume more energy and hence make energy more expensive for all other sectors, reducing their competitiveness. If governments decide to support all industrial sectors (to maintain their output/energy consumption), then household energy prices will have to rise. And all this will imply a great fiscal stimulus ultimately benefitting energy producers, many of which pay taxes outside the EU.

If energy prices remain high, supporting energy-intensive activity would mean subsidising energy prices permanently

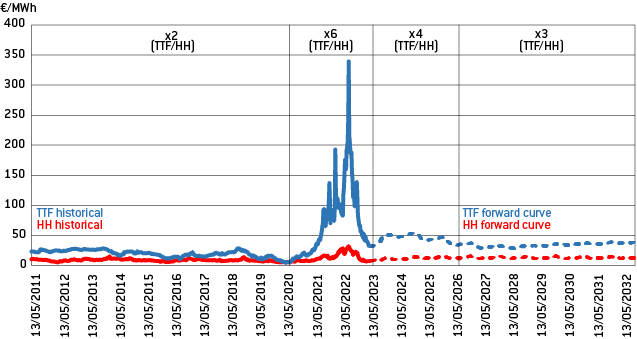

The massive increase in electricity and gas prices implied a drastic loss of competitiveness for European energy-intensive companies in 2022, and some of the effect is expected to persist. The price of natural gas in the EU is still substantially higher than before the crisis, despite having retreated from the mid-2022 peak. Financial markets expect this will remain the case for another three years, with prices at around €50/MWh, or four times the US price (Figure 5). Notwithstanding high uncertainty (flows from Russia could resume, bringing prices down, or stop completely with the opposite effect), in the baseline scenario the situation will not differ greatly from today and the EU will rely structurally more on liquefied natural gas than in the past (LNG deliveries have substituted about half of the loss of Russian pipeline flows). This development will result in a permanent increase in gas prices for EU companies as US LNG shipments are 52 percent per unit more expensive than average pipeline gas imported into the EU (Di Comite and Pasimeni, 2023).

Figure 5: Wholesale natural gas prices in Europe and the US, €/MWh

Source: Bruegel based on Bloomberg. Note: TTF indicates the price of the Title Transfer Facility, the European benchmark for the price of natural gas, while HH indicates the price of Henry Hub, the US natural gas benchmark price. The annotations in the different sections of the graph indicate how much more expensive TTF is over HH (for example x2 (TTF/HH) indicates that TTF is twice as expensive as the HH).

Therefore, national policies to temporarily bridge a gap in energy-price competitiveness might be made permanent if high EU energy prices relative to competing economies continue, providing an ongoing justification.

A re-allocation of industrial output might be already happening

In 2022, energy-intensive industries experienced a reduction in industrial production, while other manufacturing sectors saw an increase in output (Figure 3). For example, year-on-year, the manufacture of chemical products decreased by more than 6 percent, while manufacturing output from other less energy-consuming industries increased by more than 10 percent compared to 2021 (Sabadus, 2023). Similarly, while EU production of basic metals dropped by 4 percent in 2022, less energy-intensive manufacturing of machinery and equipment increased by 5 percent, and that of transport equipment by 6 percent (Figure 6).

The current approach calls for more cohesion and harmonisation across EU countries

If governments decide to continue supporting industry as currently, more harmonisation will be essential to prevent a subsidy race between countries that will lead to higher energy costs for unsupported sectors and will risk opening political rifts on climate and internal market policies between rich countries that can afford to outbid countries with less fiscal space (Tagliapietra et al, 2022). Moreover, it would be advisable to support reductions in energy intensity, rather than energy consumption. Moreover, such a strategy would probably make sense only if the wholesale price of energy was expected to decrease further in the short-term, which does not seem to be the baseline scenario of financial markets.

3.2 Strategy 2: Accelerate the transformation of energy-intensive industry

Energy-intensive industries are often also particularly emissions-intensive, making them a focus of specific decarbonisation efforts

Chemicals, basic metals and non-metallic minerals constitute what is often called heavy industry, which, together with heavy-duty transport (trucking, shipping and aviation), make up the hard-to-abate sectors in terms of emissions reductions. Worldwide, heavy industry accounts for 70 percent of industrial emissions, or around a fifth of total global emissions (Bataille, 2019b; Turner et al, 2018; IEA, 2022). Switching away from natural gas (or oil and coal) is very difficult as major industrial processes require high temperatures (in glass making, for example), hydrocarbons for processing (eg plastics and fertilisers), or both (eg primary steel and most chemicals).

