Executive summary

Energy prices are higher in the European Union than in most other industrialised economies, presenting a fundamental competitiveness challenge. The price disparity stems from the EU’s reliance on imported fossil fuels, contrasting with the United States, which is a net exporter of energy. In 2024, EU gas wholesale prices were on average nearly five times those in the US. Average EU industrial electricity prices were roughly two and a half times higher than in the US.

The transition to clean, domestically generated energy is therefore essential to reduce European energy costs. Despite rapid decarbonisation of the power sector, fossil fuels remain vital for electricity generation and continue to significantly influence final consumer costs. Additional factors influencing final prices include the fixed costs of supporting renewables and maintaining and expanding the energy networks, and consumption taxes and levies.

However, the ongoing energy transition is reshaping cost dynamics. Renewables, with fixed capital costs and no fuel requirements, are increasingly transforming the electricity sector. The electrification of heating, transport and other energy services further reduces fossil-fuel demand, shifting overall energy costs from variable fuel expenses to fixed capital investments.

As the energy transition progresses, EU energy costs can be expected to fall, but how far they fall and how they are shared will depend on policy choices in four main areas. In the short term, policymakers must allocate system costs fairly across energy consumers. Medium-term policies should encourage demand flexibility in electricity to improve system efficiency. In the long-term, coordinated investment at EU level and deeper cross-border interconnection will drive down final costs for all consumers.

1 The high cost of energy in Europe

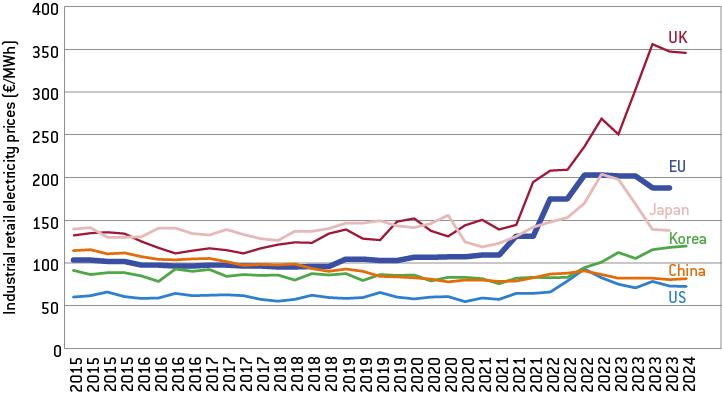

Persistently high energy costs are an entrenched problem for Europe. In 2023, industrial electricity and gas prices in the European Union were 158 percent and 345 percent higher than in the United States, respectively. Among industrialised economies, only the United Kingdom is more expensive than the EU when it comes to final industrial electricity prices (Figure 1).

Figure 1: Europe pays more for electricity than its competitors

Source: Bruegel based on Chief Economist Team/DG ENER/European Commission, based on Eurostat (EU), Energy Information Administration (US), Department for Energy Security and Net Zero (UK), International Energy Agency (Japan and Korea), CEIC (China). Note: European Central Bank conversion rates.

High energy costs stem from, first, the overall cost of energy and, second, how those costs are allocated. In Europe, most final consumers – households, businesses and industries – purchase energy from intermediaries 2 . These suppliers offer long-term contracts to customers and trade on their behalf in the gas and electricity wholesale markets. The energy bill paid by final consumers includes four main cost components, each driven by upstream factors: the energy cost, energy network charges, tax and other levies and charges (Figure 2). The components are the same for both gas and electricity.

The ‘energy and supply’ component (Figure 2) reflects the short-term costs of supplying energy. For electricity, this includes carbon costs (the costs of buying emissions allowances) and fuel costs, with gas being the most significant. The short-run costs of producing electricity with renewables and nuclear is significantly less than production using fossil fuels.

The fixed costs of electricity generation, such as capital expenditure, borrowing costs and maintenance, are recovered in different ways. Some generators recover these costs through their ‘inframarginal profits’ – the difference between the revenue earned through the short-term wholesale market and their marginal costs of production (ie the changing costs depending on the volume generated). For other generators, including those producing from renewable sources, and for backup capacity for periods with low renewable supply, fixed costs are covered by public support schemes. These costs are primarily recouped from consumers through the ‘levies and charges’ component (Figure 2).

