The economics of space is no longer the province of science fiction. However, the economics profession has paid little attention to space exploration as a dynamic market. This column argues that economists should turn their attention to the stars, harnessing opportunities that beckon beyond Earth’s limits. A variety of concepts from standard economics can be applied to space, including resource scarcity, incentives, transaction costs, externalities, and economies of scale. As launch costs continue to plummet, the global space economy will expand, unlocking a vast array of economic opportunities.

Hardly a week goes by without some space-related news. Space-faring nations are powering ahead with new ambitious moon exploration programmes, aimed at bringing humans back to Luna after half a century. Within the private sector, space startups are booming, now counting more than 35,000 spacetech companies worldwide. Indeed, the new Draghi Report identifies space as a key strategic sector that will define Europe’s prosperity for decades to come (Draghi 2024).

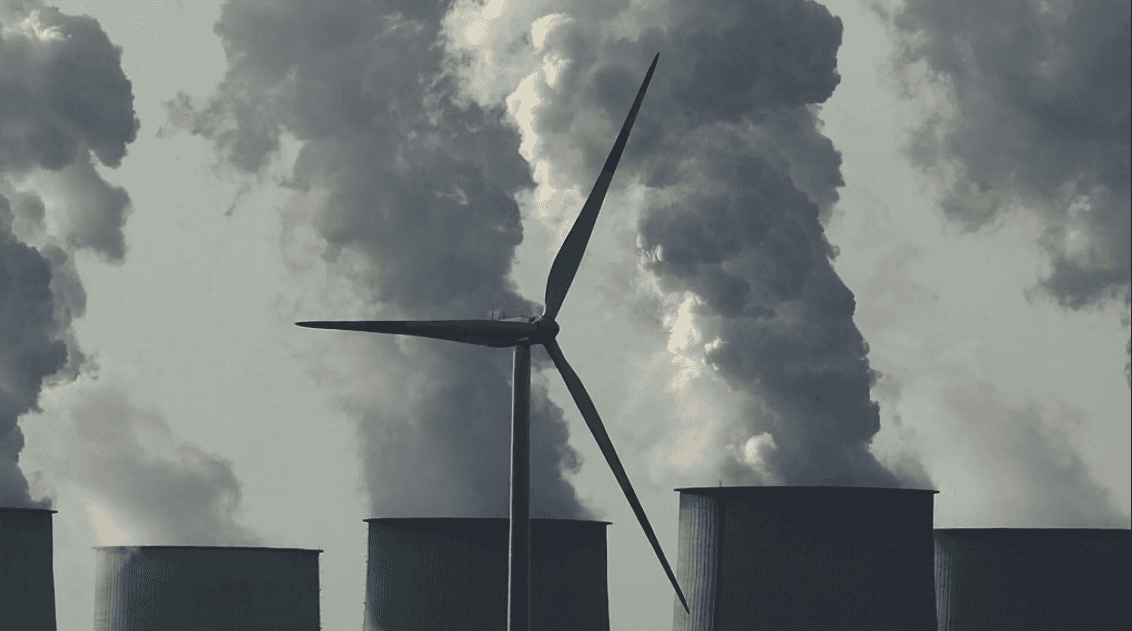

And yet, the excitement is not universally shared, especially among the public. A recent PEW Research survey shows that many still question the utility of space exploration, citing pressing issues on Earth, such as climate change, as deserving of more attention and resources (Kennedy and Tyson 2023). This scepticism is fuelled further by the carbon-intensive nature of space ventures and their association with the ultra-wealthy, framing space exploration as an environmental burden and a playground for the elites (Utrata 2023).

There is another group that so far has shown little interest in space: economists. A quick OpenAlex search across general interest top economics journals reveals that no article has been published on the space economy; if one includes all the American Economic Association journals, the count is one (Weinzierl 2018). Vox does not seem to have any entry devoted to outer space (only fiscal ‘space’, spatial economics, and GDP estimates based on pictures taken from space). In a recent paper, we contend that it is high time for this to change (Terzi and Nicoli 2024).

Space: An economic marketplace

For decades, space exploration was seen primarily as a scientific endeavour, or a political show of technical prowess in Cold War rivalries. However, since the 1980s, with the advent of commercial activity in Low Earth Orbit (LEO), space has increasingly become a marketplace. Today, nearly 80% of satellites orbiting Earth are commercial, with private actors driving a large share of space activity (Figure 1). As such, space is already a marketplace, responding primarily to economic incentives. By some estimates, in 2022 over half a trillion dollars of the world economy – roughly the size of Thailand’s economy – depended directly or indirectly on space (BryceTech 2023).

Figure 1 Satellites orbiting Earth in 2022 by user, share of total

Notes: Chart shows percentage shares based on the main purpose of a satellite. However, according to Johnson-Freese (2006), as much as 95% of space technology should be considered dual-use. The recent use of SpaceX’s Starlink within the context of the Ukraine war is a case in point.

Source: Terzi and Nicoli (2024), based on the Union of Concerned Scientists Satellite Database.