Policies to address the current energy price crisis cannot be discussed in isolation from the substantial climate policy measures applied in these sectors. The value of allowances in some production processes corresponds to a high share of the product sale price. For example, 1 tonne of hydrogen produced from natural gas is worth €1500, of which the related 10 tonnes of emitted carbon dioxide account for €1000. These sectors are typically covered by the emissions trading system and obtain free allowances related to the requirement to avoid carbon leakage. However, in the current ETS phase, free allocation volumes are set to decline quickly.

Heavy industry transition is needed anyway

The energy crisis offers an opportunity to foster the green transition: promoting energy and material efficiency and switching from hydrocarbon-based production processes to carbon-free routes. The IEA (2023) estimates that emission reductions needed by 2030 to be in line with a scenario of net-zero emissions by 2050 can be achieved with existing technologies. By 2030, the European Commission expects a reshuffling of energy sources used by industry and efficiency gains that will reduce EU oil consumption by 90 terawatt hours (TWh), coal and waste by 220 TWh and natural gas by 310 TWh (European Commission, 2022b). In the short-term policymakers should thus focus on setting the right incentives to enable the transition.

There are three main technology pathways to replace natural gas: electrification, hydrogen and bio-methane

Some industrial processes use natural gas to obtain hydrogen, which in turn is used as a feedstock for the final product (for example ammonia, a molecule composed of hydrogen and nitrogen) and for some high temperature production processes that require a gaseous fuel for clean combustion (for example in the glass and the ceramic sectors).

For feedstock purposes, policymakers could fast-track innovation and development of innovative technologies, or promote alternatives feedstocks. For processes in which natural gas is used as the default heating fuel, direct electrification and switching to hydrogen or bio-methane will likely be the required pathways. Electrification is promising for low temperatures (for example in food and paper processing), but for many high-temperature applications technologies are still at early stage (Olsson and Schipfer, 2021). Bio-methane and hydrogen can provide really high temperatures, but present other challenges: bio-methane is obtained from biomass, which takes a lot of space to store, requires high investment costs in biomass systems and it is not always easily available for these reasons. Of the biomass used for industrial heat in the EU, 90 percent is consumed by the paper, pulp and print industry, which is generally situated next to great biomass reservoirs such as forests (Malico et al, 2019). Hydrogen meanwhile requires retrofitting of gas-based heating systems, and transport and storage is likely to be more expensive than for the replaced natural gas. Moreover the cost of green hydrogen depends mainly on the cost of electricity, which in Europe is currently often set by a natural gas power plant (Olsson and Schipfer, 2021).

Low-cost low-carbon electricity can be achieved through: 1) deploying renewables (by improving permitting and investment signals); 2) building and reinforcing the grid; and 3) flexibility (short-term storage, long-duration energy storage, flexible power plants and demand response)

In addition to reducing costs for many industrial processes that are already electrified, cheap clean electricity can also replace expensive and dirty gas, allowing further electrification where possible and the production of hydrogen at lower price where it is not. The deployment of already-mature technologies including solar panels and wind turbines reduces the number of hours in which a gas-fuelled power plant sets the price, and hence lowers electricity prices (Cevik and Ninomiya, 2022). To accelerate renewable deployment, easing permitting procedures and enabling appropriate investment signals are fundamental. Only then will efficient technology choices be implemented at the right locations, providing maximum value to the system. A core objective of the reformed European electricity market design should be to deliver strong investment signals for the most efficient technologies at the right places (Heussaff and Zachmann, 2023).

Second, as electricity demand increases to enable the green transition, Europe must invest in transmission and distribution grid capacity. The power industry association Eurelectric estimates that to meet European climate targets, investment needs in power distribution grids need to increase by 50 percent to 70 percent, to €34 billion to €39 billion per year (Eurelectric, 2021).