Energy and supply costs are the largest component of electricity and gas bills, amounting to 30 percent to 70 percent of the total bill, depending on the consumer and on the energy carrier (ACER, 2023). The remaining components mostly cover fixed costs associated with the many other aspects of the electricity system. Network costs recover the cost of investing in and maintaining the energy network, while value-added tax (VAT) is the standard tax on consumption.

Figure 2: The cost of producing and supplying electricity accounts for approximately half of final household electricity bills

Source: Bruegel based on Eurostat. Note: The component breakdown on the left side is based on 2023 Eurostat data. The list of sub-components is non-exhaustive and each contribution to the main components (ie the size of the boxes) is an indicative approximation.

2 The EU-US energy cost gap

In the current, still fossil-fuel dominated energy system, the cost of supplying energy is primarily a function of access to fossil fuel resources. Europe is worse off in this respect than its competitors: the US consumes cheap, domestically produced fossil fuels, while the EU relies on energy imports to meet domestic demand. The fracking revolution, beginning in the late 2000s, provided the US with abundant, affordable shale gas and oil, allowing it to maintain high natural gas and oil production levels and enabling it to become the world’s largest liquified natural gas (LNG) exporter.

In contrast, the EU relied on imports to meet 64.4 percent of its energy demand in 2022. Most domestic production is of solid fossil fuels such as coal. Natural gas import dependency was 97.6 percent in 2022 (European Commission, 2024). The resulting vulnerabilities in case of disruptions to imports were laid bare during the 2022 energy crisis. Since then, the EU has reduced its imports of Russian pipeline gas drastically. But Europe now faces greater exposure to LNG, of which the US is the largest single supplier to the EU (Zachmann et al, 2024a). LNG is more expensive than pipeline gas because of the liquefaction and regasification costs that arise when gas is transformed into a state that can be transported by ship. US based consumers do not pay these additional costs as the gas is extracted directly and transported via pipeline throughout the country. EU consumers must pay the LNG premium, and as a result, wholesale gas prices in the EU are almost five times as high as in the US (Figure 3).

Figure 3: EU wholesale gas prices are approximately five times higher than in the US

Source: Bruegel based on Bloomberg. Note: US wholesale is the Henry Hub month-ahead price and EU wholesale is the Title Transfer Facility month-ahead price. They are the benchmark wholesale prices in the US and the EU, respectively.

Wholesale gas prices in turn influence electricity prices. As with many other commodities, including oil, wheat and metals, the wholesale electricity price is determined by the price of the last unit needed to meet demand (the marginal unit price). Gas generation is often the marginal unit in the European generation mix and therefore frequently determines the wholesale electricity price.

In the US, gas also plays an important role in power generation, but because US gas prices are much lower than in the EU, so are US wholesale electricity prices (Figure 4a). That said, some regions in Europe have lower electricity prices than some US regions (for example the price in Sweden is lower than in northern California), meaning that for certain consumers, it may still be cost efficient to locate in Europe (Figure 4b).

Gas-fired electricity generation costs are dependent on wholesale gas prices, creating a direct link between gas and power prices. Despite accounting for less than 20 percent of total EU electricity generated in 2022, gas units set the price 55 percent of the time, on average (Gasparella et al, 2023). However, as more and more renewables are added to the system, gas will set the electricity price less often, reducing average wholesale electricity prices. Furthermore, the gas price is still only one component in the overall costs borne by final consumers (Figure 2).

Figure 4: Average EU wholesale electricity prices are higher than US equivalents, though some EU regions are cheaper than some US regions

Source: Bruegel based on EIA and energy-charts.info. Note: In panel A, in the US, PJM West, Southern California, the Mass Hub in New England, the Indiana Hub and ERCOT North price were selected to calculate the mean. For the EU, Germany, France, Spain, Italy and Poland were selected. In Panel B, plotted data is the California ‘NP15 EZ Gen DA LMP Peak’ node and for Sweden, the SE1 price zone.

