Almost one year after Russia started its war of aggression against Ukraine, the economic outlook for the EU is brightening a bit. Last year, the EU economy managed to shift away from Russian energy commodities. Decisive policy support and consumers’ and businesses’ response to the energy crisis boosted the resilience of the economy. This column describes how, entering 2023 stronger than projected in autumn, the EU economy is now expected to escape the recession that was anticipated for the turn of the year. For the first time in a year, the 2023 projections for growth are revised higher while the inflation outlook is revised lower.

From the Autumn 2022 Forecast to the Winter 2023 Forecast

In November, the EU economy was seen at a turning point. As the reopening momentum faded, the terms-of-trade shock unleashed by soaring gas prices was making its way through the economy (Gunnella and Schuler 2022), eroding households’ real incomes and weighing on firms’ profitability. This, combined with monetary policy tightening and weakening external support was expected to push the EU economy into recession (European Commission 2022).

According to the European Commission’s Winter Interim Forecast, the EU economy is set to escape recession. In the history of the Commission’s euro area forecasting, which began in May 1998 after the Council decision on the introduction of the euro, the withdrawal of a recession call is unique. Against this, backdrop the Winter 2023 Forecast reassesses the global outlook, the pace of monetary tightening, the role of policy support to households, and several technical assumptions (European Commission 2023).