Third, demand-response in heavy industry can also play an important role in cost saving. New technologies can help industry to moderate its electricity requirements in line with supply from the gird. In aluminium smelting, for example, a new system allows smelters to vary their energy usage by up to 30 percent to better match electricity supply and price fluctuations, without disturbing the delicate heat balance required to make aluminium. For basic metals, secondary production (ie through recycling), which is much less energy intensive that primary production, could also be incentivised. The system cost in the next decades will depend on finding a viable option to store substantial volumes of electricity in the days and months when supply exceeds demand, and to release that supply in winter months when demand is high as electric heat pumps run while solar generation is at its lowest. National regulation should facilitate proper demand response, allowing industrial players to become active customers.

Europe already has the knowledge and tools to foster this change

While these technologies were not mature and cost-competitive enough to replace natural gas in the midst of the crisis, the structural increase in gas prices in Europe and the deployment of renewable energy sources may give a push to their roll-out at scale. In 2021, European firms invested more in green technologies than their counterparts in the US, showing how the business environment is now mature and Europe is already leading in green technology adoption (Faivre et al, 2023). Policies should help industrial players with large upfront capital investments, provide regulatory certainty, promote education and upskilling in the required professions, and cut the cost of electricity. Instruments including the European Innovation Fund, Horizon Europe, Important Projects of Common European Interest (IPCEI), the European Investment Bank (EIB) and the European Fund for Strategic Investment (EFSI) can play a major role if financed and channelled appropriately. Moreover, these technologies have the advantage of being in line with European’s climate targets. Pioneers in industry may benefit from the first-mover advantage by building business relationships with industrial buyers.

However, EU taxpayers would bear most of the cost of these new technologies, without the guarantee that the competitiveness cost issue will be resolved

Even if decarbonisation investment in the EU ramps up quickly, the comparative energy-cost disadvantage for energy-intensive industry might remain. For example, under the announced pledges scenario for 2030, the IEA expects the price of crude steel produced via hydrogen direct reduced iron (DRI) in Europe in 2030 to be above the current reference price for steel and above that of DRI-steel produced in the US or China (IEA, 2023, page 408). The availability of land and the potential for deployment of renewables is much more limited in the densely populated EU than in other parts of the word, such as the US. As noted by the IEA (2023) : “Designing industrial strategies that foster domestic competitive advantages will also be important, as the relevance of energy costs does not diminish with the transition to clean energy. For example, some regional differences in renewable hydrogen production costs will persist, producing knock-on effects for the cost of derived products such as steel and ammonia.”

A new map of energy and thus of EU industry will emerge

The energy price shock and the need to accelerate the green transition will probably drive some heavy industry relocation within Europe. Some European regions where electricity is and will be cheaper thanks to particularly favourable conditions for renewables (for example Extremadura or Sicily for solar, and the North Sea for offshore wind) may see the development of new industrial hubs for energy-intensive products. Production processes requiring hydrogen may locate to such European regions, where electricity prices goes close to or below zero during some hours of the day. For example, demonstration hydrogen steel plants have been deployed in Hamburg close to wind farms on the northern German coast. Products requiring a constant flow of electricity in their production, meanwhile, may benefit more from nuclear energy. Policymakers then have the opportunity to embrace a new economic geography of decarbonised energy (McWilliams and Zachmann, 2021). Understanding industrial needs and managing these changes will be crucial to put social justice at the core of the transition, avoiding repeating the mistakes of past exogenous shocks.

3.3 Strategy 3: Import energy-intensive intermediary products and manage the reallocation of economic activity

A small number of products consume a lot of energy, while representing only a limited share of employment and value added

In the chemical sector, for example, Belgium, France, Germany, Italy and the Netherlands in 2022 collectively reduced gas demand by almost 1.5 billion cubic metres (bcm) – or 12 percent of the gas demand from the whole EU chemical sector – by increasing net imports of urea alone (see annex). Urea is a very common nitrogen-release chemical fertiliser used in agriculture, production of which relies on ammonia. Although by late January 2023, European ammonia production costs are estimated to have fallen below the import price, in mid-March 2023, around 20 percent of ammonia production in Europe was still offline (Sabadus, 2023). Producing ammonia-based fertilisers in Europe requires considerable volumes of natural gas, but the workforce involved is limited: in 2019, total direct and indirect employment in the whole fertiliser sector (not only nitrogen-based fertilisers) in the EU (including then-member the UK) was 75,800, or just 7 percent of the employees in the EU chemical industry (excluding the UK).

