Turkey sees inflation at 28.5% in 2025 with single digits by 2027, programme says

GDP growth seen at 3.3% in 2025. Turkey’s medium-term economic programme forecasts inflation to hit 28.5% in 2025 and 16% in 2026, before reaching single

Oil heads for weekly loss as higher supply expected

For the week, Brent is down 2.2% and WTI down 1.3%. Oil extended its decline into a third session on Friday, heading for a weekly

Dollar firm as geopolitics heat up; investors await US inflation data

The data did not offer much insight into job creation since March, leaving U.S. rate expectations unchanged for now. The dollar held steady on Wednesday

Gold hovers near record high ahead of US inflation data

ANZ Group raised its year-end gold price forecast on Wednesday to $3,800 per ounce and expects prices to peak near $4,000 by next June. Gold

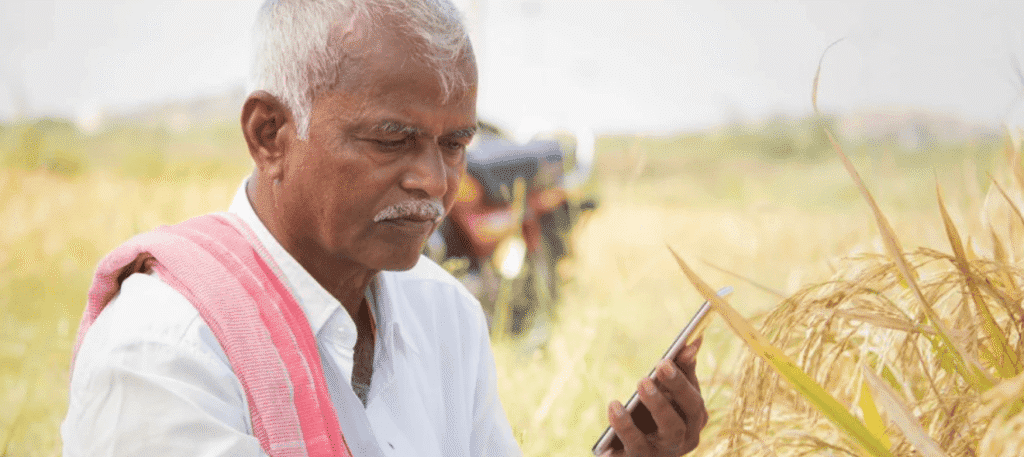

Can AI give small scale producers the right advice?

The World Bank has long recognized the critical importance of agricultural extension services – ranging from training and data to technology transfer – which make

No, pollution is not an inevitable byproduct of development

Last year, Nairobi hosted the IDA Summit for Africa, as torrential rains triggered by El Niño phenomenon flooded the city. In recent years, East Africa has seen

Artificial intelligence in the office and the factory: Evidence from administrative software registry data

The rapid adoption of AI in the workplace has raised concerns about job loss. This column uses data covering all AI-related commercial software registered with

Prudential instruments and the recent inflationary episode

Since the Global Crisis, prudential instruments to address financial stability concerns have been enhanced and broadly adopted across countries. Using the recently updated International Banking

Easy money, easy spending: A new take on the resource curse

When wealth or income suddenly increases (‘easy money’), this may be directed towards unproductive ‘easy spending’. This column explores the relationship between conspicuous consumption and

Loose monetary policy, dollar depreciation, and debt sustainability: Do not forget Venice

History suggests that using lax monetary policy and a weaker currency to address debt sustainability is a dangerous game. This column revisits a unique early