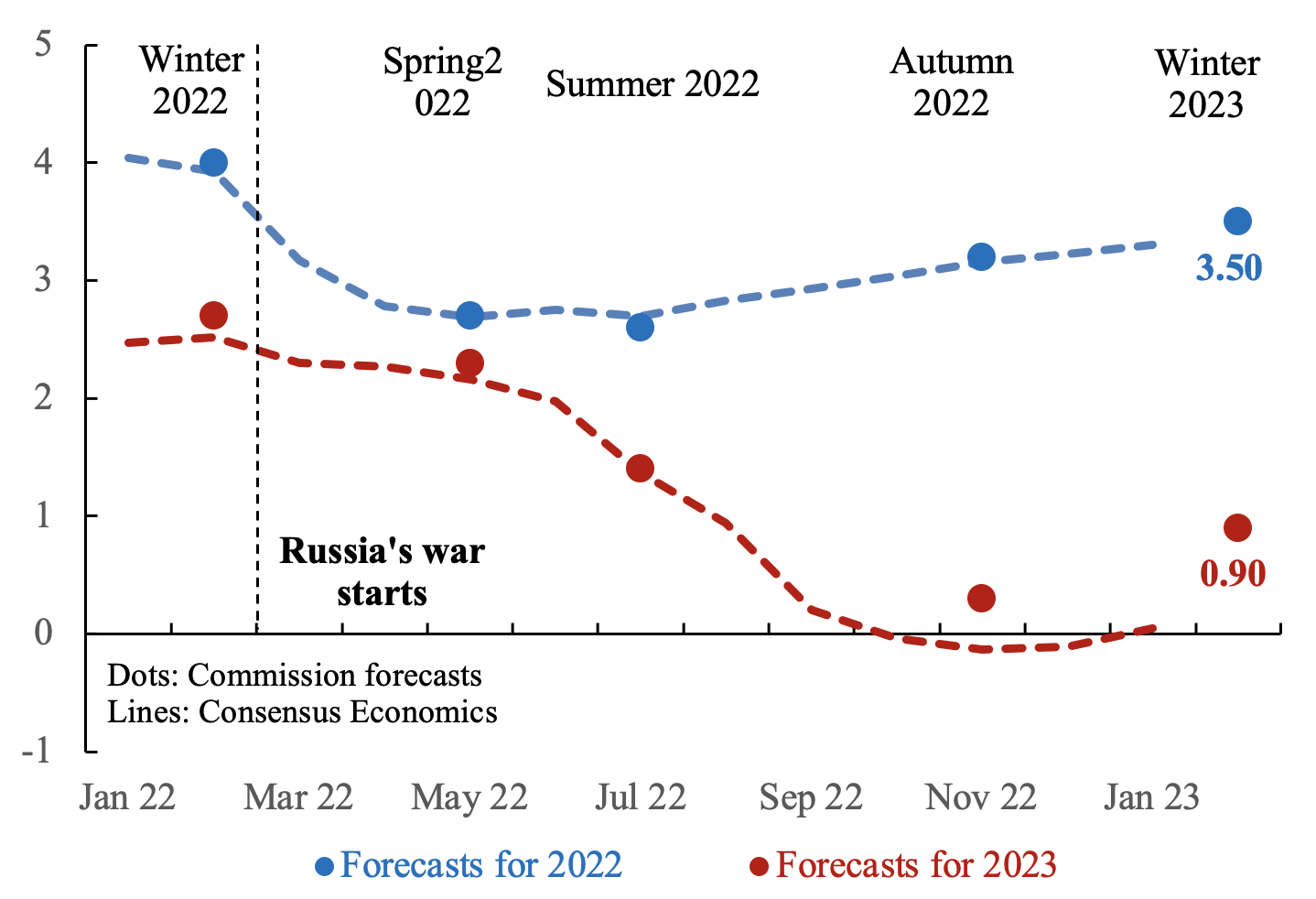

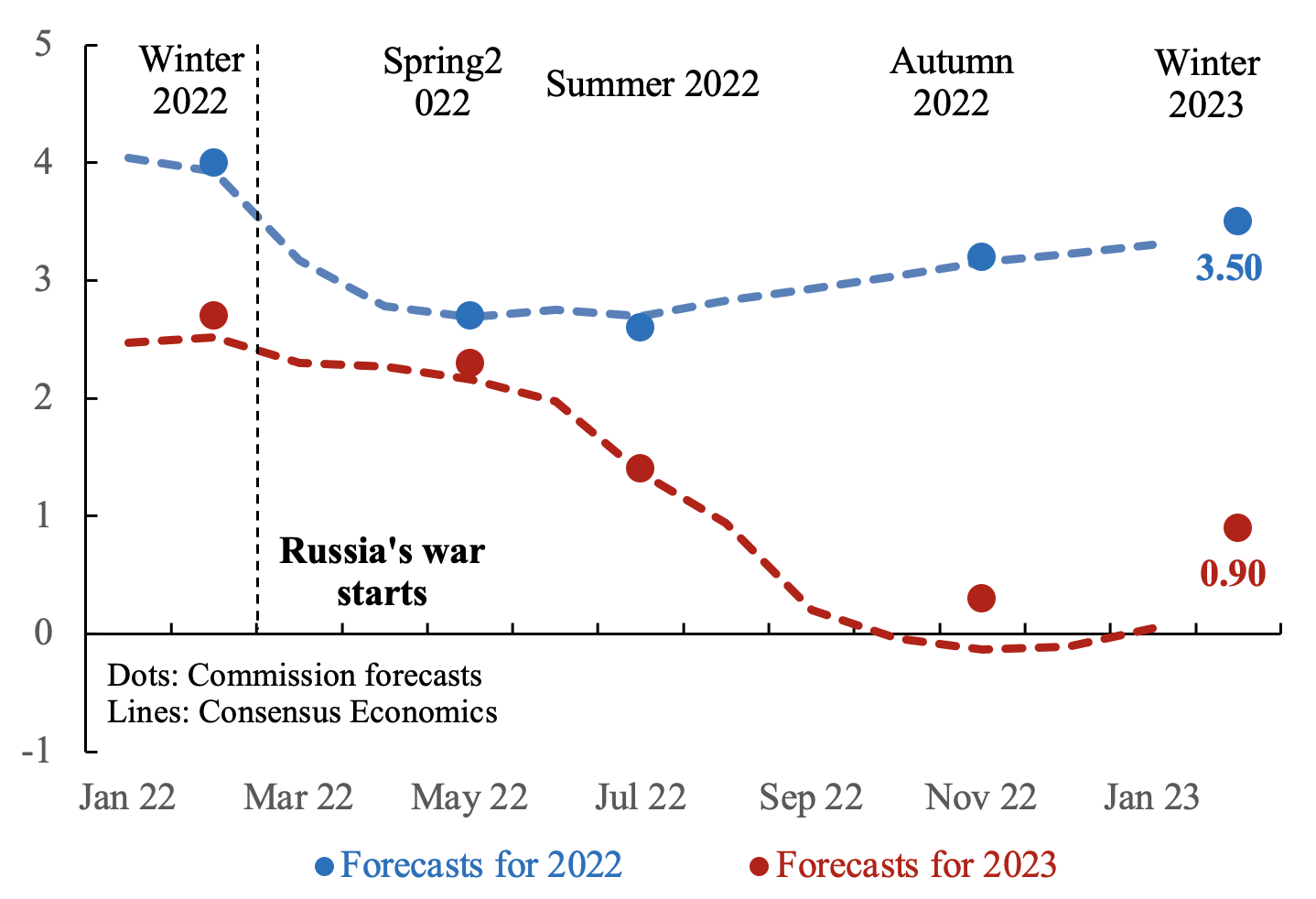

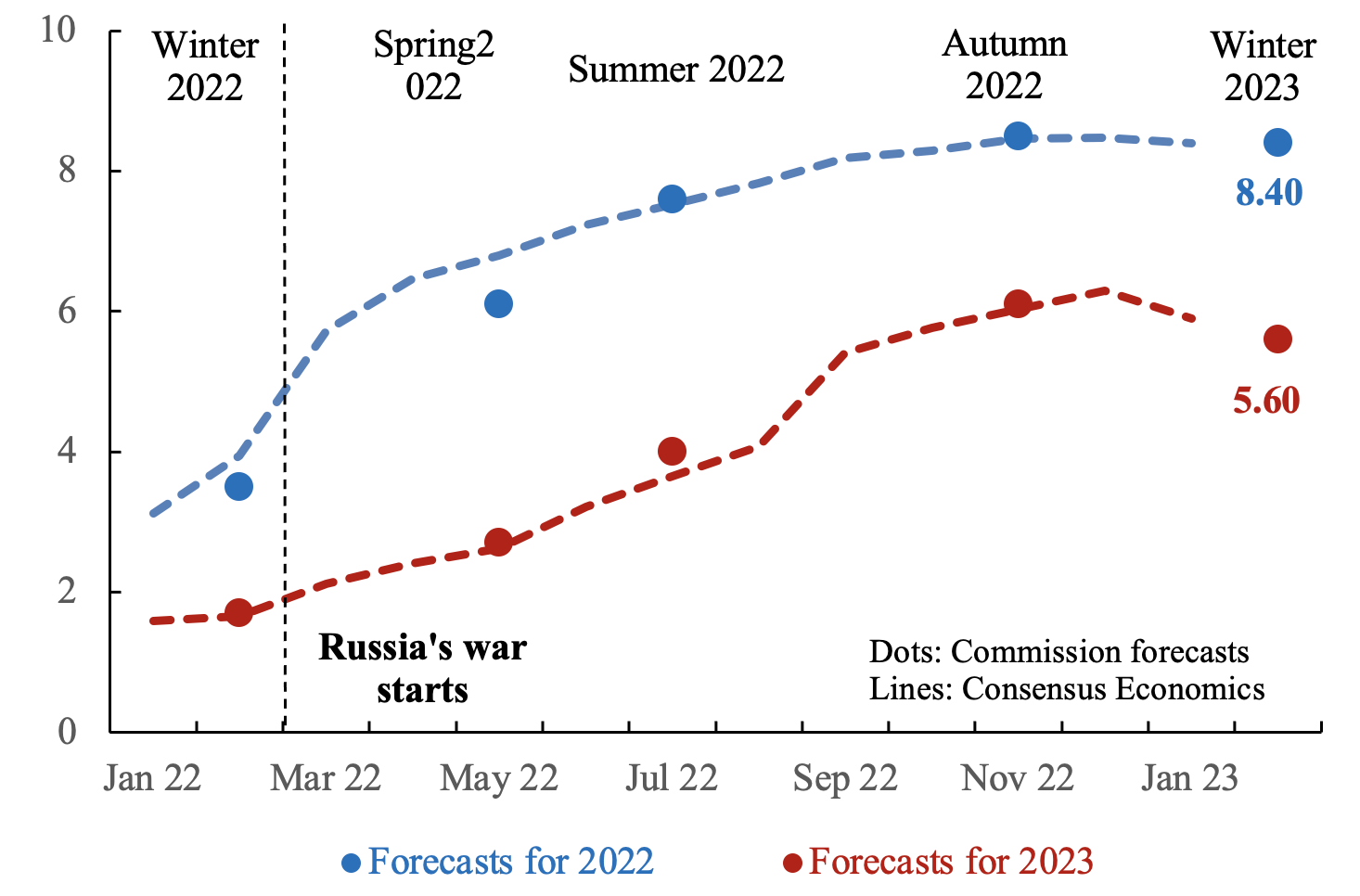

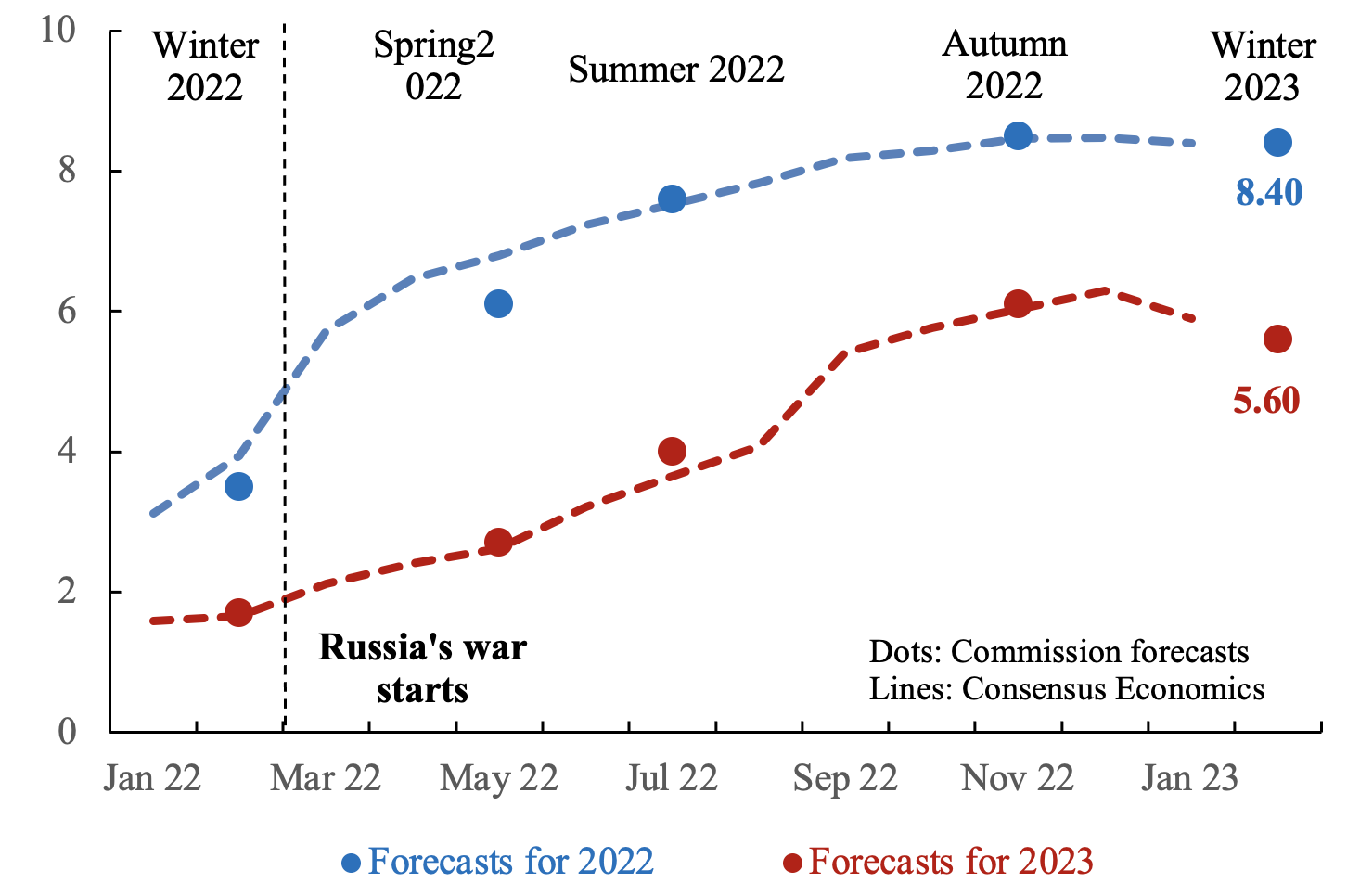

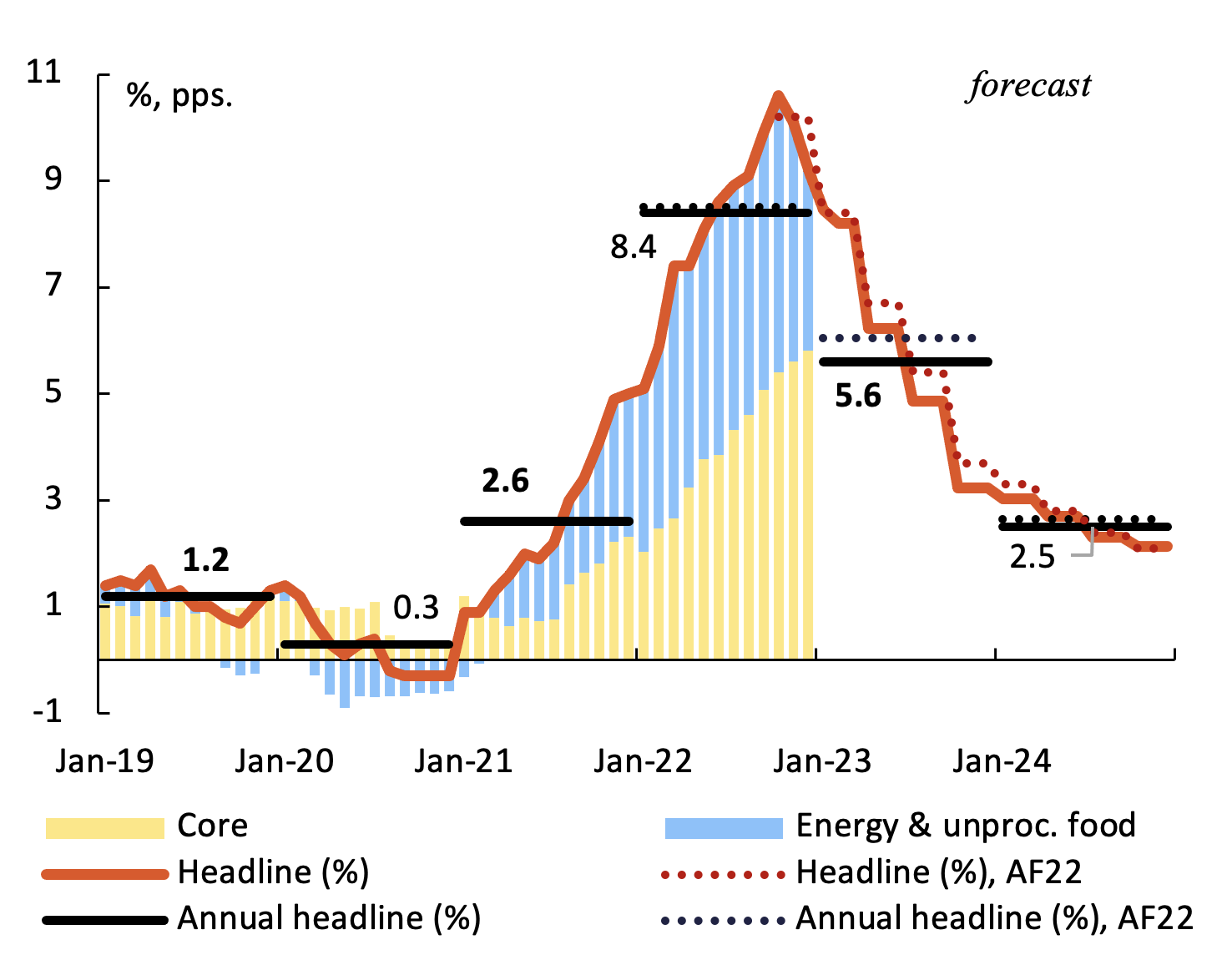

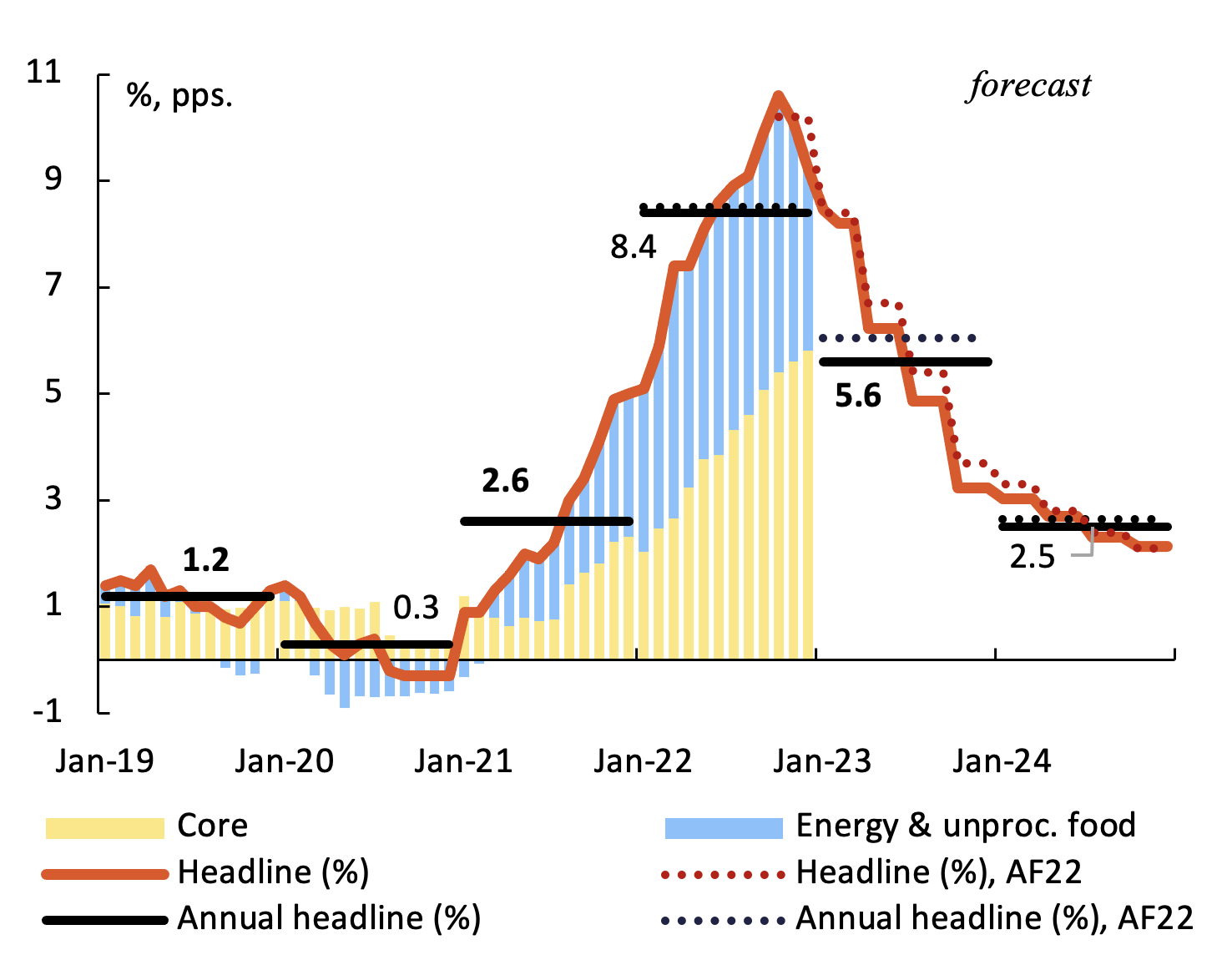

The Winter Interim Forecast includes mainly revisions to the growth and inflation outlook in 2023. For the first time since the start of Russia’s war of aggression, the 2023 projections for growth are revised upwards while the inflation outlook is revised downward (Figures 1 and 2).

Figure 1 Growth forecasts for 2022 and 2023, euro area

Figure 2 Inflation forecasts for 2022 and 2023, euro area

Enhanced resilience helped the EU economy to finish 2022 stronger than expected

The EU has made impressive progress in weaning itself off Russian energy commodities and enhancing resilience against adverse shocks. Thanks to benign weather conditions, demand restraint and efficiency gains, gas consumption was about 25% below the average for the same months over the past five years. Stepped up efforts to diversify supply sources have also borne fruit, as evident from a sharp fall in the share of pipeline gas from Russia in total EU imports of gas and the strong increase in imports of seaborne LNG. These developments have left gas storage levels at around 75% of capacity, only marginally below their level at the beginning of the heating season, and above seasonal average. This implies lower refilling needs and easing concerns about gas rationing going forward.