Importing products with high energy content may save energy while having limited impact on the output of downstream industries

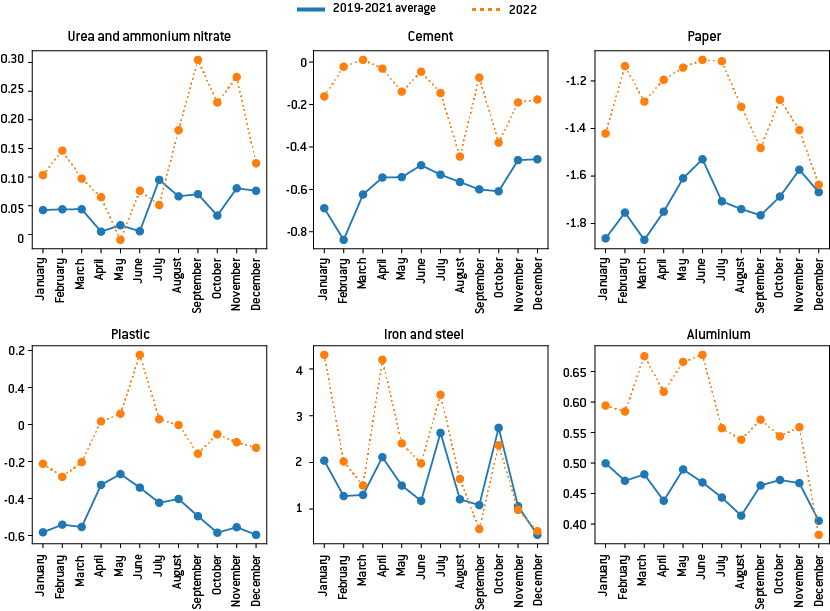

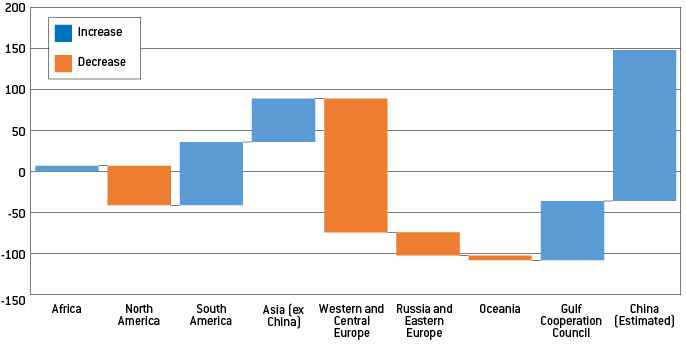

Substituting industrial output of commodities with imports, for products in which energy represents a large share of the cost, allows companies to maintain the production of final products even when domestic energy prices reduce economic margins or force production curbs. Mertens and Müller (2022) found that if Germany were to import products with high gas intensity and import substitutability, industry could reduce gas demand by 26 percent, while losing only 3 percent of final sales. For 2022, Chiacchio et al (2023) found that the EU’s imports/production ratio in energy-intensive sectors increased on average by 11 percent compared to non-energy-intensive sectors as energy producer prices rose. This indicates that imports partly replaced domestic output in sectors where energy costs increased. Looking at how the EU’s net imports (imports less exports) changed in 2022 for some of the most energy-intensive inputs into basic metals, non-metallic minerals, paper and chemicals helps understand some of these movements (Figure 7).

Figure 7: Selected commodities, EU net imports in millions of tonnes

Source: Bruegel.

Figure 7 shows, first, that net imports increased for all the selected energy-intensive products, compared to the 2019-2021 period. Second, even if net imports increased, the EU is still a net exporter of plastic, paper and (in the last months of 2022) cement. Third, net imports of urea and ammonium nitrate (used in agriculture as fertilisers) skyrocketed in summer 2022, when natural gas prices also shot up, and have not returned to pre-crisis level.

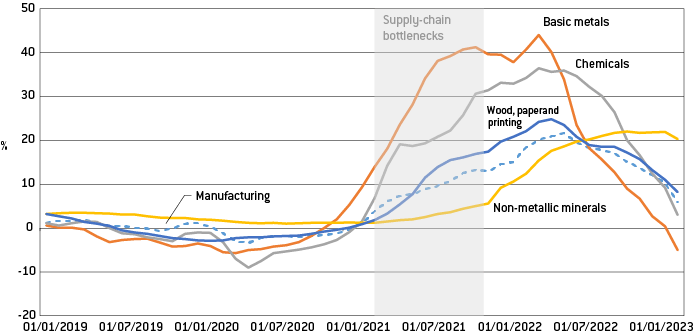

The degree of exposure to international competition affects the ability of industries to pass through higher energy costs to their consumers; basic metals and chemicals are the most exposed.

