Generative AI in German firms: Diffusion, costs, and expected economic effects

The novelty and speed of diffusion of generative AI means that evidence on its impact on productivity and the future of work is scarce. This

Immigration restrictions and natives’ intergenerational mobility: Evidence from the 1920s US quota acts

Much of the debate over the consequences of immigration restrictions for labour market outcomes of native-born workers focuses on short-run wage competition. This column exploits

Why inflation may respond faster to big shocks: The rise of state-dependent pricing

Macroeconomic models distinguish time-dependent pricing, where firms change prices at fixed intervals, from state-dependent pricing, where firms change prices in response to changing demand or

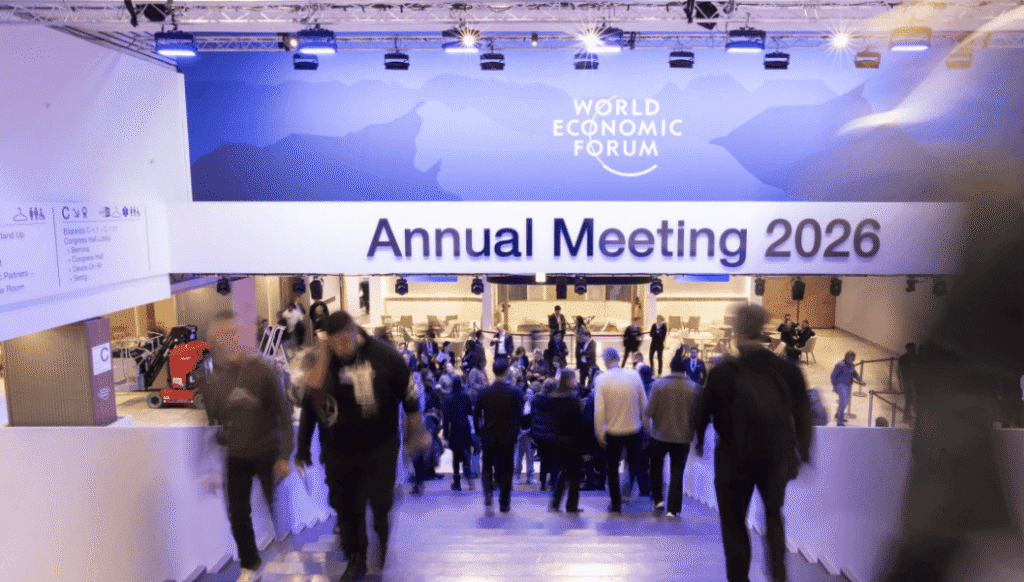

Showing up in the Alps: The economic value of Davos

Attending the World Economic Forum in Davos is costly, with estimates ranging between $20,000 and $70,000 per delegate. This column uses data on attendees from

Productivity, firm size, and why distortions hurt developing economies

In many developing countries, productive firms remain too small, while less productive firms are too large. Such misallocation contributes to losses in aggregate productivity. This

Europe’s public finances in a warming world

Climate change is increasingly shaping macro-fiscal outlooks. Extreme weather events, chronic damages from global warming, and decarbonisation efforts all have growing implications for public finances

Pricing cascades: Inflation in a networked economy

The post‑pandemic inflation surge is often attributed to pent-up demand and opportunistic price hikes by firms. This column argues that the surge was not driven

European and Chinese exports kept growing despite the 2025 Trump trade shock

Diversification has kept global trade strong, despite Trump’s tariffs and accelerated US-China decoupling. One of the main ways in which the economic policies of the

Europe’s US holdings: Leverage lies in marginal demand

The question of whether Europe’s $12.6 trillion holdings of US assets be used as leverage if relations with Washington sour has become increasingly salient in

EU barriers to scaling up: The case of fragmented product markets

European firms tend to be smaller and less productive than US firms. Qualitative and survey-based evidence suggests that one key reason is the remaining barriers