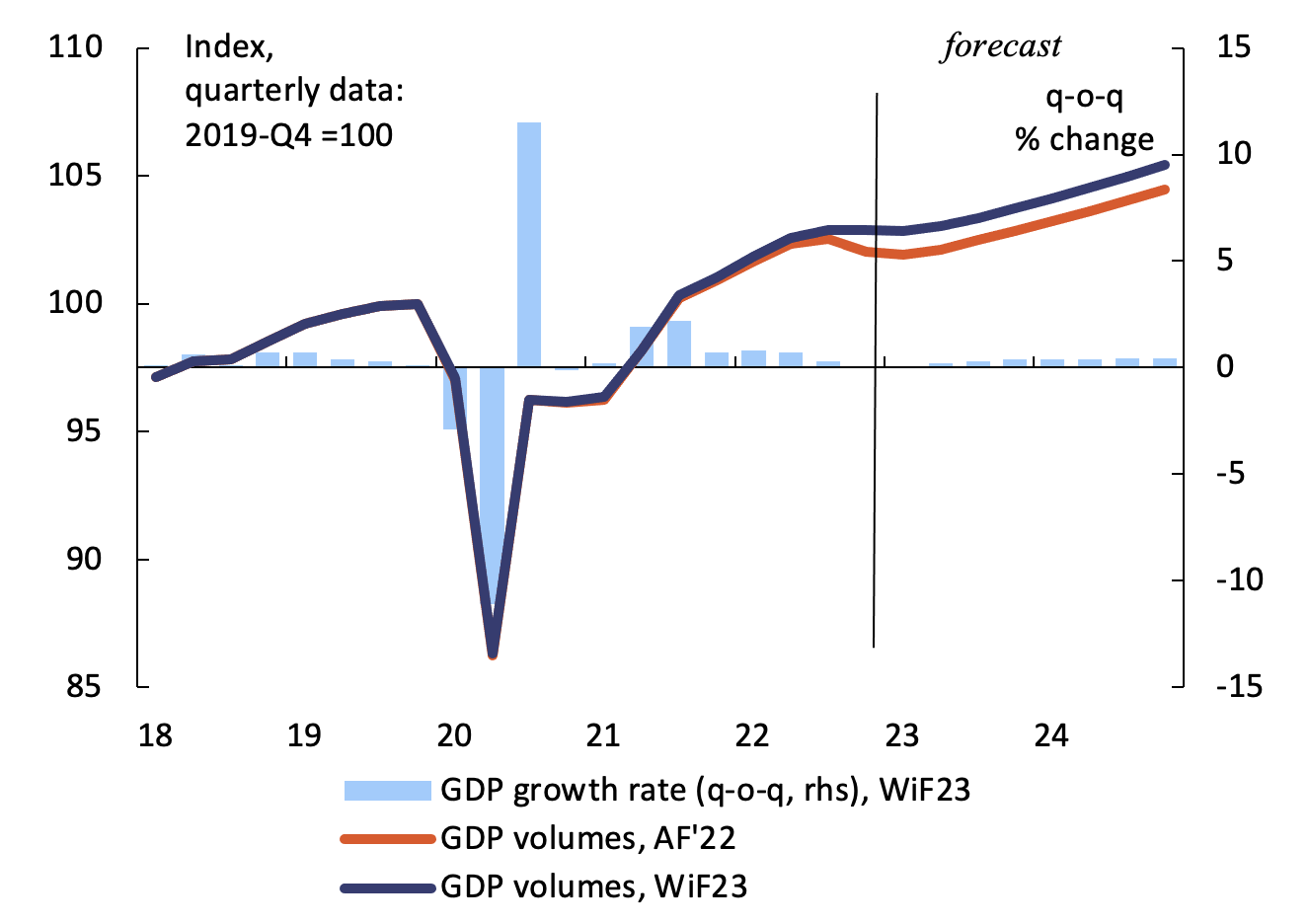

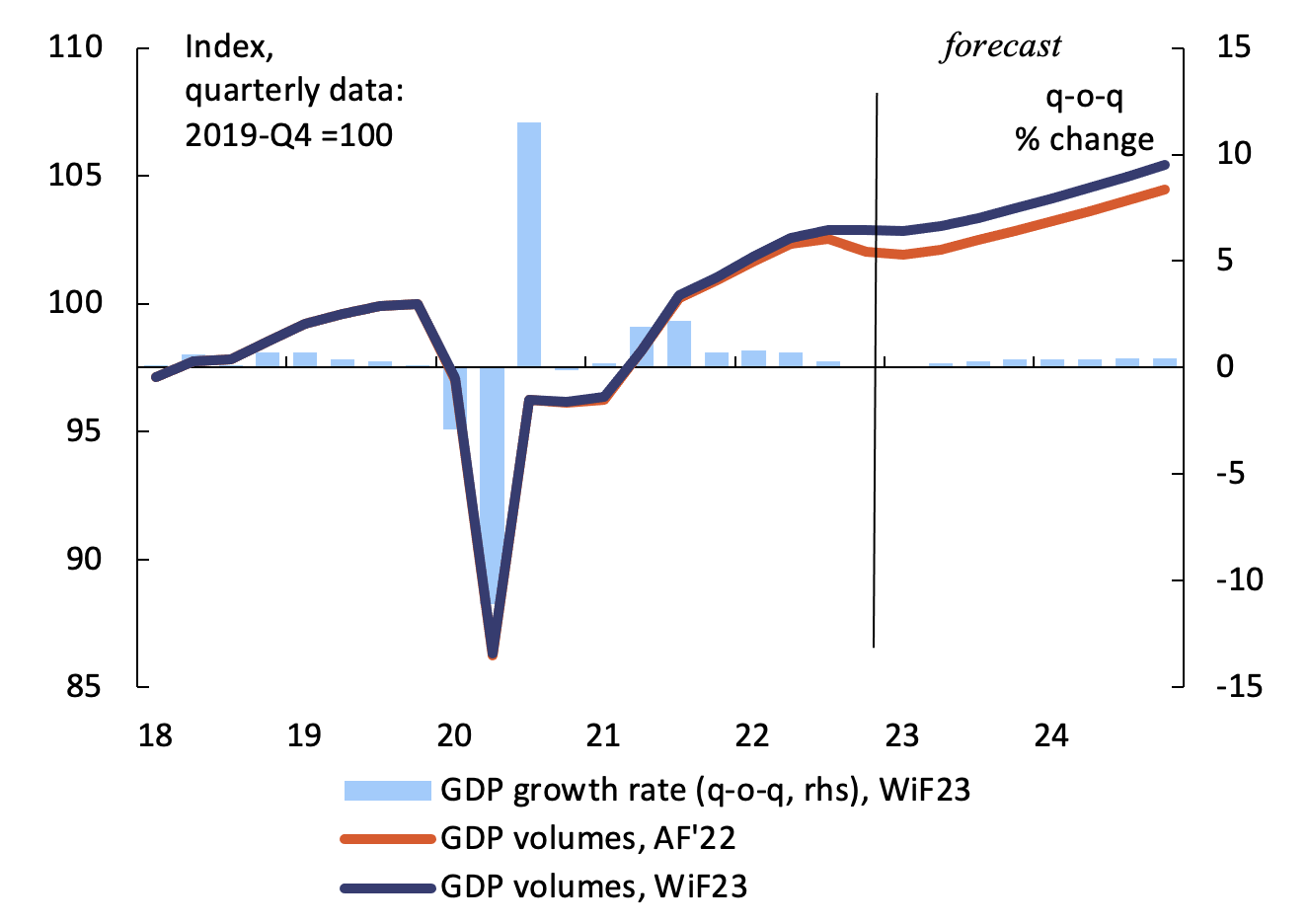

Stronger-than-anticipated growth in the second half of 2022 improved the starting position for 2023. In the third quarter, the hit to GDP growth was milder than initially estimated. In the fourth quarter, according to Eurostat’s preliminary flash estimate, economic activity stagnated in the EU instead of shrinking by 0.5% as forecast in autumn. These outcomes raised the carry-over to growth in 2023 as compared to the autumn by 0.4 percentage points to 0.3% in the EU (by 0.5 percentage points to 0.4% in the euro area). Moreover, in recent months economic confidence among households and businesses began rebounding, though from low levels.