The extent to which industrial producers have transferred the higher costs of inputs to their customers through increased output prices can help assess European industry’s response to the energy crisis thus far. To estimate this, the Producer Price Index (PPI), which gauges fluctuations in the prices that domestic producers obtain for their output, can be used. During the post-pandemic recovery, when global supply-chain bottlenecks arose and led to price hikes, the basic metals and chemicals sectors experienced very significant PPI spikes (Figure 8). However, the rate of growth of the European PPI for basic metals drastically slowed and even reversed during 2022, after supply-chain bottlenecks eased in late summer 2021, while gas and electricity prices in Europe skyrocketed. This seems to align well with the findings of Bialek et al (2023) that basic metals producers in Germany tend to be very exposed to international competition and have relatively little market power, making them price-takers. Therefore, while a global shock, such as the disruption of global value-chains, allowed European producers to increase prices substantially, the domestic European energy shock did not allow increases to the same extent, probably implying companies accepting lower profit margins or losses of market share. These increases in output prices suggest that energy-intensive industrial sectors had some margin of manoeuvre in passing their cost increases to their clients further down the value chain.

Figure 8: Producer price changes in industry, % change, year-on-year

Source: Bruegel.

Facilitate substitution between domestic production and imports of intermediate goods in energy-intensive sectors

The European energy-price shock might have made energy-intensive commodities 19 , such as primary steel, commercially unviable in Europe. Industrial policy might more usefully support high value-added parts of value chain, such as complex gearboxes, instead of persistently subsidising the production of energy-intensive commodities. Energy-intensive intermediary products generally have low margins and, as their price is set on international markets, an increase in the cost of inputs can lead to market exit (Bataille, 2019). Therefore, consistently higher energy costs compared to other parts of the world would represent for Europe a major source of comparative disadvantage. On the other hand, goods in the upper part of the value chain tend to be characterised by more product differentiation, require a higher degree of specialisation for their production, and offering higher value added.

Aggregate industrial output may have outperformed expectations, but parts of the production capacity of energy-intensive products may be gone for good

Some of the production curtailments in energy-intensive products witnessed in the midst of the crisis have not receded in line with falling natural gas prices. For plants producing ammonia for example, the production capacity that came back online after natural gas prices declined steeply in December 2022 and January 2023 remains lower than the production capacity still offline (approximately 4,017,000 tonnes a year of capacity came back online versus 4,167,000 tonnes still offline on 17 February 2023) (Sabadus, 2023). A similar pattern is emerging for other gas-intensive chemicals including methanol, methyl methacrylate and melamine. Aluminium production in Europe dropped more than anywhere else, with primary aluminium production in the first quarter of 2023 far below the same period of 2021 (Figure 9). Some of these curtailments are becoming permanent: on 24 February 2023, German chemical giant BASF announced the closure of its ammonia plants in Ludwigshafen and of other chemical units 20 . On 9 March 2023, the aluminium company Speira Gmbh announced the permanent closure of its Rheinwork smelter plant in Germany.

Figure 9: Change in primary aluminium production Q1-2021 to Q1-2023, thousand metric tonnes

Source: Bruegel based on International Aluminium Institute.

Strategic autonomy policies and trade barriers can hamper imports of energy-intensive intermediate products

In the new European high energy price environment, imposing new trade barriers on energy-intensive products could have unwanted consequences for European value chains. The EU’s ambitions of becoming a leader in hydrogen production – and hydrogen-based intermediate products 23 – also seeks to defy foreign cost advantages (IRENA, 2022). Revising trade and industrial policies might be needed to enable European companies to get competitive access to energy-intensive intermediate products.

Despite this, there remain some sound reasons to abstain from a purely short-term cost-driven approach to imports. For example, retaining a sufficiently large and high-quality steelmaking production capacity may be important for national security reasons. Moreover, the EU’s stringent environmental standards generally make products produced in the EU more environmentally friendly than imported products. Outsourcing some energy-intensive production must be complemented by strategic and environmental considerations on the origin of imports.