Network costs and energy taxes also push up European energy costs compared to other regions. The US has lower electricity network costs per unit of electricity, but worse service quality, as shown by higher outage rates than most European counterparts (Figure 5). Energy taxes are also structurally higher in the EU than in the US. In the EU, excises taxes are placed on electricity and gas consumption in many countries, although levels vary. The US has no similar taxes at federal level (OECD, 2019).

Figure 5: The US has more electricity outages than most European countries

Source: Bruegel based on World Bank. Note: SAIDI is a reliability index measuring the average total duration of outages (in hours) experienced by a consumer in a year. SAIDI of 1 should be interpreted as an average of one hour of electricity outage across an entire year. A lower score indicates greater reliability.

3 How the green transition could change energy costs

The transition to a clean-energy economy will change some of the energy-price fundamentals and consequent consumer costs. Some price changes for different consumer segments can be expected in the short-term (until 2030), while other more structural changes will materialise as the system shifts to one based primarily on renewables. Policy choices will have a substantial effect on how these changes will impact final consumer costs.

3.1 The short term

In the short term, the overall cost of the system is only likely to change in line with global fossil-fuel market dynamics. A wave of new LNG export capacity is expected to hit global markets from 2025 (IEA, 2024). Gas prices in Europe are expected to fall accordingly, although not to pre-energy crisis levels and not lower than in the US, because of the additional costs associated with importing LNG (section 2). Given its importer status, EU prices will remain higher than those in gas exporters such as the US. Lower gas prices will lead to lower variable electricity costs and ultimately to lower final consumer costs, because of the mechanisms set out in section 1.

Beyond gas-supply-driven changes, the allocation of overall system costs to different consumers is based on policy choices that could be changed in the short term. On average across Europe in 2023, household consumers paid 50 percent more per unit of electricity consumed than energy-intensive firms, but in many countries, the household/energy-intensive firm price ratio is even greater (Figure 6).

Such differences arise because energy-intensive firms can sometimes access better rates from suppliers because of their size, often pay lower network costs than households and in some countries are even entirely exempt from certain cost components, such as the costs of public support schemes for new renewable projects (Heussaff and Zachmann, 2024). Additionally, energy taxation reform is a long-overdue component of the European Green Deal. At present, the EU Energy Taxation Directive (2003/96/EC), which sets minimum excise duty rates for energy products, specifies a minimum rate for electricity at approximately the same level as fossil fuels such as natural gas. In practice, in many European countries, electricity is taxed higher than gas at the household and small business level.

Figure 6: Household/industry final electricity price ratio, 2023

Source: Bruegel based on Eurostat. Note: From the Eurostat database, consumption band DC was selected for households and the consumption band IF was selected for industry.

3.2 The longer term

In terms of more structural, long-term energy-system changes, the overall cost profile will move from mostly variable to mostly fixed as clean electricity becomes the dominant energy carrier. Variable fuel expenditures will determine the cost of energy less and less, with the fixed costs of capital expenditure needed for renewables, batteries and the network becoming more important. The EU’s energy strategy is explicit in its aim to phase out gas use to the point that the fuel plays a diminishing role in the overall energy system. Gas demand would more than halve by 2030 compared to 2021 (McWilliams and Zachmann, 2024; European Commission, 2022).

These changes will change the cost breakdown of energy bills (Figure 7). More wind and solar generation in the electricity system at near-zero marginal cost and less gas usage will lead to lower short-term electricity costs, represented by the wholesale market price (Gasparella et al, 2023). The ‘energy and supply’ component of final consumer electricity bills should fall accordingly. Conversely, the share attributed to fixed costs will increase as a consequence of the large capital investment needed to deploy and facilitate renewables.