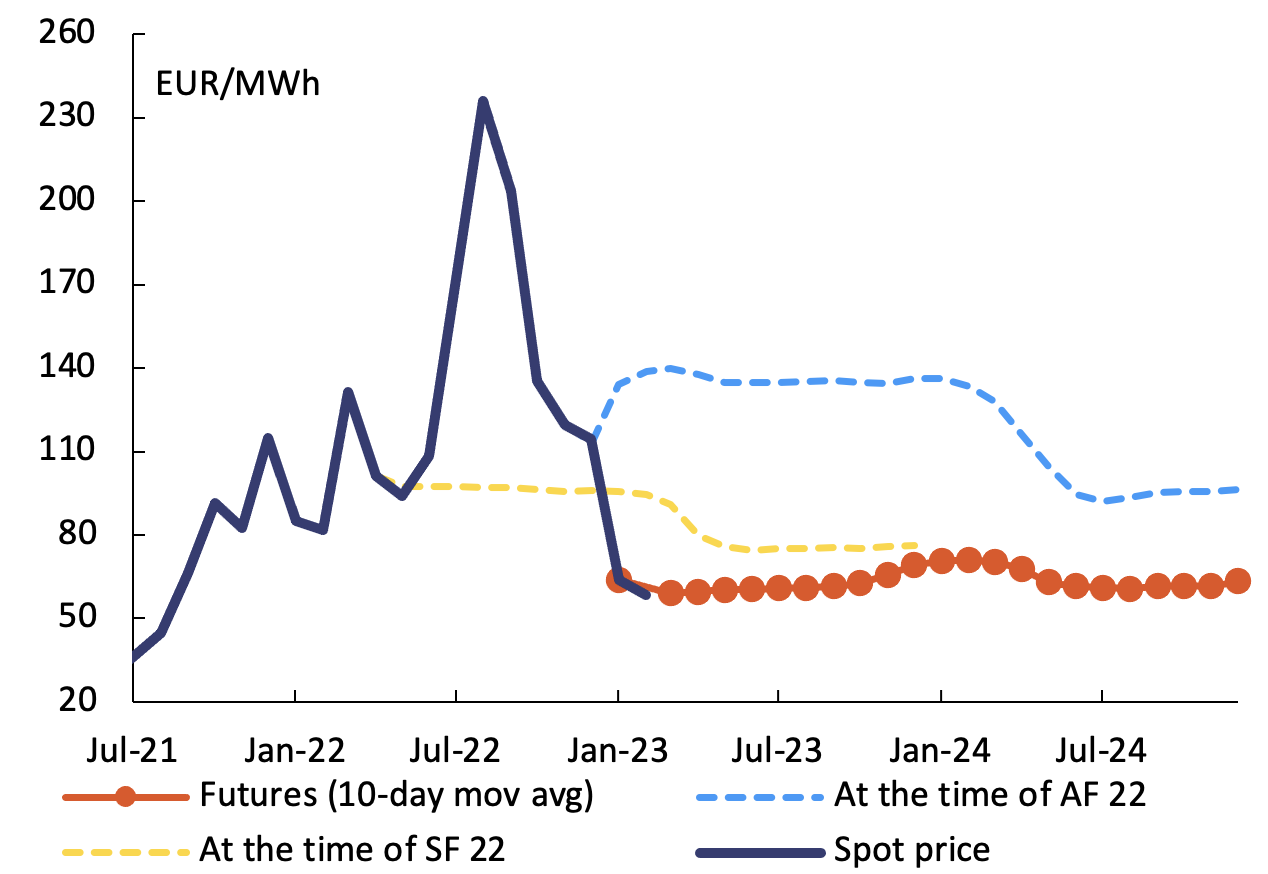

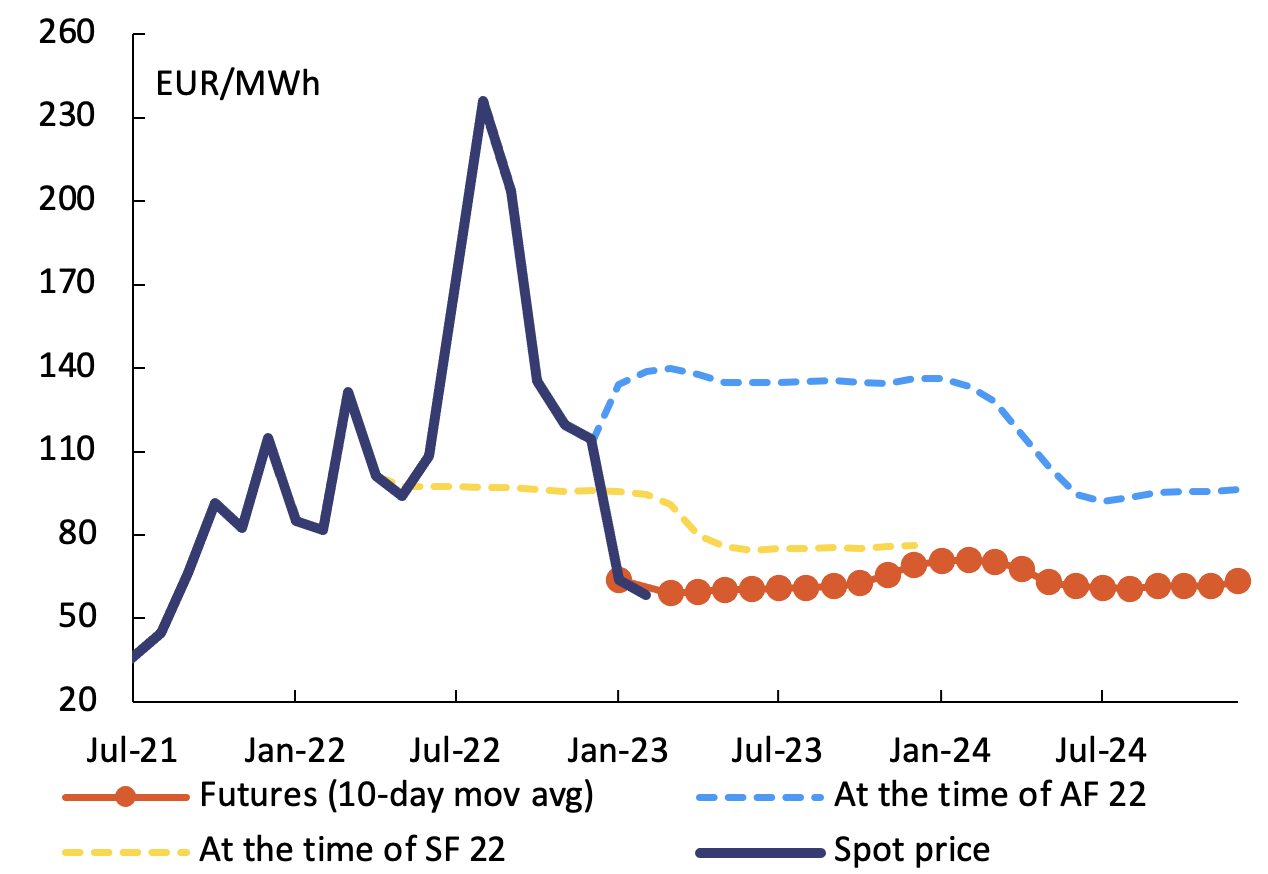

Recent developments support a slightly more positive growth outlook, but headwinds remain strong

Energy commodity prices fell below pre-war levels and should remain lower than assumed in autumn. Recent developments in demand and supply have shifted the outlook for energy prices in Europe. At the cut-off date of the forecast, natural gas prices in Europe (Dutch TTF futures) were about one half lower than at the time of the Autumn 2022 Forecast but also lower than at the time of the Spring 2022 Forecast, and markets expect them to remain broadly stable over the forecast horizon (Figure 3). Electricity prices have also come down significantly since autumn.

Figure 3 Natural gas future and historic prices

Source: ICE.

The EU labour market is expected to remain tight. In the third quarter of 2022, employment continued to increase, labour market slack was unchanged, and the job vacancy rate declined only marginally (Kiss et al. 2022, Soldani et al. 2022). Until December, the unemployment rate stood at its all-time low of 6.1%. In January, the Employment Expectations Indicator increased to the highest reading since June and survey results pointed only to a marginal abatement in labour shortages. The temporary slowdown of activity is set to weigh on employment, but difficulties in recruiting could motivate firms to hoard labour. Accordingly, the projected marginal rise in unemployment in early 2023 would be largely temporary.

Nominal wages are projected to increase stronger than before the pandemic. Continued tightness of labour markets, higher minimum wages in several Member States, and increased efforts to compensate for inflation put upward pressure on wage negotiations, especially in light of fading recession risks. Moreover, wages of many employees still reflect settlements agreed upon before inflation accelerated last year, which suggests a lagged and staggered impact of past inflation on wages.

Monetary policy tightening is expected to be stronger than previously assumed. Since the turning point in the monetary policy stance in December 2021, the ECB raised policy interest rates by 300 basis points. This has lifted market expectations about short-term interest rates, whereas long-term sovereign yields remained at the previously assumed levels. The annual growth rate of bank lending to the private sector has remained positive but decelerated further in December. In contrast with the tighter credit outlook, conditions for market financing have loosened somewhat, thanks to a pick-up in valuations, which could suggest that investors expect a rather short tightening period (Adrian et al. 2023).

The outlook for the EU’s external environment remains weak. After largely stagnating in the first half of 2022, global economic activity picked up somewhat in the third quarter, but signs of renewed weakness emerged at the end of last year. Survey indicators remained consistent with falling momentum heading into 2023, in particular in advanced economies. China’s abandonment of its zero-COVID policy and the vigorous re-opening are likely to improve its growth prospects (IMF 2023), despite possible short-term disruptions.