The decline of launch costs

A critical enabler of the burgeoning space economy is the dramatic decline in launch costs, spearheaded by SpaceX’s reusable rocket technology. According to our estimates, the average cost per kg to orbit dropped from around $87,000 in 1960 (the dawn of space exploration), to $15,000 in the early 2000s, to roughly $4,000 in 2023. Simultaneously, the number of launches per year went from a low of 47 in 2005, to a high of 174 in 2022. And because each launch contains several satellites, which have also become lighter and more efficient, the total number of objects launched in 2023 exceeded 2,600 (Figure 2). More objects were launched into outer space in the past five years than in the previous six decades, reflecting the exponential growth of the space sector. Space is no longer reserved for governments or the military, but is rapidly becoming a hub for private enterprise, innovation, and investment.

Figure 2 Number of objects launched in outer space

Notes: Annual number of objects launched into space includes satellites, probes, landers, crewed spacecrafts, and space station flight elements launched into Earth’s orbit or beyond.

Source: Authors’ elaboration based on Our World in Data.

By means of historical comparison to other transport technologies, Figure 3 shows a five-year rolling average for space launch into LEO over the past 60 years vis-à-vis the reduction in freight costs following the introduction of steam-powered boats in the Atlantic that started in 1819 with the SS Savannah (Smil 2017). Over a comparable time-horizon, space launch cost reductions are quantitatively larger in scale than those associated with the introduction of the steamer, which effectively paved the way for the first wave of globalisation.

Figure 3 Costs related to space launch compared to historical reductions of cotton and wheat freight costs following the introduction of the steamer

Notes: Graphs show five-year rolling average in an index of the costs pertaining to launch into LEO from 1964–2023 (1963=100), cotton freight between the US and UK from 1818–1877 (1818=100), and wheat freight between the US and UK from 1818–1880 (1818=100).

Source: Authors’ calculations based on own dataset and Federico and Tena-Junguito (2019).

There are reasons to expect that the cost of accessing space will decline further. In a recent paper (Terzi and Nicoli 2024), we show that space launch technology follows, almost perfectly, so-called Wright’s Law, which postulates a constant percentage cost reduction relationship for every doubling of cumulative launch mass. This allows us to create a set of scenarios for future launch costs. Under any scenario considered, including the most conservative, by 2030 average launch costs per tonne are expected to be less than a third of their 2015 value, on the back of a 40% reduction since the turn of the century. Even under the most conservative scenario, launch costs to LEO using Western providers will be 87% cheaper on average at the end of this decade than they were when the first commercial applications emerged in the 1990s. Under more bullish scenarios, launch costs could be lower than $1,000 per kg by 2038. This underpins our view that the space economy will see a significant acceleration due to falling access barriers, enabling the expansion of supply and demand for all types of space goods.

A new economic framework for space

To understand the full potential of the space economy, we propose a new analytical framework based on trade economics that echoes Krugman (2010), which used space trade as a thought experiment to discuss international trade. However, we turn the logic around and use international trade to understand the economics of space. Much like a new trading partner, space offers unique advantages and disadvantages that will shape its economic development. By treating space as a locus for economic activity – rather than merely a sector within the broader economy – we can better analyse its potential comparative advantage, the future flow of goods and services, foreign direct investment (FDI), and other key economic factors that get missed when thinking of space as merely a sector of the wider Earth-based economy.

We propose a taxonomy for categorising space-related economic activities, distinguishing between three types of goods and services:

- Pure uses of space: activities that can only occur in space, such as scientific research or space tourism. These sectors benefit from the unique environment of space, such as microgravity or the absence of atmospheric interference.

- Space tradeables: goods and services that can be produced in space but consumed on Earth. For example, space-based solar power could generate energy in space and beam it back to Earth, becoming economically viable as launch costs continue to fall.

- Space consumables: goods and services produced in space for use in space such as fuel, food, or 3D-printed components for space stations.

Each of these categories represents a different way that activities in space can contribute to economic growth. We highlight how each category depends on a combination of the future evolution of launch costs, technological innovation, and market demand.

Conclusions

For too long, space has been dismissed as a science endeavour at best and a delusionary science fiction fantasy at worst. We argue that economists should turn their attention to the stars, harnessing the economic opportunities that beckon beyond Earth’s limits. Several concepts from standard economics can be applied to space, such as resource scarcity, prices, incentives, transaction costs, externalities, economies of scale, tragedy of the commons, and more. As new missions are heading to the moon this decade, many with the aim of mining for water and selected minerals or growing crops in situ, new institutions will need to be designed, starting from a clean slate while incorporating incentives, externalities, technology, and power relations into the equation. Here again, some branches of institutional economics and political economy have much to contribute.

Our grandchildren will likely live in a world where space is just another dimension of economic activity, much as we grew up in an era when the digital marketplace provided services and utility in ways that were inexistent to our grandparents. The sooner we realise this, the greater the chance we reap the benefits of this new Age of Discovery.

Source : VOXeu