The cost of supporting renewables will be mediated through the state and recovered from consumer bills through levies and charges (Figure 7). Such costs typically last for close to the duration of the asset lifetime, and new costs will be introduced as aging renewable plants are replaced. The cost of maintaining reserve capacity for periods of system stress will also likely increase and add to this component. More network costs, to recover the sizeable grid investments required to accommodate more variable renewables and growing electricity demand, will also add to consumer bills. In all of these cases, policy choices can reduce the overall costs of these investments, for example by incentivising efficient siting of renewable projects or guiding grid investments to provide the maximum added value.

Figure 7: Expected changes in electricity cost components with the energy transition

Source: Bruegel.

3.3 Will prices come down?

In the context of these changes, the main question in relation to European energy costs is: will the reduction in variable costs associated with less fossil-fuel burn exceed the rise in fixed costs associated with capital investment in renewables, storage and grids? In other words, will the energy transition lead to cheaper European electricity?

There are reasons to believe that it will. Solar PV and onshore wind are currently cheaper than building new fossil-fuel-fired generation in most countries, when comparing the lifetime costs of the assets (Lazard, 2024). Solar and battery technology costs in particular continue to fall faster and further than expected by analysts and modellers, in stark contrast to the costs of fossil-fuel electricity generation, which have not substantially reduced in real terms for decades (Way et al, 2022). By 2030, solar could be the cheapest source of electricity everywhere on the globe (except in the sunshine-poor Nordic countries) (Nijsse et al, 2023). Renewables are unquestionably a cost-efficient technology on which to build an electricity system, even without including the costs of carbon pricing. Renewables also offer protection against volatile and insecure global fossil-fuel markets.

However, several caveats accompany this optimistic view of costs in a zero-carbon energy system:

First, while the costs of renewable energy have dropped more quickly than projected and are expected to keep falling, it is reasonable to expect that the costs of current technologies will plateau eventually because of fundamental technical constraints. The level of this ‘renewable cost floor’ remains uncertain.

Second, comparing the cost of electricity from renewable sources to that from fossil fuels is not straightforward. Managing the intermittent nature of renewable energy requires additional technologies, including storage, transmission and reserve generation capacity, which add to the overall system costs. These additional costs must be accounted for when comparing the cost profiles of different electricity systems.

Third, the price paid by European firms and consumers for these technologies depends on access to the cheapest available suppliers – currently from China in most cases. In a scenario of heightened trade restrictions, reduced access to, for example, affordable Chinese solar panels and batteries would likely increase energy costs for Europeans.

Nevertheless, notwithstanding these caveats, a decarbonised energy system based on clean electricity is not likely to be more expensive than the current fossil-fuel based system, and there are good reasons to think it will be cheaper. Furthermore, a renewables-based system will be more secure and offer more stable costs than a system based on imports from volatile global markets, providing long-term clarity to investors about energy costs. As to whether a clean European energy system will be competitive with the US, there is good reason to think that the price gap will close, as both systems are moving towards a broadly similar configuration: a large share of renewables, a relatively small contribution from nuclear power, reserve capacity provided by gas-fired power plants and significant flexibility offered by batteries.

Whether Europe’s energy costs will drop to the level of those of the US or other global competitors remains uncertain. The US has significant advantages, including superior fossil-fuel endowments and solar energy potential, and a continentally integrated fiscal and capital markets system. However, the US may face higher network costs later in the century as its grid ages and it has to link its substantial renewable resources to demand centres across great distances. Overall, there is no obvious reason to expect that future electricity costs in the EU will be any cheaper than in the US. Projected energy cost comparisons for the middle of the century have indicated that European electricity costs will fall with decarbonisation, but could remain approximately 50 percent higher than the US, China and India, compared to over 150 percent higher in 2023 (Roques and Bourcier, 2024).

4 Policy priorities for EU energy-cost reduction

Two realities about the evolving European energy-cost landscape must be acknowledged. First, Europe cannot continue to rely on fossil-fuel imports and achieve energy-cost competitiveness with fossil-fuel exporting economies such as the US. Second, as the energy transition unfolds, European energy policy choices will shape its competitiveness compared to other industrialised economies. Europe’s main advantage lies in its continentally interconnected electricity grid and its harmonised markets, enabling efficient energy trade from the Nordics to Iberia and the Balkans. With bold political ambition and strategic policymaking, Europe can leverage these strengths to reduce energy costs, while establishing clean electricity as the foundation of a decarbonised energy system.