The path of output expansion is lifted up and inflation revised downward

Opposing forces result in a marginal improvement of the growth outlook for this year. The positive growth impact of the faster unwinding of the terms-of-trade shock is set to be partially mitigated by the more forceful monetary tightening. In particular sectors most sensitive to financing conditions (e.g. construction) are set to feel the impact. Overall, GDP is projected to stagnate in the first quarter instead of contracting as forecast in autumn. As of spring, growth-supportive factors (including disbursements under the Recovery and Resilience Facility) are expected to gain importance. GDP growth in 2023 is projected at 0.8% in the EU (and 0.9% in the euro area) and thus 0.5 (0.6) percentage points higher than in autumn, which is mainly due to the higher carry-over. In 2024, growth is expected at 1.6% (1.5% in the euro area), largely unchanged compared to autumn.

The forecast puts the EU economy on a higher growth path than in autumn. After Russia’s war pulled the economy to a lower growth path, the EU is now projected to move to a slightly higher path, with GDP exceeding in the fourth quarter of 2024 the level projected in autumn by about 1% (Figure 4).

Figure 4 Real GDP growth path, EU

HICP inflation is set to continue declining at a slightly swifter pace in 2023. According to Eurostat’s flash estimate, in January, inflation in the euro area fell for a third consecutive month, whereas core inflation slightly increased, partly reflecting the impact of past energy inflation on core items (e.g. Corsello and Tagliabracci 2023). Looking forward, falling energy commodity prices and tighter financing conditions are set to lower inflationary pressures. By contrast to the expected sharp drop in energy inflation and the fall in food and goods inflation, services inflation is expected to remain elevated, reflecting the wage outlook. Taking into account strong negative base effects, HICP inflation is forecast to fall strongly (Figure 5).

Figure 5 Inflation outlook euro area

Risks to the outlook are more balanced

While uncertainty surrounding the forecast remains high, risks to growth are seen as broadly balanced. Domestic demand could grow stronger if declines in wholesale gas prices pass through to consumer prices more strongly. Nonetheless, a potential reversal of that fall cannot be ruled out in the context of geopolitical tensions. External demand could get a stronger push from China’s re-opening.

Risks to inflation remain largely linked to developments in energy markets, mirroring some of the risks to growth. Especially in 2024, upside risks to inflation prevail, as price pressures may turn out broader and more entrenched if wage growth were to settle at above-average rates.

Source : VOXEu