Value chain spill-overs need to be assessed

Finally, losing certain energy-intensive production might not only carry risks of increased unwanted dependencies, it might also impact important domestic value chains. For example, while the main product of an energy-intensive process might be replaced by imports, certain co-products (for example, AdBlue, a chemical compound used in diesel-fuelled vehicles to reduce emissions 24 ) might not be easily accessible on international markets. Moreover, industrial hubs often exploit proximity and cluster effects among factories (Valle, 2020). The closure of some energy-intensive factories could spill-over to neighbouring companies, in terms of both know-how and production processes. Examples of such clusters in Europe include Germany’s Ruhr Valley for steelmaking and the Belgian chemical cluster. If such spill-overs cannot be quickly internalised (through prices), governments might have a role in temporarily protecting essential nodes in the value chain.

Instruments including the European Cohesion Fund and the European Just Transition Fund could be useful to shield workers in areas with high employment rates in the production of energy-intensive commodities, and to reduce the risk that the very uneven distribution of national fiscal firepower leads to increasing divergence of economic and social conditions within the EU.

Overall, strategic-autonomy considerations and trade barriers are not the ideal response to these challenges as they bring risks of increased cost of intermediate goods for EU producers, and would be counter to multilateralism and open trade, values the EU has cherished for decades. A better approach would be a balancing act of import diversification, rewarding low carbon intensity, and building bargaining leverage in those parts of value chains in which the EU has a comparative advantage.

4 Conclusions

The EU has historically been a net importer of energy, with imports of primary energy representing 57 percent of the EU’s domestic consumption in 2020 according to Eurostat. The outsized dependency on Russian energy supplies proved to be a dramatic vulnerability in face of the Russian invasion of Ukraine in 2022. By cutting its gas supplies to the EU, Russia pushed up the commodity’s price, while EU’s sanctions affected the imports of coal and oil, both of which were largely supplied by Russia. Nonetheless, the pre-crisis idea that the EU economy would become much less competitive without cheap Russian fossil fuels (and notably natural gas) was exaggerated. The EU’s industrial base has shown an unexpected degree of resilience in the face of this unprecedented energy shock, even if energy-intensive industries have felt the hit.

Policymakers should now design a mix of policies to support EU energy-intensive industries. In doing so, policymakers should weigh carefully the trade-offs inherent to each single strategy. Bridging the high energy price period with unconditional subsidies would prevent irreversible large-scale relocation abroad, but it is also fiscally costly, poses a significant risk of fragmentation to the EU single market and can only succeed if internationally competitive energy supplies are made available swiftly.

Given that energy commodities on international markets will most likely remain expensive for years to come, another strategy is to support decarbonised production processes built on large-scale deployment of domestic renewables, the European electric grid and storage capacity. Adopting this deep-decarbonisation strategy would have the advantage of speeding-up the green transition in the industrial sector, and will probably bring down clean-tech prices, benefitting climate mitigation efforts worldwide. However, this approach is likely to be expensive and EU taxpayers would bear most of the cost of supporting large-scale deployment of new technologies, without the guarantee that this will undo the comparative cost disadvantage for EU energy-intensive industry.

Therefore, more weight should be given to facilitating imports of energy-intensive products, while helping EU industry to move up to higher value-added parts of the value chain. This strategy would have the advantage of directing subsidies to industrial sectors that have not become structurally uncompetitive globally. Moreover, restraining public intervention in shielding energy-intensive industries might spur creative destruction and foster innovation, while reducing energy demand and thus making energy cheaper for everyone. This strategy would need to take into account concerns about excessive import dependency, and would need to be engineered to ensure there is no carbon leakage.

The best approach would therefore be a mix of the three policy strategies. As energy prices will likely stay high for the next few years, subsidising existing energy-intensive industries should only be done in clearly justified cases, while a comprehensive analysis should underpin decisions about which energy-intensive products to leave to international market forces and which investments in new clean production processes to support in Europe. This should be done in the context of seeking to ensure an ordered transition towards a new steady state combining industrial competitiveness and environmental sustainability.

As EU countries are driving and will continue to drive these decisions for their national economies, it is of utmost important to integrate their decisions into a reliable EU framework. Using international competition from the US and China as a pretext for a subsidy race between national champions over dominance of the internal market risks leaving everyone in the EU worse off.

Source : Bruegel