Outlined below are four energy policy priorities, presented in order of how quickly they can be delivered. Responding to these priorities could make the European energy system substantially more cost-efficient, easing burdens on consumers and strengthening industrial competitiveness.

4.1 Fair allocation

To boost competitiveness, exemptions for certain industrial segments from paying for parts of the electricity system are being seriously considered. Draghi (2024) suggested that electricity producers could set aside a share of their electricity at low, regulated prices for specific industries “exposed to international competition”. A further option would be to subsidise electricity consumption by certain consumers directly using fiscal resources not solely recovered from the energy system (McWilliams et al, 2024). However, reducing costs for one consumer segment implies increasing them for another.

Since the energy crisis, households are spending a greater share of their income on electricity, and increasing these costs further may trigger more social opposition. Furthermore, significant greenhouse-gas emissions reductions must be driven by electrification of transport and heating at the household level. If, in order to give preferential treatment to industrial consumers, households are burdened with a disproportionate share of the total electricity system costs, they may be disincentivised from making investments in electrification options such as electric vehicles and heat pumps, both essential for the energy transition.

The thorny problem of energy-system-cost allocation between industrial consumers, businesses, households and the taxpayer can be addressed in the short term (eg within a year or two) through policy choices. Energy taxation could be revised either by pushing through the long-delayed reform of the EU Energy Taxation Directive or through changes at national level, to tax gas more than electricity, for example. The allocation between different consumers of network costs and the costs of public schemes to support renewables and backup capacity can be changed quickly by national governments. National governments could choose to reduce value-added tax on energy to alleviate pressure on consumers. However, fair energy cost allocation will remain a persistent challenge throughout the transition as electricity becomes more central. Apportioning these costs inevitably involves trade-offs between cost of living for citizens, industrial energy costs and the tax burden, which must be evaluated carefully from the perspective of European competitiveness and also, and equally importantly, in relation to the societal viability of the green transition.

4.2 Consumer activation

More variability on the supply side of the energy system, introduced by the intermittency of renewables, can be managed effectively by incentivising more flexibility on the demand side. As many electricity consumers are unaware of real-time electricity spot prices, or lack the ability to adjust their demand accordingly, electricity demand is typically very price-inelastic. However, evidence from Germany suggests that industrial consumers that participate directly on wholesale markets do respond to hourly price changes (Hirth et al, 2022). Policies that expose consumers to real-time prices can encourage efficient demand-side behaviour, incentivising consumers to use and store electricity in times of abundance, and to reduce demand during periods of supply scarcity. Responsive consumers reduce the need to build and maintain costly and typically emissions-intensive reserve and flexible generation capacity.

Depending on the market design, demand-side flexibility can even provide a revenue stream directly to consumers in exchange for reducing demand in times of system stress, making investments in technologies such as electric cars and heat pumps more attractive. Implementing policies that provide incentives for consumers to respond to system conditions flexibly could save billions annually for European consumers by 2030 (SmartEN, 2022).

The policy challenge in activating electricity consumers lies in balancing the need to expose consumers to real-time wholesale electricity prices, thereby encouraging demand-side response, against the need to protect consumers against price volatility. The shift in overall electricity system costs to mostly fixed costs (section 3.2), recovered through long-term contracts, may protect consumers against volatility to an extent. Introducing time-varying or ‘dynamic’ electricity pricing schemes can provide consumers with financial incentives to change energy-consumption patterns. The most direct approach, real-time pricing, would expose a part of the consumer’s bill to the real-time wholesale price (Figure 8, Panel A). Standard consumer pricing involves flat rates that do not change over periods of months. With real-time pricing, consumers could benefit from short-term system conditions by increasing consumption during low-price periods and reducing demand in high-price periods, though this would also expose consumers to the risk of greater price volatility.

Schittekatte et al (2023) preferred ‘time-of-use’ pricing, which means that final consumer prices shift between two or three pre-defined price levels depending on the hour of the day, fluctuating less frequently than real-time pricing (Figure 8, Panel B). Consumers would still have an incentive to adjust their behaviour depending on the system conditions, without being exposed to the full volatility of the wholesale price. This approach balances ease of implementation, consumer risk aversion and flexibility incentives. Such changes to consumer pricing have already been introduced in a number of European countries, such as Spain, where 35 percent of households are on dynamic pricing schemes (BBVA, 2024). The primary technical requirement for wider adoption of such schemes is the deployment of smart meters, which is progressing well across many European countries (ACER, 2023). European policymaking should support the continued deployment of smart-grid solutions to enable consumer responses. More broadly, EU energy policy should encourage electricity suppliers to offer dynamic electricity pricing schemes to end consumers.

Figure 8: Illustration of dynamic consumer pricing schemes

Source: Bruegel.

4.3 Investment coordination

Investments in electricity-system technologies, including generation, storage and networks, have substantial spillovers onto neighbouring countries, given the interconnected nature of the European grid. Surplus renewable supply is often exported to other countries, reducing their prices. Conversely, reserve capacity, often supported outside the wholesale market through so-called capacity mechanisms, can be used to provide electricity to nearby countries in periods of supply scarcity, effectively cross-subsidising neighbouring countries’ electricity systems.

While some pan-European or regional electricity system development planning already occurs, focused on the electricity network, little formal coordination between European countries on electricity-system investments currently takes place. Coordination of investments at European level would be cost-optimal, for example by carrying out joint cross-border auctions for renewable and reserve generation capacity, which would allocate funding to the projects that providing the greatest value to the European electricity system. This however would require overcoming entrenched domestic political and industrial interests that would prefer to ensure that national funds are used for national investments, even if such investments are not cost optimal. Regional coordination, for example in the North Sea basin or other offshore wind regions, could be a second-best alternative. Investment coordination could be organised and implemented by regionally-grouped European countries in the medium term up to 2030 (Figure 9).

4.4 System integration

The overall system cost can be minimised by deeper European electricity system integration that takes advantage of geographical and spatial differences in electricity supply and demand across Europe (Zachmann et al, 2024b). Deeper integration is a more long-term policy goal (see Figure 9) and would involve implementing joint institutional arrangements such as harmonised short-term electricity-market operation and long-term investment coordination (section 4.3), as well as building more physical grid infrastructure between European countries. Longstanding delays in critical connections, such as between France and Spain, must be overcome, and even more importantly, connections in the North Sea should be prioritised to take full advantage of its renewable energy potential (Heussaff et al, 2024).

To identify the priority cross border interconnections for investment, the European grid system assessment and planning process led by the European Network of Transmission System Operators for Electricity (ENTSO-E) could be strengthened through more transparency in the modelling process. For example, a new independent European agency or institution (or arm of an existing agency or institution) could develop its own scenarios for electricity system development and the associated cross-border interconnection needs, so that the ENTSO-E plans could be compared to an alternative.

Figure 9: Policy choices can impact the evolution of final consumer electricity prices

Source: Bruegel. Note: The price changes based on policy measures are illustrative and are not intended as a projection of future energy costs. Not listed is allocation of overall cost, which is a distributional policy choice that does not fundamentally change the energy system.

Europe’s best renewable resources are in around its edges: solar generation in southern Europe and the offshore wind generation potential of the Atlantic seaboard and the North Sea. Transporting energy from these regions will require investment in cross-border interconnection capacity. Developing such infrastructure projects can often take over a decade from initiation to commercial operation. Longstanding distributional and political issues hold back the development of key interconnectors. Such projects must be started urgently if the EU is to decarbonise electricity by the mid-2030s while keeping prices affordable. Doing so will require political compromise and, most importantly, embracing a bold vision of a clean, continentally-interconnected European electricity system.

Source : Bruegel